Earned Income Tax Credit

The earned income tax credit is available to low-income and moderate-income taxpayers, with the highest credits going to taxpayers with dependents. A dependent can qualify if theyâre a minor, under 24 and in college, or if they are living with permanent and total disability. The EITC was expanded for 2021, so it ranges from a maximum of $1,502 for taxpayers with no children, to a maximum of $6,728 for taxpayers with three or more children. You can claim the EITC right on your Form 1040 â the main tax form â but you also need to complete Schedule EIC if you have dependents.

What Is Tds On Salary

TDS on salary means that tax has been deducted by the employer at the time of depositing the salary into the employees account. The amount deducted from the employees account is deposited with the government by the employer. Before an employer deducts tax at source from an employees salary, he/she must obtain TAN registration. The Tax Deduction and Collection Account Number or TAN number is essentially a 10-digit alphanumeric number that is used to track TDS deduction as well as a remittance by the Income Tax Department.

Deduction For Whistleblower Fees

This deduction is an incentive to help taxpayers detect and alert the IRS to tax law violations. The deduction can cover attorney fees and court costs you paid in connection with helping the IRS. To claim the deduction, you must have received an award from the IRS . Then you can deduct your fees on Schedule 1.

You May Like: Is Selling Plasma Taxable

Chapter 5 T4a Information Return

In all instances, you have to file your T4A information return on or before the last day of February after the calendar year the information return applies to. If the last day of February falls on a Saturday, a Sunday, or a holiday recognized by the CRA, your information return is due on the next business day. For more information, go to Public holidays.

If you fail to file it on time, we can assess a penalty. For more information, see Penalties, interest and other consequences.

If you have more than one payroll account, you will have to file a separate return for each account.

If you have overpaid, include a letter explaining the reason for the overpayment and how you want us to apply it. If you owe an amount, include the account number and tax year with your payment.

Service bureaus filing returns If a service bureau is filing an information return for you, you are still responsible for the accuracy of the information, for any balance owing, and for filing on time.

Branch offices filing returns If the branch office of a company has sent in income tax deductions under a separate account, which only that office uses, file the information return for that office as a separate return.

Chapter 4 T4a Summary

If you are filing electronically, do not send us a paper copy of the slips or summary. For more information about filing methods, see Electronic filing methods, or go to Filing Information Returns Electronically – Overview.

If you are filing on paper, use the T4A Summary, Summary of Pension, Retirement, Annuity, and Other Income, to report the totals of the amounts that you reported on the T4A slips. Send the original T4A Summary and the related slips to the Tax center in Jonquière. To get a T4A Summary, go to Forms and Publications or call 1-800-959-5525.

If the total number of T4A slips you file is more than 50 slips for the same calendar year, you have to file them over the Internet.

Do not send us a summary with no T4A slips or a summary with no amounts to report.

You cannot change your address using the summary return. To change your address, do one of the following:

- if you are a business owner, go to My Business Account

- if you are an authorized representative or employee, go to Represent a Client

- if you prefer to contact your tax centre, you will find the address at Tax Centre

Also Check: Taxes For Door Dash

How Much Tax Do You Pay On $100 In Australia

Those who make $100 each year in Australia or more will owe 0 percent of their earnings. That means your salary will be $100 every year or $8 every two years. The monthly fee is $33 per month for two people. have an average tax rate of zero. There is no income tax for you, and your marginal tax rate is zero. Your immediate additional income will be taxed at a flat rate here regardless of whether you earn additional income.

Credit For Prior Year Minimum Tax

If you paid alternative minimum tax in a previous year but donât have to pay it this year, you may be able to claim a credit this year to get back some of the AMT you paid. This credit only applies to AMT you paid because of âdeferral itemsâ such as depreciation or incentive stock options that you exercised but didnât sell. This credit can also be claimed by individuals, estates, or trusts. Learn more in the instructions for Form 8801.

