What Is The Best Way To Make Sure That I Am Withholding The Right Amount Of Taxes

The Department recommends reviewing federal and state Form W-4s at the beginning of the year or when your status changes . All Vermont employees should complete the W-4VT to make sure the right amount of Vermont tax is withheld from each paycheck. Completing only the federal Form W-4 may result in the wrong amount of Vermont tax being withheld.

Can I Avoid Paying Estimated Taxes

Probably not without incurring those penalties. Some classes of workers — particularly those whose income is exceptionally modest, inconsistent or seasonal — are exempt from having to make quarterly payments to Uncle Sam, however:

- If your net earnings were $400 or less for the quarter, you don’t have to pay estimated taxes — but you still have to file a tax return even if no taxes are due.

- If you were a US citizen or resident alien for all of last year, your total tax was zero and you didn’t have to file an income tax return.

- If your income fluctuates drastically throughout the year , you may be able to lower or eliminate your estimated tax payments with an annualized income installment method. Refer to the IRS’s 2-7 worksheet to see if you qualify.

Contribute To Or Open An Ira By Tax Day

Contributions to a traditional IRA can be tax-deductible. You have until the April 18, 2022, tax deadline to contribute to an IRA, either Roth or traditional, for the 2021 tax year. The maximum contribution amount for either type of IRA is $6,000 or $7,000 if you’re age 50 or older. See all the rules here.

» MORE: Learn how IRAs work and where to get one

Recommended Reading: How Much Is Tax In Ct

Protecting Yourself From Fraud

While tax scams are nothing new, the pandemic gave rise to a new set of fraud cases, specifically around COVID-related support programs, like the Canada Emergency Response Benefit . COVID-19 phishingemail scams gave hackers and con artists the personal and/or banking information to claim the benefits.

If you suspect you are a victim of fraud, collect any relevant documents, and that can include your T4, T4As, bank statements, receipts of any related transactions, as well as any emails, or text messages related to the scam. Immediately report the fraud or the scam to the Canadian Anti-Fraud Centre and to the police. Also change all of your passwords right away for any financial accounts that you think may have been targeted, as well as your email addresses, too.

File A Tax Extension Request Online

IRS e-file is the IRS electronic filing program, which allows you to send tax forms, including Form 4868, directly to IRS computers. You can get an automatic extension to file your tax return by filing Form 4868 electronically through IRS e-file on your own, using free or commercial tax software, or with the help of a tax professional who uses e-file.

In any case, you will receive an email acknowledgment you can keep with your tax records.

If your adjusted gross income is below a specified figure$73,000 for 2021you can use brand-name software at no cost from Free Filea free service that provides taxpayers with federal tax preparation and e-file options.

If your income is above the threshold, you can use the IRS Fillable Forms tool. There are also some tax software companies that offer free filing under certain conditions.

You May Like: Do You Have To Claim Stocks On Taxes

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

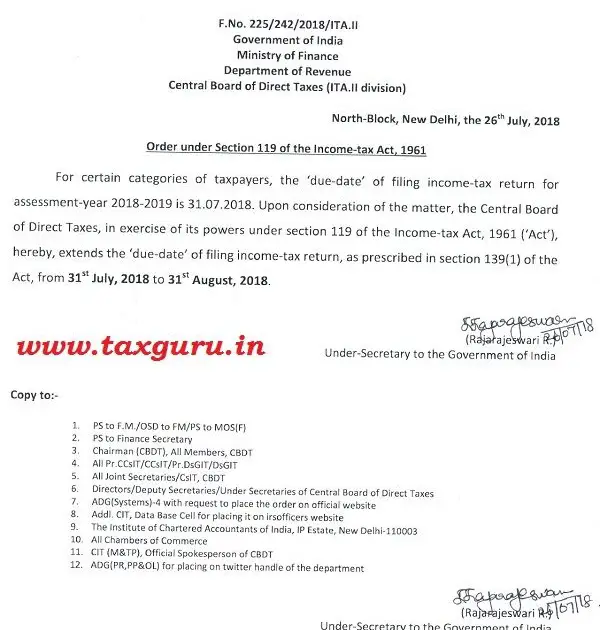

Extended Due Date Of First Estimated Tax Payment

Pursuant to Notice 2020-18PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Recommended Reading: How Much Taxes Do I Pay On Unemployment

What Happens If You Cant Pay Your Taxes

You should still file your return and immediately request a payment plan if you cannot pay all the taxes you owe at once. The IRS will generally allow you to pay over time, as long as you make the necessary arrangements to do so.

It would be beneficial for you to go to IRS Direct Payment and have the payment debited directly from your bank account if you owe money and you do not want to send a check to the IRS by mail, this involves a risk for the additional time it could take.

