Line 9899 Or 9369 Net Income Before Adjustments

For business and professional income, use line 9369 on Form T2125.

For farming income, use line 9899 on Form T2042.

For fishing income, use line 9369 on Form T2121.

Enter the gross income minus the total expenses. If you have a loss, enter the amount in brackets. If you are a partner in a partnership, this amount is the net income of all partners.

Pay Quarterly Estimated Taxes

As a sole proprietor, its great when you get paid in full by your clients.

However, Uncle Sam doesnt want you to hold onto that money all year. You have an obligation to pay taxes on earnings from self-employment as you collect revenue from your clients.

Once per quarter, youre required to make estimated tax payments on your tax liability.

Estimated means you have to determine how much tax you might ultimately owe. It can be a bit tricky if your taxable income fluctuates during the year.

Simply do the best you can to calculate accurate amounts of your income and expenses. You can adjust the amount for the following quarter if you under- or over-estimated your tax liability.

Always pay your quarterly estimated taxes even if you expect a tax refund when you file your annual return. Otherwise, the IRS might charge you an underpayment or late payment penalty.

Employ Someone In Your Family

If you have a loved one who has supported you in your business but not been remunerated, then you could pay them a salary.

Youll be able to reduce your tax bill because their salary is an allowable expense, as long as you can prove they have helped you.

Theres an added tax saving too if they have personal allowance available. And dont forget they may need to fill out a tax return too even if they have no tax to pay.

Recommended Reading: Does Doordash Take Taxes

Line 9814 Salaries Wages And Benefits

You can deduct employees’ gross salaries and other benefits you incurred. Do not deduct salaries or drawings paid or payable to yourself or a partner. For more information, see Part 9 Details of equity.

As the employer, you must deduct your part of CPP or QPP contributions and employment insurance premiums. You can also deduct workers’ compensation amounts payable on employees’ remuneration and Provincial Parental Insurance Plan premiums. The PPIP is an income replacement plan for residents of Quebec. For details, contact Revenue Québec. For more information on making payroll deductions, go to Payroll.

You can also deduct any insurance premiums you pay for an employee for a sickness, an accident, a disability, or an income insurance plan.

You can deduct the salary you pay to your child, as long as you meet all these conditions:

- you pay the salary

- the work your child does is necessary for earning farming income

- the salary is reasonable when you consider your child’s age, and the amount you pay is what you would pay someone else

Keep documents to support the salary you pay your child. If you pay your child by cheque, keep the cancelled cheque. If you pay cash, have the child sign a receipt.

Instead of cash, you may pay your child with a product from your business. When you do this, claim the value of the product as an expense and add to your gross sales an amount equal to the value of the product. Your child has to include the value of the product in his or her income.

Line 9795 Building Repairs And Maintenance

Deduct repairs to fences and all buildings you used for farming, except your farmhouse. Do not include the value of your own labour. If the expenditure improved a fence or building beyond its original condition, the costs are capital expenditures. Add the expenditure to the cost of the asset on your CCA charts on Form T2042. CCA charts are explained in Chapter 4.

If you used your farmhouse for business reasons, see Line 9945 Business-use-of-home expenses.

Read Also: Have My Taxes Been Accepted

Universal Social Charge Prsi And Vat

USC: Everyone must pay the Universal Social Charge iftheir gross income is over 13,000 in a year.

An extra charge of 3% applies to any self-employed income over 100,000regardless of age. This means that self-employed people pay a total of 11% USCon any income over 100,000. The USC does not apply to social welfare orsimilar payments. You pay your USC with your preliminary tax payment.

PRSI: Self-employed people pay ClassS PRSI on their income.

Value Added Tax

You must register forValue Added Tax if your annual turnover is more than or is likely tobe more than 75,000 for supply of goods or 37,500 for supply of service.As a trader you pay VAT on goods andservices acquired for the business and charge VAT on goods and servicessupplied by the business. The difference between the VAT charged by you and theVAT you were charged must be paid to Revenue. If the amount of VAT paid by youexceeds the VAT charged by you, Revenue will repay the excess. This ensuresthat VAT is paid by the ultimate customer and not by the business.

Revenue has information on how toaccount for and pay VAT.

