The Deadline To Opt Out Of October’s Child Tax Credit Check Has Passed What’s Next

The next deadline to stop advance payments is fast approaching. Here’s what to do.

Unenrolling from advance payments now can help reduce a financial headache next tax season.

The fourth advance child tax credit payment will hit parent’s bank accounts next week. Millions of eligible families are getting immediate benefit from receiving cash in advance this year compared to getting the credit during tax time. Parents are getting as much as $300 per month per kid each month. But some families are opting out, even though three checks have already gone out.

There’s still time to unenroll from the last two checks if your circumstances have changed. The deadline to opt out of next week’s check has passed but you have until Monday, Nov. 1, to update your banking information, address or opt out of the final checks. Unenrolling is one quick fix for parents having trouble updating their household changes or those that are concerned about repaying the IRS. This may be the case for divorced or single parents with joint custody. It’s also an option for those who’d prefer a bigger tax refund in 2022. Opting out might help nontraditional families avoid some of the ongoing child tax credit problems.

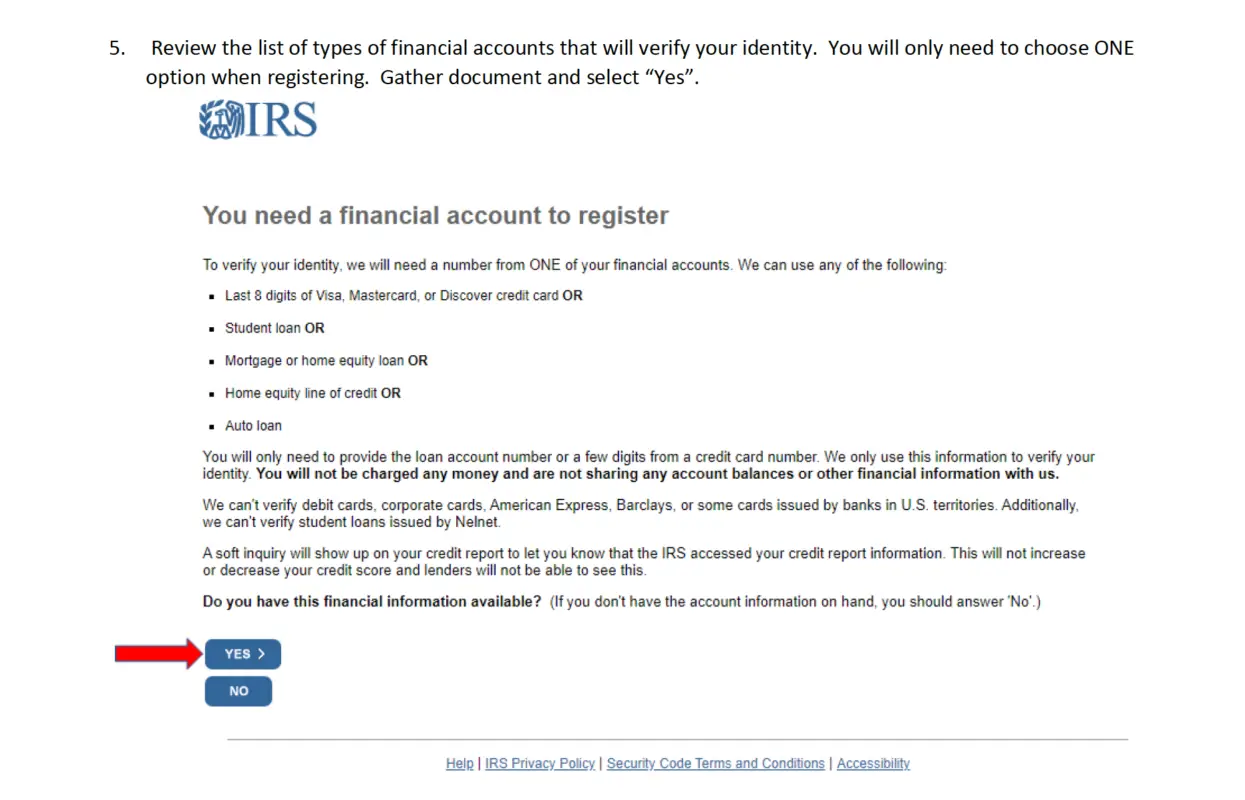

The key to managing your checks, updating your information and opting out is the IRS Update Portal, which requires an ID.me account. If you decide to use the advance payments to cover expenses now, here are some ways to spend your child tax credit money. This story was recently updated.

