Your Propertys Assessed Value

Your property is assessed at the amount indicated in this field. This amount acts as a basis for calculations of the property taxes.

Provincial legislation requires that the assessment reflect the market value of your property as of July 1st of the previous year.

All properties are assessed using similar factors that real estate agents and appraisers use when pricing a home for sale.

If your property was only partially completed as of December 31, your assessment reflects the value of the lot plus the value of the building, based on the percent complete.

If the building is completed during the current year, a supplementary assessment and tax notice will be sent to the assessed person reflecting the increase in assessment from new construction.

Your Property Tax Documentation

The most authoritative source for property tax information will always be your own assessments and tax bills. The physical documents you receive from your assessors or collectors office are correct 99.9% of the time. But this method of information-gathering is reactiveyoure waiting to find out due dates and other information until you get a bill or notice in the mail. Sometimes its best to take a more proactive approach with one of the two resource categories listed below.

How Do You Find Out If There Is A Lien On A Property In California

Property Lien Search: How Do I Find Out if There Are Any Liens on Property?

Also Check: Why Does It Cost So Much To File Taxes

How The Tax Is Calculated

Property tax is calculated based on the:

- general municipal tax rate and any additional municipal tax rates for special services provided by your municipality

- property value

Municipal tax rate

Municipal tax rates are established by your municipality and can vary, depending on the type of property you own.

Each year, municipalities decide how much they want to raise from property taxes to pay for services and determine the tax rate based on that amount.

To learn about the tax rates in your municipality, contact the finance or treasury department of your local municipality. Some municipalities may have a property tax calculator available on their website.

Education tax rate

Education taxes help fund elementary and secondary schools in Ontario. Education tax rates are set by the provincial government.

All residential properties in Ontario are subject to the same education tax rate. The education tax rates can be found in Ontario Regulation 400/98.

Personal Property Tax General Information

-

The links below provide information for taxpayers and assessors regarding personal property tax exemptions, the forms that are required to report personal property tax or to claim an exemption from personal property tax, the Essential Services Assessment and the local unit reimbursement due to certain personal property tax exemptions.

- Personal Property Tax Exemptions

The General Property Tax Act provides for exemptions for certain categories of personal property including: Small Business Taxpayer Exemption, Eligible Manufacturing Personal Property and Act 328 New Personal Property. This link will provide information on each of these exemptions including determining eligibility and how to claim the exemption.

- ESA

The Essential Services Assessment is a state specific tax on eligible personal property owned by, leased to or in the possession of an eligible claimant. This link will provide information on ESA, who must pay ESA and how to file a statement and remit payment.

