Tennessee And New Hampshire Income Tax

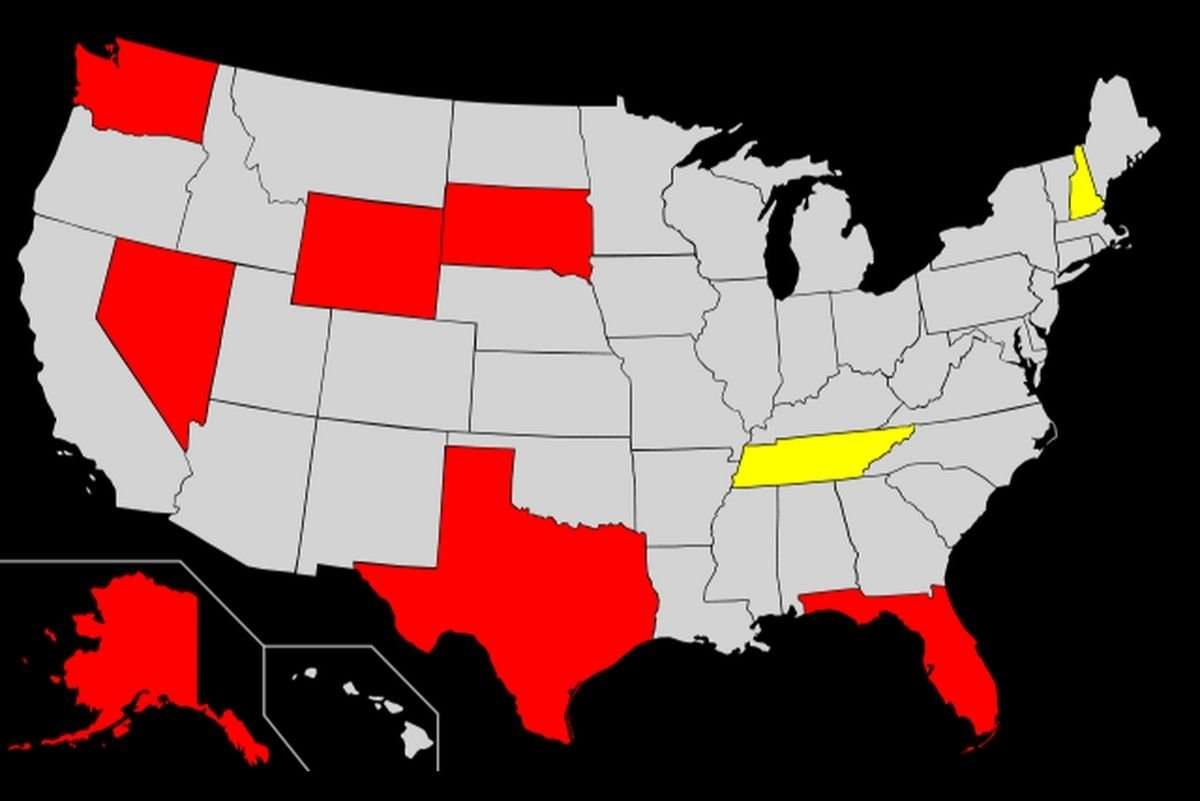

Tennessee gradually reduced its “Hall tax” on interest and dividend income. The state’s 6% Hall tax rate was reduced by 1% increments each year until the tax was eliminated as of January 1, 2021. The Hall tax rate was just 1% in tax year 2020.

Alaska, Tennessee, and New Hampshire are the only states to ever take legislative steps to eliminate an existing income tax.

New Hampshire assesses a 5% tax on interest and dividend income beyond $2,400, as of 2021. Interest and dividend income aren’t taxed for married couples filing joint returns until that amount exceeds $4,800. An additional $1,200 exemption is available for certain taxpayers who are disabled, blind, or over the age of 65.

The tax on interest and dividends is currently being phased out over a five-year period, following the signing of a bill in 2018. New Hampshire will officially have no income tax by 2024.

The 5 States Without Sales Tax

Sales tax is a large revenue driver for 45 states and the District of Columbia. According to the Tax Foundation, the average taxpayer will pay just over $1,000 per year in sales tax. In the 2020 fiscal year, income from state retail sales taxes totaled $340 billion. This makes up roughly a third of all state tax revenue, second only to income tax. Sales taxes are a key way to fund government initiatives.

