Get Your Documents Together

There are a few different documents youll need in order to file your taxes. Youll need at least one of these:

- W2 form: If you earn a salary or wage, your employer will send you this.

- 1099 form: If youre a freelancer or self-employed, you should get one of these from every client who paid you at least $600 during the tax year.

- Charitable donations: If you donate to a nonprofit religious, educational, or charitable group, make sure you get a donation receipt because youll need that at tax time!

- Mortgage interest statements

- Form 8822: Youll need this if you moved in the past year.

- SS-5: Youll need this if you changed your name in the past year.

- W-4: If you had a job change and started making a new income in the past year, this form will adjust tax withholdings.

Again, if this is your first time filing taxes, then the W2, 1099, and charitable donation forms are probably the only ones that apply to you . But it never hurts to double-check with a tax professional.

Before You Start Tax Preparation:

If you use a program such as Quicken® to keep track of your finances, print a report of your transactions for the tax year . This will make your tax preparation much easier, and helps you clearly see where your money goes each year.

- Having this information in a report is much easier than going through your checks and bank statements for the entire year.

- As you review the report, highlight information you will need to prepare your tax return or make notes to remind yourself of something later.

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

Also Check: How To Do Llc Taxes Yourself

Background: The Basics Of Tax Filing

Itâs useful to know what your tax return is for and why you have to file it in the first place. To get you started, here are three important tax terms you should know:

-

Filing is synonymous with sending something to the proper recipient. When the IRS says to file a form, it just means send it to the IRS.

-

When you claim something on your tax return, it means that you qualify to get it and you are taking it. For example, claiming the earned income tax credit just means youâre taking the credit. Claiming a dependent means someone qualifies as your dependent and youâre treating them as such on your taxes.

-

Some tax forms are called schedules. This has nothing to do with the calendar and is just another word for form.

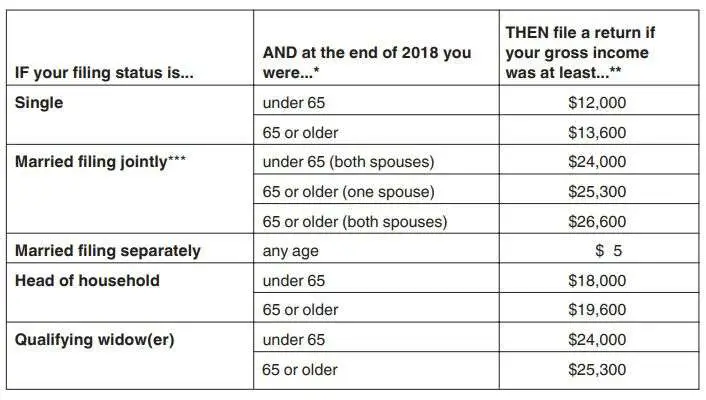

Not Everyone Has To But Be Sure You Know What Your Situation Requires

This may come as a surprise to many people, but not everyone needs to file a federal tax return. The Internal Revenue Service has threshold levels for tax return requirements just like tax brackets. Whether or not you need to file is primarily based on your level of gross income and status for the tax year. However, keep in mind that even if you arent required to file because of your gross income, you may still be eligible for a refund.

Also Check: Can You Get The Stimulus Check Without Filing Taxes

Are My Social Security Benefits Taxable

That depends on your other income and benefits for the tax year, since Social Security benefits include monthly retirement, survivor and disability benefits. They dont include any supplemental security income payments, which are not taxable.

As a very general rule of thumb, if your only income is from Social Security benefits, they wont be taxable, and you dont need to file a return. But if you have income from other sources as well, there may be taxes on the total amount.

To find if your benefits may be taxable, start with whats called the base amount for your filing status, which is:

- $25,000 if you are single, head of household, or a qualifying widow

- $25,000 if you are married filing separately and lived apart from your spouse for the entire year

- $32,000 if you are married filing jointly

- $0 if you are married filing separately and live with your spouse at any time during the tax year

To find out whether your Social Security benefits are taxable, divide your total Social Security benefit amount by 2, then add all your other income . Compare the result to the base amount for your filing status. If your result is higher than the base amount for your filing status, youll probably be taxed on the total.

If youre married and file a joint return, both spouses must combine their incomes and Social Security benefits when figuring taxable amounts. This applies even if the spouse did not have any benefits.