Race And Hispanic Origin

Race data refer to people reporting a single race only. Hispanic people can be of any race.

- Real median household incomes in 2021 for non-Hispanic White, Black, Asian and Hispanic populations were not statistically different from 2020. Among the race groups, Asian households had the highest median income in 2021, followed by non-Hispanic White , and Hispanic people. Black households had the lowest median income . The differences among the 2020 to 2021 percentage changes in household median income for the race groups were not statistically significant.

Recommended Reading: What Are Payroll Taxes Used For

Why Might A Tax Extension Request Be Rejected

Nine times out of 10, if you file on time and fill out the form correctly, you should have no issue getting an extension.

In most cases, applications are rejected for minor problems that can easily be fixed. If it comes down to a misspelling or providing information that doesn’t align with IRS records, the tax authority will usually give you a few days to sort out those errors and file the form againthis time accurately.

The IRS tends to take less kindly to unrealistic tax liability estimates. If it disagrees with your figures, your application for an extension may be denied and you could even be hit with a penalty.

What Is The Last Day To Contribute To My Retirement Account For 2019

As with other elements of the extension, individuals can wait to make 2019 contributions to their retirement accounts normally due April 15, 2020 until July 15, 2020. Consider using this extra time to set aside more money in your retirement accounts if you’re able. You can contribute a maximum of $6,000 to an IRA for 2019, plus an extra $1,000 if you’re 50 or older.

You don’t need to wait to file your tax return to make this contribution, however. If you know how much you’ll contribute by the tax deadline, you can put this on your tax return and make the actual contribution by the new deadline.

Also Check: When Will We Get Our Tax Return

Us Tax Filing Deadlines And Important Dates In 2022

Are you a citizen of the United States or a Green Card Holder residing in Canada? Do you have an interest in the U.S. or foreign business entity? Are you a Canadian individual or a business owner with U.S. interests? Or maybe you are in charge of your business tax compliance? You should be aware of the important dates and deadlines of your income tax filing requirements.We designed this page to assist you or your qualified cross-border and U.S. tax advisor in determining U.S. tax filing deadlines that may apply to your case. For example, if you are a U.S. expat and live in Canada, your general deadline for filing a U.S. income tax return with the Internal Revenue Service is April 15 . However, an automatic extension to June 15 is granted to those U.S. citizens or residents whose tax home and abode, in real and substantial sense, is outside the United States and Puerto Rico. Further extensions may be requested by taking affirmative action and filing Form 4868 ), sending a letter with a relevant explanation to the IRS , and filing Form 2350 requirements extends the filing deadline to meet the FEIC requirements).

The extension of time to file ones tax return DOES NOT extend the time for making the tax payment. To avoid potential penalties and/or interest for late tax payment, please ensure that you either pay tax with a timely filed tax return or along with filing an extension to file the respective tax return.

Expanded Penalty Waiver Available If 2018 Tax Withholding And Estimated Tax Payments Fell Short Refund Available For Those Who Already Paid 2018 Underpayment Penalty

The IRS lowered to 80 percent the threshold required for certain taxpayers to qualify for estimated tax penalty relief if their federal income tax withholding and estimated tax payments fell short of their total tax liability in 2018. In general, taxpayers must pay at least 90 percent of their tax bill during the year to avoid an underpayment penalty when they file. On January 16, 2019, the IRS lowered the underpayment threshold to 85 percent and on March 22, 2019, the IRS lowered it to 80 percent for tax year 2018.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

Taxpayers who have not filed yet should file electronically. The tax software was updated and uses the new underpayment threshold and will determine the amount of taxes owed and any penalties or waivers that apply. This penalty relief is also included in the revision of the instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Recommended Reading: Does Roth Ira Get Taxed

More Time To File Not More Time To Pay

Its important to remember that the Form 4868 extension gives you more time to file, not more time to pay. You will still have to pay your taxes by that year’s original due date, even if the IRS grants an extension to file later.

If you think you may owe taxes when it comes time to file your return, you should estimate how much you will owe and subtract any taxes that you have already paid . If your estimate is on the high side and you end up overpaying, you will get a refund when you eventually file your return. You’ll also avoid potential penalties and interest accumulating, which is what can happen if you underestimate your taxes due.

When you file Form 4868, youll need to pay the estimated income tax you owe. Sometimes it’s better to err on the high sideyoull get a refund anyway, while underestimates increase the risk of paying interest on the money owed.

You can pay some or all of your estimated income tax online using a debit or credit card, or through an electronic funds transfer using Direct Pay. It’s also possible to mail a check or money order to make your tax payment, even if you file electronically. Make the check or money order payable to the United States Treasury and include a completed Form 4868 as a voucher.

