Your Personalized Gst/hst Return Package

Each fiscal year, the CRA will mail you a personalized GST34-3 return package that includes:

- an information sheet with your reporting periods and due dates

- an access code for filing your returns electronically on GST/HST NETFILE or by phone using GST/HST TELEFILE

- remittance vouchers to use if you make your payments at your financial institution

If you are filing electronically and make two consecutive electronic payments, the CRA will no longer send you a filing package unless you request one.

If you file on paper, the CRA will send you the GST34-2 filing information package, which also includes personalized returns. You can use the access code provided in the package if you decided to start using GST/HST NETFILE or GST/HST TELEFILE.

If you need a new return package or access code, do one of the following:

- to request a new GST34-2 or GST34-3, call 1-800-959-5525

- to get a new access code for GST/HST NETFILE or GST/HST TELEFILE, go to GST/HST Access Code Online

- to get a non-personalized version of the paper return , use the Order forms and publications

Faxing Your Documents Works For Simple Documents

Faxing documents to your accountant can be a quick way to deliver them, and it’s relatively secure. As long as the accountant’s phone line isn’t tapped, chances are good that your transmission won’t be intercepted by identity thieves.

There are a few downsides. The biggest risk is that you get the fax number wrong and send the documents to an unintended recipient. Faxed documents can sometimes be hard to read and the last thing a tax professional wants to do is sit there guessing whether a number is a six or an eight .

Faxing works best if you just need to send a few pages. For longer documents, and for documents with information on both sides of the page, you may have to choose another method of delivery.

Filing Your Own Taxes With Netfile

Another popular option is to file your own return using online tax return software from the comfort of your own home. These programs guide you through the process step-by-step, making life easy. When youre finished, you can send your return to the government using NETFILE, providing the program youre using is certified by the CRA.

Our top choice for free tax software is Wealthsimple Tax, while TurboTax is our top paid option. If your return is fairly straightforward, you can easily get it by using free tax software. If youre self-employed, own an investment property, or hold foreign assets, you may be better off with a more premium tax software version.

Read Also: Doordash Income Tax

What Do I Need To Send In With My Paper Tax Return

If youre mailing your return to the Canada Revenue Agency and/or Revenu Québec, youll need to attach the following documents to your return . Be sure to keep copies for your records!

Note: You only need to send documents that the CRA requires in support of certain credits and deductions. For example, youll need to submit your T4 slip in support of your employment income for the year and not your paystubs. Keep all other supporting documents for your records in case the CRA askes to see them later.

- Information slips such as your T4, T4A, T3, T5, RL-1, RL-2, RL-3, RL-16

- All completed schedules and forms that are a part of your return, including the Schedule 1 and your provincial or territorial Form 428 or your Québec tax return

Note: When you download the mail-in copy of your return from H& R Blocks tax software, it will already include the forms and schedules that apply to you and which either agency needs.

- Tuition fees certificates for the tuition amounts you paid such as your T2202A or TL11A/TL11B/TL11C/TL11D

- Official receipts for:

- RRSP contributions, including those you arent deducting on your return for the year and those you are designating as Home Buyers Plan or Lifelong Learning Plan repayments

- Federal political contributions

- Other proof of payment for:

- Amounts of Employment Insurance you repaid

- Amounts paid for non-resident dependants

- Interest paid on your student loans

Where can I learn more?

