Washington State Vehicle Sales Tax On Car Purchases

According to the Sales Tax Handbook, a 6.5 percent sales tax rate is collected by Washington State. On top of that is a 0.3 percent lease/vehicle sales tax. This means that in total, the state tax on the lease or purchase of a vehicle adds up to 6.8 percent.

Cities and counties in Washington State collect sales taxes on vehicle leases and purchases, so the sales tax you pay includes the local sales tax rate of any where from 0.5 percent to 3.5 percent , depending on where you reside. Local governments in Washington State are also permitted to collect a local option sales tax of up to 4 percent.

Northwest Chevrolet explains that the vehicle sales tax for several of the major cities in Washington State is as follows:

- Fife sales tax: 10.2 percent

- Tacoma sales tax: 10.4 percent

- Olympia sales tax: 9.0 percent

- Puyallup sales tax: 10.2 percent

Filing Washington Sales Tax Returns

Sales tax returns can be filed electronically online, or by completing a paper return and sending it in by mail. Information about filing your sales tax return can be found here. Make sure of the rules that apply to you, however, as most businesses are required to file online. The Washington Department of Revenue accepts payment online via EFT , eCheck, and credit card.

If you have no business activity within a given period, you may file such online, by phone or by mail. Details for filing no business activity can be found here.

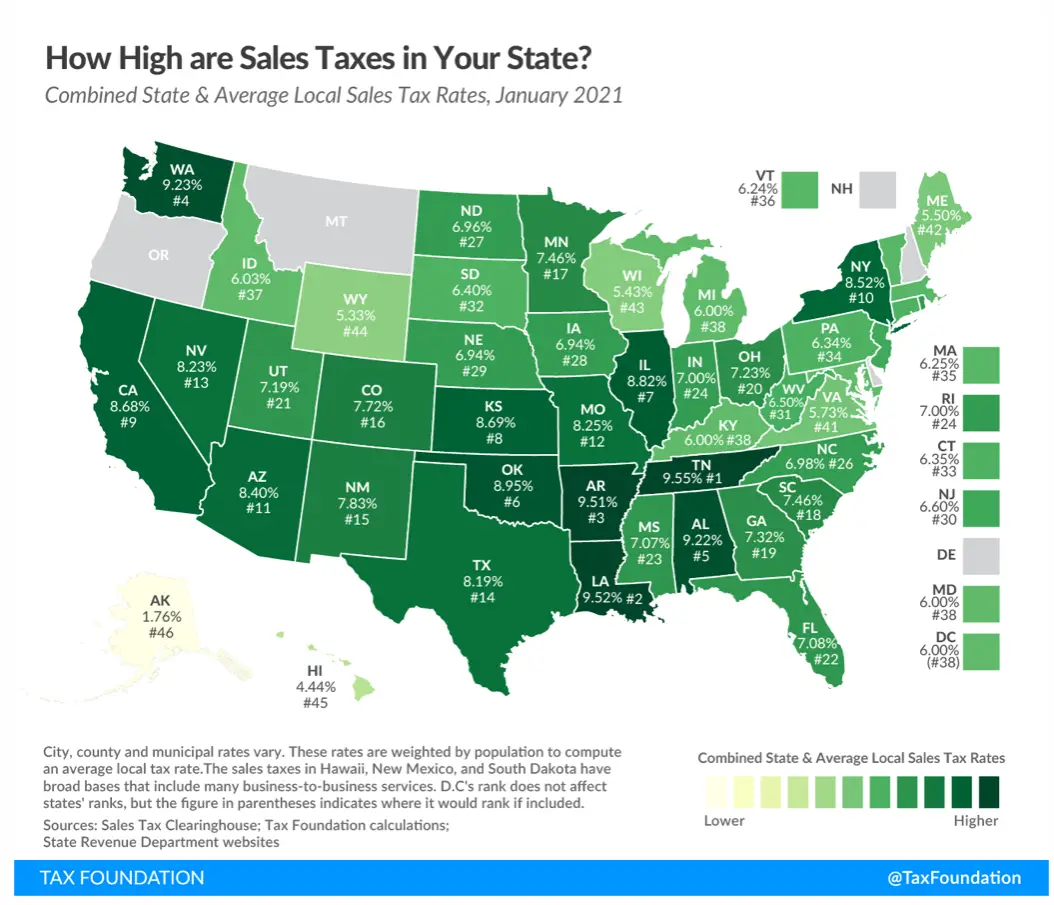

How 2021 Sales Taxes Are Calculated In Washington

The state general sales tax rate of Washington is 6.5%. Cities and/or municipalities of Washington are allowed to collect their own rate that can get up to 4% in city sales tax.Every 2021 combined rates mentioned above are the results of Washington state rate , the county rate , the Washington cities rate , and in some case, special rate . The Washington’s tax rate may change depending of the type of purchase. Some of the Washington tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Washington website for more sales taxes information.

