Receive Your Federal Tax Id Number

After you submit your online application with all the required information, you should receive your federal tax ID number. You can view, download, save and print the confirmation notice which includes your number directly from the IRS website. You can start using your EIN as soon as you receive this notice.

Once you have your EIN, meet with a your local business banker to learn how a business bank account can help get you started on the right foot and what financing options may be available for you.

For Informational/Educational Purposes Only: The views expressed in this article may differ from other employees and departments of JPMorgan Chase & Co. Views and strategies described may not be appropriate for everyone, and are not intended as specific advice/recommendation for any individual. You should carefully consider your needs and objectives before making any decisions, and consult the appropriate professional. Outlooks and past performance are not guarantees of future results. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors.

How To Get An Ein Business Tax Identification Number

Many types of businesses must obtain a special tax identification number from the IRS. If you have a business or are self-employed, you need to know:

- What is a business tax ID number?

- Why is obtaining a tax ID number important?

- When are you required to obtain a business tax ID number?

- Should you obtain a business tax ID number even if it’s not required?

- How do you obtain a business tax ID number?

- What is a business tax identification number?

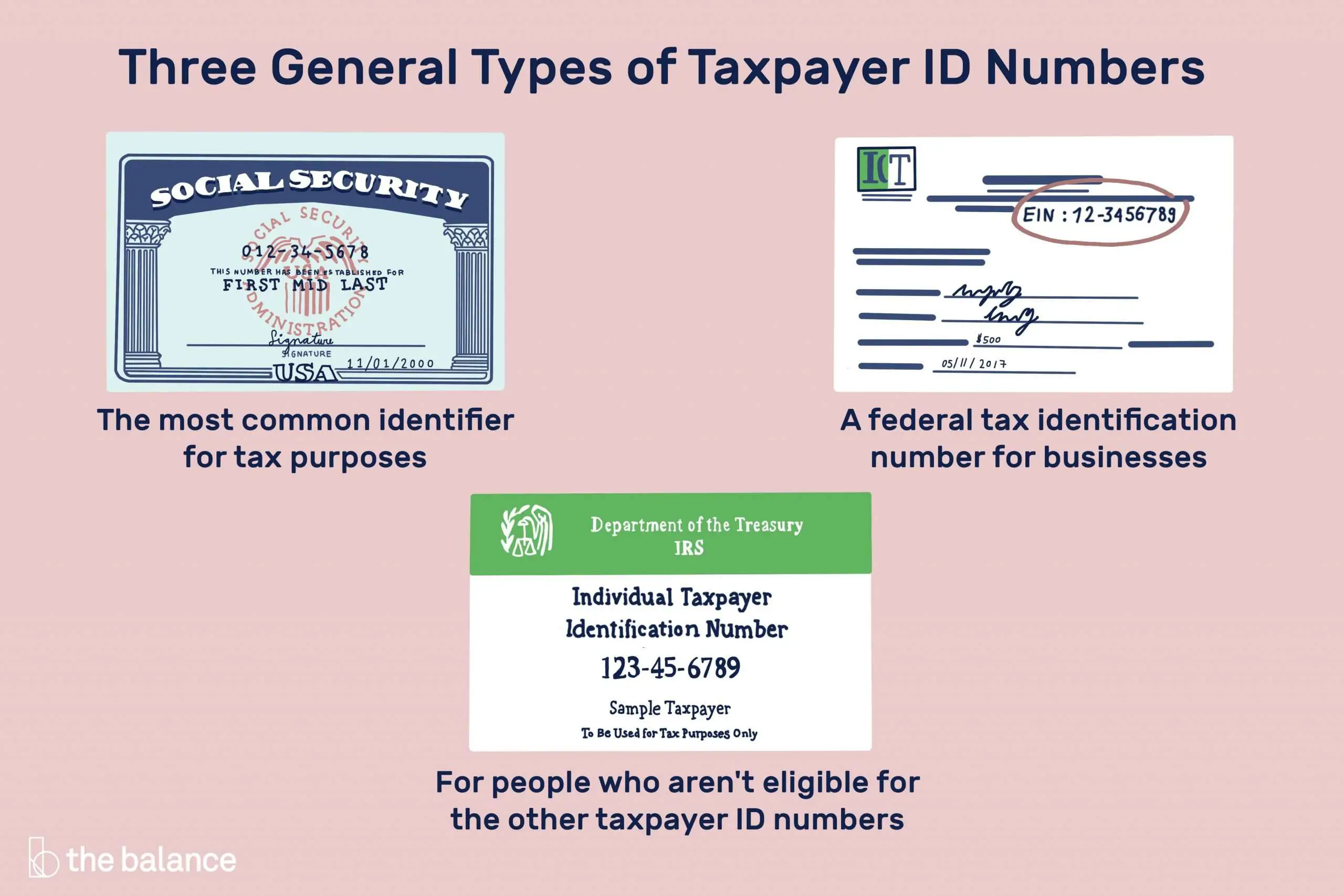

The official name for a business tax identification number is Employer Identification NumberâÃîEIN for short. An EIN is a nine-digit number the IRS assigns to businesses for tax filing and reporting purposes. It looks like this: 12-3456789.

You obtain an EIN from the IRS. You should list it on every payment, form, or other document your business files with the IRS. In most states, you also use it for your business’s state tax payments and filings. In effect, an EIN is like a Social Security number for your business.

Will You Ever Need To Change Your Ein

If you change entity type, you will need to change the EIN for the business. This usually happens when you go from a sole proprietor to a general partnership or S corporation.

When establishing a business, its a good idea to pick a business entity you can stick with to avoid having to change your EIN.

Also Check: How To Buy Tax Lien Properties In California

What Is Business Tax Id Number

Before we proceed on how to find my Tax ID number let us tell you what a Business Tax ID number is.

Business Tax ID number or EIN as we commonly call it is a Nine digit identification number used in identifying registered businesses with IRS.

It confers a certain length of legitimacy on your business. The number like we said earlier, is used in filing tax returns, loans applications, Mortgages, e.t.c.