Are Se Earnings Also Subject To Income Tax

Yes, though the amount of taxable income is figured slightly differently than for employees, because of the much greater range of allowed deductions. One of the deductions is for half of your self-employment tax. So even though you have to pay the entire self-employment tax, you get half of it back when you prepare your return.

Read Also: How Do You Do Taxes For Doordash

Examine Your Peers And Competition

Intuit’s and Gallup’s Gig Economy and Self-Employment Report shows that the median income of workers who are primarily self-employed is $34,751, compared to a median income of $40,800 for those who work for an employer. The total compensation is effectively less because self-employed individuals must pay for their own benefits. However, your self-employment situation depends a lot on your particular profession.

Line 9932 Drawings In The Current Year

A drawing is any withdrawal of cash or other assets, or services of a business by the proprietor or partners. This includes transactions by the proprietor or partners , like withdrawing cash for non-business use and using business assets and services for personal use. Include the cost or value of the personal use of business assets or services in your drawings for the year.

Recommended Reading: Doordash File Taxes

Business Use Of A Vehicle

Thinkstock

There’s a tax deduction waiting if you drive your own car for businessand it isn’t just for Uber or Lyft drivers. Any self-employed person who makes deliveries, drives to a client’s location or otherwise uses a personal vehicle for work-related purposes can claim this deduction.

There are two ways to calculate the deduction you can use the standard mileage rate or your actual car expenses. If you use the standard mileage rate, you can deduct 56¢ for every mile driven for business in 2021 . Make sure you keep good records of the dates and miles you drive for workand don’t include driving for any personal trips or errands.

With the actual expense method, you add up all your car-related expenses for the year gas, oil, tires, repairs, parking, tolls, insurance, registration, lease payments, depreciation, etc. and multiply the total by the percentage of total miles driven that year for business reasons. For example, if your total annual car costs are $5,000 and 20% of your miles were for business, then your deduction is $1,000 .

Do I Need To Include Coronavirus Business Support Grants On My Tax Return

You may have received financial support for your business during the Coronavirus pandemic. These grants may have come from your local authority , government departments or from HMRC grants).

Many of these grants are taxable and will need to be included on your tax return.

For each grant you have received you should check the conditions to see if it is taxable income and then if so, you need to work out which tax year it is taxable in, so that you know which tax return it needs to be included on. If the grants are taxable income, with the exception of the SEISS grants , factors such as when you received the support grant, your basis period and whether you prepare your accounts using the cash basis or the accruals basis will affect in which tax year they are taxable, and so which tax return they should be included on.

The 2020/21 tax return has a box on page 1 of the self-employment pages for Coronavirus business support income. There is a separate box within the self-employment pages for the SEISS grants) at box 27.1 on page 2 of the self-employment pages SA103 and box 70.1 on page 3 of the self-employment pages SA103.

For the fourth and fifth SEISS grants the rules are different and the grants are treated as taxable income within the tax year they are received, so this should be the 2021/22 tax year.

You May Like: Federal Tax Return Irs

Credit Card And Loan Interest

Check your credit card statements for potential self-employment tax deductions.

What you can deduct: Interest accrued on purchases that were business expenses.

How it works: You cant deduct credit card interest accrued from business expenses if the purchase was made on someone elses credit card, for instance.

What else you can do: You dont necessarily need to have a business credit card to deduct qualifying interest charges. If you use a personal card exclusively for business expenses, for example, you can generally still deduct the interest charges.

Line 9819 Motor Vehicle Expenses

You can deduct expenses you incur to run a motor vehicle you use to earn farming income. Fill in “Chart A Motor vehicle expenses” of Form T2042. The chart will help you calculate the amount of motor vehicle expenses you can deduct. If you are a partner in a business partnership and you incur motor vehicle expenses for the business through the use of your personal vehicle, you can claim those business related expenses on Line 9943 Other amounts deductible from your share of net partnership income of Form T2042.

You May Like: Do You Have To Report Plasma Donations On Taxes

Check Your Partners Earnings If You Claim Child Benefit

If you or your partner claims child benefit then HMRC will be interested in both partners earnings. If one partner earns more than £50,000 it will want some of the benefit paid back the charge is tapered so that by the time one person earns £60,000 the whole lot must be repaid. The form asks if either of you claimed the benefit, and if your income is higher or lower than your partners. It makes no difference whether you are married or not.

