Effects On Income Inequality

According to the CBO, U.S. federal tax policies substantially reduce income inequality measured after taxes. Taxes became less progressive measured from 1979 to 2011. The tax policies of the mid-1980s were the least progressive period since 1979. Government transfer payments contributed more to reducing inequality than taxes.

How Much Income Tax Could Canada’s Top 1% Pay

How Much Income Tax Could Canadas Top 1% Pay?, by internationally respected CCPA Research Associate Lars Osberg, shows Canadas richest now pay a lower tax rate than in the 1990s even though their share of total income has increased dramatically.

The study, released in the wake of a federal election that handed the Liberals a majority government, concludes there is plenty of room for the new government to make good on its election promise to raise the top marginal income tax rate on those earning $200,000 or more to 33%. In fact, the findings suggest there is room to do more higher up the income scale.

The findings find that a new 65% marginal tax rate for top earners could yield between $15.8 billion and $19.3 billion in additional tax revenue. To put these revenue gains in context, in 2012-2013 the total tuition revenue of Canadas colleges and universities was $8.1 billion and federal infrastructure spending was $5 billion.

The paper finds scant evidence that higher top tax rates would prompt a rush of job creators or the best and brightest to emigrate. Tax law could also be amended to deter tax avoidance and tax evasion, as well as implement tax on capital gains.

Reducing Tax Breaks On Wealthy Peoples Income That Already Is Taxable

As discussed above, much of wealthy peoples annual income is not taxed. Wealthy people also enjoy another broad tax advantage: significant streams of their income that are taxed often enjoy special tax breaks or discounted tax rates. Prominent among these are realized capital gains and dividends, carried interest, and pass-through business income. All three of these are potential areas of reform. Policymakers should also consider enacting a surtax on high-income people.

