Your Current And Future Tax Rates Matter

Finally, a circumstance where tax-loss harvesting is likely to add value, but needs to be carefully analyzed, is when you have relatively high current income and expect lower income when spending down taxable assets in retirement. In this case, you need careful planning. If you anticipate that your capital gains tax bracket in retirement will be the same or lower than it is currently, tax-loss harvesting should work to your benefit.

Beyond the $3,000 per year in tax losses that offset ordinary income, it is important to remember that your current and future capital gains tax rates matter. Since tax-loss harvesting lowers the cost basis, investors who are currently in the 15% long-term capital gains tax bracket need to analyze the risk of future realized gains pushing them into a higher tax bracket.

For investors who anticipate that they will be in the same tax bracket in the future as they are now, the gain beyond the first $3,000 each year is derived from time value of money . The best way to maximize the time value of tax-loss harvesting is to invest any tax savings into the market so these savings are likely to compound at a much higher rate over time.

Tax-loss harvesting can be beneficial for some investors, providing the opportunity to create value based on the structure of tax laws. This may help to slightly ease ones pain during the next market downturn.

The Process Can Be Automated And Secure

Given that several brokers offer automatic tax-loss harvesting for free, it would be pretty daft to not take advantage of it. When it comes to stock taxes, many agree theres no better tool than automated tax-loss harvesting.

Automated investment systems know how to calculate which stocks are optimal to shed and have fail-safes to prevent initiating a wash transaction. Automated robo advisors are often much cheaper than traditional financial advisors.

Getting Around The Wash

The wash-sale rule applies to all taxable brokerage accounts and IRAs. There are methods to get around the wash-sale rule and maximize offset losses.

One way is pretty complicated and involves multiple transactions. Essentially, you can mix selling securities and buying options contracts to trigger the wash-sale rule and then immediately override it with another transaction. This method can be fairly complex and is best left to computers that can automate the transactions.

Another option involves utilizing exchange-traded funds. ETFs consist of a wide range of securities and are usually tracked according to some exchange index, such as the S& P 500. Since ETFs encompass many different classes of investments, you can sell poorly performing ETF shares and purchase different ones in the same index without triggering a wash-sale.

So for example, say you are invested in the Vanguard S& P 500 ETF and you experience a loss. You can sell off those shares and immediately buy back into the State Street SPDR S& P 500 ETF without it being considered a wash sale.

The reasoning behind exempting ETF purchases from the wash-sale rule is that 2 ETFs have different managers and likely have different expense ratios, use different methodologies to allocate investments, and have different levels of liquidity.

Don’t Miss: Efstatus Com Taxact Com

Its An Easy 3 Step Process

Step 1: Launch the Tool

After you upload your transactions, youâll see a menu item called Tax-Loss Harvesting on your dashboard. Click on this link and we will begin to run our tool. It will take about 15 seconds to process.

Step 2: Read the Results

The output of ZenLedgerâs Tax Loss Harvesting report is a Google spreadsheet that will open in a new tab of your browser.

Each tab represents a different accounting method – use your preferred method to see your total potential losses to harvest, organized by currency. You can toggle between accounting methods in the spreadsheet.

The summary tabs show you all of the coins you currently own that have an unrealized loss using your preferred accounting method. The other tabs show you the raw data that we use to create your summaries.

Breakdown of Accounting Methods

Our tax-loss harvesting spreadsheet tabs summarize your losses as accrued by each type of supported accounting method. Please know that you must be consistent year to year and between your tax-loss harvesting and your reporting on your 8949 or Schedule D, You cannot switch between these — you have to choose one and stick with it.

Weâve included the textbook definitions below for more clarity. Youâll want to consult a tax advisor to decide which method is best for you.

Step 3: Realize Losses by Selling Your Crypto Once

Wash Sales Due To A Spouses Transactions

Some investors hope to avoid the wash sale rule by having their spouse buy a particular investment at the same time that they sell it for a loss. But, as explained in IRS Publication 550, this does not work. For the purpose of triggering a wash sale, your spouse buying or selling an investment has the same effect as you buying or selling the investment.

You May Like: Irs Forgot Ein

Don’t Undermine Investment Goals

Remember this saying: Don’t let the tax tail wag the investment dog. If you choose to implement tax-loss harvesting, be sure to keep in mind that tax savings should not undermine your investing goals. Ultimately, a balanced strategy and frequent reevaluation to ensure that your investments are in line with your objectives is the smart approach.

