How Long Does It Take To Receive My Tax Refund

Approximately 90% of taxpayers will receive their refunds in less than 21 days from the day their tax return was accepted by the IRS. Most people receive their refund in an average of 10-14 days.

You bank will usually make your payment available within 1-3 days of receiving the payment from the IRS. Checks may take longer to clear your bank.

Will I Get A 2021 Tax Refund

Typically, you receive a tax refund after filing your federal tax return if you pay more tax during the year than you actually owe. This most commonly occurs if too much is withheld from your paychecks. Another scenario that could result in a refund is if you receive a refundable tax credit that is larger than the amount you owe. Life events, tax law changes, and many other factors change your taxes from year to year. Use our tax refund calculator to find out if you can expect a refund for 2021 .

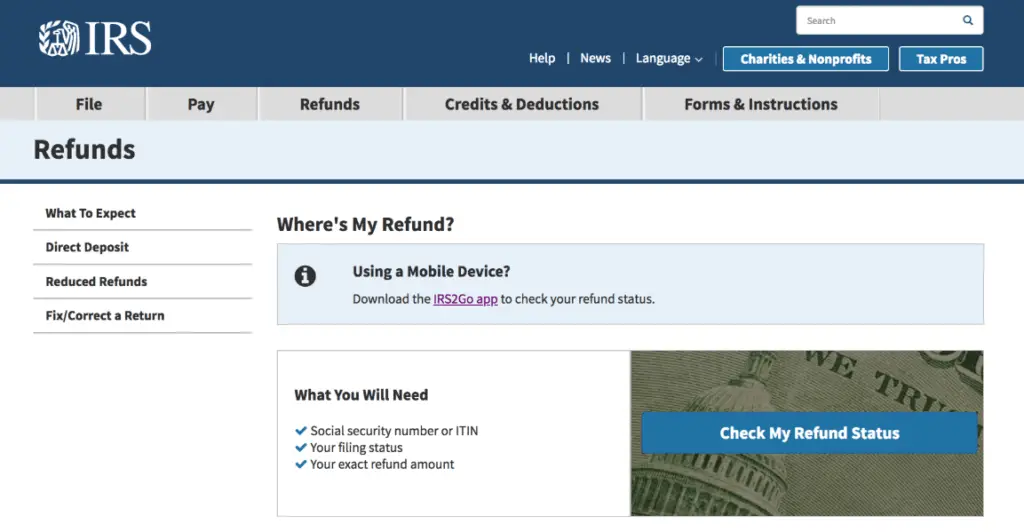

How To Check The Status Of Your Tax Return

You should be able to check IRS tax refund status roughly 24 hours after your receive confirmation from the IRS that they have received your tax refund via E-File. You will need to wait at least 4 weeks if you mailed in your tax return.

The best way to check the status of your federal tax refund is to visit the Wheres My Refund page at the IRS website.

What you will need:

- Filing Status

- Exact refund amount

You can also call the IRS at 1-800-829-1954, or 1-800-829-4477, or 1-800-829-1040 and inquire about your tax return status with an IRS a customer service representative. Note that the IRS only updates tax return statuses once a day during the week, usually between midnight and 6 am. They do not update the status more than once a day, so checking throughout the day will not give you a different result.

Should I call the IRS to check my federal tax refund status? The IRS has stated you should only call them if it has been:

- 21 days or more since you e-filed

- 6 weeks or more since you mailed your return, or when

- Wheres My Refund, tells you to contact the IRS

Read Also: Is Plasma Donation Taxable

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAsset’s tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

Starting Your Tax Season Early

Most taxpayers count on getting a refund as soon as possible, but sometimes, that is not quick enough. If you rely on your refund to pay bills you may qualify for a tax time loan. Book an appointment with a Jackson Hewitt Tax Pro to learn more. Neighborhood offices, as well as those located inside Walmart stores, are open and ready to help with your tax needs.

Recommended Reading: How To Look Up Employer Tax Id Number

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

We may take longer to process your return if we select it for a more detailed review. See Review of your tax return by CRA for more information.

If you use direct deposit, you could get your refund faster.

Is It Faster To File Electronically Or Mail In My Return

In most cases it is faster to file your return electronically. The IRS receives these returns faster than ones that were mailed in, which shortens the time in between when you submitted your return and when youll receive your refund.

File electronically with TaxSlayer and choose direct deposit to receive your refund sooner.

For more info about the advantages of electronic tax filing, read 5 Reasons Why You Should File Your Taxes Online.

You May Like: Taxes On Plasma Donation

File Your Tax Return Electronically

Combining both direct deposit and electronic filing can greatly speed up your tax refund. Since filing electronically requires the use of a tax software program, it can flag errors that may cause processing delays by the IRS. These errors may include incorrect Social Security numbers, dependents dates of birth, and misspelling of names.

You can electronically file your tax return for free using the IRS Free File Program if your adjusted gross income is less than $72,000. Most simple tax returns can also generally be filed for free, although you may be charged to file your state taxes.