Also Check: Appeal Property Tax Cook County

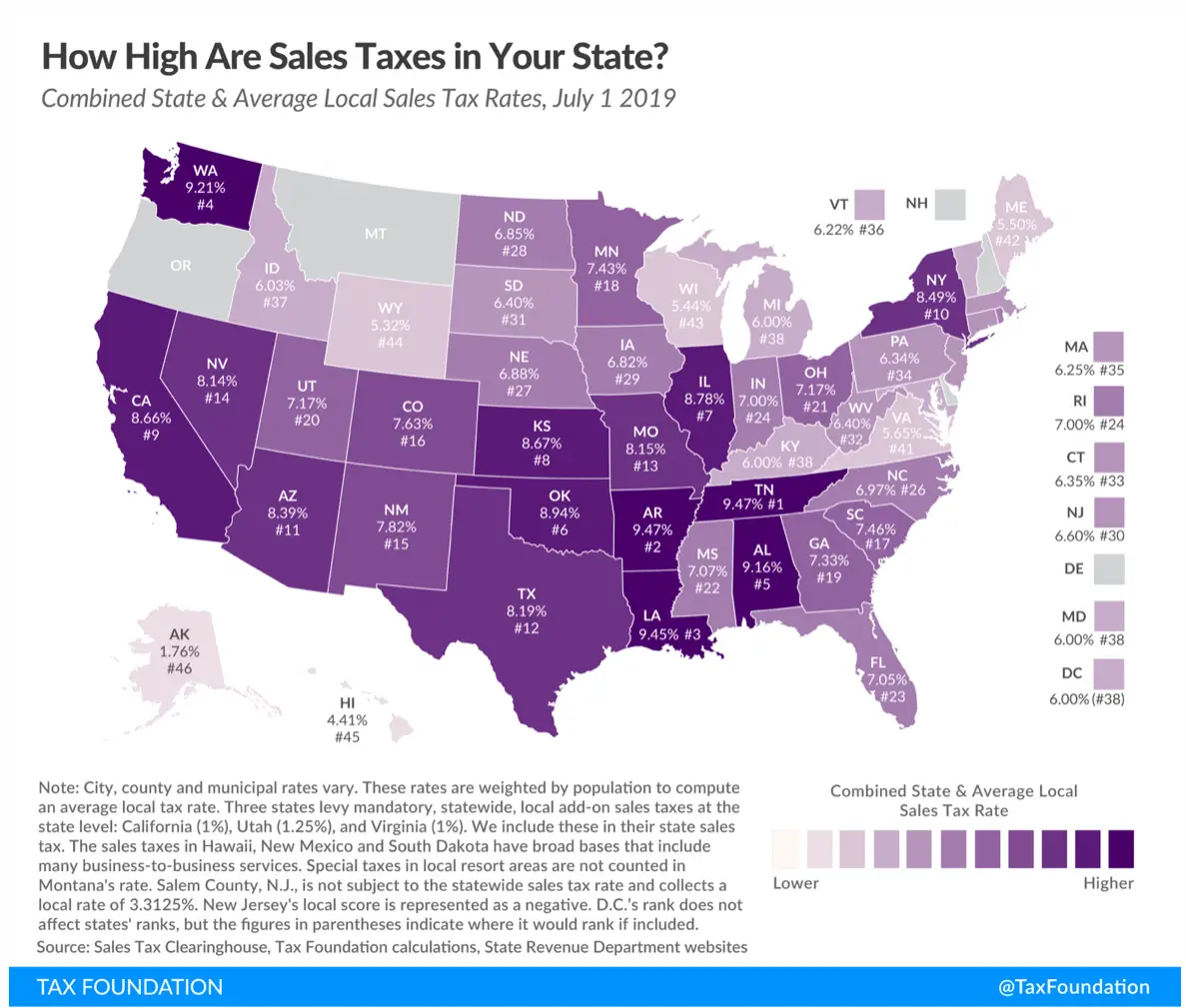

Which State Has Highest Sales Tax

State and Local Sales Tax Rates, 2020

- See the latest data.

- Five states do not have statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon.

- California has the highest state-level sales tax rate, at 7.25 percent. Four states tie for the second-highest statewide rate, at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee.

Tax Free Precious Metals

When it comes to precious metals in Washington, you should buy only bullion coins, as these do not carry a sales tax. Rare coins, in some areas including Seattle, are taxed as much as 9.5% extra, which can turn an investment sour. It is not always easy to work out what is classified as a collectible and what is a standard bullion coin, but the dealer should know and apply the tax.

The widest available and least expensive bullion coins in the state include those minted by the US Mint, Perth Mint and Royal Canadian Mint.