If you’re interested in implementing a tax-loss harvesting strategy but don’t have the skill, will, or time to do it yourself, a Fidelity advisor may be able to help.

Best Accounts To Tax Loss Harvest

Any DIY investor with a discount brokerage account can do their own tax-loss harvesting, however, keeping track of everything on your own can be tough. There are two companies I know of that take a lot of the work out of tax-loss harvesting: Questrade and Wealthsimple.

Questrade is a popular Canadian discount brokerage, in fact, its our top-rated online broker here at MapleMoney. Its easy to use and offers some of the lowest fees in the business, including no-fee ETF purchases. Questrade portfolio managers implement a tax-loss harvesting strategy inside their very own Questwealth portfolios. If you dont mind some automating of your investments, its worth checking out.

The Wealthsimple name is synonymous with robo-advisor investing in Canada. If you have a minimum balance of $100,000 in your portfolio, you qualify for Wealthsimple Black service. If your balance is $500,000 or more, its called Wealthsimple Generation. Both of these plans include automated tax-loss harvesting. Not only are you benefitting from low fees and hands-off investing, but you also benefit from additional tax savings opportunities in your taxable accounts.

If youre not using a hands-off approach like the ones offered by Questrade or Wealthsimple, I recommend that you consult with a tax professional before implementing your own tax-loss harvesting strategy.

Read Also: How To File Taxes Working For Doordash

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Tax Deferral Might Not Always Be A Good Idea

The main benefit of tax-loss harvesting is that it defers taxation on investment gains. Tax deferral can be especially beneficial if you think that you will be in a lower tax bracket later down the road. Also, if tax rates get lowered in later years, even better.

However, there is always a chance that tax rates will be higher in the future. This could happen because the government raises taxes or you might be in a higher income bracket when you retire.

