What Is Act 22

Individual Investors Act was passed by Puerto Rican lawmakers in an attempt to attract new, high-income residents. The Act allows qualifying residents to claim a number of tax advantages upon becoming a bona fide resident of Puerto Rico, including:

Capital Gains Exemptions:

-

All accrued capital gains income after becoming a resident is exempt from any tax imposed by Puerto Rico.

-

All unrealized capital gains income that was accrued but unrealized before becoming a Puerto Rican citizen is subject to a lower tax rate.

Passive Income Exemptions:

-

All new residents dividend and interest income is exempt from Puerto Rican income tax.

-

All interest and dividend income that constitutes a source of income is exempt from federal income taxation under Section 933 of the IRS Tax Code.

To establish residence under the Act, someone must create a presumptive residence in Puerto Rico, live there for at least 183 days of the year, and cannot have a home outside Puerto Rico. Additionally, a resident cannot have a closer connection to any other U.S. state or country than the connection they have to Puerto Rico.

Since the Acts passage in 2012, more than 4,000 individuals and corporations have relocated to Puerto Rico. Presumably, many of these relocators did so to take advantage of Act 22s tax benefits.

How To Get Puerto Rican Citizenship

While Puerto Rico is a country in a sociological context, it is not in the context of international relations. The world recognizes Puerto Ricans as Americans, and while Puerto Rican-born individuals and those who establish residency in Puerto Rico can obtain a Certificado de Ciudadania Puertorriqueña, this is effectively worthless as formal citizenship.

There is a possible benefit of Puerto Rican citizenship in being able to parlay that into Spanish citizenship, but we havent seen that play out.

It is important that you understand that the tax benefits of living in Puerto Rico derive from residency, not citizenship. You dont need to have any prior connection with Puerto Rico to reduce your taxes there, nor would becoming a Puerto Rican citizen help any more than becoming a resident under Puerto Rico and US tax laws.

Business Incentives Under Act 60

To benefit from the incentives under Act 60, eligible businesses have to request and receive a tax exemption decree signed by the Secretary of the Department of Economic Development and Commerce of Puerto Rico. This exemption has a term of 15 years and is renewable for another 15 years if certain conditions are satisfied, and the contract it represents is not subject to alteration by any subsequent legislation. Beyond this, the only requirement is that the business have at least one employee if its annual volume exceeds $3 million U.S.

Eligible businesses must have a real office located in Puerto Rico, perform services for non-resident or foreign entities with no connection to Puerto Rico, and not in any way be related to trade, business, or other activity within Puerto Rico. Any service that the Secretary of Economic Development and Commerce determines, in consultation with the Secretary of the Treasury, to be in the best social and economic interest of Puerto Rico, will be treated as an eligible service. But export service industries that are currently recognized as eligible are as follows:

As regards the incentives, any American citizen who becomes a bona fide resident of Puerto Rico and moves his or her business there will enjoy the following business benefits:

Don’t Miss: 1040paytax Com Legitimate

Family That Lost Benefits Because Members Lived In Puerto Rico Looks To Supreme Court To Hear Case

The issue is being assessed as part of a case involving José Luis Vaello-Madero, 67, a disabled man who lived in New York from 1985 until 2013, when he moved to Puerto Rico to care for his wife. He had begun receiving SSI benefits in 2012, when he was still in New York, until he was told in 2016 that he was ineligible after moving to the island.

A year later, the Social Security Administration filed civil action against him, demanding he pay back over $28,000 in benefits he had received while living in Puerto Rico.

Gannon relied on three key points to push the court to reverse a U.S. Court of Appeals ruling from last year deeming invalid the practice of denying SSI benefits to Puerto Rican residents, stating the federal government failed to establish a rational basis for the exclusion of Puerto Rico residents from SSI coverage.

One of those points is based on the fact that Puerto Ricans on the island are exempted from most federal taxes, including income tax.

Liberal Justice Sonia Sotomayor, who is of Puerto Rican descent, pushed back, saying that Puerto Ricans “pay as much taxes, other combined taxes, as other states in the union.”

Puerto Ricans do pay federal payroll taxes and help fund public programs such as Medicare and Social Security, contributing more than $4 billion annually in federal taxes to the United States.

But the case of Vaello-Madero is now giving the current Supreme Court, which has a 6-3 conservative majority, a chance to revisit such rulings.

Lastly And Perhaps Most Importantly Have You Visited The Island And Validated Move Is A Good Fit For You And Your Family

Although the year-long excellent weather and potential tax savings may be good reasons for some people to relocate and become bona fide residents of Puerto Rico, time has told that it is not convenient for everybody. When making your research about Puerto Rico and contemplating the pros and cons of relocating to the island, we encourage you to visit the island prior to making the final decision and see for yourself if permanently moving your domicile to Puerto Rico is an adequate and plausible decision based on your personal circumstances. Moving to a new country may be daunting to some, and international tax rules are complex and dynamic, so the move will only be worth if it fits your business, lifestyle, and family in the long run.

