Income Tax Rates And Bands

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of £12,570.

Income tax bands are different if you live in Scotland.

| Band | |

|---|---|

| over £150,000 | 45% |

You can also see the rates and bands without the Personal Allowance. You do not get a Personal Allowance on taxable income over £125,140.

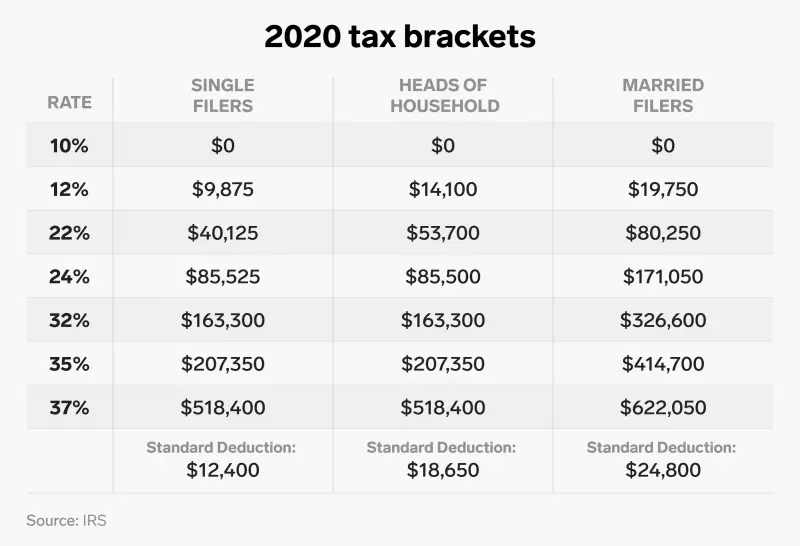

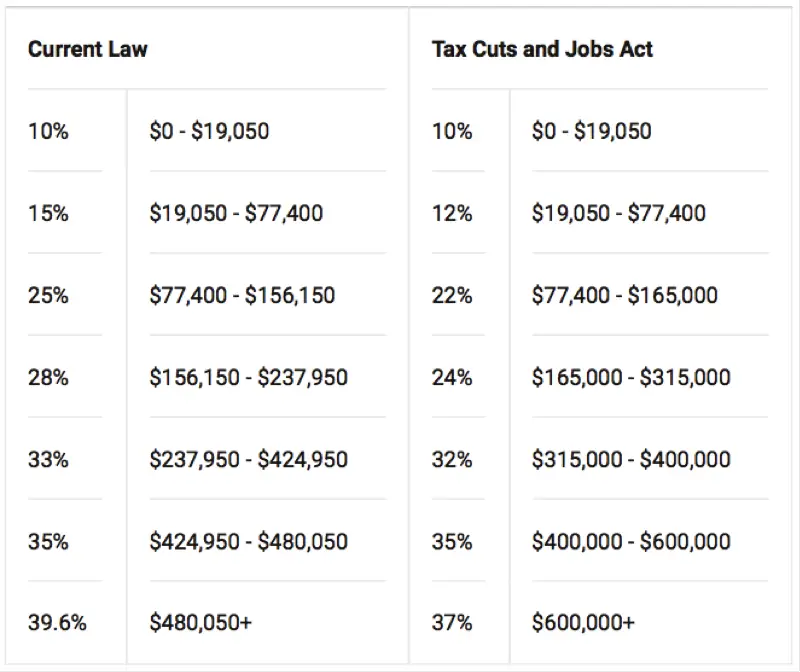

Types Of Federal Tax Brackets

There are four complete sets of tax brackets for different filing types, each with different bracket widths. These bracket types allow taxpayers filing as Married Filing Jointly or Head of Household to pay less in taxes by widening each tax bracket’s width.

Some individuals may have to follow a special tax structure not listed here, such as the Alternative Minimum Tax for certain high-income taxpayers.

How Canadas Progressive Tax System Works

The Canadian tax system is a progressive system which means low-income earners are taxed at a lower percentage than high-income earners the more money you make, the more taxes you pay.

In Canada, taxpayers pay income tax to the federal government and to the government of the province/territory where they reside. In all provinces/territories, except Québec, the federal government collects the provincial/territorial tax and gives it back to them in the form of various programs. Québec collects and manages its own income tax.