Forgetting or not having your business EIN can make authorities clamp down on your business or hinder one from getting some business incentives.

How Long Does It Take To Get A Tax Id Number For A Small Business

The length of time it takes to get a tax ID or EIN Number is predicated upon the method used to get that number.

- Online. You will receive a tax ID number within an hour if you complete your application online through a tax ID service.

- Mail. You will receive a tax ID number in four to six weeks, depending on how lengthy the processing time currently is .

- Fax. You will receive a tax ID number between three to five business days, depending on the processing time and the availability of the fax.

Generally, its best to go through an online EIN application because youll know immediately whether your application failed or succeeded.

An EIN Number is one of the most important numbers for a small business, as it allows you to open small business accounts, establish your business credit and hire employees. By going through an online application process, you can get an EIN number quickly.

You May Like: How To Do Taxes Freelance

Can You Look Up Another’s Business Ein

If you need to do an EIN number lookup for a different business, you will encounter plenty of roadblocks.

The best way to get it is to ask someone you have a relationship with at the company. If you need the number for a legitimate purpose, you should be able to get it from the other companys accountant.

If the company has applied for a liquor license or building permit, you may be able to find its EIN on the local area chamber of commerce or secretary of state database.

For public companies, you can look up the EIN on the SECs website. Search the companys name, and pull up the most recent 10-Q or 10K.

The EIN is listed with the title I.R.S. Employer Identification Number on Netflixs recent 10-Q.

All non-profit EINs are public information, and you can find them in the IRS database.

If none of these suggestions yield results, you likely wont be able to find the number for free.

You can pay for a business credit report from any of the major providers, do a business search with a legal database like LexisNexis, or use a specific EIN search company that combs through government filings to find the number.

Out of those options, I would recommend purchasing a business credit report as the agencies providing those are generally bigger and more legitimate.

What Is An Ein And What Is It Used For

As mentioned, your EIN is a unique numerical identifier that is assigned to you by the IRS. The primary purpose of an EIN is for the IRS to identify taxpayers who are required to file various business tax returns. Not every business is required to have an EIN, but there are several criteria that you must pass in order to be sure you wont need an EIN.

According to the IRS, if you answer yes to any of these questions about your business, then you need an EIN:

- Do you have employees?

- Do you operate your business as a corporation or a partnership?