Read Also: How To Buy Tax Lien Certificates In California

Puerto Rico Excluded Earned Income

U.S. Citizens who lived in Puerto Rico for the entire year do not have to file a U.S. federal income tax return if all of their income was from sources within Puerto Rico. If income was received from sources outside of Puerto Rico, a U.S. federal tax return must be filed if the amount of income earned outside of Puerto Rico is more than the taxpayer’s filing threshold. Use the worksheet found in IRS Publication 1321 to determine if a federal tax return must be filed.

Bona fide residents of Puerto Rico who are required to file a U.S. federal tax return may be eligible to exclude their Puerto Rico source income on their federal tax return. Generally, the following types of income can be excluded:

- Salaries, wages, and other compensation for labor or personal services if the labor and services are performed in Puerto Rico

- Pension Income for services performed in Puerto Rico and investment earnings from a pension trust that is located in Puerto Rico

- Interest earned while a bona fide resident of Puerto Rico

- Dividends from corporations created and organized in Puerto Rico

- Rental Income from property located in Puerto Rico

- Royalties located and used in Puerto Rico

- Income from the sale of purchased business inventory sold in Puerto Rico

- Income from the sale of produced business inventory sold in Puerto Rico

- Income from the sale of real property located in Puerto Rico

- Income from the sale of personal property if the seller’s tax home is in Puerto Rico

Additional Information:

What Makes Puerto Rico Better Than Other Tax Havens

There are only two countries in the world that implement a worldwide income tax system: Eritrea and the United States. Even if you moved to the other side of the world and never returned to the U.S., you would still be required to pay U.S. income tax. The only way out would be to renounce your U.S. citizenship, which is undesirable for most Americans and incurs an expatriation tax of nearly 24% on your unrealized capital gains.

The one solution? Move yourself to Puerto Rico. Technically, youll still be in the US, but you wont have to pay U.S. taxes, and theres no expatriation fee . In this sense, Puerto Rico is the only true tax haven for Americans. Puerto Rico allows you to escape from U.S. taxes without giving up your citizenship and still offers you the protection of the U.S. law and banking system.

Recommended Reading: Is Doordash 1099

Citizens Of The United States Serving In The Military

You must file a federal tax return if you are a U.S. citizen who is also a bona fide resident of Puerto Rico during the fiscal year and receive income as a U.S. government employee in Puerto Rico.

Your military service pay will be sourced to Puerto Rico if you are a bona fide resident of Puerto Rico and a member of the US armed forces, even if you work for the military in the US or another US possession. You will determine your residency as a member of the US armed forces by looking at your home of record. Even if you are stationed in the United States, if your home of record is in Puerto Rico, you are still a bona fide resident of the island. In this case, youll file a Puerto Rico return to report your worldwide income and a United States return to report your military pay. For taxes paid to Puerto Rico, a foreign tax credit is available on the US tax return.

Even if you are stationed in Puerto Rico, if your primary residence is in one of the fifty states, your income is sourced there. You must file a Puerto Rico tax return for income earned in Puerto Rico, as well as a United States tax return for income earned anywhere in the world. Taxes paid to Puerto Rico on income that is not exempt on the US tax return are eligible for a foreign tax credit.

The Military Spouse Residency Relief Act imposes some restrictions on spouses of active duty military personnel . Civilian spouses may be able to choose the same domicile as their military spouse.

- 1share

Treating A Us Citizen As Foreign

Congress first decided to exclude Puerto Rico from the SSI program when it was enacted in 1972. Instead, Puerto Ricans are eligible for a different government program, called Aid to the Aged, Blind and Disabled. To qualify, people cant earn more than $65 a month, compared with $750 monthly for SSI. Those who qualify under Puerto Ricos program get an average benefit of $77 a month, while SSI beneficiaries receive an average of $533 a month.

For Vaello-Madero’s lawyer, Hermann Ferré, the issue at the heart of his client’s case is “treating a citizen as though they’re foreign because they happen to reside in Puerto Rico,” adding that even U.S. citizens who aren’t of Puerto Rican descent would be treated as foreigners if they move to the island.

Conservative justices such as Brett Kavanaugh wondered about the repercussions of a ruling in favor of Vaello-Madero, including whether other benefits would have to be extended to residents of U.S. territories.

Kavanaugh said Ferré made compelling policy arguments but noted that the Constitution’s territorial clause may be something people would want to change but that’s not the role of the court.

