States With No Income Tax

Nine states don’t impose any income tax on any earned income at all as of 2020, so an employer located in one of them would not withhold taxes for that state if you work there. These states are:

- Alaska

- Washington

- Wyoming

You do have to report this income on your home state return and your federal tax return, however.

New York State Capital Gains Tax Is The Same As Ordinary Income Tax

Short-term capital gains refer to assets held less than one year, and for federal purposes are taxed at ordinary income rates. For long-term capital gains on assets held more than one year, taxes are assessed at 0 percent, 15 percent and 20 percent, depending on the taxpayer’s top income tax bracket.

New York State does not have a separate long-term capital gains rate like the federal government. Instead, New York taxes capital gains, whether long-term or short-term, as ordinary income. If you live in New York City, you will also have to pay city income tax on the gains.

New York State Estate Tax

New York is one of the 14 states that charges taxes on the estates of the deceased, with rates ranging from 3.06 percent to 16 percent on any estates that exceed the basic exclusion amount, which is $5.25 million through the end of 2018. If an estate does exceed the BEA, it pays taxes at these tiered rates.

Find Out: How to Minimize Your Estate Tax

And if the New York State Department of Taxation and Finance wasnt already making things complicated enough with different brackets, New York states estate tax is also unique for what is commonly referred to as the estate tax cliff.

The estate tax at the federal level has a basic exclusion amount of $11.18 million, and you only pay taxes on your taxable estate, which is the portion of your estate thats over that value. The New York estate tax, though, taxes the entire value of the estate for any estate that clears the BEA. So, while an estate worth $5 million would owe nothing, an estate worth $5.5 million would owe a whopping $450,000 hence the cliff for estates that are right at or near the BEA.

The state of New York does not levy an inheritance tax.

More on Tax Laws

Recommended Reading: How To Report Ppp Loan Forgiveness On Tax Return

What Are The Rules For New York City Residency

The requirements to be a New York City resident are the same as those needed to be a New York State resident. You are a New York City resident if:

- your domicile is New York City or

- you have a permanent place of abode there and you spend 184 days or more in the city.

All city residents income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax.

The rules regarding New York City domicile are also the same as for New York State domicile. If your permanent and primary residence that you intend to return to and/or remain in after being away is located in one of the five boroughs of New York City, it is considered a New York City domicile.

Your New York City domicile does not change until you can demonstrate with clear and convincing evidence that you have abandoned your city domicile and established a new domicile outside New York City. Even if you live in a location outside of the city for a period of time, if its not the place you attach yourself to and intend to return to, its not your domicile. Your domicile will still be New York City and you will still be considered a New York City resident.

For more information see, IT-201-I, Instructions for Form IT-201 Full-Year Resident Income Tax Return.

New York State Income Tax

Personal income tax in New York is on a progressive system with eight brackets ranging from 4 percent up to 8.82 percent, which is only paid by people earning more than $1 million a year.

| New York State Income Tax | |

| 2018 Estimated Income Taxes | |

| $1,077,550 up | 8.82% |

New York state income tax is also notable for the addition of a separate bracket for top earners that started with a 2009 bill, which created whats now known as the millionaires tax that boosts rates to close to 9 percent for top earners.

Find Out: How Much Money You Would Have If You Never Paid Taxes

You May Like: How To Dispute Property Tax Increase

New York State Disability Insurance Taxes

Employers in New York are required by law to provide SDI coverage for eligible employees to cover Off-the-Job Injury or Illness. Employers can choose to cover the entire cost or withhold $ 0 .60/ week of eligible employees’ wages to share the cost of coverage.

Example: $ 0 .60/ week x 52 weeks = $31. 20

Monthly: $31. 20 /12 = $ 2 .60

Biweekly: $31. 20 /26= $ 1 .20

Semi Monthly: $31.20/ 24 = $ 1 .30

Employers who use Zenefits Payroll can choose to withhold 0.5% of eligible employees wages in each payroll for NY SDI. However, Zenefits Payroll will only withhold, but not pay or file NY state disability taxes for employers. Employers are responsible for remitting these taxes to their NY SDI carrier. Learn more.