- Do you file any of these tax returns: Employment, Excise, or Alcohol, Tobacco and Firearms ?

- Do you withhold taxes on income, other than wages, paid to a non-resident alien?

- Do you have a Keogh plan?

Another piece of criteria concerns the types of organizations your business is involved with. If your small business is involved with trusts, estates, real estate mortgage investment conduits, non-profit organizations, farmers cooperatives or plan administrators, then you are required to have an EIN for your company.

See: 2020 Business Tax Deadlines You Need to Know

You May Like: Are Medical Premiums Tax Deductible

Why Do I Need An Ein

If you are operating your small biz as anything other than a sole proprietor or a partnership, as in, your business is a legally separate entity from you, then you need an EIN. Also, regardless of your business entity type, if you have employee, you need an EIN. See this handy questionnaire by the IRS to determine if you need an EIN.

If you are a sole proprietor or partnership, you report your business income taxes on your own personal business tax return. That means you are basically filing your business income under your social security number, since you = your business.

That being said, even if you are not required to get an EIN, you still have the option to get one. In todays age of identity theft, a lot of sole proprietors and entrepreneurs will voluntarily apply for an EIN. In circumstances where theyre required to give a tax ID number , they can protect their social security number and use their business EIN instead.

Getting an EIN is free and can be done quickly online via the IRS website, so theres really no downside to getting one, even if you dont need one.

Business Tax Id : 4 Ways To Find A Federal Tax Id Number Wikihow

11.09.2021 · the steuernummer is for freelancers and businesses. This number is required by your employer to pay your salary and to calculate the amount of tax you need to pay. Also, financial institutions such as banks, credit unions, and brokerage houses will not open an account for a corporation without an ein. Real estate property tax is collected on the assessed value of real estate owned by a business or an individual. Your company’s ein is like a social security number for your business and thus very important.

Recommended Reading: Have My Taxes Been Accepted

See If Your Canadian Small Business Needs A Tax Id Number And Learn How To Get One In Several Canadian Provinces

There are only a few circumstances in which a state id is not required. Getting a tax id number in the state of missouri is fairly easy as long as you have the right information regarding your business. That can depend on the services that you plan to provide. Keep reading to learn what a sars tax number is and your various options for getting it. Just like individuals need a socia.

Use Melissa Database For Nonprofits

The Melissa Database provides free federal tax ID lookup for nonprofit organizations.

If you have a legitimate need to find the EIN for another business, then you can use one of these options to look up the number. Just be sure to keep your own EIN secure. Only share the number with a limited subset of peoplelenders, prospective suppliers, bankers, etc. You should guard your business’s EIN just like you would guard your social security number.

Recommended Reading: What Tax Bracket Are You In

Sole Proprietors Do Not Need An Employment Identification Number Unless Certain Issues Arise

An Employment Identification Number , also referred to as a Taxpayer Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service for the purposes of tax reporting. It’s kind of like a Social Security Number, except that it is for businesses.

Corporations and partnerships are required to have an EIN. However, if you are a sole proprietor, the IRS does not require one. Instead, you can use your Social Security Number and report your income and expenses on a Schedule C tax form . However, many sole proprietors still elect to use an EIN because it reduces the chances of identity theft and banks often require one to open a business account.

Even if you are a sole proprietor, you will need an EIN if you have one or more employees , use a Keogh retirement plan, or file pension or excise tax returns. An EIN is also required if you change the structure of your business .

In addition, an EIN is required for certain organizations, such as trusts, estates, IRA’s, real estate mortgage investment conduits, farmer’s cooperatives, plan administrators, and non-profit organizations.

Find Out If Your Business Needs A Tax Id Number To Operate In Canada

The tax ID number is part of the 15-character program account number assigned to your business by the Canada Revenue Agency . The program account number consists of three parts:

- Nine-digit Business Number that identifies your business

- Two-letter identifier for the program type

- Four-digit reference number for the program account

An account number would look like this: 123456789 RT0001

Think of your Business Number as your business tax ID number because that’s why it exists. The CRA assigns your company a Business Number when you first register for any one of the four major program accounts you will need to operate your business:

The nine-digit tax ID number is the same across program accounts the numbers for the program ID and account number will change based on which of the four it’s referring to. You can apply for the number through The Canada Revenue Agency’s Business Registration Online service.