You May Like: Do You Get Taxed On Doordash

A Legislature In Search Of Financial Incentives

How did Puerto Rico become a haven for over-taxed Americans?

It all started when the U.S. territory went bankrupt in 2017. Puerto Rico issued too much municipal bond debt and began relying on the funds borrowed from its bond issuance to meet its budget and pay its debts. The crisis leading to bankruptcy began in 2014 when the government couldnt pay its debts and Puerto Rican government-issued bonds were downgraded by three credit agencies to junk status. The downgrade prevented the government from issuing any more bonds, so to pay its debts before it ran out of savings, it began to raise taxes and cut services, which provoked social unrest and distrust. Finally, Puerto Rico filed for bankruptcy in 2017, having over $70 billion in bond debt and $49 billion in unfunded pension liabilities.

The Puerto Rican Capitol Building Image Credit: Wikimedia Commons

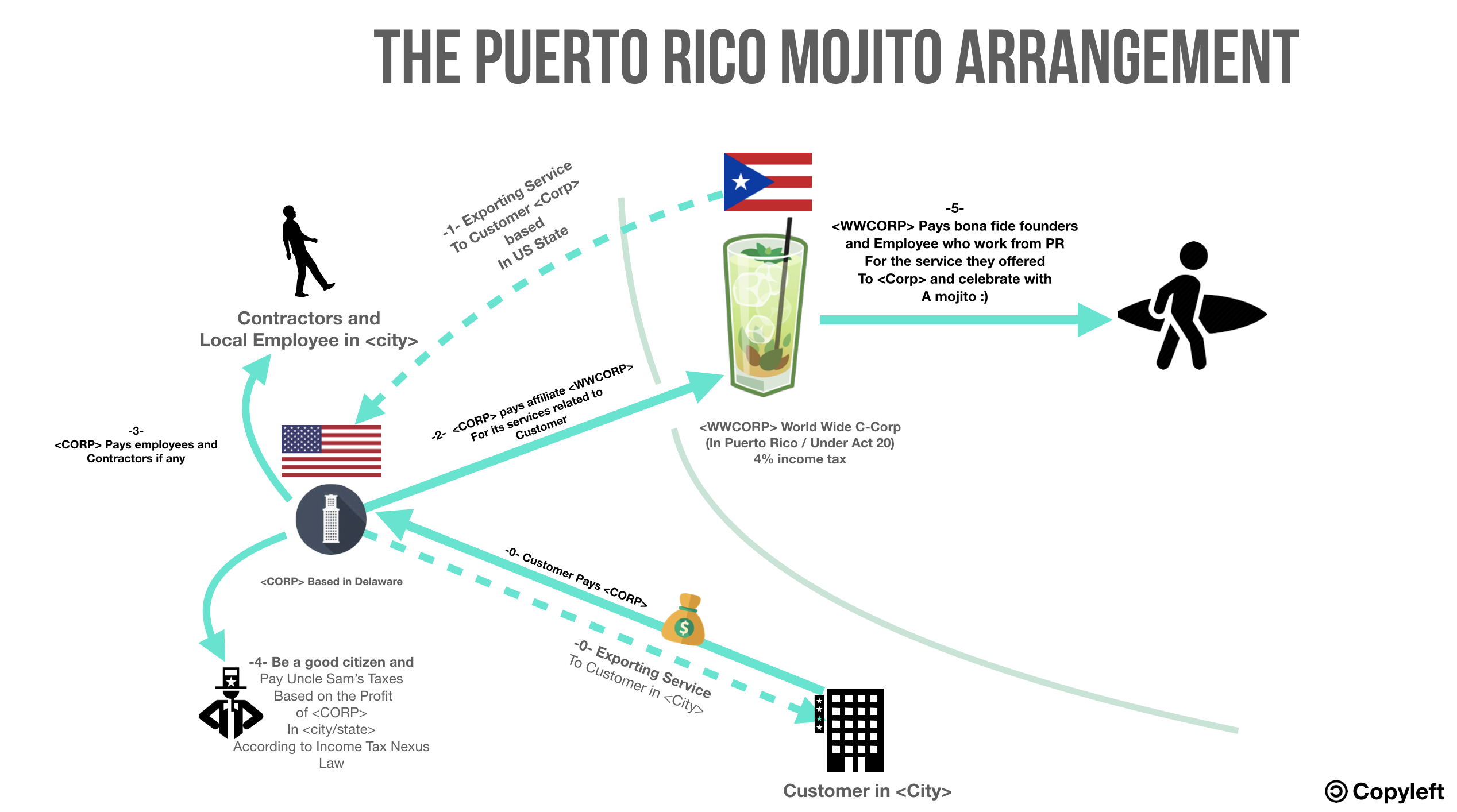

The goal of the legislation is two-fold: extend the benefits of Act 20 to make Puerto Rico an international financial center by encouraging businesses that offer services to clients outside of Puerto Rico to establish the island as their operational base and extend the benefits of Act 22 to incentivize individuals with passive income to relocate to Puerto Rico.