Gst/hst When You Buy A Business

For GST/HST purposes, if you buy a business or part of a business and acquire all or substantially all of the property that can reasonably be regarded as necessary to carry on the business, you and the vendor may be able to jointly elect to have no GST/HST payable on the sale by completing Form GST44, Election Concerning the Acquisition of a Business or Part of a Business. You cannot use this election if the seller is a registrant and you are not a registrant. In addition, you must buy all or substantially all of the property, not only individual assets.

For the election to apply to the sale, you have to be able to continue to operate the business with the property acquired under the sale agreement. You have to file Form GST44 on or before the day you have to file the GST/HST return for the first reporting period in which you would have otherwise had to pay GST/HST on the purchase.

Even when you use the election, GST/HST will still apply to a taxable supply of a service made by the seller a taxable supply of property made by way of lease, licence, or similar arrangement and, if the buyer is not a GST/HST registrant, a taxable sale of real property.

Also Check: Csl Plasma Taxable

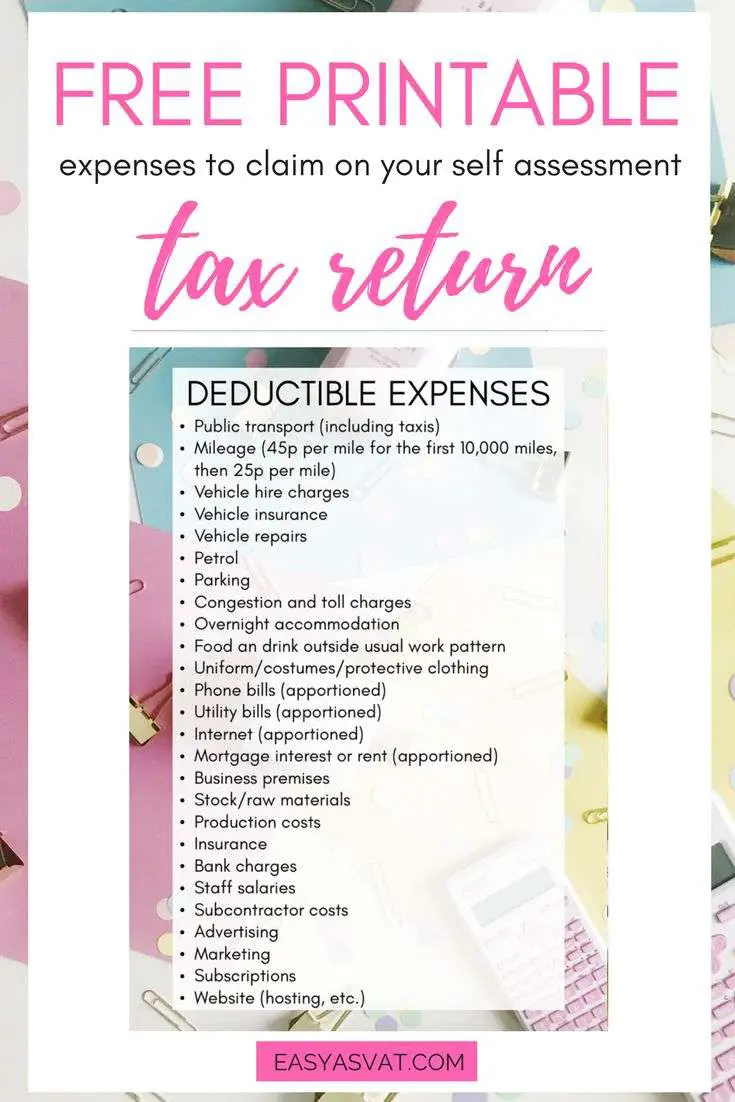

Costs You Can Claim As Allowable Expenses

These include:

- office costs, for example stationery or phone bills

- travel costs, for example fuel, parking, train or bus fares

- clothing expenses, for example uniforms

- staff costs, for example salaries or subcontractor costs

- things you buy to sell on, for example stock or raw materials

- financial costs, for example insurance or bank charges

- advertising or marketing, for example website costs

- training courses related to your business, for example refresher courses

You cannot claim expenses if you use your £1,000 tax-free trading allowance.

