Understanding State Income Tax

Tax laws, rates, procedures, and forms vary widely from state to state. Filing deadlines also vary, but for individuals, state tax day usually falls on the same day as federal tax day, which is typically April 15. However, state filing deadlines were updated for the 2019 and 2020 tax years due to the COVID-19 crisis.

Taxpayers must file tax returns in each state and each year that they earn an income more than the states filing threshold. Many states conform to federal rules for income and deduction recognition. Some may even require a copy of the taxpayers federal income tax return to be filed with the state income tax return.

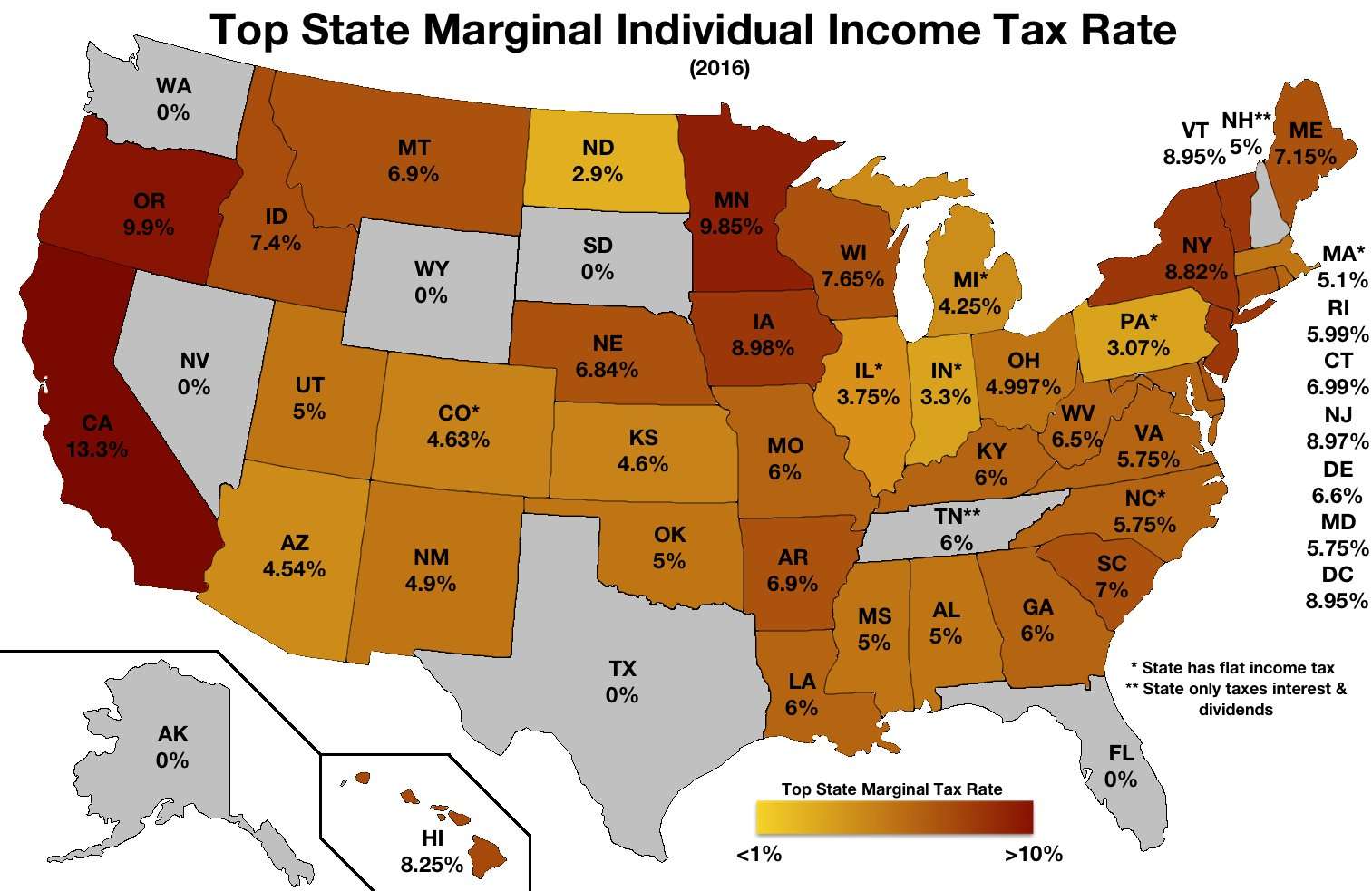

As of the 2021 tax year, eight states have no income tax: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. New Hampshire taxes unearned income, such as interest and dividends, but it will end the practice as of Jan. 1, 2024.