Read Also: Is Giving Plasma Taxable Income

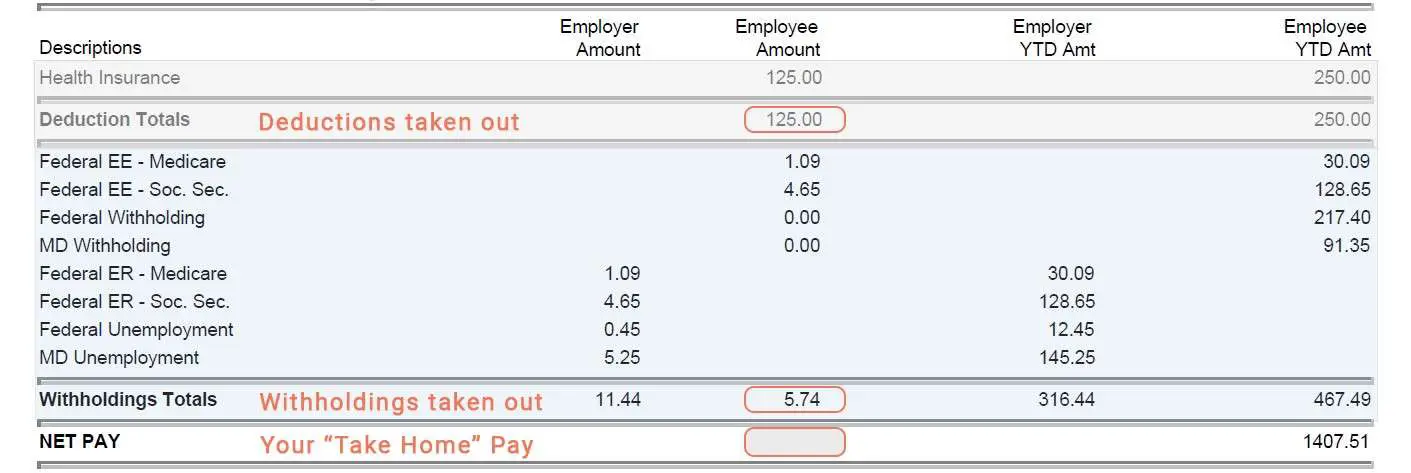

How To Calculate Tax Deductions

The payroll deductions tables help you calculate the amount of federal, provincial, and territorial income tax that you have to deduct from amounts you pay. Use the provincial or territorial tables for the province or territory in which the recipient resides, unless you will be applying lump-sum withholding rates.

You can use any of the following versions of the payroll deductions tables:

- Payroll Deductions Online Calculator You can use PDOC to calculate your payroll deductions. It calculates deductions for any pay period, province and territory. The calculation is based on exact salary figures. For more information, go to Payroll Deductions Online Calculator.

- Guide T4032, Payroll Deductions TablesandGuide T4008, Payroll Deductions Supplementary Tables You can use these tables to calculate payroll deductions. They are available at Payroll.

- Guide T4127, Payroll Deductions Formulas You may want to use these formulas instead of the tables to calculate your recipients payroll deductions. This guide contains formulas to calculate CPP contributions, EI premiums, and federal, provincial , and territorial income tax.If the computer formulas you want to use are different from ours, you have to send them to a tax services office or tax centre for approval.

All the payroll deductions tables are available for each province and territory and also for employees working in Canada beyond the limits of any province or territory, or working outside Canada.

How Much Tax Is Deducted From A Paycheck Ontario 2021

Rates for Ontario are expected to be five per cent in 2021. The first $45,142 of taxable income plus * 9.45 percent is taxable for this first $45,142. At 15 percent, your final balance will equal $90,287, plus 11 percent Taking the next step, an increase of $90,000 to $150,000, plus an addition of $14,000. A 16% raise for the next $150,000 up to $220,000, plus

You May Like: Doordash Take Out Taxes

How Do Payroll Deductions Work

Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your employees or a court order. The calculations can be done manually or you can automate the process using a payroll service provider. Many businesses choose automation because it reduces errors and ensures that payments are filed with the proper authorities on time.

The amount you withhold for each employee depends upon the individuals Form W-4 Employees Withholding Certificate, state and local withholding certificates, benefit selections and other details. For instance, has the employee enrolled in your health insurance plan or is there a court-ordered garnishment to comply with?

Your place of business and where your employees perform services also play a factor in payroll deductions because not every state collects income tax.