Don’t Miss: Is Plasma Donation Income Taxable

County Commissioners Eye Housing Sales Taxyour Browser Indicates If You’ve Visited This Link

A one-tenth of 1% salestax would raise about $1.2 million a year for county affordable housing. Island County commissioners are moving ahead with a public hearing on a proposed salestax increase that would fund an effort to help resolve the one issue that has been the top concern of politicians and community members on Whidbey for the last decade a dearth of affordable housing.

Whidbey News Times

How Do I Pay Sales Tax In Washington State

Paying sales and use tax

Don’t Miss: Appeal Taxes Cook County

Washington Sales Tax Rates

Washington sales tax rates vary by location. There is a state sales tax as well as various local rates.

Washington Sales Tax Rate: 6.5%Maximum rate for local municipalities: 9.6%

Washington is one of the more complicated states for determining sales tax. This is due to the way Washington defines tax boundaries and the multiple rates within the state. Washington uses destination-based sourcing rules, meaning that for orders shipped to a customers home, the rate is determined by the customers address.

How Cla Can Help

This capital gains tax is the first of its kind in Washington and the new law is complex. New legislation can be overwhelming, especially when planning for transactions and the associated compliance. CLAs state and local tax professionals can help you evaluate and plan for Washington capital gains tax impacts.

Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor.

CliftonLarsonAllen is an independent member of Nexia International, a leading, global network of independent accounting and consulting firms that are members of Nexia International Limited. Nexia International Limited, a company registered in the Isle of Man, does not provide services to clients. Please see the member firm disclaimer for further details.

CliftonLarsonAllen is a Minnesota LLP, with more than 120 locations across the United States. The Minnesota certificate number is 00963. The California license number is 7083. The Maryland permit number is 39235. The New York permit number is 64508. The North Carolina certificate number is 26858. If you have questions regarding individual license information, please contact .

Recommended Reading: File Amended Tax Return Online Free

What Is Sales Tax In Washington State

Sales tax rates Washingtons retail sales tax is made up of the state rate and the local sale tax rate. Local rates vary depending on the location. The sales tax rate for items delivered to the customer at the store location is based on the store location.

Washington state sales tax

- The state sales tax rate in Washington is 6.500%. With local taxes, the total sales tax rate is between 7.000% and 10.500%.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Also Check: Taxes For Doordash

Seattle Sales Tax Calculator

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you dont know the rate, download the free lookup tool on this page to find the right combined Seattle rate.

Washington Spirits Sales Tax

The Washington spirits tax is a tax on the retail sales price of spirits sold in their original container. The term “spirits” means any beverage containing alcohol obtained by distillation. This includes wines with more than 24 percent alcohol by volume, but excludes certain flavored malt beverages. The Washington spirits tax rate for retail sales to consumers is 20.5%.

For additional information, visit the Department of Revenue Washington State Spirits Sales Tax website.

Also Check: Reverse Ein Lookup Irs

Online Shoppers And Their Sales Taxes Help Wa Local Governments Weather Pandemicyour Browser Indicates If You’ve Visited This Link

Over the past 21 months, more have shopped online than ever before, getting their packages delivered to their homes, resulting in a surge of taxes for the jurisdiction where they live. “Every month that that salestax came in great was another month that I thought,

News Tribune on MSN.com

Seattle Washington Sales Tax Rate

seattle Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Seattle, Washington?

The minimum combined 2021 sales tax rate for Seattle, Washington is . This is the total of state, county and city sales tax rates. The Washington sales tax rate is currently %. The County sales tax rate is %. The Seattle sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Washington?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Washington, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Seattle?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Seattle. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Also Check: How To Calculate Doordash Taxes

Washington Sales Tax Nexus

Having nexus within a state means that a retailer becomes responsible for collecting and remitting that states sales tax.

There are several activites that cause a business to have a Washington state sales tax nexus. The most obvious and well-known is, of course, having an office or place of business within the state. However, other business activities may not be as obvious. These can include, but are not limited to:

- Having an employee or other representative in-state who solicits sales

- Installing or assembling goods within the state

- Warehousing product in the state, such as having a Washington-based warehouse, fulfillment house, or using Fulfillment by Amazon and having stock in one of the FBA warehouses

- Renting or leasing property

- Providing certain services within the state

Retailers who operate an affiliate program previously had nexus in Washington if they paid affiliates a commission and if they made $10,000 or more in gross sales into the state of Washington under the agreement during the previous calendar year. This is known as a click-through nexus, and it no longer applies.

Sellers should also be aware of a provision known as trailing nexus. This says that a retailer who had nexus but stops the business activity that created the nexus, is still considered to have nexus for the remainder of that year, as well as one additional calendar year after.