If your tax situation is more complicated if you sold property, paid business expenses or earned investment or business income, for exampleyou should consider hiring a tax professional. Having a knowledgeable tax professional, such as an enrolled agent, certified public accountant or other tax professional can help review your tax return and identify any mistakes that may slow down the processing of your tax refund.

Federal Tax Refund Schedule

The answer to that depends on how you filed your tax return, and how you want to receive your refund. For federal tax refund, heres what you need to know:

- Electronically filed, direct deposit to bank: anywhere between 1-3 weeks

- Paper filed by mail, direct deposit to bank: 3 weeks

- Electronically filed, refund check sent through mail: anywhere between 6-8 weeks

- Paper filed by mail, refund check sent through mail: anywhere between 6-8 weeks

If youre wondering about specific dates, you should know that the IRS usually issues over 90% of tax returns within 21 days after tax returns have been processed.

As of writing, the IRS has yet to release an official tax refund calendar for this years tax season Still, we have got this estimate from WebCE based on the previous statements from the IRS over the past few years.

Recommended Reading: Is Doordash Contract Work

Why Is My Tax Refund Delayed

Some tax returns take longer to course of than others. Usually, in case your return is error-free and full, it would get processed inside 21 days. Some causes that may delay processing are:

- Incomplete data

- IRS suspects identification theft or fraud

- Some claims require extra evaluations just like the Restoration Rebate Credit score, Earned Revenue Tax Credit score, Extra Baby Tax Credit score, Injured Partner Allocation, and so forth.

The IRS will contact you by mail in the event that they require any extra data or corrections. Normally, if the The places my refund software doesnt have an up to date return standing, then name middle brokers is not going to both.

How Fast Can I Get My Tax Refund This Year

If youre like most Americans, your tax refund feels like the biggest paycheck youll receive all year. Learn when youll be receiving your refund in 2021, and how you could hurry that process up.

When it comes to taxes, one of the most important questions we are often asked at Jackson Hewitt is, Will I get a tax refund? When the answer turns out to be YES! this good news leads almost immediately to clients asking, How fast can I get my refund?

For millions of Americans, your tax refund feels like the biggest paycheck youll receive all year, so filing your taxes is your most important financial transaction*.

Read Also: Protest Taxes Harris County

Where To Expect Delays

Susan Allen, senior manager for tax practice and ethics with the American Institute of CPAs, said the IRS has issued guidance to tax professionals this year noting that in some situations, it may take more than the typical wait of 21 days or less to issue any related refund.

Delays could hit returns such as:

- Tax returns that require a correction relating to the recovery rebate credit or what most people who aren’t tax professionals know as stimulus money.

- Tax returns where the IRS needs to validate information relating to the earned income tax credit or the advance child tax credit.

“Both the Rebate Recovery Credit and the EITC lookback provision require verification of information,” said Matt Hetherwick, director of individual tax programs for the Accounting Aid Society of Detroit.

Experts say the IRS has been working to develop improved fraud detection tools, which causes an additional review when a return gets caught by the filters.

“Some of these become manual reviews causing delays,” Hetherwick said.

A review by the IRS means that taxpayers will wait longer for refund cash for many 2020 tax returns.

H& R Block notes on its website: “If your return meets these criteria, the IRS will manually review your return, and it may take an additional 10 to 14 business days to receive your refund.”

Including current year returns, the IRS said that as of April 9, the agency had 16.2 million unprocessed individual returns in the pipeline.

One More Thing To Know About Your Tax Refund

It’s actually something you kind of want to avoid. It may seem great to get a big check from the government, but all a tax refund tells you is that you’ve been overpaying your taxes all year and needlessly living on less of your paycheck the whole time.

For example, if you got a $3,000 tax refund, you’ve been giving up $250 a month all year. Could having an extra $250 every month have helped with the bills? If you want to get that money now rather than later, you can adjust your withholdings by giving your employer a new IRS Form W-4 .

Don’t Miss: Is Plasma Money Taxable

What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what we’re doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won’t be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.

Whenever Your Tax Refund Comes Protect Your Identity

Identity theft during tax season is a real problem. According to the IRS, thousands of individual taxpayers have lost millions of combined dollars through tax scams.

The best way to protect your identity and your tax money is to know how the IRS communicates with taxpayers. You should never hear from the IRS through email, text or social media. You can automatically discard any phishing attempts that come through these channels.

If you owe taxes, know that IRS collection employees must show you two forms of credentials and will never request payment on the spot. When you do make an IRS payment, it should always be made to the U.S. Treasury. You can report phone scams to the Federal Trade Commission and phishing schemes directly to the IRS.

Also, be aware of how to inadvertently commit tax fraud on your own. If you dont feel confident that all of the deductions youre claiming are legitimate, you should hire a professional.

Read Also: How To Appeal Property Taxes Cook County

When Can I Expect My State Tax Refund

State and federal taxes are separate filing processes. When expecting a refund from your state government, the exact timeline varies based on several factors, including your specific state. Just like with your federal tax return, the processing time is usually much less if you file electronically with your state.

To check on the progress of your state tax return, find the contact information for your states department of taxation. Youll likely need personally-identifying information to receive specifics on your tax refund, including your Social Security number and your refund amount.