We at TurboTax want to ensure you have all of the information you need to file your taxes, either on your own, or with some help from us.

For a further explanation of tax brackets and rates, see this CRA link.

Read Also: Do I Have To Pay Taxes On Doordash

Tax Brackets Vs Tax Rates

As with most things involving the federal government, the terminology around taxes tends to be more confusing than it needs to be. When you boil it all down, heres how you tell the difference between tax bracket and tax rate:

- A tax bracket is a range of income taxed at a specific rate.

- A tax rate is the actual percentage youre taxed based on your income.

Its actually simpler than it sounds.

Tax Brackets In Switzerland

Personal income tax is progressive in nature. The total rate does not usually exceed 40%.

The Swiss Federal Tax Administration website provides a broad outline of the Swiss tax system, and full details and tax tables are available in PDF documents.

The complexity of the system is partly because the Confederation, the 26 Cantons that make up the federation,and about 2 900 communes levy their own taxes based on the Federal Constitution and 26 Cantonal Constitutions.

You May Like: Irs Taxes Due

Australian Income Tax Rates For 202021 And 202122

| Income thresholds | Tax payable on this income |

|---|---|

| $0 $18,200 | |

| 19c for each $1 over $18,200 | |

| $45,001 $120,000 | $5,092 plus 32.5c for each $1 over $45,000 |

| $120,001 $180,000 | $29,467 plus 37c for each $1 over $120,000 |

| $180,001 and over | $51,667 plus 45c for each $1 over $180,000 |

Note: These rates do not include the Medicare levy of 2%.

Note: The Low Income Tax Offset and Low and Middle Income Tax Offset can further lower your income tax if you earn less than $66,667 or $126,000 .

Background: In the 2018, 2019 and 2020 Federal Budgets, the government announced packages of income tax cuts, including the introduction of the new Low and Middle Income Tax Offset and changes to most tax brackets.

We have summarised the tax bracket changes for recent and future years in the following table:

Compare super funds

How Federal Tax Brackets Work

Tax brackets are not as intuitive as they seem because most taxpayers have to look at more than one bracket to know their effective tax rate.

Instead of looking at what tax bracket you fall in based on your income, determine how many individual tax brackets you overlap based on your gross income.

Figuring that out is easier in practice:

- Example one: Say youre a single individual who earned $40,000 of taxable income in the 2021 tax year. Technically, youd be aligned in the 12% tax bracket, but your income wouldnt be levied a 12% rate across the board. Instead, you would follow the tax bracket up on the scale, paying 10% on the first $9,950 of your income and then 12% on the next chunk of your income between $9,951 and $40,525. Because you dont make above $40,525, none of your income would be hit at the 22% rate.

That often amounts into Americans being charged a rate thats smaller than their individual federal income tax bracket, known as their effective tax rate.

- Example two: Say youre a single individual in 2021 who earned $70,000 of taxable income. You would pay 10% on the first $9,950 of your earnings then 12% on the chunk of earnings from $9,951 to $40,525 , then 22% on the remaining income

- Your total tax bill would be $11,148.50. Divide that by your earnings of $70,000 and you get an effective tax rate of roughly 16%, which is lower than the 22% bracket youre in.

Recommended Reading: Do You Have To File Taxes If You Do Doordash

How Will The New Monthly Child Tax Credit Payments Work

The monthly payments will start on July 15 and will continue through the end of the year. Since the monthly payments will provide only half the years credit, taxpayers can claim the remaining amount on their 2021 tax return when they file in 2022.

Earlier this year, the IRS announced it would roll out a portal for taxpayers to opt in for the payments. However, the IRS more recently announced the monthly child tax credit payments will be sent automatically, and most taxpayers will not need to take any action. The only people who will need to take action are those who do not want to receive the advance payments and taxpayers who had changes to their income, filing status or number of children. The IRS has not yet released additional details about when taxpayers can make these changes.

The monthly child tax credit payments will be paid through direct deposit, paper check or debit cards. The IRS hopes to send most payments through direct deposit to ensure payments are timely, fast and secure.

Individuals who qualify will receive a monthly payment of $300 for each child under the age of 6, and $250 per month for each child age 6 through 17. A family that qualifies for the full credit with two children ages 5 and 3 would receive a monthly payment of $600.