Forty-one states and Washington, D.C., do have a state income tax. If you live in a state that levies an income tax, avoidance of it by working in a no-income-tax state is not possible. Your home state will continue to tax the income even though your earnings were made in a no-income-tax state.

If you have income that is not subject to withholding, such as business or self-employment income, you must estimate your annual tax liability and pay it to the state in four quarterly installments.

Is Las Vegas A Good Retirement Place

Las Vegas has a cost of living that is less than the national average. The cost of living is actually very reasonable making retirement in Las Vegas quite affordable. Home prices are relatively inexpensive, food and utilities are inexpensive, and theres no shortage of economical retirement activities in Las Vegas.

Nevada State Personal Income Tax

Nevada is one of the seven states with no income tax, so the income tax rates, regardless of how much you make, are 0 percent. But the state makes up for this with a higher-than-average sales tax. Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax Foundation.

Read Also: Is Plasma Donation Income Taxable

Nevada Income Tax Estimator

You can use the income tax estimator to the left to calculate your approximate Nevada and Federal income tax based on the most recent tax brackets.

Keep in mind that this estimator assumes all income is from wages, assumes the standard deduction, and does not account for tax credits.

For a more detailed estimate that takes these factors into account, click “View Detailed Estimate” .

I Need Help With My State Income Tax I Worked In Ca But Lived In Nevada For My Job Then Moved Back To Ca I Think I Need Help With Y Ca State

Your state tax situation should be fairly simple, if your only two states are California and Nevada. Since Nevada has no personal income tax system, you have no need to file any tax return there, and there is no state tax credit that you would need to then claim on your California state tax return. In other words, because NV is a no tax state, there is no possibility of double-taxed income. Instead, to make things as as easy as possible on yourself, please consider these tax facts.

1) If you live in NV and work in CA, then CA taxes all of your wage income.

2) If you live in CA and work in NV, then CA taxes all of your wage income.

3) If you live in CA and work in CA, then CA taxes all of your wage income.

4) Only when you live in NV and work in NV does CA not tax your wage income.

Therefore, unless you have taxable income other than W-2 wage income , you can safely assume that CA will be taxing all of your job income. One acceptable way to file your state tax return in that instance is to just file a single CA “part-year” resident tax return, and declare that all of your W-2 income is taxable to CA. If you take that approach, this should then resolve your issue.

Also Check: Efstatus Taxactcom

Do States With No Income Tax Outperform Other States

Four of the top 10 states with the strongest economic outlook do not charge an income tax, according to 2021 rankings from the American Legislative Exchange Council, a think tank focused on free markets and limited government.

Part of that might be because theyre attracting more workers. States that dont have an income tax gained a net inflow of 285,000 new residents leaving from the 41 states that did charge an income tax, according to 2018 figures from the IRS, the most recent for which data is available.

An analysis from the Tax Foundation using Commerce Department data shows that states without an income levy grew at twice the national rate over the past decade, while gross state product grew 56 percent faster in those locations over the same period.

They tend to be outshining some of their peers that do have income taxes, says Katherine Loughead, senior policy analyst at the Tax Foundation who focuses on state tax policy.

Others, however, point out that missing income tax revenue might come with a cost particularly when it comes to infrastructure and education spending. South Dakota and Wyoming, for example, spent the least on education of all states, according to a 2021 analysis from the Census Bureau.