You May Like: Www..1040paytax.com

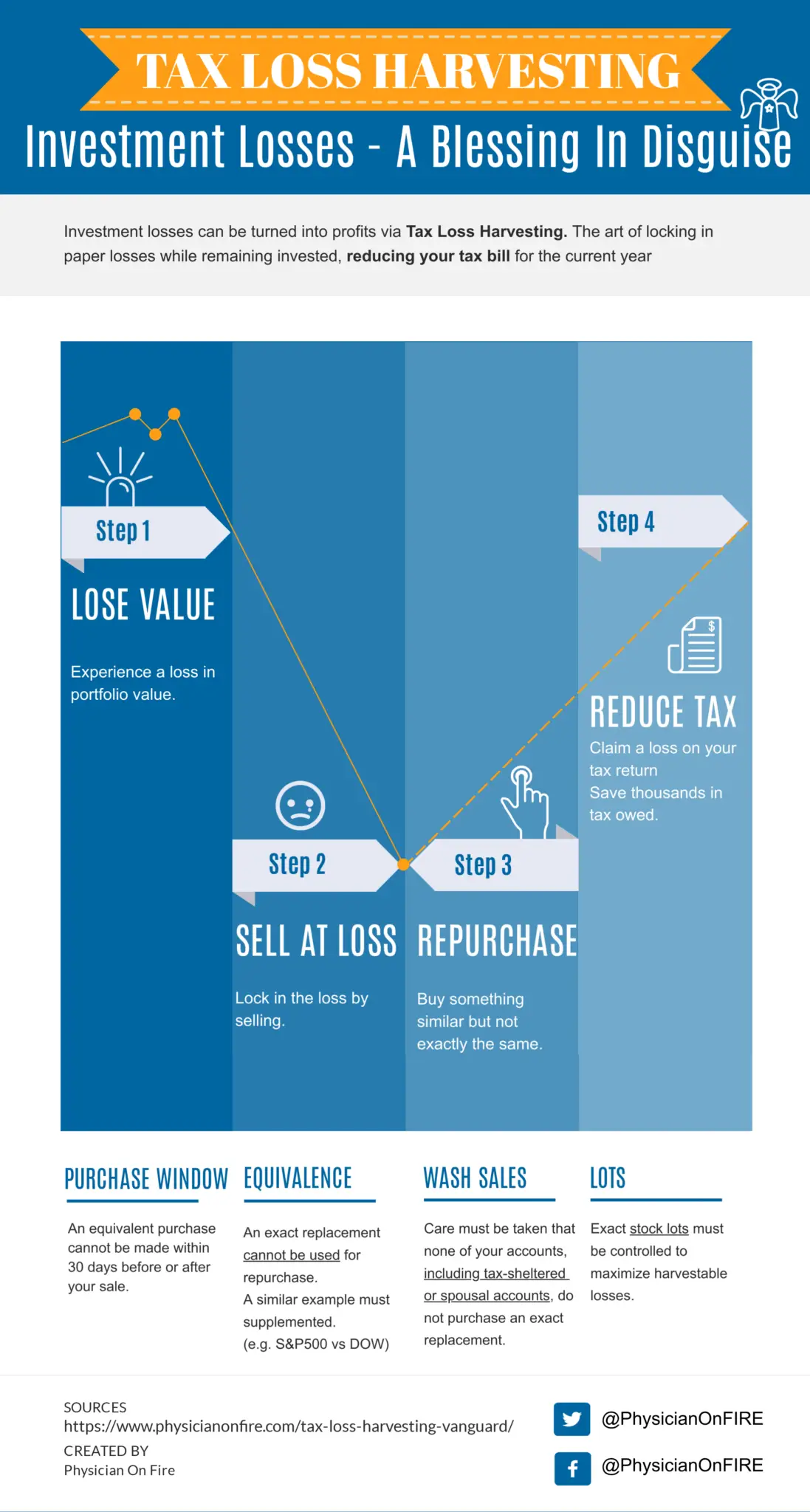

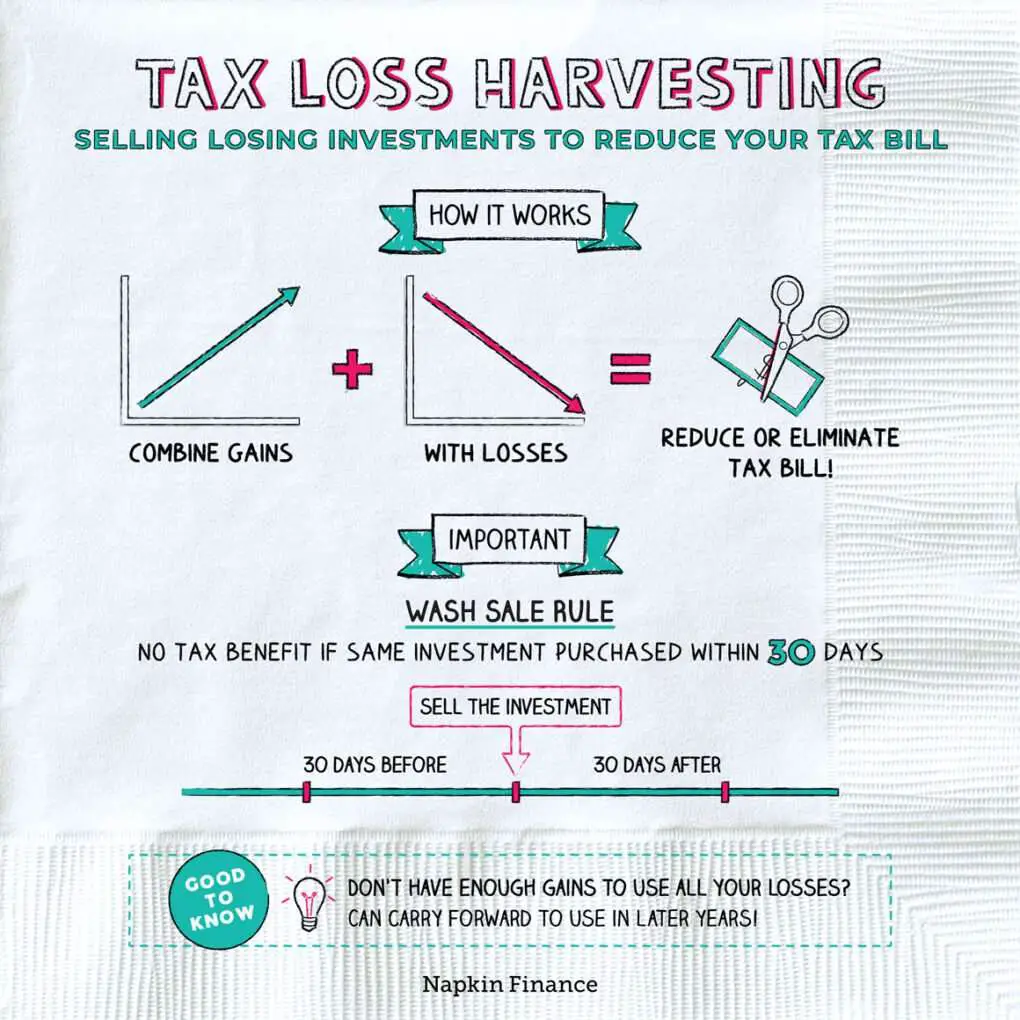

What To Know About Wash Sales

There are specific rules around tax-loss harvesting when it comes to choosing a replacement security. The IRS prohibits a wash sale, which is buying a substantially identical security within 30 days before or after selling a security at a loss.

Download our “Harvest Time” flyer for a framework to determine if you are dealing with substantially similar securities and for more tax-loss harvesting tips. It also addresses recent changes in tax law that you should keep in mind, including the CARES Act and the Tax Cuts and Jobs Act .

For more options for investors who are worried about paying higher taxes, check out our municipal bond ETF.

Tax Loss Harvesting And Iras

Now to the main question can you tax loss harvest in an IRA? Unfortunately, the simple answer is no. Tax deferred retirement accounts such as 401s and IRAs dont incur taxes in gains or dividends each year, which is necessary for tax loss harvesting. Instead, taxes are paid once distributions begin.

A Roth IRA is in a similar situation and not eligible for tax loss harvesting. Roth IRA contributions go in as after-tax funds. Gains grow in the account tax-free, so there is no benefit to tax loss harvesting.

While most brokerages can automate tax loss harvesting, for those investors with several accounts at different brokerages, working with a tax advisor can help keep track of possible tax loss harvesting transactions. Additionally, a tax advisor can help in determining which assets or accounts qualify for tax loss harvesting.

Tax loss harvesting generally applies to short-term capital gains, but may also offset long-term capital gains.

Another Way To Own Investment Properties

Read Also: How To Pay Taxes With Doordash

Does Tax Loss Harvesting Make Sense

As with almost everything in life, there are two sides to tax loss harvesting. First, there is the benefit of minimising ones capital gains tax outflows. Then there is the opinion of master investor Warren Buffett, who feels investors should think twice before selling a losing investment.

