What’s The Fastest Way To Get My Refund

The IRS recommends filing taxes online and using the direct deposit option for your refund to get your money as fast as possible. Taxpayers can choose to get their refund deposited directly into their bank accounts, prepaid debit cards or mobile apps by providing their routing and bank account numbers.

Ohio Tax Commissioner Jeff McClain also advised filing state taxes electronically for the quickest possible refund.

Taxes: Middletown man sentenced to 30 months in prison for tax fraud

How Long Does It Take To Get A Tax Refund

According to the IRS, most taxpayers should receive their tax refunds within 21 days if they filed electronically and chose to get their money through direct deposit. Refunds for mailed-in returns may take longer than 21 days.

Last year, about 74 percent of Ohio taxpayers received a refund, according to the Ohio Department of Taxation. If you filed your state tax online and chose direct deposit for your refund, you should get your money less than two weeks after filing. Taxpayers who mailed in their returns, however, should receive their refunds within two to three months.

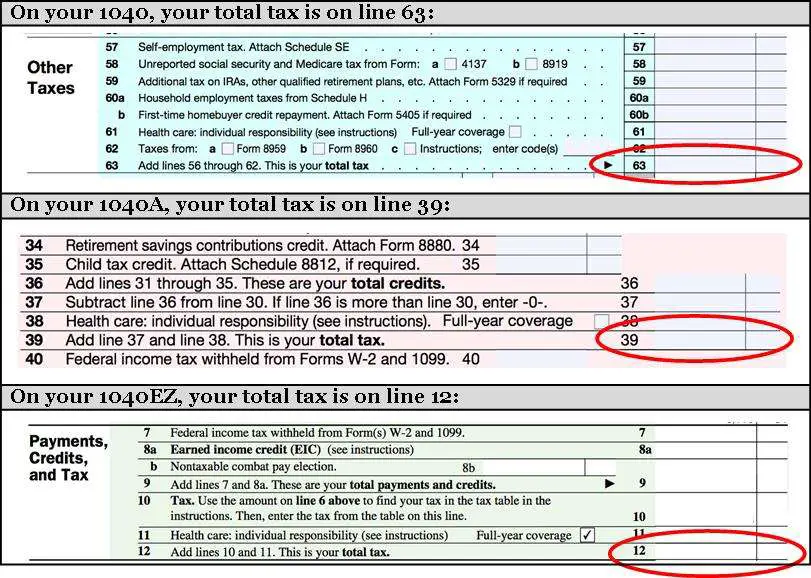

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

You May Like: Doordash 1099 Form

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

How Do I Find Line 236 Of My Spouses 2016 If He Has Not Filed Yet Either Trying To File Both Of Ours And Neither Have Filed For 2016 So There Is No Line 236

Or intuit could actually allow “net income, line 236, line 23600” to be searchable. Then I could determine what number I need to carry to the other spouses form. It seems to assume I have a paper copy showing me what that line is. There is ZERO line numerical reference on any of the pages.

You May Like: Buying Tax Liens In California

Refund Delays Due To Fraud

Another thing that could affect your IRS tax refund status is fraudulent activity on your Social Security number. You likely wont even be aware of this until you file. Identity theft has become a persistent problem with the IRS, even though the agency has put protections in place to keep taxpayers safe.

Fraudulent tax activity happens when someone uses your Social Security number to file a return and get access to your refund. If this happens, the IRS may notice it in advance and send a letter alerting you to it, but often the agency will find out when you try to file your own return, and they already have one filed on your behalf.

To prevent tax filing fraud, do your best to safeguard your Social Security number. Try to avoid using it as an identifier or including it on forms you submit non-securely.

If you work as an independent contractor, consider obtaining an Employer ID Number that you can use when filling out Form W-9 to perform work for someone. You can get an EIN in a matter of minutes on the IRS website and any taxes paid will be connected to your Social Security number without having to give that information to random third parties.

Read More:What Happens If You Don’t File Taxes?

Why Do I See A Tax Topic 152 Tax Topic 151 Or Irs Error Message

Although the IRS’ Where’s My Refund tool will generally show one of the three main statuses — Received, Approved or Sent — for your refund, there are a wide variety of messages and notices that some users may see.

One of the most common is Tax Topic 152, a generic message indicating that you’re likely getting a refund but it hasn’t been approved or sent yet. The notice simply links out to an informational topic page on the IRS FAQ website explaining the types and timing of tax refunds.

During the 2022 tax season, many Reddit tax filers who filed early say they received the Tax Topic 152 notice from the Where’s My Refund tool accompanied by a worrisome message: “We apologize, but your return processing has been delayed beyond the normal time frame. You can continue to check back here for the most up to date information regarding your refund. We understand your tax refund is very important and we are working to process your return as quickly as possible.”

The purported delay could be an automated message designed for taxpayers claiming the child tax credit or earned income tax credit. Due to additional fraud protection steps, the earliest filers with those credits could’ve received their refunds was March 1. Several Reddit users commented that the message eventually cleared and they received notifications that their refunds were sent.