While the states below do not charge sales tax, in some cases, counties and cities within these states can charge their own taxes.

How Do I Calculate My State Tax Refund

Also Check: 1040paytax.com

Taxes In Florida Explained

For decades, Florida has had one of the lowest tax burdens in the country, according to the independent research organization Tax Foundation. For 2013, Florida will place the fifth-lowest tax burden on its residents and businesses. But not all taxes are created equal, and the state collects in a variety of ways that residents need to be aware of.

What Is The Income Tax Rate

The federal income tax is a progressive tax, which means that the more income you earn, the more you’re taxed. The tax rate is divided into brackets, and you pay taxes based on the brackets your income falls into. For example, the 2021 tax brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. If your taxable income was $41,000 in 2021 and you’re a single filer, you would pay 10% on your income up to $9,950, 12% on $9,951 to $40,525 in income, and 22% on your income up to $41,000.

Read Also: Do I Have To File Taxes For Doordash If I Made Less Than $600

Tax Revenue From Other Sources

States with no income tax make up for the lost revenue with other taxes including property taxes, sales taxes, fuel taxes, etc.

New Hampshire has one of the highest property tax rates in the U.S. Its revenue from property taxes in 2018 was nearly 64%. But it does not have a sales tax.

Meanwhile, Tennessee has the highest combined sales tax rate in the country at 9.55%. At a 7% sales tax rate, 60% of its tax revenue comes from sales tax.

Florida levies a sales tax rate of 6% and a combined average of 7.08%. The property tax rate is one of the highest in the country.

Washington state levies a tax of 49.4 cents per gallon on gasoline, one of the highest in the U.S.

Other reasons for states charging no income taxes could be due to increased revenue from other sources.

For instance, Alaska gets its major chunk of revenue from the oil industry in the state. Wyoming also gets significant revenue from taxes imposed on the extraction of natural resources, primarily oil.

Youre Politically Conservative Or Libertarian

Finally, opinions on state income tax often line up with peoples political leanings. Liberals might accept more income taxes in exchange for social programs, while conservatives and libertarians might oppose income taxes and want to minimize them.

So if youre drawn to a community of like-minded individuals, then your socio-political views are another factor to consider before relocating.

Read Also: Efstatus.taxact 2013

Analysis Shows Population Growth In Lower Tax States

For many, the pandemic has altered their perceptions about where they want to live and where they can live. Millions of city-weary residents aching for more space have moved since the start of the pandemic.

Analysis of state tax burden rates and the change in population from 2019 to 2020 as estimated by the U.S. Census Bureau shows a negative correlation. The lower the state and local tax burden, the higher the population growth in 2020.

Four of the five states with an A grade in tax friendliness had population growth at or above the national average. The fifth state in the group with negative population growth was Alaska.

Of the states with an E grade, all three had population declines in 2020. Of the 9 states with a D grade, only one, New Hampshire, had population growth higher than the national average.

The included expert insights section on this page has advice on how to manage moving and taxes.

Do I Need To File State Taxes If I Live Abroad

Whether or not you will need to file state taxes while living abroad depends on the state you lived in and if you still have ties to the state. If you are planning a move abroad, this guide will help you make smart tax decisions in advance of your transition out of the US. If youve already moved abroad, this guide will help you know what filing requirements you face and make decisions about cutting ties to avoid more tax obligations.

In some cases, you wont need to file state tax for expats if youre living abroad. In fact, some states dont levy state income taxes at all.

Heres how to know if you need to file state taxes while living abroad:

Recommended Reading: How To Get A License To Do Taxes

Do States With No Income Tax Outperform Other States

Four of the top 10 states with the strongest economic outlook do not charge an income tax, according to 2021 rankings from the American Legislative Exchange Council, a think tank focused on free markets and limited government.

Part of that might be because theyre attracting more workers. States that dont have an income tax gained a net inflow of 285,000 new residents leaving from the 41 states that did charge an income tax, according to 2018 figures from the IRS, the most recent for which data is available.

An analysis from the Tax Foundation using Commerce Department data shows that states without an income levy grew at twice the national rate over the past decade, while gross state product grew 56 percent faster in those locations over the same period.

They tend to be outshining some of their peers that do have income taxes, says Katherine Loughead, senior policy analyst at the Tax Foundation who focuses on state tax policy.

Others, however, point out that missing income tax revenue might come with a cost particularly when it comes to infrastructure and education spending. South Dakota and Wyoming, for example, spent the least on education of all states, according to a 2021 analysis from the Census Bureau.

Tips For Navigating Tax Planning

- Need help finding a financial advisor? SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- You might be interested in signing up for a robo-advisor. Many robo-advisors offer tax-loss harvesting, which sells investments that are hurting your portfolio and helps offset what you earn from the gains. Robo-advisors arent necessarily right for everyone, but if youre starting your investment journey or you dont have complicated assets, you may want to give it a try. If youre unsure, find one that offers you the chance to talk to a financial professional if you have questions about your specific needs. Not all robo-advisors offer this perk, but some do, usually for a fee.

Read Also: When Do You Do Tax Returns

States That Dont Tax Social Security

As of 2021, 37 states plus the District of Columbia do not tax Social Security benefits. These states include the nine that dont have any income tax at all, which are:

-

Alaska

-

Rhode Island

-

Vermont

Specifics vary, but all the states in this category have some type of Social Security offset based on how old you are or how much you make. Colorado, for example, allows taxpayers 55 and older to subtract some of their Social Security income, while Kansas provides a total exemption for taxpayers earning less than $75,000, regardless of filing status. In Montana, some Social Security benefits may be taxable so it advises its taxpayers to complete a worksheet to determine the taxation of their Social Security benefits.

See: 35 Countries Where Your Social Security Check Goes Furthest

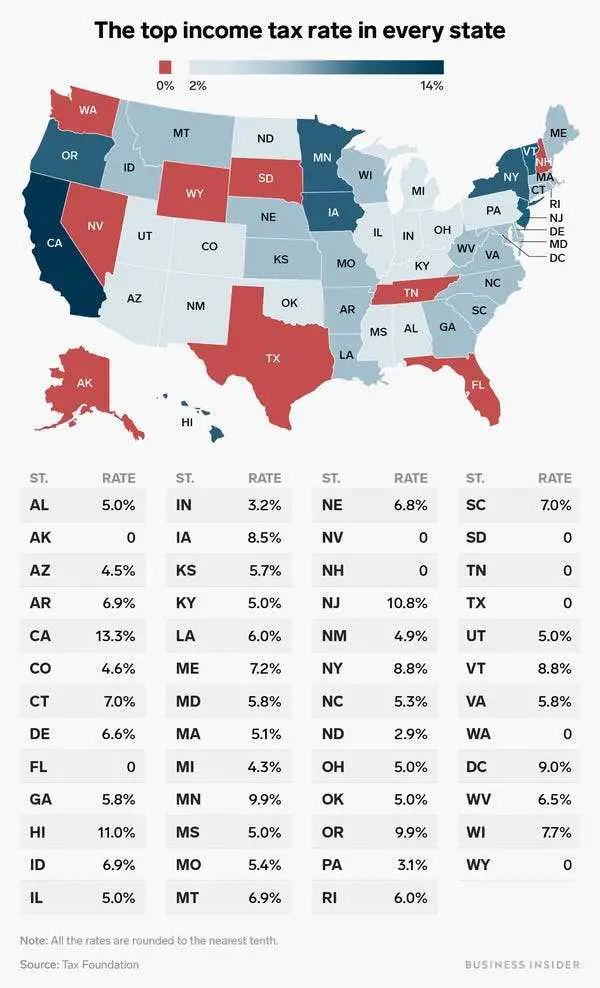

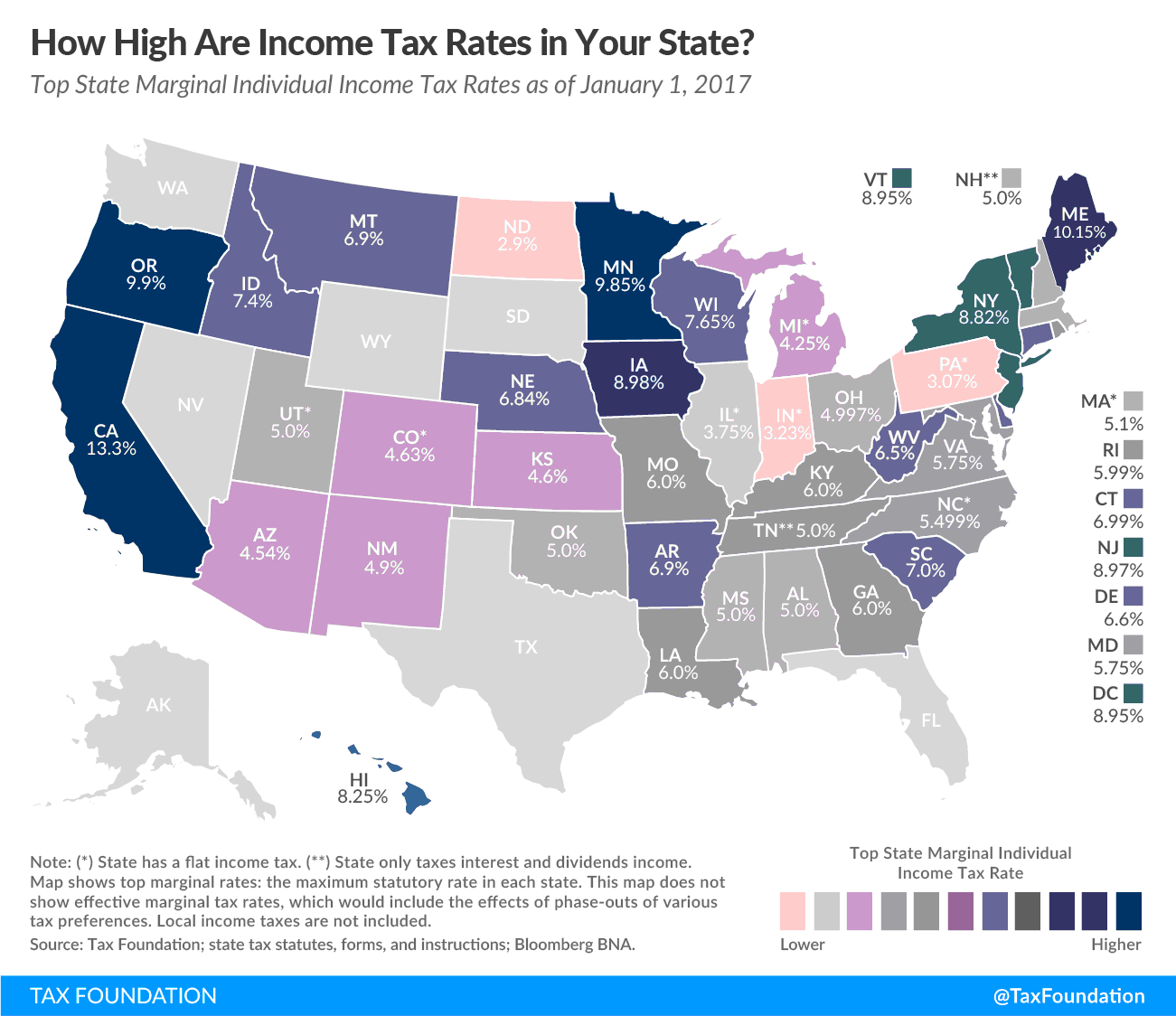

State Tax Rates Vary Widely

States that levy income taxes typically use one of two methods: the graduated income tax or the flat rate income tax. For both methods you first need to figure out your taxable income in order to calculate your state-level income tax obligation.

Of the states with an income tax, 11 use the flat-rate tax method, meaning one rate applies to all levels of taxable income. Those states are Colorado, Illinois, Indiana, Kentucky, Massachusetts, Michigan, New Hampshire, North Carolina, Pennsylvania, Tennessee and Utah. Thirty-one states and the District of Columbia have graduated rate income taxes, meaning your tax rate differs depending on your taxable income level.

Whats more, the number of brackets for those graduated levels varies by state. For example, Hawaii has 12 tax rates and brackets, while the District of Columbia has just six.

These graduated state tax rates can vary greatly. For example, in 2019 California had an income tax rate of 13.3% for couples married filing jointly with income of more than $1,181,484. And New York has a top personal income tax rate of 8.82%. In comparison, North Dakotas income tax maxes at 2.9%. When you file your taxes, you can learn your tax rate based on your states guidelines.

You May Like: What Can I Write Off On My Taxes For Instacart

Us State Income Tax Rates

The general approach to US state income tax rates is done in three different ways.

- Residents and those working in a specific state either do not pay any income tax at all

- They pay a flat rate of income tax, including on interest and dividends, and this income tax rate does not change based on the level of earnings

- Or, the state you live in imposes a progressive tax. This means that people with higher taxable incomes pay higher state income tax rates, and those with lower incomes pay less tax.

Most people live and work in the same state for the entire year. This is your state of residence and determines the rate of income tax you pay. You may have a job that requires travel to other states, but this does not typically affect the rate of tax you pay on your income, it is the state you live in that determines this.

However, if you lived in one state for part of the year and moved to another state, you may owe state income tax to two different states at two different rates. Similarly, if you work in one state and own income-generating property in another state, you may be liable to pay income tax in more than one state, which may require more than one tax return.

All The States That Dont Tax Social Security

Some retirees are surprised to learn that the federal government, in certain circumstances, taxes Social Security benefits. Even more surprising to some is that certain individual states also apply their own income tax to Social Security payouts. Fortunately, not many states fall into this category. Even those that do tax Social Security often provide certain exemptions or ways to reduce or eliminate the tax, typically based on age or income. Heres a list of the states that dont tax Social Security, along with some details about those that do.

Be Prepared: 30 Greatest Threats to Your Retirement

Read Also: How To Find Employer Ein Without W2

The Benefits Of Living In A State With No Income Tax Comes Down To Your Personal Finances

Whether you should move to a state with no income tax depends on your personal financial situation and your individual priorities. Families with college-aged students might not want to move to a state with no income tax if it means paying more tuition. Meanwhile, if the bulk of your household budget goes toward groceries and clothing items that are sales taxable you might not save much money in the long run. Statesinheritance taxes should also be taken into consideration, especially if youre nearing retirement and hoping to eventually pass down an asset while considering a move.

As the economy rebounds from the pandemic and remote work becomes increasingly more common, Americans might find that they can live and work in different places than they could before the outbreak. But if a state with no income tax has limited employment opportunities for your industry, you might want to hold off on relocating just so you can reduce much youre paying in taxes every year.

At the same time, higher-income earners might benefit from living in a state with no income tax. And if you dont own property, you might not feel a big difference in your tax burden.

You do see a trade-off when it comes to the major taxes that states levy, Loughead says. if youre a really high-income individual, youre probably going to think twice before living in a state with high income taxes, especially if theres a bordering state where you can reside in.

Moving To A State With No Income Tax

Its important to evaluate each state individually and compare it against your living requirements. These states are a great place to start and retiring with no state income tax will certainly bring you peace of mind when tax season rolls around!

The information provided is for informational purposes only. It should not be considered legal or financial advice. Matiah Fischer and RetireBetterNow.com does not make any guarantee or other promise as to any results that may be obtained from using this information or our services. To the maximum extent permitted by law, Matiah Fischer and RetireBetterNow.com disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable. Content contained on this website is not intended to and does not constitute legal advice or investment advice and no attorney-client relationship is formed. Use this information at your own risk.

Read Also: What Home Improvement Expenses Are Tax Deductible

Capital Gains Tax Rates By State

Investors must pay capital gains taxes on the income they make as a profit from selling investments or assets. The federal government taxes long-term capital gains at the rates of 0%, 15% and 20%, depending on filing status and income. And short-term capital gains are taxed as ordinary income. Some states will also tax capital gains. A financial advisor could help you figure out your tax liability and create a tax plan to maximize your investments. Lets break down how capital gains are taxed by state in 2021.

Determine If You Have Income In The State:

- Income earned from working in the state is almost always taxable in the state.

- Other income generated from a state sourcelike pension/retirement income or government benefitsmay be taxable if youre a resident of the state.

- Residency requirements are determined by the individual state, but most states consider you a non-resident if you live outside the state for more than half a year.

Read Also: Reverse Ein Lookup Irs

Taxes On Retirement Income

Thirty-seven states and the District of Columbia take it easy on retirees when it comes to taxes. Many seniors in these states don’t pay income tax, at least when they stop working. Some of these states exclude all retirement income, while others exempt only a portion.

Other states have either partial exemptions or full exemptions for people who meet certain income requirements. For example, Kansas exempts Social Security income if your adjusted gross income from all sources is $75,000 or less.

Some states don’t tax government pensions. Depending on your state, you may have to pay income tax if you earned a government pension elsewhere but moved to one of these states when you retired.

Pennsylvania also exempts private-sector pension income, and Alabama doesn’t tax income from defined-benefit retirement plans. Hawaii doesn’t tax income from contributory retirement plans.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: How To Do Taxes For Doordash