How Do I Pay My Taxes

If you are employed by a company, your taxes are deducted as you earn and are paid to the Inland Revenue Division by your employer. Businesses and professionals must make payments directly to the Inland Revenue Division:

Income Tax Basics In India

Income tax is a type of tax that the central government charges on the income earned during a financial year by the individuals and businesses.Taxes are sources of revenue for the government.Government utilizes this revenue for developing infrastructure, providing healthcare,education,subsidy to the farmer/ agriculture sector and in other government welfare schemes. Taxes are mainly of two types,direct taxes and indirect form of taxes.Tax levied directly on the income earned is called as direct tax,for example Income tax is a direct tax.The tax calculation is based on the income slab rates applicable during that financial year.

Selick: If The Govt Wants To Kick The Unvaccinated Off Healthcare Then Give Us Back Our Taxes & Let Us Pay For Our Own

If the unvaxxed are to be excluded from government services, refund their taxes.

The Ontario Vaccine Contact Centre phoned me bright and early Monday morning to ask whether Id like information on where I could get vaccinated.

I wanted information, all right but not about where I could get vaccinated. I wanted to know where they had got my phone number, and what made them select me for such a phone call. My family doctor had retired in March and I didnt think it was anyone elses business to keep track of what medical procedures I had undergone since then.

The young lady never got her question answered, but she did answer mine. Her phone call resulted from a project of the Ontario government to correlate vaccination records with OHIP coverage. As an Ontario resident, I am of course covered by the government-owned health insurance plan.

They got my phone number from my OHIP records. Theyve been combing through those records looking for individuals who arent also in the COVID vaccination database, and thats why they chose to call me. Its official now: all unvaccinated Ontarians can expect such a call eventually.

But she couldnt tell me whether the intrusions would escalate if I continued to defy the governments wishes that I be vaccinated.

Already, Alberta residents have reported incidents of being denied health care due to their unvaccinated status.

Lets go our own separate ways vaxxed and unvaxxed. Time will tell who made the smarter decision.

Don’t Miss: How Do Expats Pay Taxes

How Do Canadian Inheritance Tax Laws Work If The Estate Is Inherited By A Surviving Spouse Or Common

Any non-registered capital property may be transferred to the deceased taxpayers spouse or common-law partner.

For any registered assets , the deceased person is deemed to have received the fair market value of his or her plan assets immediately prior to death. This amount must be included in the income of the deceased persons tax return.

However, it is possible to defer income tax if an eligible person has been designated as the beneficiary of the RRSP or RRIF. An eligible person includes a spouse or common-law partner, a financially dependent child or grandchild under 18 years of age or a financially dependent mentally or physically infirm child or grandchild of any age.

Where Can I Make A Payment

Payment can be made at the Cashiers Unit at the addresses below between the hours of 8:00 am and 3:00 pm, Monday to Friday, except public holidays.

The Inland Revenue DivisionInland Revenue Division Building Government Campus Plaza

Scarborough Tobago

Payment can also be made at any district revenue office. Please follow the link below for office locations.

What are the deadlines to submit taxes?

Employers must pay Income Tax and Health Surcharge Payments deductions by the 15th of the month following the month the deduction was made from employees earnings. Self-employed individuals must make quarterly payments by the last day of each quarter, in March, June, September and December.

Where can I find more information?

For more information, please visit the Inland Revenue Division website, contact the Inland Revenue Division office or any District Revenue Office.

The Inland Revenue DivisionInland Revenue Division Building Government Campus Plaza

Also Check: How Do I File My Taxes Electronically

Apply For An Installment Agreement

If you think it will take you more than a few months to pay your tax liability, consider applying for an installment agreement. You can apply online at IRS.gov or by mail using Form 9465-FS.

An installment agreement can prevent the IRS from taking enforced collection action. You’ll still owe penalties and interest, but your monthly payments let the IRS know that you intend to make good on what you owe.

Who Has To File

Unless it is exempt, a corporation is required to file an Alberta corporate income tax return if it had a permanent establishment in Alberta at any time during the taxation year.

To determine if your corporation is exempt, complete the Exemption Criteria section in AT100, Preparing and Filing the Alberta Corporate Income Tax Return.

Additional information on who is not required to file, who is exempt and the definition of a permanent establishment are outlined in Information Circular CT-2, Filing Requirements.

Recommended Reading: Where To Mail Federal Tax Return 2021

Is It Possible To Stop The Two Remaining 2021 Payments

The child tax credit requirements are different from previous years. If you ultimately receive more money than you’re eligible for, you might have to pay the IRS back. That’s why it’s important to use the Child Tax Credit Update Portal to inform the IRS of changes to your household circumstances so adjustments can be made.

