What Are The Disadvantages Of Taking A Lump Sum On Your Pension

Perhaps the greatest risk of cashing out a pension early is the prospect of running out of money. With life expectancies rising, many retirees face the increasing likelihood that they may outlive their savings, especially if they are not frugal. Studies show that retirees who cash out their pensions are less likely to maintain the same levels of financial stability after five years. A monthly payment offers a steady income for the remainder of one’s life, and in some cases can also be passed on to a spouse.

How Much Tax Will I Pay On A Lump Sum

With UFPLS, you can take a series of ad hoc withdrawals from your pension fund or funds as and when you need to access the money.

For each withdrawal, the first 25% is tax-free and the remaining 75% taxed as income.

Once you cash in your pension pot, you can take up to 25% tax-free up front and the rest is taxable, see our example, above.

Can I Withdraw My Tax

In normal circumstances, no you can’t withdraw any of your pension before the age of 55 – without paying a huge tax penalty.

Any pension savings withdrawn before the age of 55 are subject to a huge 55% tax.

Watch out for companies promising early pension access.

Most of these schemes are scams, which come with fees as high as 30%, and the remainder of your fund is often invested in high risk or dubious schemes. Avoid doing this at all costs.

There are some circumstances when you may be able to take a lump sum, or indeed cash in your entire pension, earlier than 55.

If you’re in poor health, or you work in an occupation that traditionally has early retirement ages, such as athletes, you could access your money earlier.

But for most pension schemes, the earliest you can access your pension is at age 55.

Read Also: Federal Tax Id Reverse Lookup

Demographics: What Is Your Age Tenure Marital Status And Health

- Pensions provide a guaranteed lifetime income at retirement and, if elected, an income to your surviving spouse.

- Your life expectancy is a major factor in this decision. If you are in ill health or have a family history of short life expectancy, taking a lump-sum may be an attractive offer versus the income from the pension.

- Your current age is important in considering whether or not to take the lump sum. The earlier you are in your career and/or tenure with the company, the smaller your pension lump sum offer might be if it is a trivial amount you may want to consider taking the lump sum offer and investing it for your future.

Is The Deferred State Pension Lump Sum Taxable

The state pension lump sum is taxable at the rate you are currently paying.

So if you’re a basic-rate taxpayer at the time you come to withdraw the state pension lump sum, you’ll be taxed as a basic-rate taxpayer, even if the lump sum you get pushes you into a higher tax bracket.

The Department for Work and Pensions, will send you a declaration form when you come to claim, where you’ll have to say what rate of tax you currently pay.

HMRC will check this at the end of the tax year, and if two much tax has been deducted you’ll get a refund. But if you haven’t paid enough tax, you will have to make up the difference.

Also Check: Tax Preparation License

Income From More Than One Source

In later life, its common to have income from different sources. For example, you might still work part-time and have an income from one or more pensions, as well as perhaps from some savings.

If you have income from more than one source, make sure HMRC know this so you pay the right amount of tax against each income.

Your Personal Allowance will normally be allocated against your main job or pension usually the income thats more than the Personal Allowance.

If this is the case, any other income you get will all be taxed according to which tax band the other income falls into.

Details of the current tax bands for the UK are on the GOV.UK website

Your PAYE tax code will have letters against it, which tells you how much tax will be deducted from each income source.

Do you have income from different sources below the Personal Allowance ? Then ask HMRC to spread your Personal Allowance between the different sources of income to make sure you dont pay too much tax.

If you do overpay tax, you can claim this back at the end of the tax year.

Make sure you check the tax code so you know that the right amount of tax is deducted.

Not sure whether your tax code is correct? The charity the Low Incomes Tax Reform Group have more information on their website

If you continue to work and are self-employed or your total income is £100,000 or more for the tax year, youll have to fill in a Self Assessment tax return.

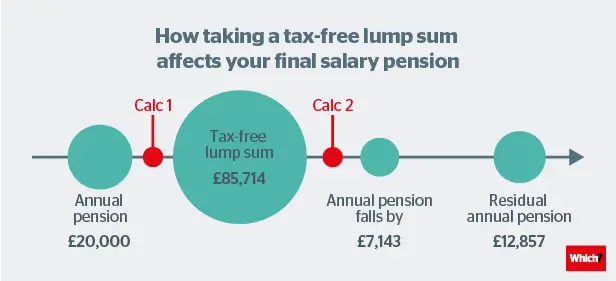

How Can I Access A Tax

If you want to take a tax-free lump sum from your pension you should speak to your pension provider to ask if you have the option to take a tax-free lump sum.

If they dont you could consider transferring your pension to another provider. Read our guide to pension transfers to find out more.

Check with your provider what fees and charges you may pay to access your lump sum and ask them about the process.

Remember, you must be over 55 in order to access your pension. Take money from your pot before then and you could face a 55% tax charge on top of penalty fees from your pension provider. If you are contacted by anyone saying they can help you access your pension early it is likely to be a pension scam.