Individuals And Businesses Redesign

We redesigned our homes for individuals and businesses. From the teal menu at the top of the site, select Individuals for income tax information, as well as resources and taxes for individuals. Select Businesses to learn about business tax requirements, filing and payment options, and more.

Read Also: How To Obtain Prior Year Tax Returns

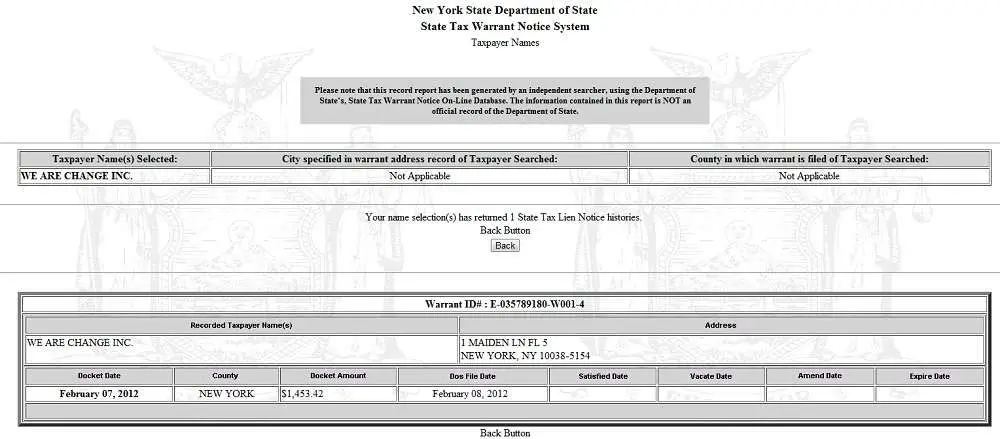

New York State And Federal Tax Whistleblowers

New York FCA Tax Whistleblower Provision

A unique provision of the NY State False Claims Act allows individuals to bring qui tam actions against those who knowingly or recklessly underpay NY State taxes. Whistleblowers can receive between 15% and 30% of the government recovery if successful.

As in federal qui tam actions, a relator can file an action under seal alleging that a corporation has significantly underpaid its NY State tax obligations. NYS sales taxes are specifically covered by the NY FCA .

The NY Attorney General’s office has been very vigilant in enforcing the NY FCA against entities that knowingly underpay taxes to the State.

In a case setting important legal precedent, the New York Court of Appeals recently held that the plaintiffs can proceed with their False Claims Act case against Sprint for the alleged failure to collect and pay sales taxes on flat-rate calling plans.

———————————————————————————–

The IRS Whistleblower Program, as well, provides financial incentives for individuals to report tax evasion, underpayments, tax shelters, and other tax fraud. Based in New York, tax whistleblower attorney James T. Ratner represents clients from across the nation who want to blow the whistle on the corporate tax corruption they can document.

Corporate Tax FraudWhistleblower Compensation

State Income Tax Brackets

| $60,000+ | 3.876% |

Youll note that in our discussion of tax rates above that we used the term taxable income. This is different from actual income earned, because it accounts for tax deductions and exemptions. In New York, the standard deduction for a single earner is $8,000 . This means that when calculating New York taxes, you should first subtract that amount from your income .

Don’t Miss: How Much To Do Taxes

Where To Send Your New York Tax Return

| Income Tax Returns State Processing Center |

You can save time and money by electronically filing your New York income tax directly with the . Benefits of e-Filing your New York tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

New York requires you to eFile if you use eFile-enabled software to process your return and you have an Internet connection. Over 90% of New York taxpayers file online, and New York state law prevents any tax preparer for charging an extra fee to eFile your tax return.