You may choose to opt out of advance monthly child tax credit payments to get one lump sum during tax time in 2022. It also may be the safest option to avoid repaying the IRS if you’re ineligible for the monthly payments, especially if your income changes this year. You can use the Child Tax Credit Update Portal to opt out of the program anytime. You’ll only need to unenroll once, and you should be able to reenroll later this month if you need to.

If you or your spouse unenrolled from the child tax credit program but still got the money, it’s possible you didn’t opt out in time. You need to do so at least three days before the first Thursday of the month because it takes up to seven calendar days to process the request. The next unenrollment deadline is Nov. 1. Note that if you file taxes jointly, both parents need to unenroll. Otherwise, the spouse who doesn’t opt out will receive half of the joint payment.

Here are the deadlines for unenrolling:

Deadline To File And Pay Taxes Was May 17

Find out what to do if you cant pay what you owe. An extension to file is not an extension to pay the taxes you owe.

The estimated tax payment deadline was April 15. Get details on the 2021 tax deadlines.

Pay with your bank account for free or choose an approved payment processor to pay by credit or debit card for a fee.

You May Like: What Is The Irs Tax Deadline

Pay Your Due Income Tax

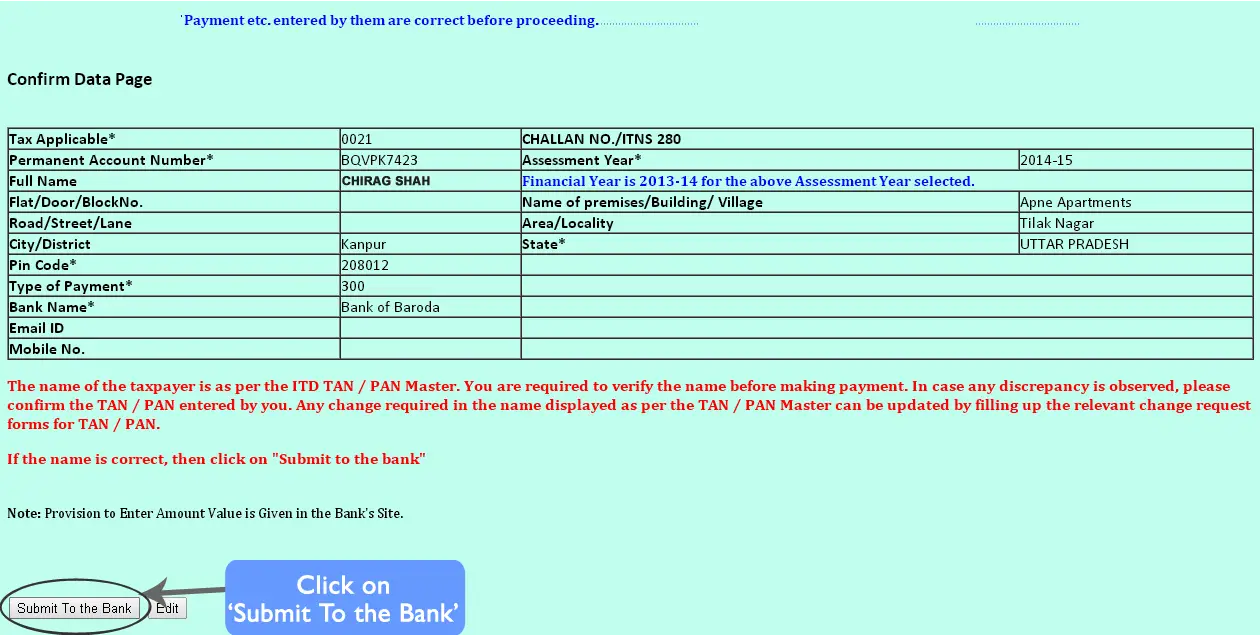

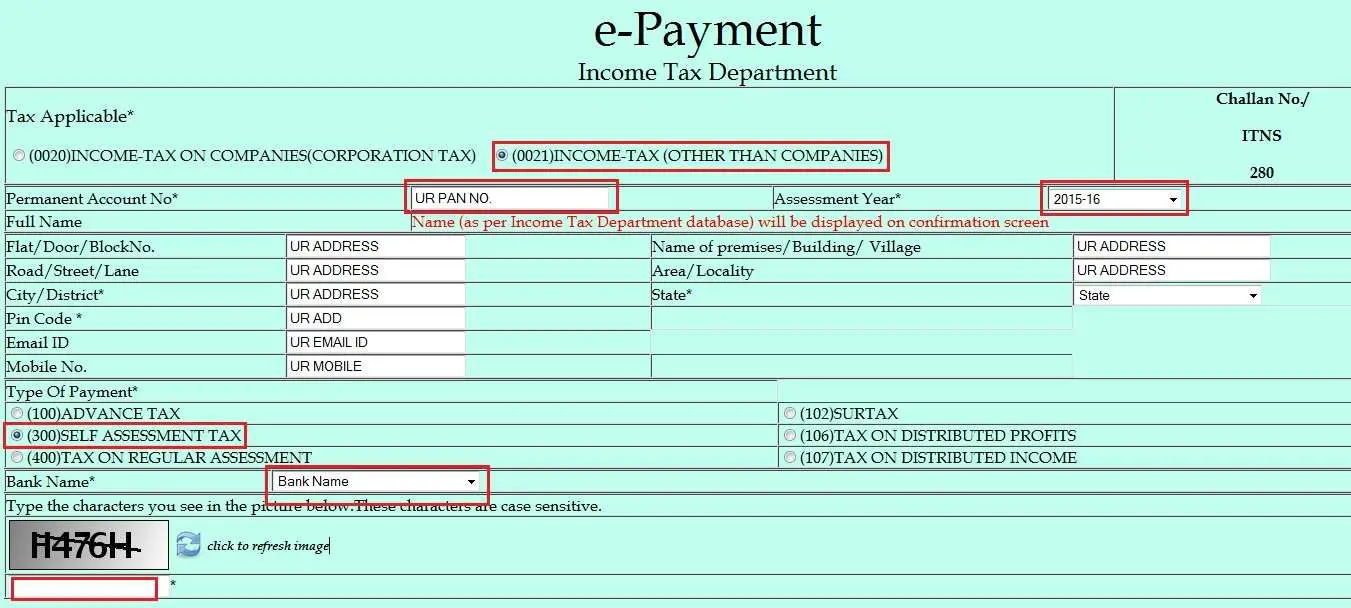

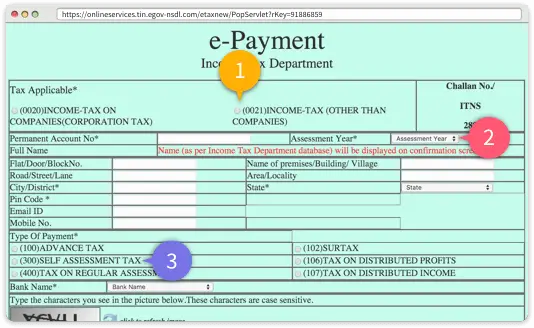

To pay your due Income Tax online at first you have to log on to the official website of the Income Tax Department and click on Challan 280. Next, you need to choose Tax on Regular Assessment‘ and select the bank through which you want to pay.

It is the duty of every eligible earning individual in the country to pay income tax, with the income tax department keeping a watchful eye on tax evaders. Paying taxes can be a burden, both financially and on our time, which is why the department has provided adequate provisions, ensuring that taxes are no longer something which people avoid.

Income Tax Slabs Under New Tax Regime

