State Income Tax Vs Federal Income Tax: An Overview

The United States has a multitiered income tax system under which taxes are imposed by federal, state, and sometimes local governments. Federal and state income taxes are similar in that they apply a percentage rate to taxable incomes, but they can differ considerably with respect to those rates and how they’re applied, as well as to the type of income that is taxable and the deductions and tax credits that are allowed.

Filing Requirements And Filing Deadlines

| Filing Frequency |

|---|

| Notice of Change or Discontinuance | This form can be electronically submitted through MTO. |

Do I have to file a return? What if I do not owe any tax?

If you are registered to pay a tax, you must file a return within your established filing frequency, even if no tax is due.

What is the definition of a tax year?

A tax year for Sales, Use and Withholding tax is defined as a calendar year: January 1- December 31.

How often do I need to file a tax return for Sales, Use and Withholding taxes?

Initially, Treasury determines your filing frequency based on your estimated monthly payment for each tax that you registered on your registration application.

Because Sales, Use and Withholding Taxes are reported together they will have the same filing frequency.

Subsequently, your filing frequency is reviewed by Treasury annually for update. If your filing frequency is changed you will be notified in writing. Because Sales, Use and Withholding Taxes are reported together they will have the same filing frequency.

For more information, See Table 1: Filing Frequencies & Due Dates.For more information, See Table 2: Tax Return Form Number by Tax Year.

I did not file my monthly/quarterly returns. Can I just file the annual return?

No, the purpose of the annual return is to reconcile, balance, and close the tax year. It does not replace monthly/quarterly returns.

I need to amend my Sales, Use and Withholding tax return. What is the process?

Monthly/Quarterly Return

Overview Of Alabama Taxes

Alabama has income taxes that range from 2% up to 5%, slightly below the national average. The Heart of Dixie has a progressive income tax rate, in which the amount of tax withheld depends on which of its three tax brackets you fall under. This generally means that youll be at a higher rate if you earn more. Depending on which county you live in, local income taxes may also be withheld.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Also Check: How To Find Out If You Owe Back Taxes

How To Calculate Income Tax After Pre

Overtime hours can make for long weeks and bigger paychecks. Before you get ready to spend the windfall, be sure to know exactly what your paycheck with overtime will be. To do this, you need to know your overtime tax rate.

TL DR

Your employer should tax your overtime wages at the same rate as your other hourly pay. Add up the gross total wages and calculate the taxes as normal.

Upcoming Tax Brackets & Tax Rates For 2020

Note: This can get a bit confusing. The filing deadline for the 2020 tax year is April 15, 2021. Which means you account for your 2020 tax bill in 2021. Add the fact that the IRS released the ground rules for 2021 taxes in October 2020, and your head is swimming in a pool so perplexing that a state of confusion can be excused.

But wait. Come springtime, will Washington ponder another filing delay in response to a new or ongoing national emergency? You never know.

What we do know is the rates and brackets for the 2020 tax year are set.

Here is a look at what the brackets and tax rates are for 2020 :

| Tax rate |

|---|

Recommended Reading: When Do Taxes Get Deposited 2021

An Example Of An Employee Pay Stub

In the case of the employee above, the weekly pay stub would look like this:

| Employee Pay Stub |

|---|

You must make deposits with the IRS of the taxes withheld from employee pay for federal income taxes and FICA taxes and the amounts you owe as an employer. Specifically, after each payroll, you must

- Pay the federal income tax withholding from all employees

- Pay the FICA tax withholding from all employees, and

- Pay your half of the FICA tax for all employees.

Depending on the size of your payroll, you must make deposits monthly or semi-weekly.

You must also file a quarterly report on Form 941 showing the amounts you owe and how much you have paid.

If you have many employees or don’t have the staff to handle payroll processing, you might want to consider a payroll processing service to handle paychecks, payments to the IRS, and year-end reports on Form W-2.