Read Also: How To Read My Tax Return

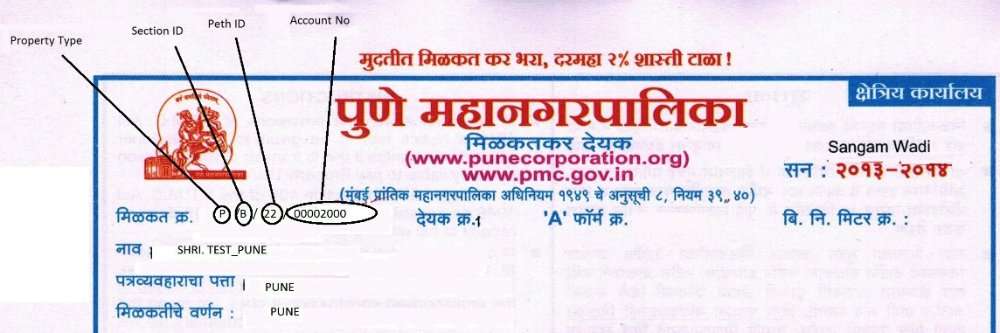

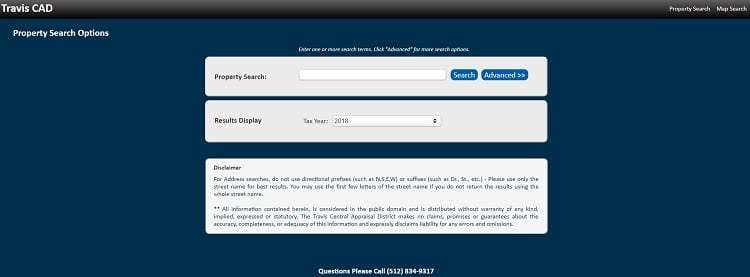

Required Online Search Information

Provide the physical address of the property, entering it into the system. There may be several addresses that populate based on the address numeric numbers and similar street names. Select the property you want to evaluate. The listing describes the property with the Assessor’s Parcel Number. This is part of the legal description of the property.

Last Year’s Property Tax Amount

This amount indicates the previous years municipal and provincial education property taxes for your property.

It may be different from the amount stated on your last annual tax notice if your property was subject to an assessment correction, Assessment Review Board decision, a supplementary or amended assessment, a change in exemption status or a change in property use.

You May Like: Can I File For Another Extension On My Taxes

Property Tax Information Aggregators

If youre looking for general information, an aggregator might be able to help. Some companies make it their primary business to track down jurisdiction property tax data, verify it, then sell it to interested parties in various formats. If you have multiple properties, it could save you from having to piece it all together.

Examples of property tax information aggregators include:

- NETROnline Choosing a state on the homepage map takes you to a list of towns, and then a list of county offices that includes a web link and phone information for the tax assessors office.

- U.S. Master Property Tax Guide Published by CCH, a leading provider of tax information, software, and services, this reference book is updated annually. In addition to property tax due dates and key contacts in various taxing jurisdictions, it also includes information on property tax and valuation assessment methods by jurisdiction .

- Taxography Subscribers to this property tax database get current assessor contact information, tax rates, and jurisdiction boundaries.

- TaxNetUSA Users can search the database by owner, address, or property ID for current information.

- CoreLogic Another database of property tax information.

Still Unsure How To Get Your Property Tax Informationor How Software Can Help

Ask us. Our team is made up of experienced property tax professionals who would be happy to send you in the right direction. Or, if youre interested in taking a look at our property tax software, let us know. Teams that use MetaTaskerPT and TPT have dramatically reduced the time they spend on information-gathering and compliance activities. As a result, theyre able to spend more time on higher-value tasks that benefit their business more.

Good luck with your search!

Recommended Reading: What Is Form 8995 For Taxes

Can Your Name Be On A House Title But Not The Mortgage

If your name is on the deed but not the mortgage, it means that you are an owner of the home, but are not liable for the mortgage loan and the resulting payments. If you default on the payments, however, the lender can still foreclose on the home, despite that only one spouse is listed on the mortgage.

How Do I Find Property Records In California

Youll find most California property deeds at the County Clerks office, also called the Registrar/Recorder office. Some of them provide online searches. Others require visiting their offices. For example, the San Diego County Clerks Office provides online searches.

Keeping this in consideration, How can I find someone for free in California?

There are many free websites that have free hosting such asblogger.com and blogspot.com. Facebook/MySpace/Twitter/LinkedIn: These common social networks are great places to find people. They are all free and you can both set up an account and search existing accounts for lost persons.

Secondly How do I get a copy of the deed to my house in California? You can obtain a copy of your Grant Deed directly from the Los Angeles County Registrar-Recorder/County Clerk. No third party assistance is needed. The County Registrar-Recorder mails the original Grant Deed document to the homeowner after it is recorded.

How do I find out who owns a property in California?

The local Recorders Office records all property deeds of ownership, property transfers, and related legal documents. Some California counties call it the Registrar of Deeds office. These offices maintain up to date property records. This includes the current property owners name.

