What If You Sell A House Less Than Two Years After Buying It

You probably cannot qualify for the $250,000 single/$500,000 married-filing-jointly exemption from gains on selling your primary residence. Thats because to qualify for that exemption, you must have used the home in question as your primary residence for at least two of the previous five years, and you generally cant use the exemption twice within two years.

However, there are exceptions for certain circumstances: Military service, death of a spouse, and job relocation are the most common reasons that might allow you to take at least a partial exemption. The IRS has a worksheet for determining an exclusion limit see Topic 701.

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAsset’s tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

Government Carefully Considering Courts Miq Decision Hipkins

Covid-19 response minister Chris Hipkins has issued a statement in response to this afternoons High Court ruling that the managed isolation lottery was an unjustified limit on the right of New Zealand citizens to enter the country.

After noting that the ruling found the requirement for returnees to undergo MIQ was not in itself unjustified, Hipkins statement acknowledges the courts finding that for some citizens, the virtual lobby system as it operated between 1 September and 17 December 2021, may have infringed their right to enter New Zealand. We are carefully considering the courts decision.

We have long acknowledged the difficult trade-offs weve had to make in our Covid-19 response to save lives and the effects of those decisions on all New Zealanders, particularly those living abroad, said Hipkins. This was particularly challenging for those applying for MIQ places between September and December 2021.

MIQ was always the least worst option to help keep Covid-19 from entering and spreading in New Zealand.

The National Party is celebrating a court ruling that sided with Grounded Kiwis against the government on the issue of managed isolation.

The High Court called the MIQ system unjustified and agreed that the virtual lobby system was flawed and akin to a lottery.

He added: Month after month, New Zealanders were shocked at the extraordinary suffering inflicted on many people because of the MIQ lottery.

Also Check: How Do Taxes Work For Doordash

What Are The Sources Of Income

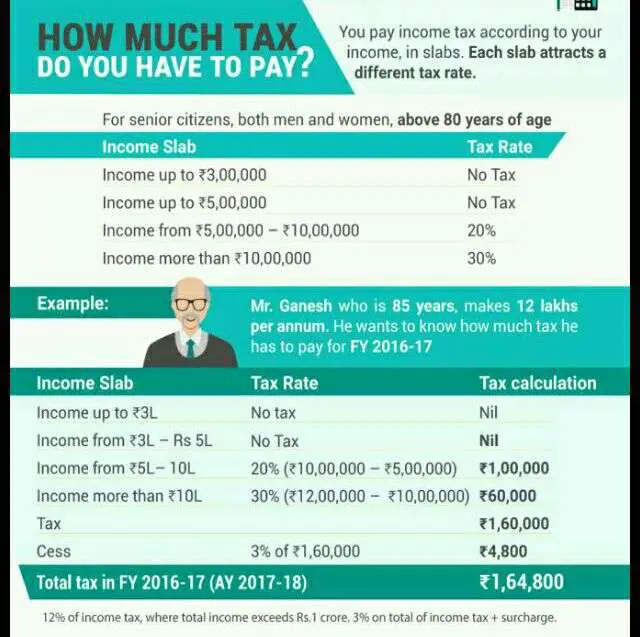

As per the rules and regulations stated by the Income Tax Department of India, an individual is allowed, at all points of time, to have 5 sources namely, salary income, capital gains, house property income, business income, and income from other sources. Generation of any kind of income will be taxable, provided you categorises each income under the aforementioned sources.

We Have No Idea How Much Tax The Wealthiest New Zealanders Pay

Revenue minister David Parker delivered a speech on tax fairness yesterday. He called GST a regressive tax that hits low income earners the hardest, and said we dont actually know how much tax the wealthiest New Zealanders pay. He will introduce a Tax Principles bill. Thomas Coughlan at the NZ Herald asks whether Parker could be hinting at the introduction of a wealth tax. Labours 2020 manifesto promised no new taxes and Parker said the government didnt have any secret plans to introduce any. He did say the government was currently collecting data thats previously been described as patchy and acknowledged the research would feed into Labour policy at the next election.

Want to read The Bulletin in full? and join over 36,000 New Zealanders who start each weekday with the biggest stories in politics, business, media and culture.

Don’t Miss: Do You Pay Taxes On Donating Plasma

S For Income Tax Calculation

There are a thousand different components in each of these steps. It is always advisable to conduct thorough research before one starts calculating his/her tax.

How Much Tax Will You Owe On A Roth Ira Conversion

When you convert from a traditional IRA to a Roth, the amount you convert is added to your gross income for that tax year. It increases your income and you pay your ordinary tax rate on the conversion.

