Is Conversion From Ira To Roth Ira Taxable

If you do a Roth IRA conversion, youll owe income tax on the entire amount you convert and it could be significant. If youll be in a higher tax bracket in retirement, the long-term benefits can outweigh any tax you pay for the conversion now.

The Similarities Between Roth And Traditional 401 Savings

To make sure we have our feet underneath us, lets get started by talking through whats the same between these two savings types.

- Theres no income limit to participate. With company-sponsored plans, theres no cap to how much money you earn to be able to contribute to either type of accountunlike IRAs, which do have a limit.

- Theyre both tax advantaged. Your money grows tax freethat is, you wont pay any taxes on the earnings as they accrue in your account for either traditional or Roth savings within these accounts. With Roth savings, youll never pay tax on those earnings with traditional, pre-tax savings, youll pay taxes on the earnings when you withdraw them.

- They share an annual contribution limit. Whether your 401 or 403 comprise traditional or Roth, you can only put in so much money. The limit is updated annually based on cost-of-living adjustments. In 2021, the cap is $19,500. If youre over 50, your plan might let you put in more using catch-up contributions.

- Early withdrawals typically incur a penalty. With either savings option, if you want to take money out before you turn 59½, youll pay a 10 percent penalty. In special circumstances and other hardships, including COVID-19 and buying your first house, this penalty is waived.

- Your income will be taxed at some point. Upon withdrawal, youll pay income taxes on any money that hasnt already been taxed. This is a similarity, but also the key differencewhich well get into now.

Savings Options For College

Options for college savings are wider than you might think. Explore six different types, from life insurance to Roth IRAs, to find the right combination for you.

1 Your account must be open for 5 years and you must be over age 59 ½ to be eligible for qualified tax-free withdrawals.

2 Subject to IRS income limitations.

3 There may be some limits on tax deductibility if you or your spouse has a retirement plan at work.

4 Based on 2021 tax year.

5 Starting in 2020, the age for required minimum distributions increased from 70 ½ to 72. However, if you turned 70 ½ before December 31, 2019 you must take the RMD for 2019, and again in 2020 even if youre not yet 72.

6 For the year 2020, taxpayers have the option to not take an RMD. Subject to certain limited exceptions provided under the Coronavirus Aid, Relief, and. Economic Security Act.

This document is intended to be educational in nature and is not intended to be taken as a recommendation.

Investment and insurance products are:

- Not insured by the Federal Deposit Insurance Corporation or any federal government agency.

- Not a deposit, obligation of, or guaranteed by any Bank or Banking affiliate.

- May lose value, including possible loss of the principal amount invested.

Financial professionals are sales representatives for the members of Principal Financial Group®. They do not represent, offer, or compare products and services of other financial services organizations.

Also Check: How To Find Tax Amount

Are Withdrawals Required After A Certain Age

Because you’ve already paid your taxes before depositing into your Roth account, the IRS doesn’t care if you withdraw your money or not. A traditional IRA requires you to make minimum withdrawals when you reach the age of 72 so that the IRS can receive taxes for each distribution.

With a Roth IRA, there are no requirements for withdrawals, which means you can leave your money in your account for as long as you like and earn tax-free income as long as you don’t make early withdrawals. However, if you transfer your Roth IRA to another party, they may be required to take minimum distributions.