None Of The Previously Mentioned Situations Apply To You

If youre married or you have primary custody of your children, your income isnt expected to increase to a level that pushes you out of the eligibility range and you dont have multiple children aging in or out of different payment amounts, then there is no reason not to accept the monthly boost to your familys finances.

Because the payments are part of a tax credit and not a welfare program like the Supplemental Nutrition Assistance Program or Temporary Assistance for Needy Families , there are no specific requirements for how the money is used. The benefit doesnt need to be applied exclusively to child-specific items or services it is an acknowledgement that raising children adds more expenses to a household, even if the extra cash doesnt go directly toward them.

For instance, you can take the monthly payments and if you find you dont need the extra cash assistance one month, put the money toward an emergency fund or using it to pay off debt, both of which are essential factors for keeping children out of poverty.

Opting Out Through Your Irs Account

1. Log into your IRS Account. You know the drill. Username, password, 2 step verification, confirm login history, stand on your head.

2. Your account will tell you your eligibility, whether or not you’ve received payments, and have a button to unenroll if you are eligible. Go ahead and click that “Unenroll From Payments” button.

3. Read their commentary and click “I Understand and Want to Proceed.”

4. Once again, confirm that you want to unenroll, check the box, and press submit.

5. You’ll see this screen confirming you have unenrolled. That’s it. Log out and you’re done.

Don’t Miss: Is Past Year Tax Legit

You Are Expecting Your Income To Increase This Year

If you or your spouse are expecting a significant change to your incomes this year that would no longer qualify you for the CTC, it would be wise to opt out. This is because you will likely have to pay back any overpaid amount, says Beth Logan, EA at Kozlog Tax Advisers. So if your adjusted gross income in 2020 was less than $75,000 or $150,000 and you expect your income this year to exceed that, you’re better off opting out. The same applies if your income goes from below $200,000 to above, as benefits decrease at this income level too.

Will There Be Monthly Child Tax Credit Payments In 2022

As it stands right now, the monthly child tax credit payments will end this year. However, President Biden and many Democrats in Congress want to continue the payments beyond 2021. Under the president’s plan, they would be extended through 2025, along with the other credit enhancements that apply this year . It’s too early to tell if that will happen, but it’s certainly possible while Democrats control both the White House and Congress.

Read Also: How To Get Social Security Tax Statement

You Share Equal Custody Of Your Children

With stimulus checks, divorced or unmarried parents with joint custody could essentially double dip and both claim their children in order to receive a bigger payment. This is not the case with the new child tax credit and monthly payments if both you and your childs other parent claim the child as a dependent and get the monthly deposits, one of you could be on the line for thousands of dollars come tax season.

In order to claim the child tax credit, your child needs to live with you for at least six months out of the year. Even if your custody agreement is completely evenly split, one parent will technically be caring for the child one day more than the other in a 365-day calendar year and thats who gets to claim the credit. If you and your co-parent havent worked out holidays, vacations, weekends and more for this year, it may be best to opt out of the monthly payments, wait until next tax season to determine who receives the benefit, and split the money once the designated parent receives their refund.

Child Tax Credit: Why You May Want To Opt Out Of Monthly Payments This Week

by: Talia Naquin, WJW, Nexstar Media Wire

Money from the child tax credit advance could be a lifeline for many.

The first of six monthly child tax credit payments began July 15.

Parents should expect $300 a month for kids under the age of 6 and $250 a month for children between 6 and 17.

Those payments will continue until Dec. 15. Then in April 2022, there will be a lump sum distributed up to $1800 per child.

The next check is scheduled to be disbursed on Aug. 13.

However, families may want to opt out, and they can do so this week.

Qualifying families have to alert the IRS and confirm they want to unenroll from monthly payments, and instead get it all at once next year.

The payments differ from stimulus checks in that they are not completely new funds, but rather an advanced payment on the Child Tax Credit parents already were deducting from their taxes at filing time.

The total value of the credit was beefed up for 2021 as part of the Biden administrations American Rescue Plan. This year, parents are getting half of the funds in advance and the rest when filing is done next spring. That means the monthly check payments will run out at the start of 2022.

