What Does Income Tax Pay For

Do you feel intimidated when it comes to paying taxes? Do you wonder what does income tax pay for, or what various types of income taxes represent?

In this article, well talk in detail about income taxes, their use, and types like progressive income tax and personal income tax. Well help you resolve any doubts and ambiguities related to income taxes, and hopefully, after reading, youll feel more confident about taxes.

The Benefits Of Living In A State With No Income Tax Comes Down To Your Personal Finances

Whether you should move to a state with no income tax depends on your personal financial situation and your individual priorities. Families with college-aged students might not want to move to a state with no income tax if it means paying more tuition. Meanwhile, if the bulk of your household budget goes toward groceries and clothing items that are sales taxable you might not save much money in the long run. States inheritance taxes should also be taken into consideration, especially if youre nearing retirement and hoping to eventually pass down an asset while considering a move.

As the economy rebounds from the pandemic and remote work becomes increasingly more common, Americans might find that they can live and work in different places than they could before the outbreak. But if a state with no income tax has limited employment opportunities for your industry, you might want to hold off on relocating just so you can reduce much youre paying in taxes every year.

At the same time, higher-income earners might benefit from living in a state with no income tax. And if you dont own property, you might not feel a big difference in your tax burden.

You do see a trade-off when it comes to the major taxes that states levy, Loughead says. if youre a really high-income individual, youre probably going to think twice before living in a state with high income taxes, especially if theres a bordering state where you can reside in.

Will You Owe Taxes On Your Social Security Benefits In 2023

Social Security benefits look different than they did a month ago, thanks to the latest cost-of-living adjustment . You might be sizing up how far your new, larger check will buy each month — but you might have less available for spending than you think.

Not everyone knows this, but the government can tax some of your Social Security checks if your income is high enough. A lot of people are likely to encounter this rule for the first time in 2023. Here’s how to know if you’ll be one of them.

Also Check: What Is The Easiest Online Tax Service To Use

What Is Progressive Income Tax

Taxes in the US are collected through a progressive system, meaning that people who earn more pay more tax than those who earn less. A higher tax rate is charged to those with a higher income, and someone with a lower income pays less.

Incomes are divided into seven income slabs that determine tax rates.

This system is generally praised, as it helps people with lower incomes. Moreover, it allows people to enjoy services like medical care, transportation, and education at a reduced cost.

However, everything has pros and cons. This system is mainly opposed by people with higher income as theyre forced to pay more money. It can also discourage people from becoming more successful.

| DID YOU KNOW? There are more than seven types of taxes that Americans pay during their lifetime, which can make taxes very complicated for both taxpayers and the government collecting them. |

Policy Basics: Where Do Our State Tax Dollars Go

Understanding where state tax dollars go and the trends in state spending can help state policymakers make good decisions about how to pay for important services now and in the future.

States help educate the nations children, build and repair its roads and bridges, provide health coverage to low-income families and their children, and much more. Many of these services are essential to building strong, healthy communities and the nations long-term economic vitality.

In total, the 50 states and the District of Columbia spent $1.2 trillion in state revenues in fiscal year 2016, according to the most recent survey by the National Association of State Budget Officers.

As a share of state spending, education has remained fairly constant over the last decade. The share of state budgets devoted to Medicaid has grown, the share devoted to corrections and transportation has fluctuated some, and the share for cash assistance to low-income families has declined.

Don’t Miss: How To Legally Avoid Taxes

What To Do About Social Security Benefit Taxes

When you know Social Security benefit taxes are a possibility, you might be able to avoid them with the right strategy. If you have Roth savings, for example, you can rely upon these accounts more when you near the taxation thresholds above. Roth accounts allow for tax-free withdrawals in retirement, so they won’t affect your provisional income. You could also try cutting back on how much you withdraw from your tax-deferred retirement accounts.

But avoiding benefit taxes isn’t always possible. If you think you’ll owe, you’ll need to prepare for the added tax burden. You can deal with this at the end of the year when you file your tax return or request that the Social Security Administration withhold some taxes from your Social Security checks throughout the year.

Even if you manage to avoid benefit taxes in 2023, you could owe them in future years. So always keep an eye on your provisional income and pay attention to any Social Security rule changes that could affect what you owe.

SPONSORED:

The $18,984 Social Security bonus most retirees completely overlook

The Motley Fool has a disclosure policy.

What Is The New Tax Deadline For California Storm Victims

On Jan. 11, the IRS announced that California storm victims now have until May 15, 2023, to file various federal individual and business tax returns and make tax payments. The IRS is offering the extension to people in areas designated by the Federal Emergency Management Agency . Included areas cover the most populous parts of the state, including Los Angeles, San Diego, Orange, Riverside, Sacramento and San Francisco counties.