Federal Corporate Income Tax Brackets 2018

Corporations operating in the state of Nevada are also required to pay corporate income tax on the federal level. This tax rate also follows a bracket system, including eight tax brackets that are based on the corporation’s income level. These tax brackets are different from the brackets that apply to personal income tax in that they are not progressive brackets. The final bracket isn’t the highest, which ensures that the burden of corporate taxes is spread more evenly across corporations with all levels of revenue.

If you need help with the Nevada corporate tax rate, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Read Also: Cook County Appeal Property Tax

Nevada Income Tax Calculator

Although the Nevada income tax rate is 0%, we have provided you with various scenarios of the tax you will pay on your income as a resident of Nevada.

The following Nevada income tax calculator should be used for approximation purposes and does not represent legal authority, or the exact amount of Nevada income tax that you will be liable for it is a guide based on information from the IRS, the State of Nevada Department of Taxation, and other sources.

The range we have provided in the Nevada income tax calculator is from $1,200 per month or $14,400 per year to $12,000 per month, or $144,000 per year. The gross monthly wage of $1,560 or $18,720 per year in the table represents the Nevada minimum wage of $9.00 per hour. A standard full-time position in the US typically includes a 40-hour workweek that translates to 2,080 hours worked in a year .

Finally, while the state has no income tax, what is also beneficial to residents of Nevada, is that it does not impose any local income tax as some other states do.

Here is the Nevada income tax calculator

| Monthly Gross Wage |

|---|

| $107,711.04 |

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Read Also: Prontotaxclass

Do Property Taxes Decrease At Age 65

Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 homestead exemption for school district taxes, in addition to the $25,000 exemption for all homeowners. Each taxing unit decides if it will offer the exemption and at what percentage.

Working And Living In Different States

Most taxpayers live and work in a single state and file a resident state income tax return there. However, taxpayers who earn wages or income in one or more states other than where they live may be required to file state income tax returns in those states as wellunless, of course, a state is a no-income-tax state.

If, for example, you are an actor living in Jersey City, N.J., and you work on Broadway in New York City, do TV or movies in Los Angeles, and play a regional theater gig in Chicago, then you must pay taxes in the states of New Jersey, New York, California, and Illinois. Furthermore, your tax home is the general area of your main place of business. If you spend most of your time working on Broadway, then your tax home would be New York.

According to the IRS, to determine your main place of business, you must take into account the length of time you spend in the location, the degree of business activity occurring in the location, and the relative significance of the financial return from each location. However, the most important factor is the length of time that you spend in each location.

Depending upon the residency rules of the home state, expats may also still have a state filing requirement.

Don’t Miss: How To Find Employer Ein Without W2

States With No Income Tax Might Put More Pressure On Lower

Income taxes are usually progressive in nature, meaning that they tax higher earners at a greater rate than lower earners. Other taxes typically dont have that Robin Hood-like characteristic.

Sales taxes, for example, are considered regressive. They dont change depending on the income level of the consumer. They treat everyone the same. So do levies on food, gasoline and other key consumable items.

These taxes place a bigger burden on the poor, according to ITEP research. The reason is the lowest earners in the state devote the lions share of their take-home pay to buying things that are subject to sales taxes. The wealthy, who can save a chunk of their income in their 401s and other investments, have a much smaller proportional exposure to the sales tax.

The 1930s Nevada Gaming Law Established

Stories that concerned the impact of the Depression and the resultant decline in assessed valuation. One of the Depression solutions for additional revenue in Nevada was the suggestion to impose a State income tax .

The Legislature opted instead for passing Assemblyman Tobins bill that established the Nevada Gaming Law and created the table games tax the proceeds of which were shared by the state, counties, and incorporated and unincorporated towns. During this period, the Association advocated county-wide school districts.

You May Like: Harris County Property Tax Protest Services

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Property Tax Vs Real Estate Tax

People often use the terms property tax and real estate tax interchangeably. And it’s partially true: Real estate tax is a property tax. However, that’s not true the other way around. Not all property taxes are real estate taxes.