Contact the Self Assessment helpline if youre not sure whether a business cost is an allowable expense.

Correct And Claim Against Previous Tax Years

You can claim a refund for any overpayments youve made in the last four tax years. So if you stumble across something you couldve claimed for previously, or if you spot a mistake in previous years tax returns, make a note.

Write to HMRC explaining that youre making a claim for overpayment relief. Youll need to include:

- Proof youve overpaid tax through self-assessment

- Signed declaration saying the details youve given are correct and that you havent previously tried to reclaim the refund in question

- How youd like the repayment to be made

Also Check: Cook County Appeal Property Tax

Who Must Pay Self

You must pay self-employment tax and file Schedule SE if either of the following applies.

- Your net earnings from self-employment were $400 or more.

- You had church employee income of $108.28 or more.

Generally, your net earnings from self-employment are subject to self-employment tax. If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-employment.

If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total earnings subject to self-employment tax.

Note: The self-employment tax rules apply no matter how old you are and even if you are already receiving Social Security or Medicare.

Home Office Expense Limits

In some cases, you may not be able to claim the entire amount of your home office expenses in a single tax year, especially if you started a new job or business late in the year. The allowed claim for employees is limited to the amount of employment income remaining after all the other employment expenses have been claimed. Self-employed taxpayers are limited to the net income of the business before the expense is claimed. In other words, both employees and self-employed individuals cannot create a loss from claiming home office expenses. The excess expenses can be carried forward and in most cases can be applied to future years. Whether you are an Employee or Self-Employed, TurboTax Online makes it easy to claim your home office expenses.

If you need more help, consider TurboTax Live Assist & Review, and get unlimited assistance and advice as you do your taxes, plus a final review before you file. Or, choose TurboTax Live Full Service and have one of our tax experts do you return from start to finish.

With more than 20 yearsâ experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Read Also: Doordash Mileage Calculator

Eliminated Or Changed Deductions

Some deductions that have been eliminated or changed post-TCJA include:

- Entertainment and fringe benefit deduction

- Employees parking, mass transit, or commuting expenses deduction

- Domestic production activities deduction

- Local lobbying expenses deduction

- State and local tax deduction is now limited to $10,000

- Deduction of settlement or legal fees in a sexual harassment case, when the settlement is subject to a nondisclosure

Key provisions that are set to expire in 2025 include:

- QBI deduction

- Standard deduction will return to pre-TCJA levels

- Income tax rates will return to pre-TCJA levels

It is important to note that tax laws are constantly changing, and these provisions may be modified or extended at any point prior to 2025. A review of the most common self-employed taxes and deductions is necessary to keep you up to date on any necessary changes to your quarterly estimated tax payments.

WATCH: 8 Tax Benefits For The Self-Employed

How Do I Pay Self

Being self-employed, your business earnings and your personal incomes are the same as far as the Canada Revenue Agency is concerned. Theres no separate income tax rate for money you make from your business. What this means is that the income tax rates for sole proprietors are the same as for individuals. However, you do need to pay Canadian Pension Plan contributions, and you have the option of making Employment Insurance contributions as well.

So, the total of your tax obligations would be income tax + CPP + EI .

Disclaimer: The information provided on this page is intended to provide general information. The information does not consider your personal situation and is not intended to be used without consultation from accounting and financial professionals. Salman Rundhawa and Filing Taxes will not be held liable for any problems that arise from the usage of the information provided on this page.

Also Check: Doordash Taxes Percentage

Vehicle Loans Interest Expenses

You can deduct interest on money you borrow to buy a motor vehicle, zero-emission vehicle,passenger vehicle, or zero-emission passenger vehicle you use to earn business income. Include this interest as an expense when you calculate your allowable motor vehicle expenses.

However, there is a limit on the amount of interest you can deduct for a passengervehicle or zero-emission passenger vehicle. In such a case, the amount of interest you can deduct is limited to the lesser of the following two amounts:

- Total interest payable for the year

- $10 × the number of days for which interest was payable in the year.

To calculate the amount of interest you can deduct, complete “Chart B Available interest expense for passenger vehicles and zero-emission passenger vehicles” on Form T2125.