From the FY 2020-21, a new tax regime is available for individuals and HUFs with lower tax rates and zero deductions/exemptions. Individuals and HUF have the option to choose the new regime or continue with the old regime.The new tax regime is optional and the choice should be made at the time of filing the ITR. If the old regime is continued than all the deductions/exemptions as available can be availed by the taxpayer. The income tax slabs under the new tax regime are:

| New regime slab rates | |

|---|---|

| Income above Rs 15 lakh | 30% |

Most of the deductions like deductions and exemptions are not allowed if the taxpayers opts for the New Tax regime. However he exemptions and deductions available under the new regime are:

- Transport allowances in case of a specially-abled person.

- Conveyance allowance received to meet the conveyance expenditure incurred as part of the employment.

- Any compensation received to meet the cost of travel on tour or transfer.

- Daily allowance received to meet the ordinary regular charges or expenditure you incur on account of absence from his regular place of duty.

Also Check: How To Pay Back Taxes Online

Exceptions To The Tax Slab

One must bear in mind that not all income can be taxed on slab basis. Capital gains income is an exception to this rule. Capital gains are taxed depending on the asset you own and how long youâve had it. The holding period would determine if an asset is long term or short term. The holding period to determine nature of asset also differs for different assets. A quick glance of holding periods, nature of asset and the rate of tax for each of them is given below.

| Type of capital asset | |

|---|---|

| Holding more than 36 months â Long Term Holding less than 36 months â Short Term | 20% Depends on slab rate |

What Happens If You Can’t Pay Your Taxes

What happens if you complete your tax return and find that you can’t pay the amount you owe?

This isn’t supposed to happen. You’re supposed to pay income taxes gradually throughout the year so that in April you won’t owe much or will even be entitled to a refund of overpaid taxes. Employees have income tax withheld from their paychecks. Self-employed taxpayers pay quarterly estimated taxes directly to the Internal Revenue Service .

But sometimes your life situation changes or an unusual one-time event occurs during the year. When you prepare your annual return, you may get an ugly surpriseyou owe hundreds or thousands of dollars that you didn’t expect and simply don’t have.