Think you might qualify for an extension? .

According to the IRS, the tax relief postpones various tax filing and payment deadlines that occurred starting Jan. 8, 2023. Those affected have until May 15, 2023, to file returns and pay any taxes that were originally due during this period. This includes 2022 individual income tax returns due on April 18, as well as various 2022 business returns normally due on March 15 and April 18. Eligible taxpayers will also have until May 15 to make 2022 contributions to their IRAs and health savings accounts.

Recommended Reading: How Much Is Maryland Sales Tax

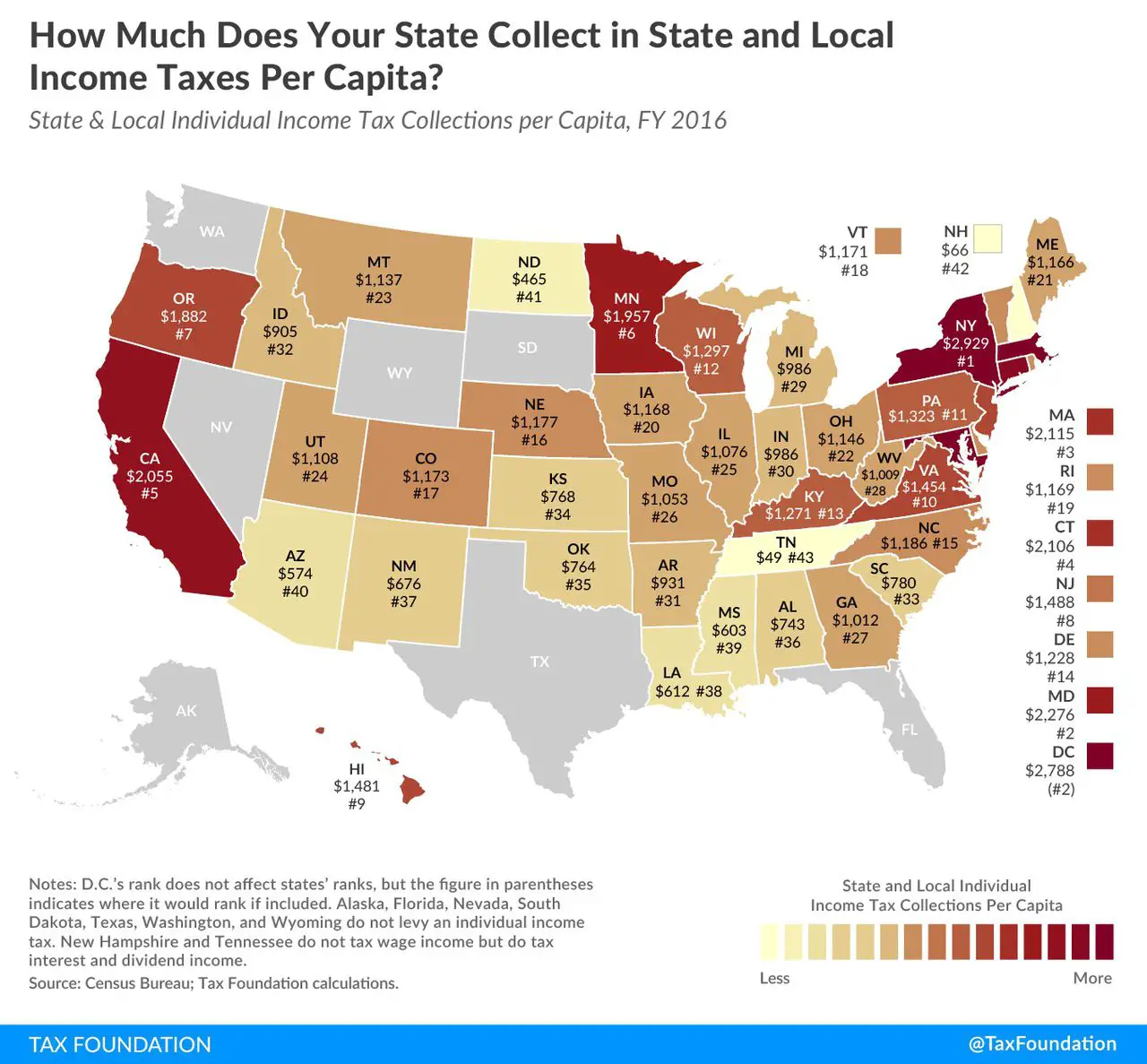

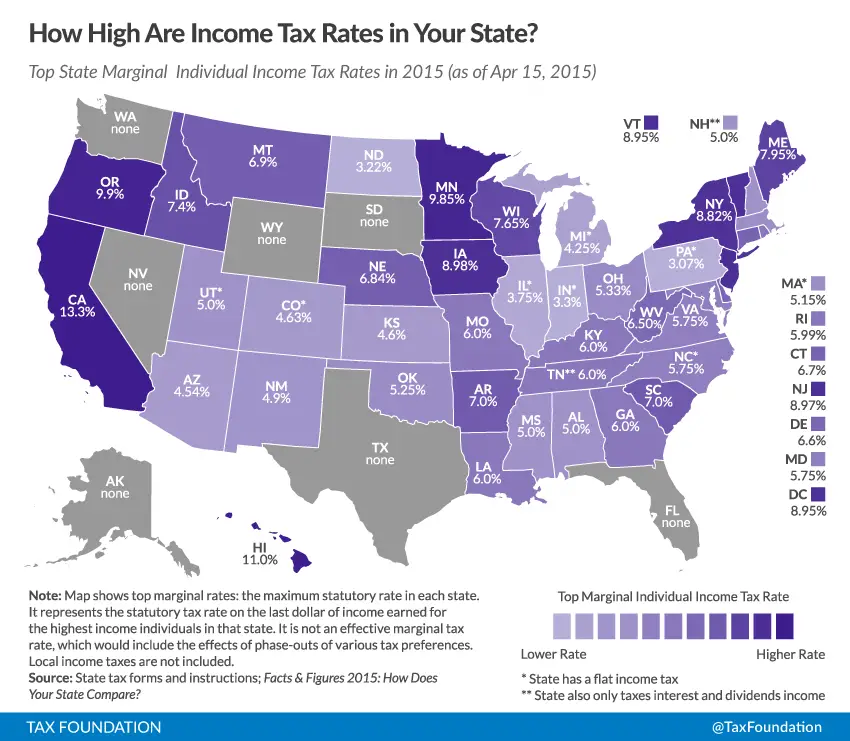

Which State Has The Highest Income Tax

That depends on how much is earned. Some states impose a flat tax while others offer varying rates of taxation depending on the amount of income generated. In the 2021 tax year, the highest marginal income tax rate is 13.30% in California. However, that rate is only paid on income in excess of $1 million.

Not Eligible Here’s How You Can Request A Tax Extension Now

According to the IRS, anyone can request an extension of time to file.

To receive an automatic 6-month extension of time to file your return, you must file Form 4868. An extension of time to file is not an extension of time to pay. You may be subject to a late payment penalty on any tax not paid by the original due date of your return.

Read Also: Can You Refile Your Taxes From Previous Years

What Should I Do If I Forgot To Deduct State And Local Taxes On My Tax Return

You generally have up to three years to amend your tax returns. All you have to do is file IRS Form 1040-X with the corrected information. Your three-year window of opportunity starts on the due date for the tax year you want to correct unless you filed for an extension of time to file that year, in which case the three-year window starts on the day the IRS receives your original return.

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

There are numerous other credits, including credits for the installation of energy-efficient equipment, a credit for foreign taxes paid and a credit for health insurance payments in some situations.