The IRS offers a worksheet to calculate taxable benefits.

Does Everyone Need To File An Income Tax Return

OVERVIEW

Not everyone is required to file an income tax return each year. Generally, if your total income for the year doesn’t exceed certain thresholds, then you don’t need to file a federal tax return. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status.

Apple Podcasts | Spotify | iHeartRadio

Also Check: Who Needs To File Taxes

What Are 1099 Forms

1099-G: States will send both you and the federal government a 1099-G form at the beginning of the year, which shows income you received from that state during the previous tax year. The income can include:

- Unemployment compensation.

- State or local income tax refunds, credits or offsets.

- Reemployment trade adjustment assistance payments.

- Taxable grants.

- Agricultural payments.

You will receive a 1099-G in 2021 from any state that gave you money in 2020. This form is where the unemployment compensation you received is listed. Remember: If you made less than $150,000 in 2020, only unemployment benefits over $10,200 are taxable. If taxes were withheld from your unemployment insurance checks, this will be reflected in your 1099-G form.

Best for:People who received unemploymentcompensation.

1099-MISC and 1099-NEC: For tax year 2020 or a prior year, entities or people who have paid you money during the year will mail you a 1099-MISC form for miscellaneous income. If youre a freelancer or a contract worker, you can expect to receive a 1099 form in the mail for each of the people or companies you worked for. Starting with tax year 2020, freelancers will receive the new Form 1099-NEC. There are a number of other reasons you might receive a 1099-MISC form, including if you received monetary prizes or awards, or were paid royalties or rent. Youll use the form to file your own taxes.

Best for:Freelancers, contract workers or anyone who receives miscellaneous income.

How Filing Online Impacts Your Tax Refund

Filing your taxes online is instantaneous, unlike mailing a paper tax return which takes time to reach the IRS.

Submit your forms online and youll get a notification from the IRS saying that they successfully received it, or an error occurred. If the IRS owes you a tax refund, you can have this direct-deposited into your bank account, or they will mail you a check. The former is quicker and eliminates the risk of your money getting lost in the mail.

Read Also: How To Get My Income Tax Return Copy Online

What Information Do I Need For The Deceaseds Tax Return

- You have to know the deceaseds income from all sources, from January 1st of the year of death up to and including the date of death.

- You will probably have to look at previous returns and may have to contact employers, banks, trust companies, stockbrokers, and pension plan managers.

- You will gather information slips and any other documentation that you need to indicate or estimate income and deductions.

The final return cannot be submitted through NETFILE.

Using Tax Preparation Software

Over 90% of corporations file their return electronically. To do so, you must use CRA certified software. We certify commercial software to ensure that it meets our specifications. To find a list of certified software, go to Software.

A return prepared by certified software can then be electronically filed using:

- the CRA’s Corporation Internet Filing service

- My Business Account, if you are a business owner

- Represent a Client, if you are an authorized representative or employee

If you cannot file electronically, you can print the T2 Bar Code Return and mail it to the CRA.

Read Also: Are Tax Returns Delayed This Year

Irs Electronic Free File For Federal Returns

You may qualify to electronically file your federal return for free by using IRS Free File Some of the companies participating in the IRS Free File service will file your Maryland return electronically for free as well. No matter what company you select, you can always return to file your Maryland tax return for free online, using our iFile or bFile services. Keep in mind that your Maryland return begins with your federal adjusted gross income, so you must prepare your federal return first before you can prepare your Maryland return.

Generally, you are required to file a Maryland income tax return if:

- You are or were a Maryland resident

- You are required to file a federal income tax return and

- Your Maryland gross income equals or exceeds the level listed below for your filing status. The filing levels also apply to nonresident taxpayers who are required to file a Maryland return.

Even if you are not required to file a federal return, you may be required to file a Maryland return if your Maryland addition modifications added to your gross income exceed the filing requirement for your filing status. Dependent taxpayers must take into account both their additions to and subtractions from income to determine their gross income.

For more information, see the instructions in the and nonresident tax booklet.

Filing Requirements for 2020 Tax Year

|

Filing Status |

|

| One spouse 65 or older | $ 24,800 |

| $ 24,800 |

Your income tax return is due July 15, 2021.