Us Tax Calculator: $45k Salary Example

Before reviewing the exact calculations in the $45,000.00 after tax salary example, it is important to first understand the setting we used in the US Tax calculator to produce this salary example. It is important to also understand that this salary example is generic, if you are looking for a precise calculation we suggest you use the US Tax Calculator and alter the settings to match your tax return in 2022.

This $45k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Pennsylvania State Tax tables for 2022. The $45k after tax calculation includes certain defaults to provide a standard tax calculation, for example the State of Pennsylvania is used for calculating state taxes due. You can produce a bespoke Tax calculation or compare salaries in different states and/or at different salary package rates if you need a more detailed salary overview or tax calculation for a specific state.

Recommended Reading: When Can I Get My Tax Refund

Best Free Paycheck And Salary Calculators

If youve ever had a job before, you know that your gross pay is significantly more than your net pay, the number you deposit in your bank account. So, how can you figure out how much money you’ll take home when you get paid? What will you net after taxes and other deductions are taken out of your paycheck?

How You Can Affect Your Louisiana Paycheck

If you want to shelter more of your earnings from taxes, you can always contribute to tax-advantaged accounts. You can put pre-tax dollars in a 401 and let that money grow tax-free until you start taking distributions in retirement. You can also put pre-tax dollars in a flexible spending account or health savings account account to use for medical expenses. Some workplaces offer other benefits you can pay for with pre-tax dollars, such as commuter cards that let you pay for parking or public transit.

If, on the other hand, your focus is on having more take-home pay in your paycheck, you can ask for a raise or seek supplemental wages. This includes overtime, but also bonus pay, award money and commissions. These supplemental wages are subject to Louisiana income taxes at the regular rate.

With average income tax rates and low property taxes, Louisiana may be on your list of potential places to call home. If youre looking to become a resident, take a glance at our Louisiana mortgage guide to understanding mortgages in the Pelican State.

You May Like: What Tax Form Should I Use

Your Taxes Are Based On Profit Not The Money You Get From Doordash And Others

I was going to make this a sub-point of the filing as a business. It just seems to flow.

But this is incredibly important to understand. It’s worth its own point.

A business’s income is not its revenue. It’s the profit. Profit is the amount left over after expenses. This is the big difference between being taxed as a business and taxed as an employee.

As an employee, your taxes are based on that W-2 number.

In a bit I’ll talk about what your version of a W-2 is. It’s not your 1099. Your 1099 is only your business revenue. You could call it your sales. You sold a service.

As a business, you subtract the cost of doing business from your revenue. That gives you your profit. Profit is your income as a business owner.

Paycheck And Salary Calculators

A paycheck calculator lets you know how much money will be in every check that you receive from your employer, and they are available online for free.

Salary calculators can help you determine how much you could be earning, and how much a job offer is worth and how far your paycheck will go in a specific location, based on the cost of living in that area.

Recommended Reading: Do Elderly Have To File Taxes

I Have Checked The Status Of My Return And I Was Told There Is No Record Of My Return Being Received What Should I Do

- The NCDOR will send a confirmation email to you once your electronically filed return is accepted. If you did not receive this email, there may be an error with your return and it is recommended you contact the Department at 1-877-252-3052 to confirm the return was successfully transmitted.

- You can mail a duplicate return to NC Department of Revenue, P O Box 2628, Raleigh, NC 27602, Attn: Duplicate Returns. The word “duplicate” should be written at the top of the return that you are mailing. Please allow 12 weeks for your original return to be processed before mailing a duplicate return copy to this address. The duplicate return must be an original printed form and not a photocopy and include another copy of all wages statements as provided with the original return.

The Benefits Of Living In A State With No Income Tax Comes Down To Your Personal Finances

Whether you should move to a state with no income tax depends on your personal financial situation and your individual priorities. Families with college-aged students might not want to move to a state with no income tax if it means paying more tuition. Meanwhile, if the bulk of your household budget goes toward groceries and clothing items that are sales taxable you might not save much money in the long run. Statesinheritance taxes should also be taken into consideration, especially if youre nearing retirement and hoping to eventually pass down an asset while considering a move.