Is Tax Higher In Uk Or Usa

If you are paying income tax in the UK, it is whether you are paying the basic rate, higher rate, or the additional rate. Typically, income tax in the United States is imposed jointly by the state, city, and federal governments, which typically range from 20 to 30%. Additionally, UK companies tend to be cheaper than their international counterparts.

Read Also: Paying Taxes For Doordash

Tax Rates For Previous Years

To find income tax rates from previous years, see the Income Tax Package for that year. For 2018 and previous tax years, you can find the federal tax rates on Schedule 1. For 2019, 2020 and later tax years, you can find the federal tax rates on the Income Tax and Benefit Return. You will find the provincial or territorial tax rates on Form 428 for the respective province or territory . To find the Quebec provincial tax rates, go to Income tax return, schedules and guide .

How To Calculate Your 2021 Federal Income Tax

If youre looking at that table and thinking, What in the world does any of this mean?dont worry! The first thing to remember is that the rates on the table only apply to your taxable income. So take out deductions before you start doing the math.

Heres an example: Lets say youre a single filer who made $60,000 this year and are taking the standard deduction of $12,550. Youd first subtract the $12,550 from $60,000, leaving you $47,450 of taxable income. That means only $47,450 is going to be taxed. Yeah, baby!

Now if you give that tax chart another look, youll notice $47,450 falls into the 22% bracket. But the whole amount isnt going to be taxed at 22%just a portion of it. Heres how it breaks down:

2021 Tax Brackets on $47,450 of Taxable Income

|

Tax Bracket |

|

|

Total Taxes Due |

$6,187.50 |

And remember that these are the federal income tax rates. Some states might have either a flat income tax, different tax brackets, or no income tax at all.

Oh, and dont forget to claim any tax credits you might be eligible for after you find out how much you owe in taxes! Tax credits are extremely valuable, because they lower your tax bill dollar for dollar.

For example, the child tax credit allows taxpayers to claim up to $3,600 per qualified child. So in the scenario above, if you had one child under 6 years old, you could claim that credit and knock your tax bill down to $2,587.50 . This is assuming you chose not to receive child tax credit payments in advance in 2021 .3

Don’t Miss: How To Get 1099 From Doordash

The Irs Will Use Your 2019 Or 2020 Tax Return To Determine Your Eligibility For The Expanded Ctc

Your eligibility for the new child tax credit will be based on your 2019 or 2020 tax returnwhichever is the most recent on file when the IRS starts distributing funds. Even if you did not earn any income, the IRS encourages you to file a tax return. This will ensure you receive your monthly child tax credit payments.

Since the IRS is using your 2019 or 2020 tax return, you may not qualify for the advanced monthly child tax credit payment when you file your 2021 tax return in 2022. In this case, you may be required to repay some or all of the credit to the IRS.

For this reason, the American Rescue Plan Act includes a safe-harbor rule for households whose 2021 MAGI is less than $40,000 for single filers and $60,000 for married couples. If you meet these thresholds, you wont have to repay any overpayment of the credit when filing your tax return.

The Tax Brackets In Canada For 2020 Broken Down By Province Too

By Sanjeevan Kandasamy on November 16, 2020

This guide breaks down the different tax brackets in Canada and the tax rates, and why knowing these numbers will help you be prepared for filing your income tax return.

As we head toward the end of a year in which many Canadians incomes were erratic, its important for taxpayers to find out which provincial and federal tax brackets they fall into. Why? Understanding where you fit will help you estimate how much tax you owe on your 2020 income, while you still have a few months to save up before outstanding payments are due in the spring.

Your tax bracket lets you know the percentage of taxes you could pay on the next dollar you earn, says Andrew Zakharia, an accountant and founder of AZ Accounting Firm in Toronto.

Simply put, tax brackets outline how much tax each of us should pay, based on our annual income. In Canada we have whats called a progressive tax system, which means the more money you make, the more you are expected to contribute to taxes, says Zakharia. So, instead of everyone paying a flat percentage of their income in taxes, those with low incomes pay a smaller percentage, with rates progressively increasing for higher income earners.

Also Check: How To Get Your 1099 From Doordash

Understanding Canadas Personal Income Tax Brackets

Tax rates apply to personal income earned between predetermined minimum and maximum amounts, also referred to as tax brackets.