Read Also: How To File Robinhood Taxes On H& r Block

Deadline For Renewing Transaction Privilege Tax License Less Than Two Weeks Away

Phoenix, AZThe Arizona Department of Revenue is advising businesses to renew their transaction privilege tax licenses, which are due January 1, 2023, and penalties will be assessed for all renewals after January 31.

Businesses are required to have a current TPT license and to renew the license before continuing to conduct business in Arizona.

Futa Tax Deposit Deadlines

Youre required to make FUTA tax deposits via EFT every calendar quarter unless your FUTA tax liability for that quarter is $500 or less, in which case you can add the amount you owe for the quarter to your deposit for the next calendar quarter.

For FUTA tax deposits of more than $500 in any calendar quarter, youre required to deposit the amount owing by the last day of the first month following the end of the quarter:

- For the January to March calendar quarter, your deposit is due on April 30

- For the April to June calendar quarter, your deposit is due July 31

- For the July to September calendar quarter, your deposit is due October 31

- For the October to December calendar quarter, your deposit is due January 31

Recommended Reading: How Do Illegal Immigrants Pay Taxes

Which Counties Are Eligible For A Filing Extension

Alameda, Colusa, Contra Costa, El Dorado, Fresno, Glenn, Humboldt, Kings, Lake, Los Angeles, Madera, Marin, Mariposa, Mendocino, Merced, Mono, Monterey, Napa, Orange, Placer, Riverside, Sacramento, San Benito, San Bernardino, San Diego, San Francisco, San Joaquin, San Luis Obispo, San Mateo, Santa Barbara, Santa Clara, Santa Cruz, Solano, Sonoma, Stanislaus, Sutter, Tehama, Tulare, Ventura, Yolo and Yuba

In addition to the traditional income tax return, those who submit quarterly estimated tax payments to the IRS will have until 15 May to provide the reports due on 17 January and 18 April. Most businesses are required to submit their tax returns and payments on 15 March. However, firms located in one of Californias affected countries will have until 15 May to get their finances in order.