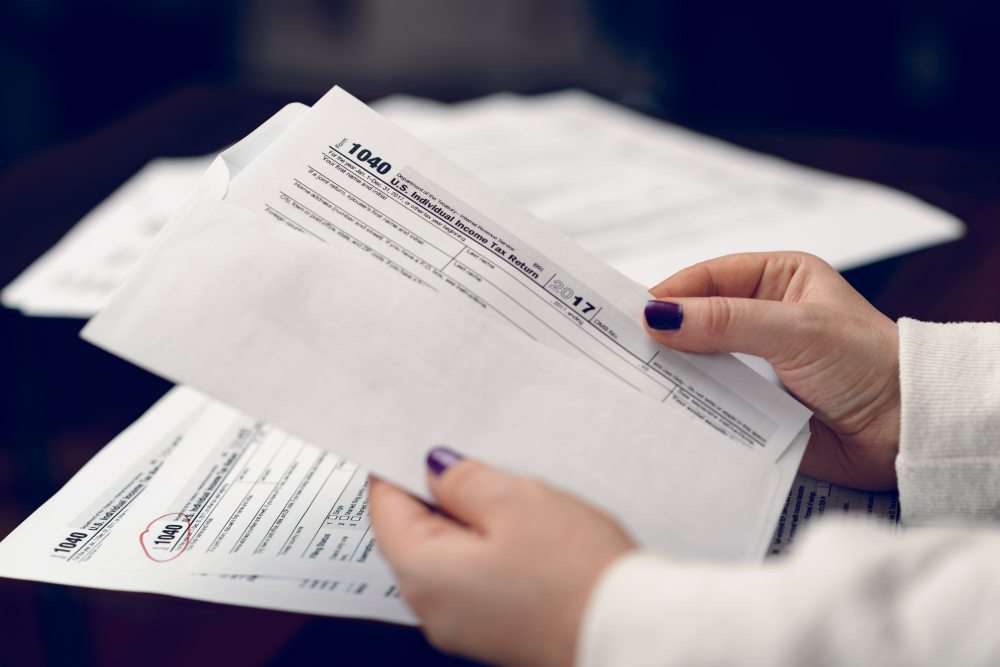

Filing A Paper Income Tax Return

Before starting your Minnesota return , you must complete federal Form 1040 to determine your federal taxable income.

We use scanning equipment to process paper returns. Follow these instructions to ensure we process your return efficiently and accurately:

- Use your legal name, not a nickname.

- Use whole dollar amounts. Round your amounts to the nearest whole dollar.

- Leave lines blank if they do not apply to you or if the amount is zero.

- Do not write extra numbers, symbols, or notes on your return, such as decimal points or dollar signs. Enclose any explanations on a separate sheet unless you are instructed to write them on your return.

- Place a copy of your federal return and schedules behind your Minnesota forms. Do not include your federal Forms W-2 or 1099.

- Sign and date your return. Your spouse must also sign if you are married and filing a joint return.

- Do not use staples or tape on your return. You may use a paper clip.

Note:

Recommended Reading: Will A Roth Ira Reduce My Taxes

Mailing Your Documents Is A Good Second Option

Mail delivery is pretty secure, and it’s probably your second-best option if hand delivery is impossible or imposes a significant inconvenience.

Mailed documents are protected from casual “eavesdropping” thanks to the envelope. Opening someone else’s mail is a crime in the U.S., and while that might not deter a determined criminal, at least there are laws on the books to punish offenders.

That said, documents can and sometimes do become lost or damaged in the mail, so it might be a good idea to send those backup copies you made rather than the originals. You might also consider using tracking services or requiring a signature upon delivery.

How To File Your Return

For accurate and efficient processing, the Department strongly recommends taxpayers use an electronic eFile option to file their returns.

For taxpayers filing using paper forms, you should send us…

- Your North Carolina income tax return .

- Federal forms W-2 and 1099 showing the amount of North Carolina tax withheld as reported on Form D-400, Line 20.

- Federal Form 1099-R if you claimed a Bailey retirement deduction on Form D-400 Schedule S, Line 21.

- Form D-400 Schedule S if you added items to federal adjusted gross income on Form D-400, Line 7, or you deducted items from federal adjusted gross income on Form D-400, Line 9.

- Form D-400 Schedule A if you deducted N.C. itemized deductions on Form D-400, Line 11.

- Form D-400 Schedule PN if you entered a taxable percentage on Form D-400, Line 13.

- Form D-400 Schedule PN-1 if you entered an amount on Form D-400 Schedule PN, Part B, Line 17e or Line 19h.

- Form D-400TC and, if applicable, Form NC-478 and Form NC-Rehab if you claimed a tax credit on Form D-400, Line 16.

- A copy of the tax return you filed in another state or country if you claimed a tax credit for tax paid to another state or country on Form D-400TC, Line 7a.

- A copy of your federal tax return unless your federal return reflects a North Carolina address.

- Other required North Carolina forms or supporting schedules.