Other Taxes And Fees On Washington Car Purchases

Washington vehicle buyers may encounter a number of additional fees and taxes, such as:

- Registration fee: $50

- Plate transfer fee: $10

- Title fee: $26

Some dealerships also charge a documentation fee, which covers the costs of the dealership handling the documents associated with the purchase of the vehicle. The average documentation fee in Washington State is $150, and state law caps the fee at this rate. However, the cost can vary depending on the dealership you go to.

Understanding Washington State vehicle sales tax can often take time, especially since sales tax on vehicles can vary drastically depending on where you live. However, with just a little patience and understanding, it will get easier to familiarize yourself with how vehicle sales tax in Washington State works.

Also Check: Doordash Taxes Calculator

Requirement To Collect Sales Tax

The University is required to collect and remit sales tax on sales of tangible personal property and certain services to outside entities . Sales tax is calculated on the total sales price . Examples of services subject to the retail sales tax include cleaning, repairing, altering, or improving real or personal property. Sales of goods shipped directly to entities outside the state of Washington are not subject to sales tax.

For current Washington state sales tax rates please see the Department of Revenue website.

Reseller’s Permit

Every business that sells at wholesale must present a valid reseller’s permit to purchase goods as wholesale goods not subject to the sales tax. If you believe you qualify to purchase goods at wholesale contact the Tax Office at to obtain a copy of the permit. For additional information about the reseller’s permit click here.

Procedure for Reporting Sales Tax Collected

If your department sold externally and needs to report the tax collected, you can do so through the Cash Transmittal process. As you are depositing checks, post the merchanise amounts to your budget and post the tax amount on the tax line of the CT. This will transfer the tax collected to the appropriate accrual account and the funds will be captured and reported to the Department of Revenue by the Tax Office.

For any questions on this process, contact .

Snohomish Adopts Sales Tax For Mental Health Affordable Housingyour Browser Indicates If You’ve Visited This Link

The city’s new 0.1% tax is also under consideration elsewhere in Snohomish County. SNOHOMISH The city of Snohomish appears to be the first local government in Snohomish County to use a new law to adopt a local salestax dedicated to funding affordable housing and mental health care,

HeraldNet

Also Check: Can Home Improvement Be Tax Deductible

Washington State Use Tax

Use tax applies when sales tax hasn’t been paid is what the Washington State Department of Licensing tells us. So, when you purchase a vehicle from a private party, you are required to pay use tax when said vehicle is transferred to you.

Sales Tax Handbook states that if the vehicle’s purchase price is not in line with its true value, the value is calculated as close as possible to the selling price of similar vehicles. The total amount of collected use tax is determined based on the vehicle’s fair market value.

If you believe that a vehicle is worth less than the average fair market value and you purchased the vehicle for well below this amount, you can use an affidavit or a verified appraisal from the seller. By doing so, you can get the vehicle’s market value lowered.

If you are in the military and on active duty, you could be automatically exempt from paying any use tax when you purchase a vehicle.

What Qualifies As Taxable Long

Capital asset has the same meaning as defined for federal income tax purposes and long-term capital asset means a capital asset that is held for more than one year. As such, long-term capital gains from the sale or exchange of stock, bonds, partnership interests, business assets, and other capital assets could be subject to the new tax.

Taxable Washington long-term capital gains start with the net federal long-term capital gain . Adjustments are made for exempt gains and losses, gains and losses allocated outside of Washington, and loss carryforwards not allocated to Washington, to the extent included in the federal long-term capital gain or loss.

Read Also: How Much Do You Pay In Taxes Doordash

Do Washington Vehicle Taxes Apply To Rebates And Trade

With many dealerships, you can trade-in your old car and receive a credit that will be applied to your new chosen vehicle. If you trade-in your old vehicle and receive a $5,000 credit on a $10,000 vehicle, you’ll only end up paying $5,000 for the new car. In Washington State, the taxable price of the new vehicle would only be $5,000 because your trade-in’s original value is not subject to sales tax.

Often, manufacturer rebates or cash incentives are offered on vehicles as a way to encourage sales. However, Washington applies its vehicle taxes before the rebates or incentives, so taxes will be paid on a vehicle as if it costs the full, original price.

What Items Are Excluded From Sales Tax

Some items are exempt from sales and use tax, including:

- Sales of certain food products for human consumption

- Sales to the U.S. Government.

- Sales of prescription medicine and certain medical devices.

- Sales of items paid for with food stamps.

Read Also: Irs Employee Lookup

How Often Should You File

How often you need to file depends upon the total amount of sales tax your business collects. The state of Washington will ask for an estimate of expected sales tax when you obtain your Seller’s Permit, and will assign you a filing frequency. If and when you cross into a certain threshold of sales tax collected, the State will alert you about what bracket you belong in.

Note: Washington requires you to file a sales tax return even if you have no sales tax to report.