Knowing where your income falls within the tax brackets can help you make decisions about when and how to claim certain deductions and credits. By understanding which tax bracket you are currently in, it can also help you understand changes in your income taxes if, for example, you start a side-gig or have other extra income that pushes you into the next bracket.

When youre preparing your income taxes this year, this could explain why you have taxes owing or your refund amount is different than what it was last year.

It is important to note that these rates apply to taxable income, which is your Total Income from Line 15000 less any deductions you may be entitled to.

Remember, all provinces and territories also have their own tax brackets. When using the tax brackets and your annual earnings to make contribution decisions, make sure to also consider the tax rates for the province where you reside.

What Is Taxable Income

Taxable income is the amount of income you report to the IRS after taking all tax deductions, exemptions, and standard deductions on the tax return. The gross income minus all deductions and exemptions are the amounts used to calculate how much tax liability you owe for the tax year.

Knowing how much income and deductions you can claim during the year can help estimate your tax refund or liability. In addition, specific tax planning strategies such as investments in IRA or 401 can be used to minimize the tax burden.

The current IRS Federal income tax brackets above should be used to figure out your taxable income. In general, the more income you have, the higher your tax liability.

Also Check: How To File Taxes From Doordash

Example Of Tax Brackets

Below is an example of marginal tax rates for a single filer based on 2021 tax rates.

- Single filers with less than $9,950 in taxable income are subject to a 10% income tax rate .

- Single filers who earn more than $9,950 will have the first $9,950 taxed at 10%, but earnings beyond the first bracket and up to $40,525 will pay a 12% rate .

- Earnings from $40,525 to $86,375 are taxed at 22%, the third bracket.

Consider the following tax responsibility for a single filer with a taxable income of $50,000 in 2021:

- The first $9,950 is taxed at 10%: $9,875 × 0.10 = $995.00

- Then $9,950 to $40,525, or $30,575, is taxed at 12%: $30,250 × 0.12 = $3,669

- Finally, the top $9,475 is taxed at 22%: $9,475 × 0.22 = $2,084.50

Add the taxes owed in each of the brackets:

- Total taxes: $995.00 + $3,669+ $2,084.50 = $6,748.50

The individuals effective tax rate is approximately 13.5% of income:

- Divide total taxes by annual earnings: $6,748.50/$50,000 = .1350

- Multiply .1350 x 100 to convert to a percentage, which yields 13.50%.

Did Tax Tables Change For 2022

Yes. Each year, the IRS adjusts the tax brackets to account for inflation. Below are the income thresholds for tax year 2022.

The top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 . Below are the other rates:

- 35%, for incomes over $215,950

- 32% for incomes over $170,050

- 24% for incomes over $89,075

- 22% for incomes over $41,775

- 12% for incomes over $10,275 .

The lowest rate is 10% for incomes of single individuals with incomes of $10,275 or less .

Recommended Reading: Paying Taxes With Doordash

Pros And Cons Of Tax Brackets

Tax bracketsand the progressive tax system that they createcontrast with a flat tax structure, in which all individuals are taxed at the same rate, regardless of their income levels.

-

Higher-income individuals are more able to pay income taxes and keep a good living standard.

-

Low-income individuals pay less, leaving them more to support themselves.

-

Tax deductions and credits give high-income individuals tax relief, while rewarding useful behavior, such as donating to charity.

-

Wealthy people end up paying a disproportionate amount of taxes.

-

Brackets make the wealthy focus on finding tax loopholes that result in many underpaying their taxes, depriving the government of revenue.

-

Progressive taxation leads to reduced personal savings.

Federal Tax Brackets Chart

Here are the 2021 tax rates and brackets organized by filing status:

Single

Your tax bracket is incredibly important because its the pivotal piece of information that defines your taxes. Therefore, you must know which tax bracket you fall into so you know which percentage youll be paying from your income and which segments of your income fall into which bracket.

The United States Internal Revenue Service uses a tax bracket system. The tax rate increases as the level of taxable income increases. The 2021 tax rate ranges from 10% to 37%. Use this tax bracket calculator to discover which bracket you fall in.

Being in a higher tax bracket doesnt mean all your income is taxed at that rate. The tax bracket rate is a marginal tax each level of income is taxed at its own bracket rate as opposed to the total income being taxed at the highest tax rate, which is a common misconception. So although your income may fall in a higher tax bracket, your effective tax rate is much lower.

Read Also: How To File Taxes For Doordash