Don’t Miss: Www.1040paytax.com

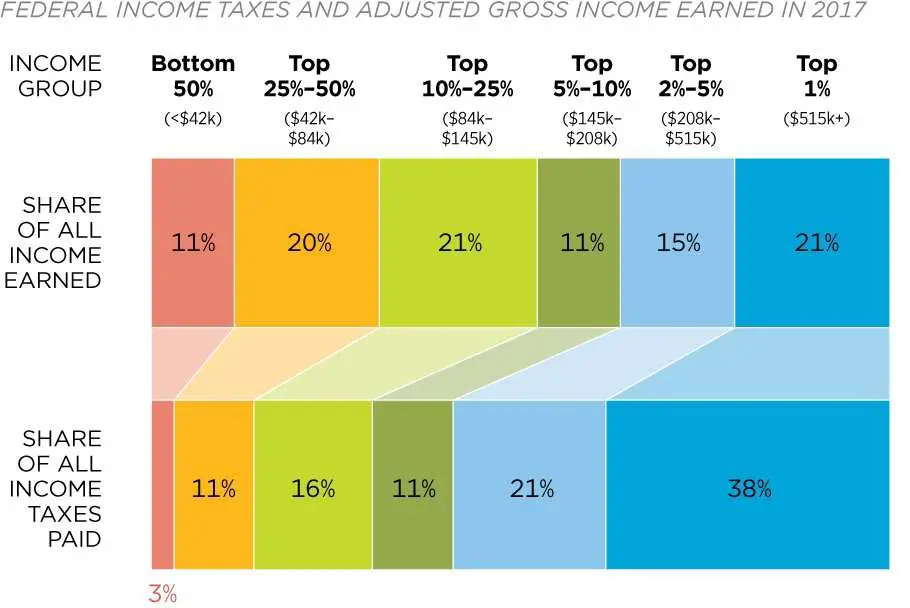

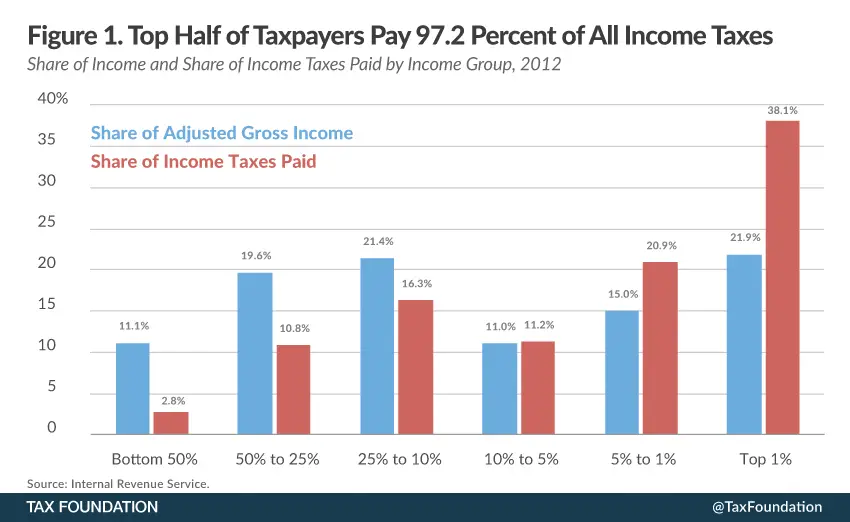

How Much Does The Middle Class Pay In Taxes

An individual in the middle class would be defined as a single person earning between $24,042 and $72,126. A married couple or common-law partners would be middle class if they earned between $34,000 to $102,001. Half of Americans would be considered part of the middle class.

The middle class has the largest population and accounts for less than 10% of the total tax revenue earned by the government. This would be an example of a group that receives tax credits and breaks, which result in little or no taxes being paid out of pocket or through their wages.

At times, the middle class will receive tax benefits because governments look at the group in the long term. For instance, the intent is that these individuals get out of the middle class and move up to the top income earners. Over time, by earning a higher income, there should be more tax revenue flowing into government accounts.

At the end of the day, even though the middle class accounts for the largest percentage of the population, the top income earners are the ones that help the government accumulate its tax revenue.

Surtax On Adjusted Gross Income

A surtax on AGI of over $1 million is another policy tool for raising revenues. A surtax can work in combination with other tax policies to ensure that very high-income households pay a fair amount of taxes. It would raise substantial revenue and is easy for taxpayers to understand. In 2009, the House passed a 5.4 percent tax on AGIs above $500,000 for individuals and $1 million for joint filers that would have raised $460 billion over ten years, according to the Joint Committee on Taxation. Two years later, Senate Democrats proposed a 5.6 percent surtax on AGIs above $500,000 for individuals and $1,000,000 for couples as part of the American Jobs Act. In recent weeks, Senator Chris Van Hollen, Rep. Don Beyer, and other lawmakers introduced legislation for a millionaires surtax, which would impose a 10 percent tax on AGIs above $1 million for individuals and $2 million for couples.

Recommended Reading: How To Find Employer Ein Without W2

Those At The Very Top Of The Income Spectrum Deny The Us Government Roughly $175 Billion A Year In Revenue Researchers Estimate

The richest Americans are hiding more than 20 percent of their earnings from the Internal Revenue Service, according to a comprehensive new estimate of tax evasion, with the top 1 percent of earners accounting for more than a third of all unpaid federal taxes.

Thats costing the federal government roughly $175 billion a year in revenue, according to the findings by a team of economists from academia and the IRS.

The data comes as Senate Democrats consider raising taxes on the ultrawealthy to reduce inequality and fund their legislative priorities.President Biden, in a sharp reversal from his predecessor, has signaled that he wants to raise taxes on the wealthy, corporations and estates.

The researchers say that years of IRS funding cuts, combined with the increased sophistication of tax evasion tactics available to the rich, have made shirking tax obligations easier than ever. And they say that these estimates probably understate the true extent of tax evasion at the top of the income spectrum.

To catch tax cheats and measure evasion, the IRS randomly audits returns. But such reviews turn up very little evidence of evasion among the extremely wealthy, in part because the rich use sophisticated accounting techniques that are difficult to trace, such as offshore tax shelters, pass-through businesses and complex conservation easements.

These riches sheltered overseas, moreover, were concentrated almost exclusively among the very top earners.

Modern Interpretation Of The Power To Tax Incomes

The modern interpretation of the Sixteenth Amendment taxation power can be found in Commissioner v. Glenshaw Glass Co.348U.S.426. In that case, a taxpayer had received an award of punitive damages from a competitor for antitrust violations and sought to avoid paying taxes on that award. The Court observed that Congress, in imposing the income tax, had defined gross income, under the Internal Revenue Code of 1939, to include:

gains, profits, and income derived from salaries, wages or compensation for personal service … of whatever kind and in whatever form paid, or from professions, vocations, trades, businesses, commerce, or sales, or dealings in property, whether real or personal, growing out of the ownership or use of or interest in such property also from interest, rent, dividends, securities, or the transaction of any business carried on for gain or profit, or gains or profits and income derived from any source whatever.:p. 429

The Court held that “this language was used by Congress to exert in this field the full measure of its taxing power”, id., and that “the Court has given a liberal construction to this broad phraseology in recognition of the intention of Congress to tax all gains except those specifically exempted.”:p. 430

Don’t Miss: Is Plasma Money Taxable

Income Tax In The United States

| This article is part of a series on |

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed , but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels.