Also Check: How Do I Protest My Property Taxes In Harris County

Use Property Tax Software To Simplify Data

All the above sources are useful for locating property tax data, but checking multiple sources can be time-consuming. The property tax cycle is pretty fast-pacedespecially if you have multiple propertiesso the less time you spend going from source to source the better.

You can reduce the amount of effort you put into information-gathering with TotalPropertyTax and MetaTaskerPT, advanced property tax software products that dramatically streamline compliance activities. Much of the information you would look for in the sources above is already in our software . Heres how you can leverage software to save time researching:

- Use TPTs built-in depreciation tablesor upload your own tableand skip the step of looking them up online yourself. Depreciation tables for many jurisdictions are already incorporated into TPT, so you can complete your tax returns faster.

- Use TPTs integrated tax return forms rather than searching assessors websites. The latest tax forms for most jurisdictions around the country are incorporated right into the software, saving you time searching online and ensuring you get the filing process right.

- Use TPT to see your property in Google Maps. Whenever you have an address plugged in, TPT pulls up the associated Google Maps image automatically, saving you from having to look it up separately. Map images are helpful for seeing the whole of a property, including its surrounding parcels, to help you gather information about property value.

How Does Funding Schools Impact My Property Taxes

About one third of your property tax goes to funding education. The Legislature passed Engrossed House Bill 2242 in 2017, in response to a Supreme Court order to fund education. This bill makes changes to:

- property taxes imposed by the state.

- voter-approved property taxes imposed by school districts.

- state funding for certain school districts.

In 2018, the Legislature made additional changes to lower the levy rate for taxes in 2019.

Don’t Miss: What Does Locality Mean On Taxes

Assessment Procedures Manual Revisions

An overview of the Arizona property tax assessment system including property classification and assessment ratios, appeals, standard appraisal methods, statutory valuation procedures, exemptions and a discussion of full cash and limited property value. In 2018, the manuals team deployed a major update project comprising all manuals and guidelines produced by the Local Jurisdictions District. The following definitions are being incorporated as intrinsic project elements:

- Review: Manual conforms to standard style and formatting. Legislative and other citations have been verified. No changes to content, methodology, policy or practice.

- Revision: Includes all review processes manual is a newly edited version. Manuals are also considered revised when conforming to a non-substantive legislative change. Information that does not alter valuation methodology may have been added or deleted.

- Rewrite: Includes all review processes major substantive changes have been made to any combination of content, valuation methodology, policy or practice.

The Updated Assessment Procedures Manual material available on the website supersedes prior electronic and/or hardcopy versions of these chapters, guidelines, memoranda or directives which may conflict with the updated material.

Best Places To Gather Property Tax Information

Businesses can easily get bogged down in property tax data. County addresses, deadlines, valuation methods, depreciation tables, tax ratios there are too many data types to list. And while there are common pieces of information people look for, the options are limited when it comes to places to look. Thats because a good chunk of this data varies by jurisdiction. So instead of having central repositories for property tax information, a single county website may be your only option. And even finding that isnt quite as easy as it seems .

So when you do need property tax information, what is the best way to find it? Whether youre looking for information about a specific property you own or more general information about property tax in your state or county, one of the resources listed below should help lead you to the answers.

Don’t Miss: How To Find Out Tax Identification Number

A Right To Know How Your Property Tax Dollars Are Being Spent

The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. While taxpayers pay their property taxes to the Lake County Treasurer, Lake County government only receives about seven percent of the average tax bill payment. School districts get the biggest portion .

- See how your individual property taxes are distributed and how to contact those taxing bodies on Lake County’s Tax Distribution website.

Our Services Are Available Online By Phone By Email Or By Mail:

- Phone: Real Property Tax 206-263-2890

- Phone: Mobile Homes and Personal Property Commercial Property Tax 206-263-2844

- Email:

- Mail: King County Treasury Operations, 201 S. Jackson Street, Suite 710, Seattle, WA 98104 NOTE NEW MAILING ADDRESS

- Secure drop box: on side of 2nd Ave nearer to S Jackson ST

COVID-19 Update: The health and safety of our community and employees is our top priority. To help slow the spread of coronavirus , King County Treasury customer service operations are being provided remotely until further notice.