You do not need to file a paper Form 4868 if you submitted one electronically and are not mailing a payment.

Estimated Tax Payments Are Due Today Who Needs To File How To Submit And More

Sarah Szczypinski

Staff Writer

Sarah is a staff writer at CNET, covering personal finance. She previously contributed stories about money, health, and parenting to The New York Times, The Seattle Times, and The Washington Post. She once bought a car on eBay.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Courtney Johnston

Editor

Courtney Johnston is an editor for CNET Money, where she manages the team’s editorial calendar, and focuses on taxes, student debt and loans. Passionate about financial literacy and inclusion, she has prior experience as a freelance journalist covering investing, policy and real estate. A New Jersey native, she currently resides in Indianapolis, but continues to pine for East Coast pizza and bagels.

What’s happening

Self-employed workers and freelancers don’t have taxes withheld, so they’re required to pay estimated tax payments throughout the year.

Why it matters

Paying quarterly estimated taxes can help you avoid penalties when filing your return with the IRS.

What’s next

The next estimated quarterly tax due date is today, Sept. 15.

Don’t Miss: What Address Do I Send My Tax Return To

Reasons To File A Tax Deadline Extension

You may want to file a tax deadline extension for a number of reasons. For the majority of people, it makes more sense to just file your taxes on time. This is because you will either delay receiving a refund if youre getting one, or you could end up paying penalties and fees if you owe tax and didnt pay on time. Here are the top reasons you may consider filing an extension:

- Your returns arent done: If you havent had enough time to thoroughly go through your return and make sure its accurate and has taken advantage of all the possible deductions, then you may want to file an extension.

- Missing information: If you havent received information from an employer, for example, you wont be able to file on time.

- You know youre receiving a refund: If you know youre getting a refund and want to push receiving it until the fall, then filing an extension might work well for you.

- Your business filed an extension: If you have business taxes that are falling to your personal tax return and the business filed an extension, then youll likely be forced to file one for your personal returns as well.

Keep in mind that you should be very careful about filing an extension if you think youre going to owe tax to the government. You dont want to be hit with penalties or fees for not paying on time. You also want to be careful that if you are extending to make sure you file the proper paperwork so that you dont receive a no-file penalty as well.

Tax Deadline 202: When Is The Last Day To File Taxes

One of the most important things to remember as a taxpayer are the deadlines for filing your taxes. The Canada Revenue Agency sets strict due dates for returns and payments. Filing your return on time helps you avoid any interest or penalties and get your refund earlier. Weve rounded up all the major dates that matter for your taxes to make this season stress-free.

Key Takeaways

Read Also: How Long Do You Need To Keep Tax Records

What Is The Best Way To File My Tax Returns And Other Documents

More than 87% of all returns filed in Vermont are e-filed. Electronic filing through a commercial software vendor or your tax preparer is a secure way to file federal and Vermont returns. On average, e-filers get their refunds about two weeks faster than filers using paper forms because returns transmitted electronically get to the department more quickly, with fewer errors, and are more easily processed.

The Department continues to make improvements to make online filing easier for all taxpayers. You may use commercial tax software or a tax preparer to e-file Vermont personal income tax, but some filings may be made for free through myVTax as follows:

- Homestead Declaration

- Landlord Certificate

- An extension to file personal income tax

What If I Am Asked To Verify My Identity Or For More Information

After you submit your return, you may receive a letter from the Department requesting additional identification. Please respond as soon as possible to avoid a delay of your refund. You may provide additional information, including requested documents, online through myVTax, select Respond to correspondence. If we ask you to verify that the return the Department has received is truly your return, you also may respond through myVTax select Return filing verification.

You May Like: When Is The Earliest You Can File Taxes 2021

Can I File A Tax Extension Electronically Free Of Charge

Yes, you can. If your adjusted gross income falls below the annual threshold, you can use the IRS Free File program to electronically request an automatic tax-filing extension. Higher earners can use the IRS Free Fillable forms, assuming they are comfortable handling their taxes. If that’s not the case, there are several tax-software companies that offer free filing under certain conditions.

How Tax Brackets Work

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

-

Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

-

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

-

The percentage of your taxable income that you pay in taxes is called your effective tax rate. To determine effective tax rate, divide your total tax owed on Form 1040 by your total taxable income .

-

Example #1: Lets say youre a single filer with $32,000 in taxable income. That puts you in the 12% tax bracket in 2021. But do you pay 12% on all $32,000? No. Actually, you pay only 10% on the first $9,950 you pay 12% on the rest.

-

That’s the deal only for federal income taxes. Your state might have different brackets, a flat income tax or no income tax at all.

Also Check: How Much Is Medicare Tax