Recommended Reading: Harris County Property Tax Protest Services

How Should I Invest My Pension Lump Sum

A lot of people ask, How should I invest my pension lump sum? There are many investment options, each with benefits and risks, but which one is best for you?

Im Ted Thomas, and for the past 30 years, Ive been involved in an alternative real estate market. This really involves investments and investors, and its a subset of the traditional real estate market. Its called tax liens and tax deeds.

Want to learn how you can make big profits from real estate? Would you like to buy homes for pennies on the dollar? Or earn double-digit interest rates? Secure your retirement. Get started today with this FREE mini classon how to prosper beyond your wildest dreams from tax liens and deeds!

HOW SHOULD I INVEST MY PENSION LUMP SUM? TAX LIENS

I know the mention of the word tax or tax lien or even the word lien for many people brings up a handful of negative thoughts. In this instance, as investors, Im discussing something very positive.

As a matter of fact, its a government-mandated and administered business that was created 200-years ago.

Currently, the tax lien and tax deed business is mandated by the state legislature. However, its administered locally by the county government under the watchful eye of the board of supervisors or the county commissioners.

HOW SHOULD I INVEST MY PENSION LUMP SUM? RETIREMENT

Today Im discussing your question, How should I invest my pension lump sum?

HOW SHOULD I INVEST MY PENSION LUMP SUM? INVESTMENT OPTIONS

Want To Know If Taking A Tax

To make sense of your pension options and get started on your journey to retirement, you can take our free no-obligation meeting.

You tell us what you want to do, you tell us your goals and aspirations, and then we start your journey to retirement.

Retirement Savings how much you need to save for retirement

Retirement Date when you can afford to stop working and start enjoying financial freedom

Retirement Income how much you can spend in retirement without worrying youll run out

So, if youre looking to make sense of pension and retirement planning options with

straightforward financial planning advice, were here to help.

Contact our friendly team on, 033 0133 3035 or use the form below to arrange a free call back from one of our experts.

Joslin Rhodes Pension & Retirement Planning Real Advice, For Real People

Joslin Rhodes Pension & Retirement Planning is authorised and regulated by the Financial Conduct Authority .

Note: Figures quoted in this article are based on tax year 2021-22

Don’t Miss: How Much Tax For Doordash

A Couple Of Questions To Ask Yourself First

Taking cash from your pension may sound appealing, but there are two questions its worth asking yourself first.

- Do you want to keep building up your pension? If you do, youll probably want to consider options 1 or 2 above. This is because if you take a taxable payment from your pension, your annual allowance will be cut to just £4,000 a year. This is known as the money purchase annual allowance and it can make it much harder to build up your savings in future. Our factsheet has more information.

- Will you still have enough for your retirement? You could have many years of retirement to look forward to, so taking out too much too early could cause problems for you down the line.

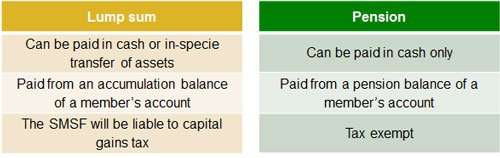

Taking A Lump Sum From A Defined Contribution Pension

A defined contribution pension is a personal or workplace pension where you build up a pension pot with contributions from you and your employer, plus any investment returns.

With this type of pension, the decision about whether to take a lump sum has traditionally been more straightforward. But its less so since recent pension reforms.

You can take up to 25% tax-free from a DC pension, which means the scheme is crystallised. This will prompt you to decide what to do with the rest of the fund:

- keep it invested in an income drawdown plan

- buy an annuity

- or cash in your entire pension, subject to tax

Before the pension changes, taking a tax-free lump sum was the only chance to get a sizeable withdrawal before the money was converted into regular annuity payments.

With more people now choosing the greater flexibility of income drawdown, theres an argument for keeping your pot intact to enable maximum future investment growth.

An alternative strategy is to use your tax-free entitlement gradually, by taking what are called ‘uncrystallised funds pension lump sums’, or UFPLS.

Recommended Reading: Doordash Payable 1099

Income Tax And National Insurance Contributions

After youve retired, you still have to pay Income Tax on any income over your Personal Allowance .

This applies to all your pension income, including the State Pension.

Many people assume that their pension income especially the State Pension will be tax-free, but thats not the case.

Some income, including your State Pension, is paid without any tax being taken off. But it doesnt mean that tax isnt due.

If you have to pay tax on your State Pension, this will usually be collected through any personal or workplace pension you might have.

National Insurance contributions are payable from the age of 16 to State Pension age. So if you continue working beyond the State Pension age, you no longer pay National Insurance contributions on your earnings.

You dont pay National Insurance on any income from a pension.