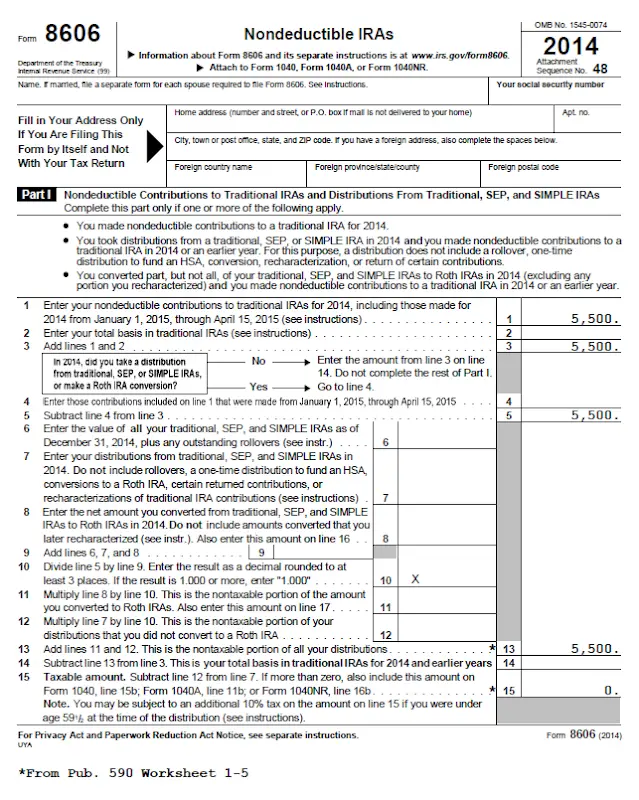

How Do I Report A Roth Ira Conversion On 1040

If you convert money to a Roth IRA, you must file your taxes with either Form 1040 or Form 1040A. First, complete Form 8606 to determine the taxable portion of your conversion. If you use Form 1040A and converted from a traditional IRA, you report the total amount converted on line 11a and the taxable portion on 11b.

Also Check: How Much Income To File Tax Return

Tax Breaks For Roth Ira Contributions

The incentive for contributing to a Roth IRA is to build savings for the futurenot to obtain a current tax deduction. Contributions to Roth IRAs are not deductible for the year when you make them rather, they consist of after-tax money. That is why you dont pay taxes on the funds when you withdraw themyour tax bill has been paid already.

However, you may be eligible for a tax credit of 10% to 50% on the amount contributed to a Roth IRA. Low- and moderate-income taxpayers may qualify for this tax break, called the Savers Credit. This retirement savings credit is up to $1,000, depending on your filing status, AGI, and Roth IRA contribution.

Here are the limits to qualify for the Savers Credit for the 2022 tax year:

- Taxpayers who are married and filing jointly must have incomes of $68,000 or less.

- All head of household filers must have incomes of $51,000 or less.

- Single taxpayers must have incomes of $34,000 or less.

The amount of credit that you get depends on your income. For example, if you are a head of household whose AGI in the 2022 tax year shows income of $29,625, then contributing $2,000 to an IRA generates a $1,000 tax credit, which is the maximum 50% credit. The IRS provides a detailed chart of the Savers Credit.

The tax credit percentage is calculated using IRS Form 8880.

Why You Can Fund A Roth Ira After You File Your Taxes

You fund a Roth IRA with after-tax dollars. In other words, youve already paid taxes on the money that youre about to invest.

The government has received its cut, and there is no need to report the contributions on your income tax return. You wont receive a tax break for contributing, so the Internal Revenue Service doesnt need to see what you contributed when you file.

And you wont even have to amend and refile your tax return.

Also Check: How Many Years Do You Have To File Taxes

These Are The Documents That You Need

Once youve determined your eligibility status, opening a Roth IRA is relatively simple. Most banking or investing platforms require just a few key pieces of information to open an account:

- Drivers license or some other form of government-issued photo identification

- Your Social Security number

- A way to fund the account, generally bank routing and account numbers

- Your employers name and address, if applicable

If youre transferring other assets or converting a traditional IRA into your new Roth IRA, then you may need the account numbers for those accounts as well.

A Roth Conversion Could Trigger Other Taxes

Look at the big picture if you plan a conversion. The added taxable income could boost you into a higher tax bracket, at least temporarily. A big jump in income could trigger one-time taxes, too, such as the 3.8% net investment income tax, or also called the Medicare surtax.

A series of small conversions over several years could keep the tax bill in check. For instance, you may want to convert just enough to take you to the top of your current tax bracket.