While this isn’t a good situation to be in, it’s not the end of the world. There are a number of ways to resolve it.

Don’t Miss: Are Nonprofit Organizations Tax Exempt

Paying Your Property Taxes Through Your Financial Institution

Paying your property taxes through your mortgage means you dont have to worry about keeping track of when your taxes are due. Your financial institution holds your money in a separate tax account and pays the tax for you.

There are some disadvantages to this option, however.

Firstly, you may have to pay a bit more because some lenders may require a cushion of funds just in case property taxes increase. This is offset and used for future taxes, or is refunded when you request it. Secondly, you dont have a choice in how you pay the taxes the money is debited out of your account, so you cant, for instance, use a and collect points.

If there isnt enough money in your tax account, the financial institution will still pay your taxes but youll get a notice from them to pay the balance due.

How To Calculate And Pay Advance Tax

Add income from all sources. Include salary income, interest income, capital gains etc., just like you do at the time of filing your income tax return. If you are a freelancer, estimate your annual income from all clients, and deduct expenses from it. Rent of your workplace, internet bills, mobile bills, depreciation on computers, travel expenses etc. are some expenses.Read more information on freelancers and taxes.

Read Also: Are New York State Tax Refunds Delayed

If You Cannot Pay In Full

If you are not able to pay the full amount:

- file on time to avoid paying a late-filing penalty

- make a partial payment to reduce the amount of interest you need to pay on unpaid amounts

You can set up a payment arrangement to give yourself more time and flexibility to repay what you owe. For details: Arrange to pay your personal debt over time

If you are unable to pay, you can discuss your options with the CRA.

Understanding Canadas Personal Income Tax Brackets

Tax rates apply to personal income earned between predetermined minimum and maximum amounts, also referred to as tax brackets.

Knowing where your income falls within the tax brackets can help you make decisions about when and how to claim certain deductions and credits. By understanding which tax bracket you are currently in, it can also help you understand changes in your income taxes if, for example, you start a side-gig or have other extra income that pushes you into the next bracket.

When youre preparing your income taxes this year, this could explain why you have taxes owing or your refund amount is different than what it was last year.

It is important to note that these rates apply to taxable income, which is your Total Income from Line 15000 less any deductions you may be entitled to.

Remember, all provinces and territories also have their own tax brackets. When using the tax brackets and your annual earnings to make contribution decisions, make sure to also consider the tax rates for the province where you reside.

Don’t Miss: What Does Locality Mean On Taxes

Tax On State Benefits

Your tax code can take account of taxable state benefits, so if you owe tax on them its usually taken automatically from your other income.

If the State Pension is your only income, HM Revenue and Customs will write to you if you owe Income Tax. You may need to fill in a Self Assessment tax return.

How To Pay Your Individual Taxes Online

- Participating financial institutions

1 These financial institutions also provide non-resident payment options.

You May Like: Where Can I Find My Real Estate Taxes

Paying Your Taxes Late

You might be tempted to send in your tax return but not pay the money you owe. If you fail to pay your taxes by the due date, you will begin to accrue interest and penalties on the outstanding amount.

The interest rate for failure-to-pay is the federal short-term rate plus 3%, compounded daily after the due date .

The failure-to-pay penalty charge is calculated at a rate of 0.5% of the outstanding tax liability for every month the debt remains unpaid, up to a maximum of 25%. If you have not filed your tax return and have not paid your tax liability, both failure-to-file and failure-to-pay charges are applicable. In this case, the charge each month is a maximum 5% .

The maximum penalty for failure-to-file and failure-to-pay is 47.5% of your total tax liability .

At a certain point, the government will issue you a letter demanding payment for your unpaid tax balance. If you ignore this letter, the IRS may file a Notice of Federal Tax Lien to alert creditors that the IRS has a right to your personal property, real estate, or other assets. A lien secures the government’s interest in your property.

If the debt goes unpaid for much longer, the IRS may issue a levy. An IRS levy initiates the legal seizure of your assets in order to satisfy your outstanding tax debt. Levies come in many forms and may include garnishing your wages via your employer, seizing your assets directly from a bank account, or seizing and selling your property such as a vehicle or a home.

What Are Canadas Inheritance Tax Rates

As there is no inheritance tax in Canada, all income earned by the deceased is taxed on a final return.

Non-registered capital assets are considered to have been sold for fair market value immediately prior to death. Any resulting capital gains are 50% taxable and added to all other income of the deceased on their final return where income tax will be calculated at the applicable personal income tax rates. They are taxed at the applicable capital gains tax rates.

The fair market value of a Registered Retirement Savings Plan or a Registered Retirement Income Fund is included in the deceased persons income and taxed at the regular applicable personal income tax rates with no special treatment for any capital gains earned within the RRSP or RRIF.

Don’t Miss: How Do I Get My Pin For My Taxes