When Is A State Pension Lump Sum Taxed

The state pension lump sum is usually taxed in the year in which you stop deferring and decide to claim it. The point at which the lump sum is taxable is the tax year in which the first benefit payment date falls. This will usually be the same tax year in which you notify the DWPs Pension Service of your claim to the state pension. However, if you claim very close to the tax year end, it could be the next tax year.

For example, Richard decides to stop deferring his state pension at the end of the 2020/21 tax year and notifies the Pension Service of his claim to the state pension on 5 April 2021. He tells them that he wants to claim a lump sum for the period in which he has been deferring his claim. He is informed that the first weekly entitlement date for his state pension will be 12 April 2021. This means that his lump sum will be taxable in 2021/22 unless he claims to delay receipt of it until April 2022, in which case it will be taxable in 2022/23 . So even though Richard claimed his state pension in 2020/21, the default tax point for the lump sum is in 2021/22.

Claiming to delay receipt of a state pension lump sum to the start of the next tax year

You can choose to delay payment of the lump sum to the next tax year to the one in which you stop deferring, which means that it will then be taxed in that later year. You might choose to do that if, for example, you are a basic rate taxpayer in the year you stop deferring but will be a non-taxpayer the following year.

Recommended Reading: Appeal Taxes Cook County

Withholding Rates For Lump

Combine all lump-sum payments that you have paid or expect to pay in the calendar year when determining the composite rate to use.

Use the following lump-sum withholding rates to deduct income tax:

- 10% on amounts up to and including $5,000

- 20% on amounts over $5,000 up to and including $15,000

- 30% on amounts over $15,000

Should I Take A Lump Sum

Not all pension companies will offer UFPLS, so you will need to check with your provider to make sure it’s possible if this is your chosen option.

Some employers or pension providers may limit you to one or two lump-sum withdrawals a year, or apply a charge if you take out all your money within a set period of time.

If you go ahead and take sums from your pension in this way, the main things to consider are the tax implications and the possibility of running out of money.

Spreading withdrawals over a number of years can minimise your tax bill and mean that your tax-free entitlement is spread over several years.

Don’t Miss: Does Doordash Withhold Taxes

Tax Implications Of Lump

No income tax will be deducted from any payment to a registered retirement savings plan , locked-in retirement account , life income fund , the registered pension plan of a new employer or a life insurance company to purchase a deferred lifetime annuity.

Any payment not transferred to an RRSP, LIRA, LIF or RPP will have income tax deducted. Tax is deducted at the following rates for Canadian residents, where applicable:

- 10 per cent for payments of $5,000 or less

- 20 per cent for payments of $5,000.01 to $15,000

- 30 per cent for payments of $15,000.01 or more

If you are not a Canadian resident at the time of the lump-sum payment, the amount of tax withheld is based on the country of residency .

The above flat rates are set by the Canada Revenue Agency. These rates do not represent the actual tax that you may owe, which is calculated based on your personal tax rate when you file your tax return for the year in which you receive the lump-sum payment.

How Can I Avoid Paying Tax On My Pension

The way to avoid paying too much tax on your pension income is to aim to take only the amount you need in each tax year. Put simply, the lower you can keep your income, the less tax you will pay.

Of course, you should take as much income as you need to live comfortably. But unlike when taking a salary theres less advantage to having more income than you need and putting it into savings. In most cases, its best to leave money inside your pension until you are sure you are going to spend it.

This is where it can be an advantage to use a drawdown scheme. Drawdown lets you vary your income from year to year, which can potentially lead to tax savings. For example, if in one year you spend £25,000 but in the next year you only need to spend £20,000, you will save £1,000 in tax if you draw down only as much as you need. However, if you draw the same income but end up not spending it, youll have wasted that £1,000.

If you have an annuity, you wont have this flexibility, as your annuity income will be at least the same every year. However, drawdown comes with its own set of risks. Talk to an IFA about which option is better for you.

Don’t Miss: 1040paytax Irs

Pension Or Lump Sum: Which Should You Choose

Traditional pensions, which promise lifetime income payments in retirement, have become less common in the private sector, with only about 10% of workers currently participating in a traditional pension plan. However, pensions are still widely offered in federal, state, and local government employment, and 61% of workers expect a pension to be a major or minor source of retirement income.1

About half of pension plan participants can choose to take their money in a lump sum when they retire.2 In addition, companies may offer pension buyouts to vested former employees who are working elsewhere, and even to retirees who are already receiving pension payments.

A Critical Decision

For most workers, there are clear mathematical and psychological advantages to keeping the pension. However, a lump sum could provide financial flexibility that may benefit some families. The prospect of a large check might be tempting, but cashing out a pension could have costly repercussions for your retirement. One study found that one out of five people who took a lump sum depleted the money within five and a half years, and an additional 35% were concerned that the money would run out.3

Given the risks, its important to have a long-term perspective and consider the following factors when a sizable lump-sum offer is on the table.

Fewer Active Participants

Participants in single-employer pension plans, by status

Continue Reading