Say youre in the 22% tax bracket and convert $20,000. Your income for the tax year will increase by $20,000. Assuming this doesnt push you into a higher tax bracket, youll owe $4,400 in taxes on the conversion.

Be careful here. Its never a good idea to use your retirement account to cover the tax you owe on the conversion. Doing so would lower your retirement balance, which could cost you thousands of dollars in growth over the long-term. Instead, save up enough cash in a savings account to cover your conversion taxes.

Also Check: Is Selling Plasma Taxable

If You Need To Reimburse Crb

If you received the CRB and your net income is more than $38,000 , you may have to reimburse some or all of the benefit.

Any amounts you need to reimburse will be included as part of your total balance owing for your 2021 taxes.

If you are filing electronically with certified tax software, the amounts you need to repay should be calculated for you and added to your balance owing.

If line 23400 is more than $38,000, you will have to repay $0.50 of the CRB for every dollar of net income you earned above $38,000. You will not have pay back more than what you received in CRB benefits for that year.

If line 23400 is more than $38,000, complete section “Line 23500 Social benefits repayment” of the worksheet to calculate how much you need to reimburse.

Use the worksheet that applies to you:

You will have to reimburse $0.50 of the CRB for every dollar of net income you earned above $38,000. You will not have pay back more than what you received in CRB benefits for that year.

How to calculate the social benefits repayment on the worksheet

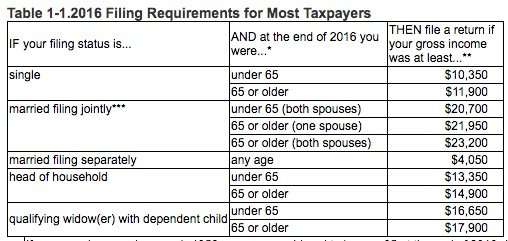

Federal Income Tax Calculator

for a 2021 Federal Tax Refund Estimator.Taxes are unavoidable and without planning, the annual tax liability can be very uncertain. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates.

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Read Also: Is Doordash A 1099

What Are Some Other Inflation Adjustments I Should Look Out For

We mentioned earlier that the IRSâs tax brackets apply to your taxable income, which is what you get when you apply certain adjustments and deductions to your revenue.

One other way that the IRS helps guard against bracket creep is by adjusting the values of deductions to keep up with inflation. Here are the main ones you should look out for:

How To Check Your Withholding

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Or, the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

If you adjusted your withholding part way through 2020, the IRS recommends that you check your withholding amounts again. Do so in early 2021, before filing your federal tax return, to ensure the right amount is being withheld.

Read Also: How To Calculate Taxes For Doordash

How To File Taxes While Self Employed

To file a tax return while self-employed, youd use Schedule C to calculate your income, and then youd use Schedule SE to calculate your self-employment taxes.

From there, you could do one of the following:

After youve finished filing your tax return, make sure to keep a record of it. If youre trying to get a mortgage while self-employed, your lender will need to see copies of your personal tax returns. In addition, they may ask for copies of profit and loss statements for your business.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Other Notable Taxes In Texas

Texas has an oyster sales fee. Shellfish dealers in Texas are required to pay a tax of $1 per 300 pounds of oysters taken from Texas waters.

- Cameron County, Texas is located at 26.15° North, and contains the most southern point along the US-Mexico border.

- Three of the ten most populous cities in the country are in Texas.

- In 2014, Texas produced more oil than any country in the world except Saudi Arabia.

Also Check: Is Plasma Money Taxable

Can I Withdraw My 401k Now

People affected by COVID-19 can withdraw up to $ 100,000 from employee-sponsored retirement accounts such as 401 s and 403 s, as well as personal retirement accounts such as traditional individual retirement accounts, or a combination of both. The 10% penalty will be waived for withdrawals made in 2020.

Can I cash out my 401k while still employed?

You can withdraw 401 while you are employed, but you cannot withdraw it while you are still employed with the company that sponsors the 401 that you wish to withdraw.

Can I still withdraw from my 401k without penalty in 2021?

Although the initial payout provision of 401,000 that it will be

Should I take money out of my 401k now?

A withdrawal of 401 gives you instant access to your funds. If you lose your job and use your living expenses until you start your new job, early payment of 401 can help you stay out of debt. When your income rises again, you can go back to saving for retirement.

Real Estate Taxes Vs Property Taxes

The terms real estate and property are often used interchangeably, as are real estate taxes and property taxes. However, property is actually a broad term used to describe different assets, including real estate, owned by a person also, not all property is taxed the same.