Buffett, who is the Chairman and CEO of Berkshire Hathaway, feels the strategy could end with the investor selling a good stock with strong fundamentals just because it made losses one year. In a letter to his shareholders in 1965, he wrote: What is one really trying to do in the investment world? Not pay the least taxes, although that may be a factor to be considered in achieving the end. Means and end should not be confused, however, and the end is to come away with the largest after-tax rate of compound.

But backers of tax loss harvesting say the strategy has three distinct benefits:

- Time value benefit

Is There Anything To Be Careful About

Tax loss harvesting is not possible in retirement accounts. These accounts are already taxed advantaged so you can’t benefit from further tax reductions. As we mentioned earlier, you can’t buy and sell the exact same investments and tax loss harvesting can be a little complicated if you choose to do it yourself. Since everyone’s situation is unique, it’s wise to consult a tax professional, financial advisor or have a robo-advisor do the tax loss harvesting for you.

If all this talk about tax loss harvesting has you eager to start investing, now might be a good time to join Wealthsimple. We offer state of the art technology, low fees and the kind of personalized, friendly service you might have not thought imaginable from an automated investing service. Get started investing in a matter of minutes.

Article Contents2 min read

Read Also: Doordash Filing Taxes

One Thing To Watch Out For

In order to harvest tax losses, all you have to do is sell the stock. However, you can’t simply buy back the stock immediately thereafter. In order to comply with the wash sale rules, you have to stay out of the stock for at least 30 days following the sale. If you don’t, then you can’t harvest that tax loss. But once you wait out the period, then you can buy back the stock with no tax penalty.

The wash sale rule can make it difficult to harvest tax losses from a stock that you hope to rebound. By being out of the stock for roughly a month, you might well miss out on a sizable share-price gain. However, the IRS thinks these measures are necessary to prevent abuse of the tax loss harvesting strategy.