Real and personal property tax statements have been mailed. If you pay your property taxes yourself, rather than through a mortgage lender, you should receive your statement by March 1, 2021.

Payment deadline for first half of property taxes is April 30, 2021 and second half November 1, 2021. To review current amounts due please use the safe and secure online eCommerce System

What are Real Property and Personal Property Taxes?

- Real Property is residential or commercial land and structures

- Personal property is assets used in conducting a business

- Mobile homes and floating homes are taxed as personal property if not associated with a real property account

I know my parcel/account number

Need help? Check our Frequently Asked Questions , call 206-263-2890, or email .

Many changes have been made to the property tax exemption and deferral programs for seniors, people with disabilities, and military veterans with a service-connected disability.

You May Like: How Do I Pay My State Taxes In Missouri

What Is Lake County Doing To Lower My Bill

Lake County has more than 200 individual entities that levy property taxes, which is why the Lake County Board is pursuing partnerships and looking for consolidation opportunities to reduce this number. Consolidation efforts are centered around partnerships that will enhance efficiency, accountability, and cost savings.

- Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021.

- Learn more about consolidation efforts and how your property tax dollars are used to help make Lake County a great place to live, work and visit.

Are Duis Public Record In California

A DUI, or a conviction that finds a driver guilty of Driving Under the Influence, is a misdemeanor, and a serious offense in California. Searching for, obtaining, and studying these records are a public right under Californias Public Records Law, and can be easily obtained through a number of record search websites.

Read Also: How To Calculate Payroll Tax Expense

Real Property Tax Forfeiture And Foreclosures

-

Real property tax delinquency entails a three-year forfeiture and foreclosure process in Michigan. Parcels are forfeited to the county treasurers when the real property taxes are in the second year of delinquency. Real property taxes which remain unpaid as of March 31 in the third year of delinquency are foreclosed upon by the Foreclosing Governmental Unit . The FGU is responsible for inspecting forfeited property, providing due process notifications and subsequent disposition of the tax foreclosed property. Beginning with the 2021 foreclosure auctions, those who hold interest in property at the time of foreclosure, may file to claim leftover proceeds for parcels which sell for more than the owing delinquency. Further details are available on our Auctions and Claimants webpage.

Forms: Property Account Assessment And Taxes

School Support Declaration – for corporations

Mailing Address and Ownership Changes

Corrections or changes to mailing addresses, owner names and changes of ownership are administered by Alberta Land Titles. The City of Edmonton receives these updates electronically once they have been processed by Alberta Land Titles.

You can request a change of mailing address by submitting a Change of Address form. Changes or corrections to owners name and changes of ownership can be made by submitting the appropriate forms to Alberta Land Titles.

If you receive a “Please wait….” message opening PDF forms1. Right click on the link2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop3. Locate the file on your local computer4. Open the file using Adobe Reader

You May Like: How Much Does The Top 1 Percent Pay In Taxes

Local Property Appraisal And Tax Information

The Comptroller’s office does not have access to your local property appraisal or tax information. Most questions about property appraisal or property tax should be addressed to your county’s appraisal district or tax assessor-collector.

Appraisal districts can answer questions about:

- agricultural and special appraisal

County tax assessor-collector offices can answer questions for the taxing units they serve about:

- payment options

- tax receipts

- other information related to paying property taxes

Questions about a taxing unit that is not listed as consolidated in a county should be directed to the individual taxing unit.

This directory contains contact information for appraisal districts and county tax offices and includes a listing of the taxing units each serves. Taxing units are identified by a numerical coding system that includes taxing unit classification codes.

This directory is periodically updated with information as reported by appraisal districts and tax offices.