To e-file your New York and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

The two most popular tax software packages are H& R Block At Home, sold by the H& R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. Both companies produce multiple editions for simple to very complex tax returns, so be sure to carefully compare the features offered by each package.

New York State Income Tax Rate 2017 Brackets

There are eight marginal tax brackets in the state of New York, which range from 4 percent to 8.82 percent, with additional amounts charged for all but the lowest bracket. For tax year 2017, the top marginal capital gains tax rate in New York is 31.5 percent, the second highest in the nation after California. The State has yet to release its tax bracket information for 2018.

These are the rates for single filers in 2017:

- Up to $8,500 in adjusted gross income : 4 percent

- $8,500 to $11,700: 4.5 percent plus $340.

- $11,700 to $13,900: 5.25 percent plus $484.

- $13,900 to $21,400: 5.9 percent plus $599.50

- $21,400 to $80,650: 6.45 percent plus $1,042.

- $80,650 to $215,400: 6.65 percent plus $4,863.63

- $215,400 to $1,077,550: 6.85 percent plus $13,824.50

- Over $1,077,550: 8.82 percent plus $72,881.78

These are the rates for married couples filing jointly in 2017:

- Up to $17,150 in adjusted gross income: 4 percent

- $17,150 to $23,600: 4.5 percent plus $686

- $23,600 to $27,900: 5.25 percent plus $976.25

- $27,900 to $43,000: 5.9 percent plus $1,202

- $43,000 to $161,550: 6.45 percent plus $2,092.90

- $161,550 to $323,200: 6.65 percent plus $9,739.38

- $323,200 to $2,155,350: 6.85 percent plus $20,489.10

- Over $2,155,350: 8.82 percent plus $145,991.38

References

You May Like: Where Can I Get Taxes Done For Free

New York Estate Tax Exemption

The New York estate tax threshold is $5.25 million in 2018. It is scheduled to increase to $5,490,000 in 2019 and then will increase with inflation each year after that.

This means that if a persons estate is worth less than $5.25 million and they die in 2018, the estate owes nothing to the state of New York. New York has a cliff that impacts very wealthy estates. If the estate exceeds the $5.25 million exemption by less than 5%, it only pays taxes on the amount that goes over the threshold. If the total value is more than 105% of exemptable amount, taxes are paid on the entire estate.

Heres an example of how that works: 105% of $5.25 million is $5.5125 million. If your estate is worth between $5.25 million and $5.5125 million, you only pay tax on the amount that exceeds $5.25 million. So if your estate is worth $5.4 million, your taxable estate is only $150,000. If your estate surpasses $5.5125 million, all of your estate is taxable. If your total estate is $5.6 million, for example, you will pay estate taxes on all of that.

Nonresidents Do Not Pay Nyc City Taxes

This is routinely misunderstood, so I thought Id take a second at the end of the article to make sure its clear. If you are not a resident of NYC, you do not pay NYC taxes.

This wasnt always the case. It was only in the early 2000s that New York City stopped taxing non-NYC residents for income earned in NYC, hence the reason why its still largely misunderstood .

This means that if you live in New Jersey, Connecticut, Long Island or even Florida, the long arm of NYC wont reach you there .

Further Reading:

- Meredith Bentley, Hucaby v. New York State Demonstrates the Need for Legislative Action

Hat tip to MissBonnieMD who alerted me to this blatant money grab by the state of New York.

Lets talk about it. Would you be interested in working remotely for a company in New York?

Joshua Holt A practicing private equity M& A lawyer and the creator of Biglaw Investor, Josh couldnt find a place where lawyers were talking about money, so he created it himself. He knows that the Bogleheads forum is a great resource for tax questions and is always looking for honest advisors that provide good advice for a fair price.

Read Also: Can I File My Taxes Over The Phone

How To File And Pay Your Real Estate Transfer Tax

Form TP-584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax should be filed with the county clerk where the property is being sold and is due no later than the 15th day after the delivery of the deed. In general, your realtor, lawyer and/or title company or broker will help you pay the necessary closing costs, include this tax. If youre interested in doing it yourself, or are acting as your own agent you can find more information on the list of NYS real estate transfer tax forms and instructions.