You May Like: What Is The Difference Between Estate Tax And Inheritance Tax

Roth Ira Taxable Distribution Examples

Here are some examples of how Roth IRA distributions may be taxable. First, say that youre 55 years old and opening a Roth IRA for the first time. You make an initial contribution of $7,000 . You also convert $70,000 that you have saved in a traditional IRA to your Roth account.

Once you turn 59½, you decide to withdraw your Roth IRA savings. Because youve reached the age milestone, you wont owe an early withdrawal penalty on the distribution. However, if you havent yet reached the five-year mark since opening the account, then you would have to pay tax on the earnings portion of your withdrawal. This doesnt include earnings from converted amounts, though, since you would have paid taxes on those at the time of the conversion.

Converted amounts may escape income tax, but they still can be subject to the 10% early withdrawal penalty.

Now assume that you opened your Roth IRA at age 54 instead. You made the same initial contribution and rolled over the same amount. Then at age 59½, you withdraw all of the money in your account. The account has been open for five years at this point, so you escape paying any income tax on earnings. You also avoid the 10% early withdrawal penalty, because you meet the age requirement.

The Election And Other Us Retirement Arrangements

1.24 The Election described in ¶1.9 is also available to an individual resident in Canada who is a beneficiary of any other U.S. retirement arrangement generally exempt from tax in the U.S. that qualifies as a pension under the Canada-U.S. Treaty. However, the Election will be of benefit only where the income accrued in the arrangement is taxable to the individual under the Act on a current basis. Where the income accrued is not taxable under the Act until it is paid out to the individual in the form of a distribution , there is no benefit in filing the Election.

1.25 The income accrued in atraditional IRA referred to in subsections 408, or of the Code is not subject to current taxation under the Act therefore there is no benefit in filing the Election. These arrangements are defined in subsection 248 of the Act and section 6803 of the Regulations as a foreign retirement arrangement for Canadian income tax purposes.

1.27 Where no employer contributions are made, the arrangement will not be characterized as an EBP or a RCA. In this situation, the individual might be subject to current taxation under the Act on the income accrued in the arrangement and therefore should consider filing the Election. The procedures for filing the Election for these arrangements are the same as those described in ¶1.15to 1.21 for Roth IRAs.

You May Like: How To Include Unemployment On Taxes

Do I Have To Report My Roth Ira On My Tax Return

Opening a Roth IRA can be an excellent decision to make for retirement. This account offers its holders more flexibility than the traditional IRA, and they can receive many benefits in their retirement. Most importantly, account holders can have tax-free growth on their investments and withdraw contributions anytime they want and can avoid penalties if they meet certain criteria. But do you have to report your Roth IRA on your tax return? The article will provide an outline of a Roth IRA and help answer this important question.

You Can Still Recharacterize Annual Roth Ira Contributions

Prior to 2018, the IRS allowed you to reverse converting a traditional IRA to a Roth IRA, which is called recharacterization. But that process is now prohibited by the Tax Cuts and Jobs Act of 2017.

However, you can still recharacterize all or part of an annual contribution, plus earnings. You might do this if you make a contribution to a Roth IRA then later discover that you earn too much to be eligible for the contribution, for instance. You can recharacterize that contribution to a traditional IRA since those accounts have no income limits. Contributions can also be recharacherized from a traditional IRA to a Roth IRA.

The change would need to be completed by the tax-filing deadline of that year. The recharacterization is nontaxable but you will need to include it when filing your taxes.

Read Also: How Many Years Of Tax Records To Keep

City Of Tacoma Employees: Buy

Starting Monday, January 11 through Friday, January 29, eligible City of Tacoma employees have an opportunity to buy affordable additional long-term disability insurance coverage through the City. While this benefit may not sound too exciting, it represents essential insurance coverage that you should consider.

You May Like: How To Review My Tax Return Online

What Is A Roth Ira

A Roth IRA is an individual retirement account that allows account holders to make tax-free withdrawals if they meet certain conditions. The first condition is that they own the account for at least five years. Additionally, they have to be 59 and a half or older, use the money to buy a first home, or have a disability.