In the United States, the term “payroll tax” usually refers to FICA taxes that are paid to fund Social Security and Medicare, while “income tax” refers to taxes that are paid into state and federal general funds.

Most business expenses are deductible. Individuals may also deduct a personal allowance and certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits.

Capital gains are taxable, and capital losses reduce taxable income to the extent of gains . Individuals currently pay a lower rate of tax on capital gains and certain corporate dividends.

The Complexity Of The Us Income Tax Laws

United States tax law attempts to define a comprehensive system of measuring income in a complex economy. Many provisions defining income or granting or removing benefits require significant definition of terms. Further, many state income tax laws do not conform with federal tax law in material respects. These factors and others have resulted in substantial complexity. Even venerable legal scholars like Judge Learned Hand have expressed amazement and frustration with the complexity of the U.S. income tax laws. In the article, Thomas Walter Swan, 57 Yale Law Journal No. 2, 167, 169 , Judge Hand wrote:

Complexity is a separate issue from flatness of rate structures. Also, in the United States, income tax laws are often used by legislatures as policy instruments for encouraging numerous undertakings deemed socially useful â including the buying of life insurance, the funding of employee health care and pensions, the raising of children, home ownership, and the development of alternative energy sources and increased investment in conventional energy. Special tax provisions granted for any purpose increase complexity, irrespective of the system’s flatness or lack thereof.

Recommended Reading: Is Plasma Donation Income Taxable

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans

Abstract: We estimate the average Federal individual income tax rate paid by Americas 400 wealthiest families, using a relatively comprehensive measure of their income that includes income from unsold stock. We do so using publicly available statistics from the IRS Statistics of Income Division, the Survey of Consumer Finances, and Forbes magazine. In our primary analysis, we estimate an average Federal individual income tax rate of 8.2 percent for the period 2010-2018. We also present sensitivity analyses that yield estimates in the 6-12 percent range. The Presidents proposals mitigate two key contributors to the low estimated rate: preferential tax rates on capital gains and dividend income, and wealthy families ability to avoid paying income tax on capital gains through a provision known as stepped-up basis.

How the wealthy enjoy low income tax: preferred rates on an incomplete measure of income

The wealthy pay low income tax rates, year after year, for two primary reasons. First, much of their income is taxed at preferred rates. In particular, income from dividends and from stock sales is taxed at a maximum of 20 percent , which is much lower than the maximum 37 percent ordinary rate that applies to other income.

Analyzing a more comprehensive measure of income

Preferred tax rates on income from stock sales and from dividends feature prominently in commonly cited tax rates as well as in our analysis.

Primary estimate and sensitivity

Method

Technical Appendix

Tax Cuts And Tax Fairness

Democratic party leaders have taken rhetorical shots against tax reform bill since it was introduced back in 2017. During the debate, Speaker of the House Nancy Pelosi went so far as to the TCJA the worst bill in the history of the United States Congress. Senate Minority Leader Chuck Schumer also disparaged the bill as a product that no one can be proud of and everyone should be ashamed of.

Progressives continue to assail the TCJA in the years since its passage. A few days before the election, the Center for American Progress, a self-described progressive policy institute, the tax system unfair and said the results of the TCJA were a hugely regressive tax cut.

This ignores that most taxpayers paid less thanks to the TCJA. In fact, the Tax Policy Center estimated that nearly two-thirds of households paid less income taxes in 2018 than they would have under the pre-TCJA code, while 6 percent paid more .

Low-income households having very little tax burden to cut in the first place, in dollar terms, is also why tax cut proposals targeted at lower-income households rely heavily on refundable credits. Like other tax credits, these reduce a filers income tax liability. But unlike nonrefundable credits, any remaining credits are paid to the filer. The refundable portion manifests as direct spending through the tax code.