Get A State Income Tax Deduction

If you’re a New York State taxpayer and an account owner, you may be able to deduct up to $5,000 of your Direct Plan contributions when you file your state income taxes. Please consult your tax advisor. **

You must make a contribution before the end of a given calendar year for it to be deductible for that calendar year. If you send your contribution by U.S. mail and it’s postmarked on or before December 31, we’ll treat your contribution as having been made in the year in which it was sent.

To learn more about depositing your tax refund directly to your NY529 Direct Plan account, see here.

Note: There are no federal tax deductions for contributions to 529 plans.

You May Like: Can I Pay Quarterly Taxes Online

Make An Estimated Income Tax Payment Through Our Website

You can pay directly from your preferred account or by credit card through your Online Services account.

Note: There is no online option at this time for Forms IT-2658, Report of Estimated Tax for Nonresident Individual Partners and Shareholders, or CT-2658, Report of Estimated Tax for Corporate Partners. See Pay estimated tax by check or money order for instructions.

My Primary Office Is Inside New York State But I Am Telecommuting From Outside Of The State Due To The Covid

If you are a nonresident whose primary office is in New York State, your days telecommuting during the pandemic are considered days worked in the state unless your employer has established a bona fide employer office at your telecommuting location.

There are a number of factors that determine whether your employer has established a bona fide employer office at your telecommuting location. In general, unless your employer specifically acted to establish a bona fide employer office at your telecommuting location, you will continue to owe New York State income tax on income earned while telecommuting.

Read Also: Can Medical Expenses Be Deducted From Taxes

Tax Arrangements Between Reciprocal States

Some states have reciprocity agreements in place between them that allow residents of other states to work there without filing nonresident state tax returns. This is most common among neighboring states where crossing over the line to go to work is a common practice among residents.

You probably won’t have to file a return in the nonresident state if your resident state and the state in which you’re working have reciprocity, but these agreements typically cover only earned incomewhat you collect from actual employment. Reporting and paying taxes on unearned income might still require filing a return.

You’ll want to file a return in your work state even if you’re not required to pay taxes there to get a refund if your employer mistakenly withheld taxes from your pay despite a reciprocal agreement being in place.

Earned income includes wages, salaries, commissions, bonuses, tipsbasically anything you receive in exchange for services you provide as an employee.

Enjoy A Federal Gift Tax Incentive

You can contribute up to $15,000 per year without triggering federal gift taxes. Or you can choose a special election that allows you to treat a single $75,000 contribution as if it were made over a five-year period.***

Gifts in excess of these amounts may be subject to federal gift taxes. For more information, consult a qualified tax advisor.

Don’t Miss: How Fast Can You Get Your Tax Refund

Considerations You Need To Understand

Here are some additional points you should understand before submitting an offer.

- Submitting an OIC does not automatically suspend the collection of a warrant.

- Submitting an offer does not change the time you have to respond to an assessment.

- The statutory period for collections is suspended while the offer is pending and for a year afterward.

- You must file all tax returns and pay all tax owed for five years after the offer is accepted.

- If you qualify for any refunds or credits, the state applies those amounts to your taxes owed. That applies to the calendar year that you submit the offer and to any years prior to the offer.

- You may have to provide a collateral agreement to the state. A collateral agreement is where you agree to pay more than the offer if you come into extra money. For example, if your income goes up in the next few years, you agree to pay some of that money to the state.

- If you submit an OIC for trust taxes on behalf of a business, responsible individuals part of the business may still be personally liable. Trust taxes are withholding taxes that were withheld from an employees paycheck but not paid to the state. They also include sales taxes which are held in trust by the business on behalf of the consumer and remitted to the state.

- If the tax bill is more than $100,000, a New York Supreme Court judge needs to approve the OIC.