Also important to note is that there is a limit on the amount of money that can be deposited into a Roth IRA. The IRS sets the limit and changes it periodically. Currently, it stands at $6,000. That means people can deposit up to $6,000 per year to their accounts, or $7,000 if they are 50 or older.

Don’t Miss: Does New Mexico Have State Income Tax

Roth Ira Contribution Limits

Anyone of any age can contribute to a Roth IRA, but the annual contribution cannot exceed their earned income. Lets say that Henry and Henrietta, a married couple filing jointly, have a combined MAGI of $175,000. Both earn $87,500 a year, and both have Roth IRAs. In 2022, they can each contribute the maximum amount of $6,000 to their accounts, for a total of $12,000.

Couples with highly disparate incomes might be tempted to add the higher-earning spouses name to a Roth account to increase the amount that they can contribute. Unfortunately, IRS rules prevent you from maintaining joint Roth IRAsthats why the word individual is in the account name. However, you may accomplish your goal of contributing larger sums if your spouse establishes their own IRA, whether they work or not.

How can this happen? To illustrate, lets go back to our hypothetical couple. Lets say that Henrietta is the primary breadwinner, pulling in $170,000 a year, while Henry runs the house, earning $5,000 annually. Henrietta can contribute to both her IRA and Henrys, up to the $12,000 maximum. In this case, they each have their own IRAs, but one spouse funds both of them.

A couple must file a joint tax return for the spousal IRA to work, and the contributing partner must have enough earned income to cover both contributions.

How Do I Avoid Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Recommended Reading: How Much Federal Income Tax Should Be Withheld

How Inherited Iras Work

When you inherit a Roth IRA, many rules are the same as they are for an account you open yourself. As long as the original owner opened the Roth IRA at least five years before their death, you can withdraw the earnings tax free.

While you never have to withdraw money from your own Roth IRA, an inherited Roth IRA requires beneficiaries to take distributions. One exception is that if youre the spouse of the original owner, you have the option to treat the account as your own, avoiding required minimum distributions .

The SECURE Act, which passed in late 2019, changed how inherited IRA distributions work. If you inherited an IRA from someone other than your spouse who died before 2020, youll have to take required minimum distributions , but you can stretch them over your lifetime.

If you inherited an IRA from a non-spouse who died on Jan. 1, 2020, or later, the SECURE Act rules apply. You wont have to take RMDs, but in most cases, youll need to deplete the entire account within 10 years.

IRAs and other retirement accounts avoid probate as long as youve properly designated a beneficiary.

Does Roth 401k Get Reported On W2

Yes, contributions to a designated Roth account must also be separately reported on Form W2, Wage and Tax Statement, in accordance with the W2 instructions. … Designated Roth contributions to 401 plans will be reported using code AA in box 12. Q: When do I have to make my ROTH 401k contributions by?

Don’t Miss: Why Is Self Employment Tax So High

Are Losses On A Roth Ira Tax Deductible

OVERVIEW

When the value of your investments in a Roth IRA decreases, you might wonder if there is a way to write off those losses on your federal income tax return. Find out what tax deductions you can and cant take when it comes to your Roth IRA.

Having made it a point to carefully grow your retirement fund, when the value of your investments in a Roth IRA decreases, you might wonder if theres a way to write off those losses on your federal income tax return. The Internal Revenue Service does not permit you to deduct losses from your Roth IRA on a year-to-year basis, so the only way to deduct your losses is to close your Roth IRA accounts.

Additionally, this deduction is only available through 2017. For tax years after 2017, the deduction described below is no longer available.

Qualified Roth Ira Withdrawals

If a withdrawal is qualified, it means its tax- and penalty-free. The following are instances of qualified Roth IRA withdrawals:

- When youve attained the age of 59.5 or older.

- If you have a permanent disability

- When you transfer your account to a beneficiary

- When you want to buy, build or rebuild your first home

References

You May Like: Can I File My Taxes For Free