Note that in Quebec, the Business Number does not include your GST/HST accounts. You must register for a separate GST/HST account with Revenu Québec. Its General Information Concerning the QST and the GST/HST provides further clarification.

Several other tax accounts, such as Excise Tax, require a tax ID number/Business Number if they apply to you.

Also Check: Where Do I Mail My Federal Tax Return

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

When Claiming Exemptions For Dependent Or Spouse

You generally must list on your individual income tax return the Social Security number of any person for whom you claim an exemption. If your dependent or spouse does not have and is not eligible to get an SSN, you must list the ITIN instead of an SSN. You do not need an SSN or ITIN for a child who was born and died in the same tax year. Instead of an SSN or ITIN, attach a copy of the child’s birth certificate and write Died on the appropriate exemption line of your tax return.

Also Check: Do You Have To Pay Taxes On Plasma Donations

Can Your Businesss Identity Be Stolen With The Ein

It is unlikely that someone could take out a million dollar loan with your EIN because lending institutions have several layers of identity verification.

However, it is possible that someone could apply for business credit lines or business credit cards online using the number and other publicly available information.

To decrease the risk of identity fraud, set up a business account with a credit reporting institution like Dun & Bradstreet, and keep an eye on all tradelines and scores for your business every few months.

How To Change Or Cancel An Ein

Once you obtain an EIN for your business, that tax ID remains with your business for its entire lifespan. However, there are some situations where you might need a new business tax ID number.

Here’s when you’ll need to apply for a new EIN:

-

You incorporate for the first time or change your business entity

-

You buy an existing business or inherit a business

-

Your business becomes a subsidiary of another company

-

You are a sole proprietor and are subject to a bankruptcy proceeding

-

You are a sole proprietor and establish a retirement, profit sharing, or pension plan

-

You receive a new charter from your state’s Secretary of State

-

There are changes to your ownership structure

The IRS has a detailed list of situations where you need a new EIN. A new EIN replaces your old EIN, so once you get the new tax ID, you would use that on tax returns and other business paperwork moving forward.

Note that more common changes, such as changes to your business name or address, generally don’t require a new EIN. But you should still report a business name change or location change to the IRS.

Recommended Reading: How Much To File Taxes

Do I Need A Tax Id Number If My Small Business Is A Sole Proprietorship

Often known as a DBA , a sole proprietorship means that you and your business are a single entity. When you have a sole proprietorship, you usually only file a single tax return, and you use your social security number as your Federal Tax ID Number. Consequently, you may feel as though theres no reason to get a Tax ID Number.

However, there are two really important reasons. As a sole proprietor, you cant hire employees unless you have an EIN. You can hire contractors, but not employees. If you need to hire employees, you need an EIN. Further, as a sole proprietor, you cant open your own 401 plan without getting an EIN first. An EIN lets you put away more money toward retirement.

Moreover, it really isnt a bad thing to have an EIN in general, and a sole proprietor and self-employed person can qualify for an EIN.

Tin Search: Finding Your Tin Number

If youre a Canadian business owner looking for your TIN number, weve got good news: its easy to find.

For individual residents of Canada , your TIN number is your nine-digit SIN.

So long as you know your SIN, youre good to go!

However, for corporations , your TIN is your nine-digit Business Number issued by the Canada Revenue Agency .

So, lets talk about how to find your BN.

Recommended Reading: What Do Tax Accountants Do

How To Get An Ein

Applying for an EIN costs nothing and an application form available on the IRS website can easily be filled and submitted electronically. Once the online information has been validated, an EIN is assigned immediately. A business must be located in the U.S. or U.S. Territories to apply for an EIN online.

A business needs an EIN in order to pay employees and to file business tax returns. Furthermore, financial institutions such as banks, credit unions, and brokerage houses will not open an account for a corporation without an EIN. Self-employed individuals such as subcontractors are typically required to have an EIN, which will be used by the primary contractor to report to the IRS all business income paid to the subcontractor.

Employer Identification Numbers are unique to the businesses to which they are assigned. The numbers never expire, and the same number set is never reissued to another business, even if the original employer goes out of business.