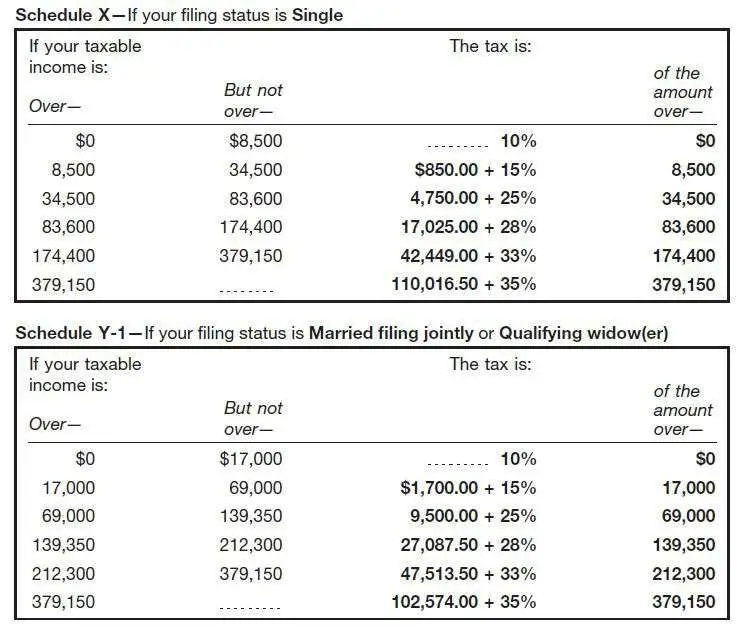

Adjusting Tax Bracket Parameters

Congress decides how many tax brackets there are and what the rates will be for each bracket. It’s the Internal Revenue Service’s job to adjust income thresholds to keep pace with inflation.

For example, in the 2021 tax year, for a married couple filing a joint return,

- The 10% bracket applied to the first $19,900 in taxable income.

- The 12% bracket went up to $8,050.

- The 22% bracket went up to $172,750, and so on.

- The top rate, 37%, applied when taxable income topped $628,300.

For single taxpayers, the thresholds were lower. The IRS announces the tax brackets for each year before that year begins.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

We also offer a handy Tax Bracket Calculator to help you easily identify your tax bracket.

Don’t Miss: Payable Doordash 1099

You Do Not Meet The Paye Criteria If You

- earn more than NOK 651,250 per year . For the 2022 income year, the maximum amount is NOK 643,800.

- If you expect to earn more than NOK 651,250/643,800 , you must choose to be taxed under the general tax rules when you apply for a tax deduction card.

- If youre not sure whether youll earn more than the maximum amount, you can start with PAYE and opt out later on.

- have other taxable income. This could for example be

- public benefits from NAV, for example sickness benefit or unemployment benefit, when youre liable to pay national insurance contributions on the benefit

- parental benefits from NAV, also when your employer pays this in advance

- taxable income from business activity in Norway

- income earned on Norwegian ships

- income earned on the Norwegian continental shelf

- other income thats only subject to national insurance contributions in Norway, for example salary from a Norwegian employer for work performed abroad when youre a member of the Norwegian National Insurance Scheme

- income thats not taxable to Norway according to a tax treaty, for instance if your employer does not have a permanent establishment and neither you nor your employer is liable to pay tax in Norway according to a tax treaty

- taxable salary from a Nordic employer where withholding tax is paid to another Nordic country according to the rules in the Nordic Tax Withholding Agreement

- income thats taxable to Svalbard

Standard Deduction Vs Itemized Deductions

Your income, filing status and amount of potential deductions determine whether you should claim the standard deduction or itemize deductions when filing your income tax return. You have to choose one route or the other you cannot choose both.

The standard deduction is a specific amount determined by the government based on your filing status. The amount varies based on your filing status and is adjusted each year.

Standard Deduction

The standard deduction is also higher for taxpayers who are 65 or older and for blind taxpayers.

Even if you have no other deductions or tax credits, you can claim the standard deduction. But taking the standard deduction means that you can not claim other deductions.

Itemizing deductions is more involved. Not every dollar you spent on qualified deductions can be subtracted from your income to lower your tax bill. Sometimes theres a cap on how much you can deduct.

Itemizing also requires that you keep records of your qualifying deductions throughout the year, fill out more tax paperwork and preserve all these records in case youre audited in the future.

You May Like: How To Protest Property Taxes Harris County

Income That Is Assessed For Tax

Under the PAYE system, income tax is charged on all wages, fees, perks,profits or pensions and most types of interest. Tax is payable on earnings ofall kinds that result from your employment .