As noted above, in addition to real estate, many jurisdictions also levy property taxes against tangible personal property. According to a 2019 report by the Tax Foundation, 43 states tax tangible personal property. Both types of property are tax deductible if you file Schedule A with your income taxes. However, since the Tax Cuts and Jobs Act, the amount of state and local taxes taxpayers could deduct on their federal income taxes fell from no limit to $10,000 per year for either married couples or single taxpayers. Those in the married filing separately category have a $5,000 cap.

So here’s the difference: Real estate taxes are taxes on real property only property taxes can include both real property and tangible personal property.

Read Also: Plasma Donation Taxable

If You Choose To Live In These States Every Penny You Earn Is Safe From State Income Tax But That Doesn’t Mean You Won’t Have To Pay Other State And Local Taxes

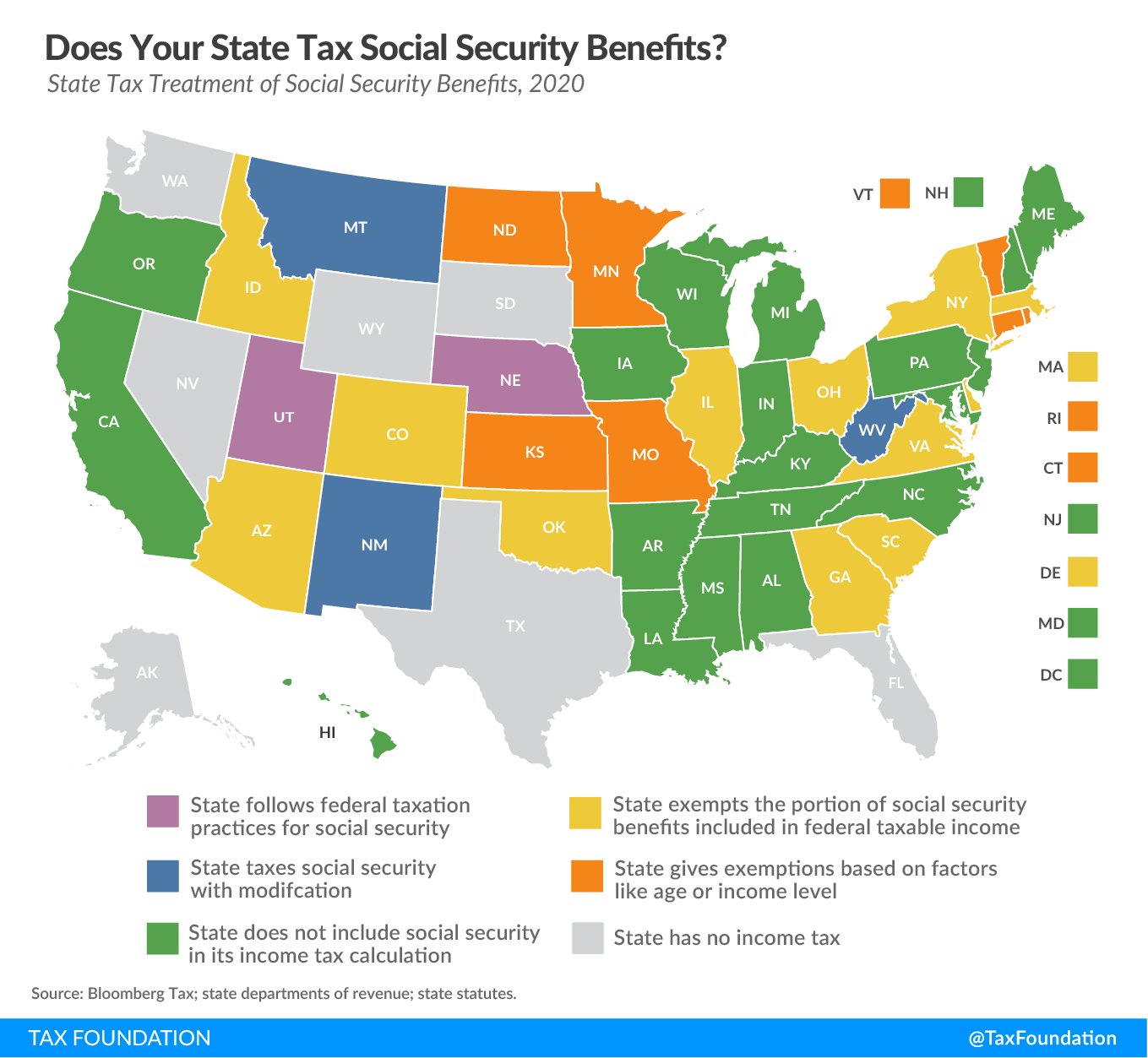

Everyone hates paying taxes. So why don’t we all live in one of the nine states without an income tax? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming don’t tax earned income at all. If you’re retired, that also means no state income tax on your Social Security benefits, withdrawals from your IRA or 401 plan, and payouts from your pension. That sounds pretty darn good to me!

But, of course, no state is perfect. The states without an income tax still have to pay for roads and schools, so residents still have to pay other taxes to keep the state running . And sometimes those other taxes can be on the high end. New Hampshire and Texas, for example, have some of the highest property taxes in the country. So, if you’re thinking of moving to a state without an income tax, continue reading to see some of the other taxes you’ll have to pay in those states. Maybe the state you’re in right now won’t look so bad.

Overall Rating for Taxes: Mixed Tax Picture

State Income Taxes: New Hampshire doesn’t tax earned income, but currently there’s a 5% tax on dividends and interest in excess of $2,400 for individuals . The tax on dividends and interest is being phased out, though. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026. The tax will then be repealed on January 1, 2027.

Sales Tax: New Hampshire has no state or local sales tax.

Inheritance and Estate Taxes: There is no inheritance tax or estate tax.

Tax Season Is Here: Check Out Select’s Top Tax Services

The IRS started accepting and processing tax returns on February 12, but if you haven’t yet filed yours you can still make the process as painless as possible by using one of Select’s best online tax software.