As the economy rebounds from the pandemic and remote work becomes increasingly more common, Americans might find that they can live and work in different places than they could before the outbreak. But if a state with no income tax has limited employment opportunities for your industry, you might want to hold off on relocating just so you can reduce much youre paying in taxes every year.

At the same time, higher-income earners might benefit from living in a state with no income tax. And if you dont own property, you might not feel a big difference in your tax burden.

You do see a trade-off when it comes to the major taxes that states levy, Loughead says. if youre a really high-income individual, youre probably going to think twice before living in a state with high income taxes, especially if theres a bordering state where you can reside in.

You May Like: How To Pay Income Tax

How Tax Brackets Add Up

In 2019, the IRS collected more than $3.5 trillion in Federal taxes paid by individuals and businesses individuals accounted for about 56% of that total.

The agency processed more than 253 million individual and business returns a whopping 73% of returns were filed electronically. Of roughly 154 million individual tax returns, 89% were e-filed.

Individuals and businesses claimed nearly 121.9 million refunds totaling more than $452 billion. The vast majority of these totals 119.8 million refunds amounting to more than $270 billion went to individuals.

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

In IRS Publication 15-A, find the tables marked âWage Bracket Percentage Method Tables.â Use the table corresponding to your employeeâs pay period.

Check form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Find the employeeâs gross wage for the pay period in columns A and B. The wage should be over the amount found in column A but under the amount found in column B.

Subtract the amount found in Column C.

Multiply the result by the percentage found in Column D.

Check form W-4 to determine if the employee requests additional tax withheld from each paycheck. If they do, add that amount to the final number.

The end result is the amount you should withhold from the employeeâs paycheck for that pay period.

The Percentage Method is much more complicatedânot recommended if youâre doing this alone. If you want to learn more about the Percentage Method, you can read all about both methods in IRS Publication 15-A.

Once youâve figured out how much income tax to withhold from your employeesâ paychecks, your next step is to figure out how much FICA to withhold , and how much youâll be required to pay on their behalf.