Don’t Miss: Protest Taxes Harris County

How Can I See If My E

If you e-filed your return yourself using the IRSs Free File or Fillable Forms, the IRSs system does a quick check and tells you immediately that your return has been accepted or rejected. Minor errors, like a mistake in addition or subtraction or a Social Security number typo, can cause them to reject it. If its rejected for a simple reason like one of these, you can correct the error and resubmit it right away.

Tips

-

You can use a variety of methods in order to determine whether or not your e-filed tax return was successfully received by the IRS. If you used online tax preparation software to file your return, these services will typically provide real-time updates concerning the receipt of your paperwork.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Do You Have To Pay Taxes Working For Doordash

Taxes Due Today: Last Chance To File Your Tax Return Or Tax Extension On Time

It’s tax deadline day, and tax returns filed after will be considered late. Get the details and tips for quick filing.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

The time to file your 2021 tax return or a tax extension has nearly expired.

Monday is your final opportunity to complete and file your 2021 tax return on time . Midnight — in your local time zone — marks the deadline for electronically filing or postmarking a tax return.

If you can’t complete and file your tax return by Monday, you’ll want to file a tax extension, particularly if you owe. The IRS could charge a 5% failure to file penalty, plus additional interest and fines on top of that. Free tax software like Cash App Taxes can help you file an extension as well as finish your return. If you are expecting a refund, there’s no penalty for filing late.

Most state income tax returns are also due on April 18, although a handful of states have different deadlines. And, of course, some states don’t require you to file income taxes at all.

Why Did The Irs Send My Tax Refund In The Mail Instead Of Depositing It In My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If that’s not the reason, you may be getting multiple refund checks, and the IRS can only direct deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS’ next best way to refund your money quickly.

It’s also important to note that for refunds, direct deposit isn’t always automatic. Just in case, sign in to your IRS account to check that the agency has your correct banking information. If you are receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

Get the CNET How To newsletter

Also Check: How To Do Taxes With Doordash

How To Get A Fast Refund

The sooner you file your tax return, the sooner you’ll get any tax refund due. Plus, this year, filing your tax return early could boost your third stimulus check .

If you have a federal tax refund coming, you could get your money back in as little as three weeks. In the past, the IRS has issued over 90% of refunds in less than 21 days. If you want to speed up the refund process, e-file your 2020 tax return and select the direct deposit payment method. That’s the fastest way. Paper returns and checks slow things down considerable.

Even if you e-file and request direct deposit, it still takes more time for the IRS to process some tax returns. If that happens, your refund could be delayed. Process delays should be expected if your return:

- Includes errors

- Is incomplete

- Is affected by identity theft or fraud

- Includes Form 8379, Injured Spouse Allocation or

- Needs further review in general.

The IRS will contact you by mail if they need more information to process your return.

Also, don’t expect your refund before the first week of March if you claim the earned income tax credit or the additional child tax credit. By law, refunds for returns claiming these credits must be delayed. This applies to the entire refund, not just the portion associated with the credits.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Recommended Reading: Tax Preparation License

To Follow Up On Your Submitted Return:

You should receive an email within 24-48 hours indicating that your return has been received by TaxAct and transmitted to the IRS. Later, you will receive a second e-mail indicating the status of your return .

After transmitting your return, it is your responsibility to ensure that it is accepted by the IRS or state agency. If you do not receive an email confirmation or acceptance, you can check the status of your electronically filed returns using the TaxAct E-File and Tax Refund Status webpage.