Image Credit: Wikimedia Commons

What Language Is Spoken In Puerto Rico

Spanish and English are both official languages, and English is widely spoken in urban coastal areas like Vieques. If you plan to live in the expat bubble around the Ritz-Carlton, you can easily get by without a word of Spanish, and most tourist industry workers will speak fluent English.

Outside of the tourist urban areas, Spanish will be more of a necessity as it is the daily language for most Puerto Ricans. That means that learning Spanish may not be a bad idea if you plan to move to Puerto Rico.

You May Like: How Much Is Taxes For Doordash

Do Us Laws Apply To Puerto Rico

Do US laws apply to Puerto Rico? U.S. federal law applies to Puerto Rico, even though Puerto Rico is not a state of the American Union and their residents have no voting representation in the U.S. Congress.

Is Puerto Rico under U.S. law? Puerto Rico is an unincorporated territory of the United States. Most but not all federal laws apply to Puerto Rico. In addition to the U.S. Constitution, which is the supreme law of the U.S., federal laws include statutes that are periodically codified in the U.S. Code.

Does Puerto Rico have its own laws? Ultimately, the powers of the government of Puerto Rico are all delegated by Congress and lack full protection under the U.S. Constitution. Because of this, the head of state of Puerto Rico is the President of the United States.

Do U.S. territories follow U.S. laws? All territory under the control of the federal government is considered part of the United States for purposes of law. From 1901 to 1905, the U.S. Supreme Court in a series of opinions known as the Insular Cases held that the Constitution extended ex proprio vigore to the territories.

Do You Currently Own Investments That Generate Interest Dividends Or Capital Gains

From a federal income tax perspective, there are special sourcing rules for certain investment assets you own before the move to Puerto Rico, that you must keep in mind. Before you pack your bags and move to the island, you should know that federal income tax rules will tag along, including federal income sourcing rules. In connection to income that is exempted from Puerto Rico tax under a Grant, sourcing is determined as follows:

- dividends are sourced at the payers country of incorporation

- interest is sourced at the residence of the payor and

- sale of personal property , are generally sourced at the residence of the seller. However, gains from the sale or exchange of certain investment property owned by citizens of the United States prior to becoming bona fide residents of Puerto Rico, are considered from sources within the United States . Nevertheless, you may choose to treat a portion of the gains related to the Puerto Rico holding period as from sources within Puerto Rico based on certain rules set forth in §937-2 of the Unites States Treasury Regulations.

In addition to potential continuous federal taxation of certain passive income regardless of your move to Puerto Rico, as a condition for granting the tax benefits in Puerto Rico, the Incentives Code requires, among others, that you:

Therefore, a relocation to Puerto Rico will not necessarily mean tax savings for you. As previously stated, there is no “one size fits all” formula.

Read Also: Doordash Stripe 1099

When Did Puerto Rico Become A Us Territory

Puerto Rico was given to the United States after the Spanish-American War 120 years ago. The US Constitution allows for US possessions to be only states or territories, and as Puerto Rico is not a state, it is technically a US territory, regardless of its reclassification to commonwealth in the 1950s.

A Final Reality Check

Image Credit: Wikimedia Commons

Now that youre all excited about moving to Puerto Rico, lets take stock what such a move would entail. This isnt so much about curbing your enthusiasm as making sure youre aware of the ramifications and taking them into account.

If you really want no longer to be beholden to the IRS and have all the benefits of Puerto Rican tax incentives, you have to be a bona fide resident of Puerto Rico. This means more than just spending at least 183 days each year on the island. It means that you cannot have a tax home outside of Puerto Rico, nor can you have closer connections to any place other than Puerto Rico. In particular, passing the test of closer connections means that youre going to have to move your whole life to the island to prove that its really your home. This means that Puerto Rico will be:

- The location of your primary and permanent home

- The place where your family lives

- The primary location of your automobiles, furniture, clothing and other personal goods

- The location of your bank accounts and financial activities

- The location of your business activities

- The location of your primary social, religious, cultural, professional, political and other relationship associations

- The primary location for the charitable organizations to which you contribute

- The jurisdiction in which you hold your drivers license

- The jurisdiction in which you vote

- The country of residence that you list on all of your official documents

You May Like: How Do I Get My Pin For My Taxes