Federal Income Tax: W

W-2 employees are workers that get W-2 tax forms from their employers. These forms report the annual salary paid during a specific tax year and the payroll taxes that were withheld.

This means that employers withhold money from employee earnings to pay for taxes. These taxes include Social Security tax, income tax, Medicare tax and other state income taxes that benefit W-2 employees.

Both employers and employees split the Federal Insurance Contribution Act taxes that pay for Social Security and Medicare programs. The FICA rate due every pay period is 15.3% of an employees wages. However, this tax payment is divided in half between the employer and the employee.

Don’t Miss: How To Report 1099 K Income On Tax Return

What Is The Difference Between Federal And State Income Taxes

Federal income taxes are collected by the federal government, while state income taxes are collected by the individual state where a taxpayer lives and earns income. There are seven federal tax brackets, ranging from 10% to 37%, depending on your income and filing status. At the state level, some states use a flat-rate tax, while others impose a progressive system or have no state income tax at all.

Do I Need To Pay State Income Tax

There are eight states that do not levy an income taxnine if you include New Hampshire, which taxes dividend and interest income but not wage income . If you live in one of these states, state income tax will not be withheld, and you will not need to file a state income tax return.

| States With No Income Tax | States With a Flat Income Tax | States With a Graduated Income Tax |

|---|---|---|

| Alaska | ||

| Wisconsin | ||

| District of Columbia |

Ten states levy a flat tax on income however, in New Hampshire, individuals are only taxed on their dividend and interest income. Individuals in these states are generally taxed the same percentage amount. If you live in Colorado, for example, you would be taxed at the same 4.55% rate whether you make $50,000 or $500,000.

States with a graduated-rate income tax, which are taxes charged based on the amount of income you make, are more common, and the rates can vary widely. If you live in California, for example, and you make more than $1,000,000 and file as a single taxpayer, your rate is 13.3%. Meanwhile, those earning less than $9,325 pay a 1% state income tax.

Read Also: When Are Estimated Taxes Due 2021

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Read Also: What Is The Inheritance Tax In California

Special Rules For Spouses

Married couples who file separate returns must both claim the standard deduction, or they must both itemize.

Most income is considered community property if you or your spouse live in one of the nine community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, or Wisconsin as of 2022. Each spouse must report half of the income on their tax return when they file separately. Deductions are split in half between the two spouses as well.

Do States With No Income Tax Outperform Other States

Four of the top 10 states with the strongest economic outlook do not charge an income tax, according to 2021 rankings from the American Legislative Exchange Council, a think tank focused on free markets and limited government.

Part of that might be because theyre attracting more workers. States that dont have an income tax gained a net inflow of 285,000 new residents leaving from the 41 states that did charge an income tax, according to 2018 figures from the IRS, the most recent for which data is available.

An analysis from the Tax Foundation using Commerce Department data shows that states without an income levy grew at twice the national rate over the past decade, while gross state product grew 56 percent faster in those locations over the same period.

They tend to be outshining some of their peers that do have income taxes, says Katherine Loughead, senior policy analyst at the Tax Foundation who focuses on state tax policy.

Others, however, point out that missing income tax revenue might come with a cost particularly when it comes to infrastructure and education spending. South Dakota and Wyoming, for example, spent the least on education of all states, according to a 2021 analysis from the Census Bureau.

Recommended Reading: How To View Tax Return Online

Interest On Government Debt

Lets just say that Uncle Sam is not exactly working the Baby Steps. The U.S. government is currently more than $31 trillion in debtand countingwith a small percentage of your tax dollars going toward paying the interest on that debt.3

The interest on the national debt, which must be paid by the federal government each year, changes based on two factorsthe size of the debt itself and rising and falling interest rates. And since both the national debt and the interest rates on that debt are expected to increase over the next decade, so will the size of our nations interest paymentswhich means more of our taxpayer dollars might be used to make those payments.4

Maybe its time to finally get Washington on the debt snowball . . .