Don’t Miss: Wheres My Refund Ga.state

Hand Delivering Your Return

Under normal circumstances, you can hand deliver your return to a local IRS Taxpayer Assistance Center if there’s one near where you live. You would ask the IRS agent for a stamped receipt upon submitting it.

As of 2020, walk-ins are no longer accepted, though you may be able to make an appointment. The IRS website provides locations, addresses, and phone numbers for each state.

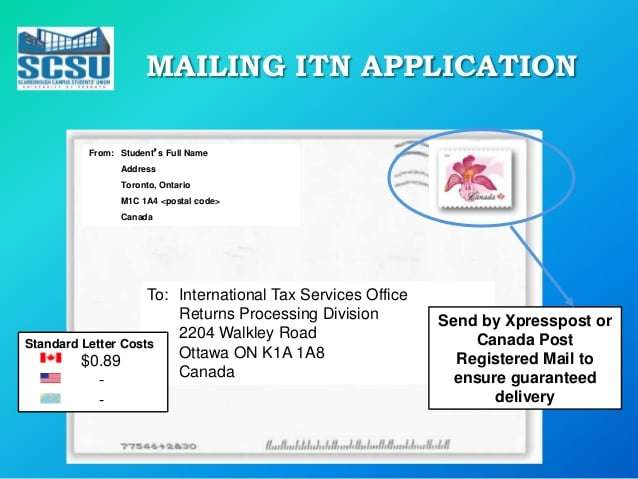

Where To Mail Your Income Tax Return

If youre a Canadian resident, you can mail your income tax return to the following addresses, dependent on where you live:

Residents of Manitoba, Saskatchewan, Alberta, British Columbia, Yukon, or the Northwest Territories Ontario residents who live in Hamilton, Kitchener, Waterloo, London, Thunder Bay, or Windsor, mail to:

Winnipeg Tax CentreStation MainWinnipeg MB R3C 3M3

Residents of New Brunswick, Nova Scotia, Newfoundland and Labrador, Prince Edward Island, or Nunavut Ontario residents residing in Barrie, Belleville, Kingston, Ottawa, Peterborough, St. Catharines, Sudbury, or Toronto Quebec residents residing in Montréal, Outaouais, or Sherbrooke, mail to:

Sudbury Tax Centre

Quebec: All areas other than Montréal, Outaouais or Sherbrooke, mail to:

Jonquière Tax CentreJonquière QC G7S 5J2

Don’t Miss: How To Report Plasma Donation On Taxes

S Before Mailing Your Return

When youre filing a paper return, you dont have the benefit of a tax software program to check your return for errors or omissions. Thats why its increasingly important that you review your return carefully to make sure its accurate.

Once youve done that, make sure youve included all of the necessary schedules and information slips. Remember to keep copies for your own records. Also, remember to sign your income tax return. Once thats done, youre ready to mail your completed return to the CRA.

Can You File A Paper Tax Return

While most people go for the e-filing or professional accountant route, its still entirely possible to file your income taxes by mail and all on your own. While filing the old way saves you from hacking risks, paper filing does tend to take longer, which means you might have to wait longer for your refund if youre expecting one.

Don’t Miss: How Much Will A Roth Ira Reduce My Taxes

If You Must Use Email Use Encryption

Email is convenient and fast, but it also poses some security risks. Unless you take precautions, such as the use of encrypted communication, your emails and attachments are likely vulnerable.

Luckily, there are many encrypted services that security-minded consumers can use. Chip Capelli, an accountant located in Provincetown, Massachusetts, mentions LeapFILE as one such communication method that’s a game-changer.

At the very least, place your tax documents inside an encrypted wrapper such as a password-protected DOC, PDF, or ZIP file. “Scan everything to a PDF and then password protect it,” Capelli advises.

Never send information you want to keep private, such as your Social Security number, as plain text in the body of your email message. This poses significant risks if you were to accidentally send the message to the wrong address, or if prying eyes manage to access your email account. Taking simple precautionary steps to secure your tax documents goes a long way in helping to protect your finances.

Don’t Mess With Taxes

Tuesday, April 17, 2018

It’s been years since U.S. Post Office branches in Austin have stayed open for Tax Day. I suspect that’s the case across much of the United States.