Also, note that some states are implementing refunds through debit cards rather than checks or direct deposits to make it easier for people who dont have a bank account.

Refund Schedule: How Long Do I Have To Wait Until I Get My Tax Refund

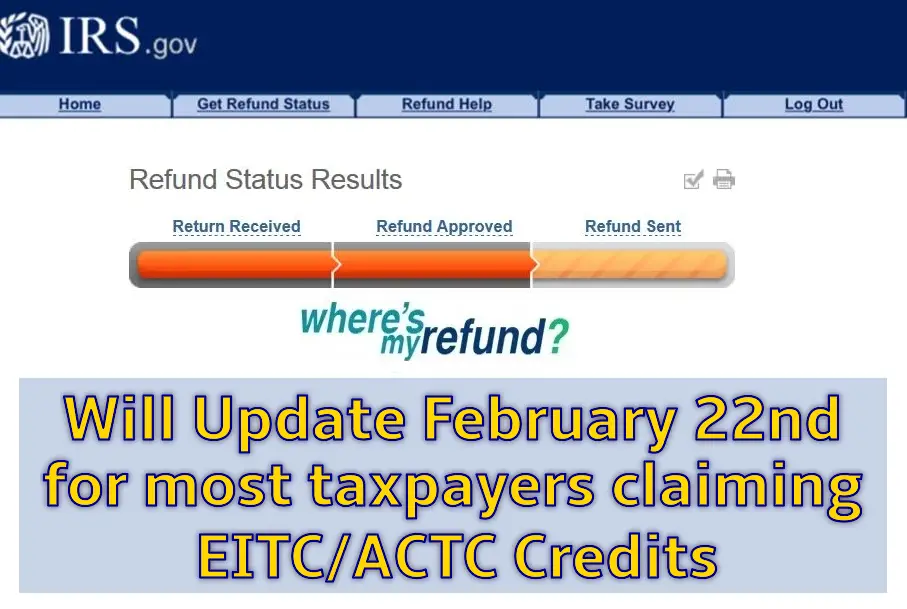

Weve based these timelines on historical data noting that most refunds will be issued by the IRS in less than 21 days after the return has been accepted. Certain things can affect the timing of your refund, including:

- How you sent your return Sending your return electronically allows the IRS to process it faster than if you mail it in.

- When you filed The earlier you file, the earlier your return could be processed.

- Which credits you claimed Claiming certain credits can cause your refund to be delayed .

You May Like: Efstatus/taxact

Why Do Paper Returns Take So Long

Paper returns have to be input manually into the system for processing. Even when the IRS isn’t understaffed in the middle of a pandemic, the process normally takes six to eight weeks.

“Submitting a paper return circumvents the limited automation that the IRS has in place for cross-referencing returns with information received from third parties,” says Richard Lavinia, CEO and co-founder of Taxfyle. “Paper returns require this information to be inputted by hand and then manually reviewed by an IRS agent.”

Why Did I Receive My State Tax Refund First 2020

It doesnt mean that anything is wrong, each state processes their state tax returns separately from the IRS, and the fact that you received your state refund first, just means that your state was able to process your state return and process your refund a bit more quickly than the IRS has processed your federal return

Read Also: Do You Have To Claim Plasma Donation On Taxes

What Does It Mean When My Tax Return Is Accepted

When you receive confirmation that the IRS accepted your return, it means that they have reviewed your return, and it has passed their initial inspection. They verify your personal information and other basic items, like if your dependents have already been claimed by someone else. Then they have a few days to approve your refund. They will take a more in-depth look at your return and your history. After the IRS approves your return, they will fund your refund based on the schedule mentioned above.

What An Accepted Tax Return Means

When you e-file a tax return, the IRS completes a basic check of your information before accepting your return. Robert Farrington, founder of The College Investor explains it like this:

“Accepting your tax return simply means that the IRS has looked at your name and Social Security number, and compared to make sure it hasn’t already been filed this year. If it passes that check, your return is allowed in for processing. That’s all ‘accepted by the IRS’ means. This process takes less than 24 hours, and usually happens within a few minutes.”

Farrington also notes that different tax software providers may have different processes for both batching and sending to the IRS, and notifying customers about when their returns are accepted.

Quick tip: If you make less than $72,000 a year, you can use IRS Free File to send in your tax return electronically at no cost.

Read Also: How To Look Up Employer Tax Id Number

Where’s My State Tax Refund

Forty two states levy an individual income tax, according to the Tax Foundation. The eight states that have no state income taxes are:

- Alaska,

- South Dakota

- Wyoming

Each state will have its own means of tracking the status of tax refunds. State tax refunds are processed separately from federal tax refunds and you will need to find your own state’s information to check on the status. You can start by looking at the state revenue sites, which the IRS lists here.

Will Ordering A Transcript Help Me Find Out When Ill Get My Refund

A tax transcript will not help you find out when youll get your refund. The information transcripts have about your account does not necessarily reflect the amount or timing of your refund. They are best used to validate past income and tax filing status for mortgage, student and small business loan applications, and to help with tax preparation.

Read Also: Employer Tax Identification Number Lookup