Taxes are traditionally due on April 15, but the IRS extended the federal income tax filing due date to May 17, 2021. You can check your state’s filing deadline here. Some states have changed their due dates to May 17 as well.

Select reviewed 12 tax filing software programs, evaluating them on a range of features, including cost, user experience, expert tax assistance and Better Business Bureau rating. Here is our roundup of the top tax software programs to ensure a fast process:

- Best overall tax software: TurboTax

Also Check: Protesting Harris County Property Tax

Premier Trust Works With People Throughout The United States To Provide Nevada Trust Services

Premier Trust is among the top trust companies in Nevada because unlike other trust companies, we allow our clients across the country to formulate and execute their estate plans to take advantage of Nevada trusts, corporate, and tax laws. We call this the Nevada Advantage. You can reside anywhere in the United States and still benefit from a trustee relationship with Premier Trust.

Nevada is consistently ranked as the top trusts jurisdiction in the United States for the many advantages that people gain:

- Nevada does not have a state or fiduciary income tax. Irrevocable trusts are taxed at the state level on where the trustee resides. If a client has a Nevada trustee, the Nevada trusts may avoid filing a state income tax return. This helps reduce the erosion of trust assets by the tax rate. *The Nevada trusts will always have to file a federal income tax return. Also, if a beneficiary of trust from Nevada trust companies receive a trust distribution, that distribution will be subject to their own states personal income tax filings.

- Nevada dynasty trusts allow a trust to continue for 365 years. The length of time a trust can last is commonly referred to as a states Rule Against Perpetuities. Dynasty provisions allow a trust to avoid the estate tax arena for multiple generations.

What Is Property Tax

Property tax is a tax paid on property owned by an individual or other legal entity, such as a corporation. Most commonly, property tax is a real estate ad-valorem tax, which can be considered a regressive tax. It is calculated by a local government where the property is located and paid by the owner of the property. The tax is usually based on the value of the owned property, including land. However, many jurisdictions also tax tangible personal property, such as cars and boats.

The local governing body will use the assessed taxes to fund water and sewer improvements, and provide law enforcement, fire protection, education, road and highway construction, libraries, and other services that benefit the community. Deeds of reconveyance do not interact with property taxes.

Recommended Reading: Federal Tax Return Irs