You May Like: How Do I Get My Pin For My Taxes

How To Let The Irs Know Of Changes To Dependents Income And Marital Status

The Child Tax Credit Update Portal is the best way to quickly make any changes that have happened since you last filed your taxes. Right now, you can use the portal to update your banking information and mailing address. Later this fall, you should be able to add or subtract qualifying children, report a change in your marital status or income or reenroll in monthly payments if you previously unenrolled.

Though we don’t know the exact date, the IRS will soon give the portal more functionality. For example, if you had a new baby in 2021 or gained a qualified dependent or if your income recently changed, the IRS wouldn’t have that on file yet and would need to be informed in order to adjust your child tax credit payments.

Bidens Child Tax Credit And How To Opt Out

Joe Biden doesnt believe in tax cuts, but he is willing to mess with your refund and possibly prevent you from getting one.

My introduction to this brazen tampering with taxes was a form letter the I received from the IRS.

My first question after why, is what will this do to my taxes when I file on or before April 15th next year?

Folks, the question of whether you wish to participate in this is dazzle the voters program is in two parts. First what does the child tax credit do to my taxes? and second, how much will I get?

I took a look at my taxes from last year . The Child Tax Credit in 2020 was $2,000.

The child tax credit is deducted directly from the amount of taxes that you owe.

Suppose per the tax tables, you owed $15,000 in Federal tax. The child tax credit is deducted directly from this amount. Thus $15K minus $2K is $13K. If you had $13K withheld from your pay, then youd owe zero in additional taxes.

Biden is doing two things simultaneously with the credit this year. First, he raised the credit from $2K to $3K per child. Then Uncle Joe is going to send you a series of checks between July and December which will total $1,500. The other $1,500 will then be available to deduct from your taxes.

Now Im going back to my previous example to demonstrate the math.

Frankly, I think this scheme will bite me in the fiscal butt, so I decided to opt out. Please note that doing so is difficult and time consuming. But I did it. Here is my guide.

Click on UNENROLL FROM PAYMENTS

Also Check: How Much Tax Do You Have To Pay On Stocks

How Does The Ctc Work For Divorced Parents

Parents who file their taxes jointly can share the CTC payments because they effectively file the return as a single entity. But that is not the case for parents who file tax separately, such as in the case of divorced parents. Only one parent can claim the Child Tax Credit, according to the IRS.

Often, divorced parents will swap years when they claim their child or children as dependents. But this can be an issue with the CTC since the IRS is relying on 2019 or 2020 tax returns to send out the advance payments of a 2021 tax credit. That means one parent could end up with the tax credit for two years in a row.

The Child Tax Credit Update Portal allows parents to opt out of the CTC, which could be useful for divorced parents to avoid such an issue. For instance, if one parent claimed the child as a dependent in 2020 and the other parent plans to claim the child in 2021, the first parent would want to opt out of the CTC now to avoid claiming the credit for two consecutive years.

Ok Great So Why Would I Opt Out

You should opt out, because you are probably not eligible for these payments and will need to repay them with your 2021 tax filing. It is possible that you will have the standard Additional Child Tax Credit to cover most of the advance payment, however our recommendation is to just wait until tax filing to claim your refund and not risk owing money back to the IRS.

Read Also: How Does Doordash Do Taxes

By Step Instructions To Opt Out Through Idme

If you’re not so lucky to have an IRS Account, you’ll need to verify your identity through ID.me. The IRS is not messing around with this. Be prepared to upload a picture of your driver’s license and then do a live video where they confirm you actually look like your driver’s license. Our test subject took multiple tries to get everything confirmed. If you’re using a computer make sure you have a webcam. Ok, here we go.

1. Create an account. Enter the email address you want to use and a password.

2. Read the fine print and press continue

3. Set up 2 Step Verification with Your Mobile Number.

4. Type in Your Phone Number & Click Continue

5. Type in the code sent to your phone and click continue.

6. Click Generate Recovery Code and Save that, just in case. Click Continue.

7. Upload a picture of your driver’s license. You’ll need both front and back. Make sure the picture is super clear, with no glare, and good lighting. We had to do this step twice. If you’re using a mobile phone, make sure turn the phone horizontal when taking the picture to get as close up as possible.