Property taxes, as they relate to real estate, are ad valorem taxes assessed by the state and local governments where the real property is located. The real estate property tax is calculated by multiplying the property tax rate by real propertys market value, which includes the value of the real property and the land that it sits on.

Property taxes, as they relate to personal property, are taxes applied to movable property. Real estate, which is immovable, is not included in personal property tax. Examples of personal property include cars, watercraft, and heavy equipment. Property taxes are applied at the state or local level and may vary by state.

Don’t Miss: Protesting Harris County Property Tax

Convert Your Second Home Into Your Primary Residence

Capital gains exclusions are attractive to many homeowners, so much so that they may try to maximize its use throughout their lifetime. Because gains on non-primary residences and rental properties do not have the same exclusions, more people have sought clever ways to reduce their capital gains tax on the sale of their properties. One way to accomplish this is to convert a second home or rental property to a primary residence.

A homeowner can make their second home as their primary residence for two years before selling and take advantage of the IRS capital gains tax exclusion. However, stipulations apply. Deductions for depreciation on gains earned prior to May 6, 1997, will not be considered in the exclusion.

According to the Housing Assistance Tax Act of 2008, a rental property converted to a primary residence can only have the capital gains exclusion during the term in which the property was used as a principal residence. The capital gains are allocated to the entire period of ownership. While serving as a rental property, the allocated portion falls under non-qualifying use and is not eligible for the exclusion.

To prevent someone from taking advantage of the 1031 exchange and capital gains exclusion, the American Jobs Creation Act of 2004 stipulates that the exclusion applies if the exchanged property had been held for at least five years after the exchange.

How Much Can A Small Business Make Before Paying Taxes

If you operate a small business, you must pay taxes on the income, regardless of the profit and loss. The tax return you must file depends on how your business is structured. For example, if you have a sole proprietorship youll file the schedule C with your personal tax return.

If youre a freelancer, you must also pay self-employment taxes for income more than $400. These taxes cover Medicare and social security taxes.

Sole proprietors must file IRS Form 1040, Schedule C and Schedule SE if your net income is greater than $400. If you have an employee, you will need to withhold federal and state income taxes and Social Security and Medicare taxes for each employee.

Also Check: Power To Levy Taxes

Do You Pay Capital Gains Taxes When You Sell A Second Home

Because the IRS allows exemptions from capital gains taxes only on a primary residence, its difficult to avoid capital gains taxes on the sale of a second home without converting that home to your primary residence by considering the two-in-five-year rule . Put simply, you determine that you spent enough time in one home that it is actually your primary residence.

If one of the homes was primarily an investment, its not set up to be the exemption-eligible home. The demarcation between investment property and vacation property goes like this: Its investment property if the taxpayer has owned the property for two full years, it has been rented to someone for a fair rental rate for at least 14 days in each of the previous two years, and it cannot have been used for personal use for 14 days or 10 percent of the time that it was otherwise rented, whichever is greater, for the previous 12 months.

If you or your family use it for more than two weeks a year, its likely to be considered personal property, not investment property, and thus subject to taxes on capital gains, as would any other asset other than your principal residence.

Income From Capital Gains

The nature and number of transactions usually determine the computation of income from capital gains. It can be attained in the following manner:

- Calculate your long-term capital gains from your total sales of assets.

- Calculate your short-term capital gains from the total sales of capital assets.

- Deductions are to be claimed after this.

You May Like: What Is The Sales Tax In Philadelphia

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Use 1031 Exchanges To Avoid Taxes

Homeowners can avoid paying taxes on the sale of their home by reinvesting the proceeds from the sale into a similar property through a 1031 exchange. This like-for-like exchangenamed after Internal Revenue Code Section 1031allows for the exchange of like property with no other consideration or like property including other considerations, such as cash. The 1031 exchange allows for the tax on the gain from the sale of a property to be deferred, rather than eliminated.

Ownersincluding corporations, individuals, trust, partnerships, and limited liability companies of investment and business properties can take advantage of the 1031 exchange when exchanging business or investment properties for those of like kind.

The properties subject to the 1031 exchange must be for business or investment purposes, not for personal use. The party to the 1031 exchange must identify in writing replacement properties within 45 days from the sale and must complete the exchange for a property comparable to that in the notice within 180 days from the sale.

Since executing a 1031 exchange can be a complex process, there are advantages to working with a reputable, full-service 1031 exchange company. Given their scale, these services generally cost less than attorneys who charge by the hour. A firm that has an established track record in working with these transactions can help you avoid costly missteps and ensure that your 1031 exchange meets the requirements of the tax code.

Read Also: How To File Taxes As A Doordash Driver