Most of us e-file our 1040s. Through April 6, the Internal Revenue Service had received almost 96 million electronically filed returns. It’s expecting millions more electronically delivered returns as we rush to make today’s filing deadline.

So the mail service isn’t swamped like in olden days when some offices had special pre-midnight festivities for taxpayers to drop off their returns.

This shift means that if you’re still committed to mailing a paper Form 1040, you need to check with your local office to make sure you get your envelope there in time for it to get the April 17 postmark.

And that’s the first of this year’s five tax tips for traditional paper tax return filers.

1. Make sure your post office is open. The U.S. Postal Service offers some help here, electronically of course. Its “Find Locations” page at USPS.com lets you enter your location and find your nearest post office and its hours of operation. You also might want to call the office and ask when it’s last pickup for postmark purposes is.

That timing is key because an April 17 postmark is what the Internal Revenue Service accepts as validation that your tax return was timely filed. If it gets stamped April 18 or later, you’ll face late-filing penalties and interest charges on any tax you owe, even if you included with your filing.

Recommended Reading: Irs Employee Lookup

How Do I Print And Mail My Return In Turbotax Online

If you’re looking for information on last year’s AGI, go here.

If you just need the mailing address: See the filing instructions document that prints out with the paper copy of your return. You’ll see the address in those instructions. For your federal return, you can also look it up at this IRS website.

Related Information:

Alternatives To Sending Your Tax Return By Mail

The easiest way to file your tax return is to do it online. If you use a professional tax preparation service, such as H& R Block, they will be able to Efile your return directly to the government. This way, you can get your refund in about a week. You also have peace of mind knowing that your tax return will be optimized and checked for accuracy.

Don’t Miss: Is Freetaxusa Legitimate

I’ve Printer My Tax Returns To Send In Via Mail I Need Step By Step Guidance Of What To Include

Federal and state returns go to completely separate addresses. Mailing instructions should print out with your return to tell you where to send your returns. Yes, you can fold your return to put it in an envelope.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2s or any 1099s.

Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS received the return.

How Do I Send My Tax Return By Mail

Use the U.S. Postal Service® to mail your tax return, get proof that you mailed it, and track its arrival at the IRS. Mailing Tips

Also Check: Pastyeartax Com Review

How To Send W2 To Irs

You dont need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return. Use Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-File Return to submit any paper documents that need to be sent after your return has been accepted electronically.Nov 4, 2021

Information Slips You Need To Include In Your Return

When you file your taxes online, you are not required to attach any receipts, scheduled, or information slips with your return. However, you do need to keep copies on hand in case the CRA requests them at a later date.

If youre sending a paper tax return by mail, you will need to attach the applicable documentation. Here is a list of what you may need to include:

- Income slips: T4, T4A, T3, T4RSP, T4RIF, etc.

- Schedule 2, 5, etc.

- Child care expenses

- Other expense receipts for self-employment

While not all of these documents are likely to apply to your situation, you can see that its a long list.

Don’t Miss: Taxes On Plasma Donation

Heres Where You Want To Send Your Forms If You Are Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Internal Revenue Service, P.O. Box 931000, Louisville, KY 40293-1000

- Florida, Louisiana, Mississippi, Texas: Internal Revenue Service, P.O. Box 1214, Charlotte, NC 28201-1214

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Internal Revenue Service, P.O. Box 802501, Cincinnati, OH 45280-2501

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7008

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7910

If youre filing a different 1040 income tax form, the IRSs website has a nifty breakdown of where each form has to go, most depending on whether or not a payment is enclosed.

How And Why To Mail Federal Tax Returns By Certified Mail

You want to be sure that your tax returns are actually received. We look at how and why to mail federal tax returns by certified mail.

When it comes to dealing with tax returns, nothing springs uncertainly into the hearts of even the most confident individuals. Since no one wants to pay extra to file late when they haven’t applied for an extension, it’s important to get everything your federal tax returns off in a timely manner.

But what’s the best method to ensure there’s no snags or hang-ups along the way? Is there anything you can do to feel confident about your return getting to the right place on time?

If you’re asking, its time to explore the benefits of certified mail. Learn more about how this service can help when dealing with the IRS postmark rule.

Recommended Reading: Doordash Tax Deductions