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Don’t Miss: How To File School District Taxes In Ohio

Qualifying Rules If You Can Be Claimed As A Dependent

You must file a tax return for 2020 under any of the following circumstances if you’re single, someone else can claim you as a dependent, and you’re not age 65 or older or blind:

- Your unearned income was more than $1,100.

- Your earned income was more than $12,400.

- Your gross income was more than $1,100, or $350 plus your earned income up to $12,050, whichever is greater.

Married dependents who are not age 65 or older or blind are subject to these filing requirements plus one more: They must file if their gross income was at least $5, and their spouse files a separate return and itemizes deductions.

Youll Need To Gather Your Paperwork Before You File

Many of the forms youll need when you file your taxes are sent to you by others.

For example, youll receive forms from your employer or companies you did contract work for, from your student loan lender or mortgage lender detailing interest you paid, and from your health insurer specifying whether you have qualifying coverage to avoid a tax penalty. You may also receive bank account statements that show interest income, dividend statements and other types of unearned income that you need to report.

Youll want to get all these forms together before filing your return. This way, youll have the information you need to complete your 1040 form, as well as the different schedules youre required to include.

Youll also need last years tax return when preparing this years, because the IRS will ask for information from it. For example, your previous years adjusted gross income is used to verify your identity.

Read Also: Do Nonprofits Pay Payroll Taxes

Should I File A Return Anyway

Even if youre not required to file, sometimes its in your own best interest to do so anyways, for the following reasons

- You want to claim a refund.

- Entries on your tax return determine if youre eligible for certain federal and provincial benefit programs. Even if you had no income, you still may qualify for the GST/HST Credit, or provincial benefits such as the Ontario Trillium Benefit. You can find a complete list of provincial benefit programshere.

- Your RRSP contribution limit starts growing as soon as you earn any income. Even if youre not expecting a refund, the more RRSP contribution room, the better.

- If you want to claim the Canada Workers Benefit or if you want to continue receiving your Canada Child Benefit

- If you attended school and have eligible tuition fees, you must declare the amounts on your tax return, even if you are not using them. You might not need to use the credits this year, but in order to carryforward or transfer them, they must be reported on your current year tax return.

- If you or your spouse want to continue to receive Guaranteed Income Supplement on your Old Age Security payments.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

False Statements Or Omissions

We will charge a penalty if a corporation, either knowingly or under circumstances of gross negligence, makes a false statement or omission on a return. The penalty is the greater of either $100 or 50% of the amount of understated tax.

Reference Subsection 163

Note

If a corporation is charged a penalty for making a false statement or omission under subsection 163, the corporation cannot be charged a penalty on the same amount for failing to report income under subsection 163.

Also Check: Can I File Old Taxes Online

File Your Taxes For The First Time Like A Boss

Okay, fam. Youve got your documents. You know your filing status. You decided if youre taking the standard deduction or itemizing all the way. Now its time to actually file your taxes.

There are a few different ways to do this:

- You could get the help of a tax pro, which can seriously help with the stress and confusion .

- You could use tax software .

- You could fill out all the paperwork yourself and mail it to the IRS.

This easy quiz can help you figure out which option is best for you.

Should you do your own taxes or hire a pro?

Take this free 5-minute quiz to figure out if you can easily file by yourself, or if youre better off using a tax pro.

Once thats done, its time to run a couple victory laps because . . . You. Just. Filed. Your. Taxes. For. The. First. Time! Im so proud.

What Is A 9465 Form

If you cannot pay your taxes in full when you file, you can use Form 9465 to request a monthly payment plan. If you can pay within 120 days and you owe less than $50,000, you can request a payment plan online, too. Such payment plans will incur a user fee, accrued penalties and interest, but low-income taxpayers may have the user fee reduced, waived or reimbursed. User fees are usually lower when you set up a payment plan online. While a payment plan is in effect, late-payment penalty accruals are cut in half. If you can pay your taxes in full within 120 days, you can apply online for the IRSs payment plan or call the IRS at 800-829-1040 to avoid the fee associated with setting up an installment agreement.

Best for:People who need more than 120 days to pay their taxes in full and owe more than $50,000. If you want to set up a monthly payment plan, the IRS encourages you to request one online.

You May Like: When Will Tax Refunds Be Issued