Suffering losses in your investments is never fun, but tax loss harvesting lets you get a little of your money back from the IRS. By knowing what you have to do in order to claim those tax losses, you’ll be better prepared to cut your tax bill when tax season rolls around again.

This article is part of The Motley Fool’s Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We’d love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest, better! Email us at . Thanks — and Fool on!

How Does It Work

When an ETF in your Wealthfront portfolio declines in value, a common occurrence in broadly diversified investment portfolios, we sell that ETF at a loss if the loss meets certain thresholds established by our model. You can use the losses to offset ordinary income or investment gains, which can lower your overall tax bill.

Whats more, when we sell an ETF at a loss, we replace it with another highly correlated ETF. The result is that the risk and return profile of your portfolio is unchanged, even as Tax-Loss Harvesting can generate tax savings. These tax savings can then be reinvested to further grow the value of your portfolio.

Read our Tax-Loss Harvesting White Paper for more details.

Also Check: How Much Do I Pay In Taxes For Doordash

How Can You Work Around The Superficial Loss Rule

The superficial loss rule says you cant buy the same security within 30 days after selling it for a loss. But that doesnt mean you cant buy any security.

Savvy Canadians often sidestep the superficial loss rule by buying shares in an ETF or buying a different stock thats closely related to the stock that you sold. For instance, if you had a losing tech stock, you could still buy shares in a tech-focused ETF or in a winning tech stock. This allows you to continue exposing your money to the market, while also getting rid of stocks that arent right for your portfolio.

Smart Investors Know That Sometimes Losers Can Be Winners Heres How Tax

chesterf

Tax-loss harvesting can be useful in an array of situations, but understanding when to best utilize this strategy is key. Tax-loss harvesting is the practice of selling an investment for a loss. By realizing, or harvesting, a loss, investors can offset taxes on gains and income.

The following example illustrates the concept:

On the first day of the year, you invest $50,000 in a fund that tracks the entire U.S. stock market. The market drops approximately 20% by May 1, and as a result the value of the fund has dropped to $40,000. While few people enjoy watching the market fall, there is one potential benefit: You can sell the investment, realizing a $10,000 loss for tax purposes.

At this point, you can then purchase a different fund that tracks only the S& P 500. Per IRS rules, you must wait at least 30 days from the day the loss was realized before purchasing a substantially identical investment, but by choosing this method you can immediately purchase a fund that tracks a different index. After 30 days elapse, you may then switch back to the original investment, or continue to hold the new investment if it meets your needs.

Tax-loss harvesting has the potential to add value in a number of circumstances, but it does not make sense for every situation. Tax-loss harvesting both creates a capital loss for tax purposes in the current year and also lowers the cost basis of the investments you own.

Also Check: Is Plasma Donation Taxable Income

Wash Sales From Buying In A 401

Update: A few readers asked whether a wash sale can be triggered when, after selling an investment for a loss in a taxable account, substantially identical securities are purchased in a 401 or 403.

This answer is a bit trickier. Section 1091 of the Internal Revenue Code is the law that creates the wash sale rule. It doesnt mention retirement accounts at all. The rule about wash sales being triggered from purchases in an IRA comes from IRS Revenue Ruling 2008-5. If you read through the ruling, youll see that it speaks specifically to IRAs and does not mention 401 or other employer-sponsored retirement plans.

To the best of my knowledge, there is no official IRS ruling that speaks specifically to wash sales being created by a transaction in a 401. In other words, Im not aware of any source of legal authority that clearly says that a purchase in a 401 would trigger a wash sale.

However, in my opinion, it seems pretty clear that the line of reasoning in the above-linked revenue ruling would apply to employer-sponsored retirement plans as well as IRAs.

So, personally, I would not be comfortable taking a position on a tax return thats based on the assumption that purchases in a 401 cannot trigger a wash sale. But thats just my personal opinion. Others may disagree.

Do I Need To Pay Capital Gains Tax

You’ll only pay capital gains tax on “net gains,” which means your gains minus losses. You can use a capital loss to offset a capital gain if your gains exceed your losses. You can reduce your taxable income by the lesser of $3,000 or your total net losses if your losses exceed your gains during the tax year.

You can only reduce your taxable income by up to $1,500 in losses if you’re married and filing a separate return.

An investor can carry forward any unused losses into future tax years if net losses exceed $3,000.

You May Like: Irs Employee Lookup