Also Check: What’s The Property Tax In Texas

Federal Withholding Is Consistent But It Varies By State

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

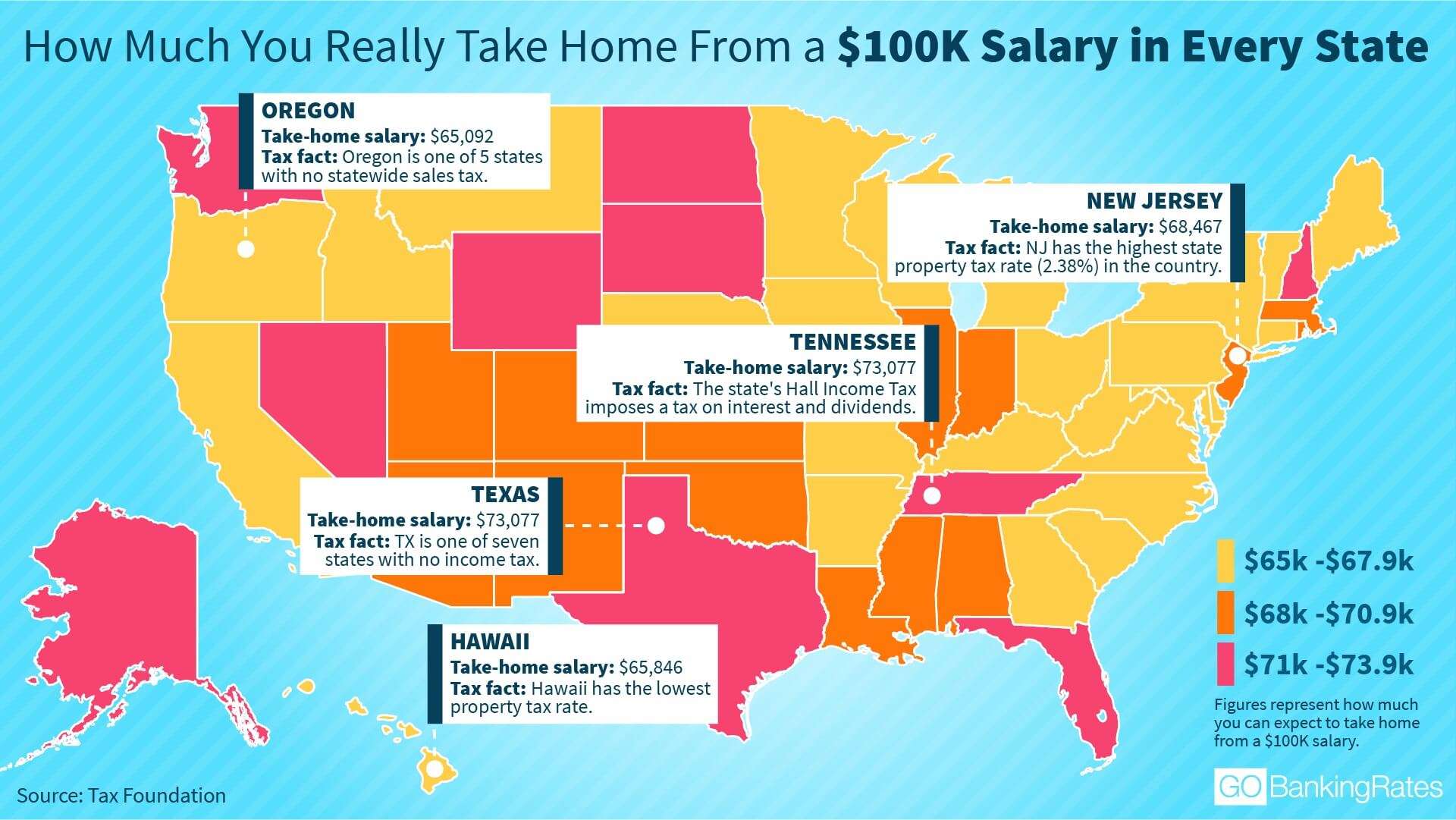

How Much Money Gets Taken Out Of Paychecks In Every State

See where there are fewer tax withholdings. Taxes 101

Its payday, and you log on to your bank account hoping to see a hefty deposit, but it has a lot less heft than you expected. You can thank payroll taxes for that. They take a big bite out of paychecks each month, and just how big depends on where you live. If youre single and you live in Tennessee, expect 16.5% of your paycheck to go to taxes and thats the state with the lowest tax burden in the nation.

Support Small Biz: Dont Miss Out on Nominating Your Favorite Small Business To Be Featured on GOBankingRates Ends May 31

To find out just how much taxpayers in each state can expect to have withheld from their biweekly paychecks, GOBankingRates analyzed the average income data from the U.S. Census Bureau and combined that information with federal and state tax rates provided by the Tax Foundation. The result is precisely what gets pulled out of the typical persons biweekly paycheck in each state, sorted from the lowest amount for single filers to the highest.

- Total income taxes paid: $8,797

- Tax burden: 16.5%

- Amount taken out of an average biweekly paycheck: $338

Joint Filing

- Total income taxes paid: $7,067

- Tax burden: 13.25%

- Total income taxes paid: $9,113

- Tax burden: 20.22%

- Amount taken out of an average biweekly paycheck: $351

Joint Filing

- Total income taxes paid: $7,293

- Tax burden: 16.18%

- Amount taken out of an average biweekly paycheck: $281

Joint Filing

Joint Filing

Joint Filing

Also Check: How To Pay Taxes For Free

What Is The Total Income Tax On $9200000

It’s a question we probably ask ourselves the most, Mow much tax will I pay? Whether you are comparing salaries when taking a new job, producing a payslip example or understanding what your payslip will look like after a pay raise, it’s important to understand how much tax you will pay, particularly when a pay rise or change in financial situations mean that your tax calculation will change significantly.

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

Recommended Reading: How Do I Change My Tax Withholding On Unemployment