8. Consent for the collection of biometric data.

9. Choose whether you will take a picture with your device or you will upload the photos.

10. Upload front & back pictures of your drivers license.

11. Wait for the software to Verify Your Identity.

12. Click “Take a Selfie.” You can use your mobile device or computer webcam. Follow the directions and be prepared for a weird cartoony looking picture.

What Is The Deadline To Unenroll

You must complete the unenrollment process at least 3 days before the first Thursday of the next month. The enrollment process takes approximately 7 calendar days and is a one-time action you do not need to unenroll each month. Check back with the IRS to ensure your request has been processed successfully.

If you miss the deadline, you will receive the advance payment as scheduled. The IRS will process the request to unenroll for the next payment. Once unenrolled, the IRS has no option to re-enroll for the 2021 tax year.

Also Check: What Address Do I Send My Tax Return To

Stimulus Check: How To Opt Out Of The Child Tax Credit Payment

Families that opt-out will still receive payments they will simply be able to claim the full amount as a lump sum on their tax returns in April 2022.

Why would any family choose not to claim the Child Tax Credit advance payments, starting on July 15?

The IRS has provided a mechanism for opting out, but the default is to receive the checks each month. Families that opt-out will still receive those payments they will simply be able to claim the full amount as a lump sum on their tax returns in April 2022. Since the amount will be the same either way, however, it seems difficult to understand why a family would voluntarily delay receiving money until next year.

The Biden administrations approach, approved in the March 2021 American Rescue Plan Act, included the novel measure of sending the payments out in advance. The rationale behind this decision was simple: it would assist with the coronavirus economic recovery by quickly providing cash relief to American families, who had disproportionately suffered worse economic outcomes during the pandemic. Because the payments are being sent by the IRS, the Child Tax Credit has sometimes been regarded as a miniature fourth stimulus check for American families.

However, the stimulus checks and the Child Tax Credit are different in one fundamental way: while the stimulus payments are tax-free, the Child Tax Credit, ironically, is not. The total amount received by the credit will be added to a familys net income for the year.

The Irs Won’t Be Calling Emailing Or Texting Don’t Fall For Child Tax Credit Scams

3. Your child is now officially an adult!

The 2021 Child Tax Credit covers children from birth to 18. If your child turns 18 anytime in 2021 , he or she is not eligible for the credit. The IRS should have taken this into account in estimating the amount of your monthly payment, but it’s best to double-check.

If you are mistakenly getting monthly payments for that child, you will have to pay the money back.

Likewise, if you have a child who turns 6 this year, you may want to double-check that the monthly payment you’re getting for that child is correct. The 2021 credit provides up to $300 a month for children under 6 and up to $250 a month for children ages 6 to 17.

Also Check: How To Find Out Your Tax Rate

Child Tax Credit Payments How To Opt

In the past week, many people have received âgiftsâ from the IRS in the form of an unexpected bank deposit or check in the mail. Unfortunately, many of these recipients â especially for our clients â are not eligible for these payments and will need to return the money to the IRS when they file a 2021 tax return. As such, we recommend that any of our clients who receive these payments select to âopt outâ of the advance payments and wait until they file 2021 tax return to claim any eligible refundable credits.

Should You Opt Out Of The Advance Child Tax Credit

There are a few compelling reasons that one might seek to unenroll from the advance payments.

The third Child Tax Credit advance payment is slated to arrive on Wednesday, September 15. The last day to reliably un-enroll from that payment was on Monday, August 30 while parents may still un-enroll, doing so will not take effect until the October check arrives on Friday, October 15.

The checks are arriving by default. Unenrolling from them, in order to claim the entire benefit at the end of the fiscal year in April 2022, has always been possible, but it has been an opt-out rather than an opt-in decision. On the face of it, if the money is going to a family either way, it makes little sense to delay receiving it for seven to eight months.

On the other hand, however, there are a few compelling reasons that one might seek to unenroll from the advance payments. Most of these reasons involve a change of circumstance. If a person knows something about their income that the IRS does not and that something could change the status of their Child Tax Credit payments, it might be more convenient to simply opt out as early as possible.

This is a problem because when the IRS finds out, it will want its money back. Surprise bills during tax season are already unpleasant to save time and trouble, many Americans will find it convenient to simply forego the advance checks, rather than accepting them and having to pay them back later.

Image: Reuters

Recommended Reading: Can You Claim Rent On Your Taxes