Money you get which is not liable to income tax may be liable to othertaxes. If you get gifts or inheritances, you may have to pay CapitalAcquisitions Tax. If you sell assets such as property or shares you mayhave to pay Capital GainsTax.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: Doordash Payable Account

Taxable Income Is What Matters

Tax brackets apply only to your taxable incomethat is, your total income minus all your adjustments and deductions.

For example, in 2021, let’s say a married couple files jointly with a combined total income of $80,400. They take the 2021 standard deduction amount of $25,100 and each spouse takes a $6,000 IRA deduction.

- $6,000 + $6,000 + $25,100 = $37,100 deductions

- $82,100 total income – $35,800 deductions = $45,000 taxable income

These deductions could reduce their taxable income by $35,800 and help drop the family into a lower tax bracket.

Deductions That Reduce Taxable Income

Deductions are taken after calculating your Total Income on Line 15000 of your tax return. Certain deductions are used to arrive at your Net Income Line 23600. You can, for example, deduct RRSPs, Child Care Expenses, Employment Expenses, just to name a few. Your total income minus these deductions equals your net income.

Then there are items you may be able to deduct from the net income to arrive at your Taxable Income on Line 26000. You could, for example, deduct losses from previous years and an amount if you are a northern resident. The best strategy for claiming deductions of this type is to go through your income tax form line by line. We will explain these deductions and the line numbers they are seen on below.

Don’t Miss: Do Doordash Pay Taxes

Tax Deductions Under Different Sections Of The Income Tax Act

As the name suggests, tax deductions help to save tax on your total income. One can claim a tax deduction on the money he/she spends on medical expenses or on charity. There are certain investments that help you bring down tax – these include life insurance plans, health insurance plans, retirement schemes or even NSC. Here are the sections under which one can claim tax deduction:

- Section 80C: Under this section, all investments made towards ELSS Mutual Funds, Tax saving Fixed Deposits, Term Life Insurance Premium, Pension Schemes, Provident Fund etc. are eligible for tax deduction. Maximum available deduction unders section 80C is 1,50,000/-.

- Section 80 CCD: This section encourages investments in two pension schemes – Atal Pension Yojna & National Pension Scheme . This section has been further divided into two sub sections: 80CCD & 80CCD. Under the provisions of section 80CCD:

- One can claim a maximum deduction up to 10% of basic salary + dearness allowance.

- Additional benefit of up to 50,000/- has been granted under section 80CCD, post a new amendment in union budget of 2015 – 16.

Furthermore, sub section 80CCD allows employer’s contribution to Pension Schemes subject to a maximum of 10% of basic salary + dearness allowance, to be claimed as a tax benefit. This limit is over and above the limit prescribed under 80CCD.

What Is A Personal Allowance

Everyone, including students, has something called a Personal Allowance. This is the amount of money youre allowed to earn each tax year before you start paying Income Tax.

For the 2021/22 tax year, the Personal Allowance is £12,570. If you earn less than this, you usually wont have to pay any income tax.

Your Personal Allowance might be bigger if you claim Marriage Allowance or Blind Persons Allowance. Or it might be smaller if youre a high earner or if you owe tax from a previous tax year.

Check the most up-to-date Personal Allowance figures on the GOV.UK website

You May Like: Property Tax Protest Harris County

Australian Income Tax Calculator

Employment income: Employment income frequency

Enter an income to view the result

The estimated tax on your taxable income is0

| Your income after tax & Medicare levy: |

|---|

| Your marginal tax rate: |

This means for an annual income of you pay:

| No tax on income between $1 – $18,200 | $0 |

| 19c for every dollar between $18,201 – | 0 |

| 32.5c for every dollar between – | 0 |

| 37c for every dollar between – $180,000 | 0 |

| c for every dollar over $180,000 | 0 |

- The rates are for Australian residents.

- Your marginal tax rate does not include the Medicare levy, which is calculated separately.

- The Medicare levy is calculated as 2% of taxable income for most taxpayers. The Medicare levy in this calculator is based on individual rates and does not take into account family income or dependent children.

- The calculations do not include the Medicare Levy Surcharge , an additional levy on individuals and families with higher incomes who do not have private health insurance.

- These calculations do not take into account any tax rebates or tax offsets you may be entitled to.

- For the 2016-17 financial year, the marginal tax rate for incomes over $180,000 includes the Temporary Budget Repair Levy of 2%.

- In most cases, your employer will deduct the income tax from your wages and pay it to the ATO.

- 2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020.