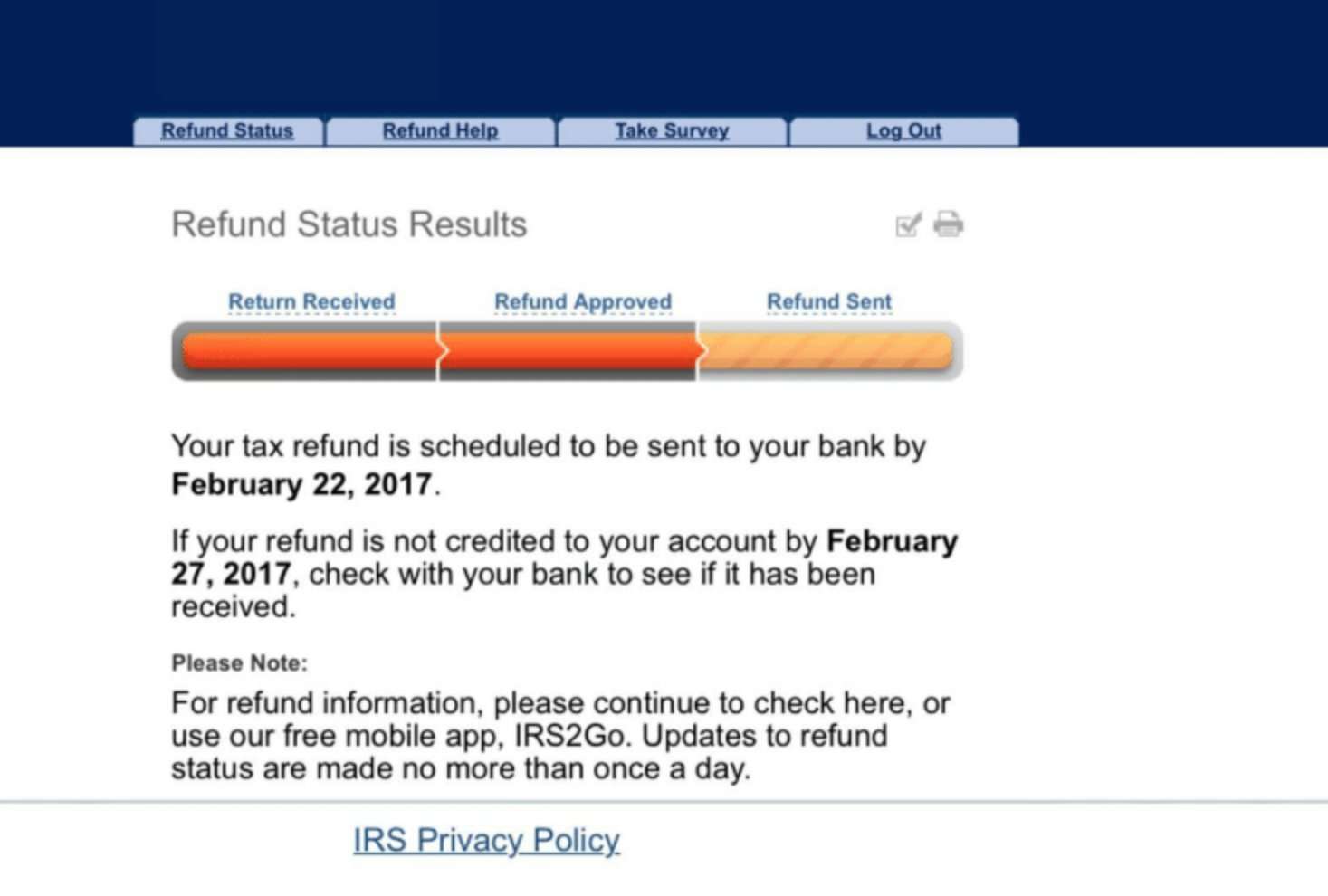

How To Check Your Tax Refund Status

OVERVIEW

The IRS has made it easy to check the status of your income tax return online with their “Where’s My Refund” web page.

If you are anxiously awaiting your refund check to arrive or have it deposited into your checking account, theres no reason for it to remain a mystery. The IRS has an online tool called Wheres My Refund? that allows you to check the status of your refund. After providing some personal information, you can find out when it will arrive.

TurboTax also has a Where’s My Refund Tracking guide that explains each step of the efiling process and how to check the status of your federal tax refund.

You May Like: Turbo Tax 8962

Why Is My Tax Refund Still Being Processed

Your refund is most likely still being processed if it’s been less than three weeks since you e-filed for direct deposit or less than six weeks since you filed by mail for a paper check. You can call the IRS to check on the delay after that time. Reasons for delay might include errors on your return, a mismatch on your direct deposit account, or that you filed an amended return.

What Is A Tax Refund

Whenever the Canada Revenue Agency collects more income tax from you than you owe, youll receive that amount as a refund. Its like savings you didnt know you had.

A refund is assessed based on your total income, the taxes you paid, and whether you have enough deductions and credits to warrant a refund.

As well, it never hurts to follow up with the CRA on unused deductions you can carry forward to future years.

Want to learn how to make the most of your tax return and get your maximum refund? Heres how.

You May Like: Michigan.gov/collectionseservice

Heres How Taxpayers Can Check The Status Of Their Federal Tax Return

IRS Tax Tip 2021-70, May 19, 2021

The most convenient way to check on a tax refund is by using the Where’s My Refund? tool. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Track The Status Of Your Irs Tax Refund Here’s How

If you filed your taxes weeks ago, it’s time to find out when that money will arrive.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Almost 58 million Americans have already received their 2021 tax refunds.

If it’s been more than three weeks since you submitted your tax return to the IRS, it’s time to start tracking down where your refund money is. Tax refunds generally arrive within 21 days — if no errors are found — for those who file electronically and set up direct deposit. If you haven’t filed your taxes yet, you’ve got less than one week left until the tax deadline day of

Once your return has been accepted by the IRS, you can start tracking the status of your refund until it arrives in your bank account. If you’re getting a paper check, you can even track that check to your mailbox using a free Postal Service tool. Be aware that filing a paper return will result in a delayed tax refund.

Recommended Reading: Deductions For Doordash

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.