You May Like: Doordash Income Tax

Realized Capital Gains And Dividends

Realized capital gains and dividends are both heavily concentrated among the affluent. The top 1 percent of households received 75 percent of taxable long-term capital gains in 2019, according to the Tax Policy Center. More than half went to the highest-income 0.1 percent of households those with annual incomes of more than $3.8 million. Before the supply-side tax cuts of the 1980s, the tax rate on capital gains was 35 percent . Today, the top tax rate on capital gains is a much lower 23.8 percent. Moreover, as noted above, effective tax rates on capital gains are even lower than these statutory rates because taxpayers can avoid taxes altogether by holding, rather than selling, their assets until death .

President Bidens campaign proposal to phase out the deduction for households with more than $400,000 in income would raise $143 billion, almost exclusively from the top 1 percent, before the deduction expires at the end of 2025 , the Tax Policy Center estimated.

Policymakers could combine the Biden proposal to eliminate lower tax rates on realized capital gains and dividends for high-income households with his campaign proposal to phase out the pass-through deduction and, as a result, eliminate the special tax advantages that the wealthiest people enjoy on their taxable income.

Revealed: How Much Tax The Top 10pc Pay

Higher income earners continue to pay the bulk of income taxes amid politically-charged complaints that inequality is rising, new Tax Office data reveals.

While Treasurer Scott Morrison will use Tuesday week’s budget to unveil tax cuts targeted at lower and middle-income Australians, the lack of meaningful tax relief for those at the upper end of the scale since the early years of the Rudd government continues to leave them shouldering more of the burden.

Economists are warning the lack of across-the-board tax cuts serves as a disincentive for high-income earners and if delivered, would help boost growth.

Economists are warning the lack of across-the-board tax cuts serves as a disincentive for high-income earners. Dominic Lorrimer

The Tax Office’s tax statistics for 2015-16 released on Friday show that 44.9 per cent of the total net tax collected was paid by the top 10 per cent of taxpayers.

The top 1 per cent of taxpayers about 90,000 people contributed 16.9 per cent.

But data provided to AFR Weekend by the ATO shows how the proportion paid by high income earners has crept up over the last decade. In 2004-05, the top 10 per cent of taxpayers paid 43 per cent of net tax, while the top 1 per cent paid 15.8 per cent.

Professor Davidson said at a time of soft economic growth and the Reserve Bank of Australia bemoaning a lack of animal spirits, “part of the reason is because we tax successful people to the death and regulate everything else”.

Read Also: Www..1040paytax.com

This Problem Has Been Solved

1. Consider the table below. We can use these data to find outwhat percentage of federal taxes is paid from the top down by thetop 40%, top 60%, or top 80% of income earners. Likewise, we cancount from the bottom up by the bottom 40%, 60%, or 80% of incomeearners. Fill in the table and show workings for full credit.

|

Everyone |

Progressive System Marginal Rates

The federal income tax is progressive, meaning that tax rates increase as your taxable income goes up.

For example, in 2021,

- Income is taxed at seven different rates:

- 10, 12, 22, 24, 32, 35 and 37 percent.

Also Check: Doordash Accounting Method

% Of All Households Pay No Federal Income Tax

Of the 76 million households that pay no federal income tax, only 110 thousand make $200,000 or more in income and pay no federal income taxes. This is roughly 1.5%-2.4% of all households with +$200k incomes, and about 0.1% of all zero liability filers.

- Andrew GrimmJul 3 ’13 at 23:35

- My mind skipped over that word. It is already in the bar chart at the bottom, or if you want The chart it is in the CBO report . Pg16 for before/after tax income as a share of the whole.Jul 4 ’13 at 5:01

- 1Whoops! And the bottom bar chart shows that tax grows as fast as the amount of income. Andrew GrimmJul 4 ’13 at 5:19

- I don’t think there exists any country in the world where the tax grows slower than the income. Even very non-progressive tax systems are at least flat percentage rate. ithisaJul 6 ’13 at 0:40

- Yes, I meant that there are no regressive tax systems. This implies that the percentage per quantile when graphed is at least linear, never drooping downwards. I was referring to Grimm’s comment about “as fast as”.

This is rather a comment to the question than an answer .

However, for Germany the claims are not unknown, either, and the asked numbers for 2011 are:

* I’m not sure what the total refers to, possibly it is the total of all federal taxes.

Source: German federal tax office data collection, table 2.2

Table 2.3 says that this covers the ca. 37 million tax payers another 27 million adults have 0 income tax . 17 million children are not considered for income tax.

Side note: