Irs Balance Or Refund On Taxes

The first step in finding out if you will owe the IRS or get a refund is to determine your income for the year. Gather all your income documentation and your spouses as well if youre filing jointly. This includes your gross income from any work you do, income thats reported on a Form 1099, any unemployment compensation youve received and any distributions from a retirement account. Any income needs to be included, such as interest youve earned on investments or other accounts. Add all this up to determine your gross income.

Fortunately, your gross income is not the basis for your taxes. The IRS bases your tax rate on your adjusted gross income. To find your AGI, subtract allowable expenses. These include educator expenses, moving expenses in some circumstances, contributions to a traditional IRA and student loan interest deductions. You can find details about allowable expenses in the instructions for Form 1040. Once you subtract these items, you have your AGI.

Once you have your AGI, you can subtract either your itemized deductions or your standard deduction. Itemized deductions include business expenses and medical expenses, while your standard deduction is a flat rate based on your filing status. For example, the standard deduction for a single filer in 2017 was $6,350. You may want to figure out both and use whichever is higher to find your tax rate.

How Much Do I Owe In Taxes To The Irs 3 Ways To Find Out

If you owe tax to the IRS but arent sure how much you owe, there are a few ways to find out. You can do that online, over the phone, or through the mail. The most reliable ways are over the phone or by using the online tool offered by the IRS since mail you receive from the IRS may not contain total balances for all years or mail could have been lost. Here are the details.

If You Cannot Pay In Full

If you are not able to pay the full amount:

- file on time to avoid paying a late-filing penalty

- make a partial payment to reduce the amount of interest you need to pay on unpaid amounts

You can set up a payment arrangement to give yourself more time and flexibility to repay what you owe. For details: Arrange to pay your personal debt over time

If you are unable to pay, you can discuss your options with the CRA.

Recommended Reading: Doordash 1099-nec Schedule C

Plan For Tax On Your Small Business

Self-employed individuals have special challenges paying enough income tax through the year.

Their income may be sporadic, and it can be difficult to know how much they will owe in taxes after business deductions.

And no one deducts tax from their pay. Naturally, its harder to find money for taxes than it is to have it deducted from a persons pay in the first place.

The only way self-employed taxpayers can be sure they are setting aside enough money for taxes is to maintain good records throughout the year.

Once a quarter, calculate your net income and estimate the amount you owe in taxes. Dont forget self-employment tax.

If you have trouble making your estimated tax payments, consider opening another bank account just for taxes.

Every time you deposit money into your business checking account, transfer the appropriate amount to the tax account.

Then, consider that money untouchable for anything but your federal taxes.

Now That I Know How Much I Owe How Do I Pay

The next step after finding how much you owe to the IRS is to make a payment. In some cases though, It might be difficult to pay the amount needed probably because the accumulated amount is too high, or maybe for reasons. In this case, there are also several options to settle your tax debt if you find it difficult to pay the IRS with the amount theyre asking from you. We do recommend consulting with a tax attorney before making any of the below decisions unless you can already pay it off easily.

Also Check: Taxes For Doordash

What If I Can’t Pay My Taxes

- Receive monthly installments. If you haven’t paid your taxes, but think you’ll be able to catch up at some point, this is probably the most attractive option.

- Request a compromise proposal. This is the second approach the IRS recommends when the taxpayer simply can’t pay what they owe.

- Send and don’t pay or pay in part

California estate taxDoes California have an estate tax? Property taxes are paid if the property is owned prior to payment of the property. There is no estate tax in California, so the estate is generally used to verify the validity of a will and confirm who the executor will be.Does California have an inheritance tax?As with most states, California has no estate taxes. If you are receiving money from a relative who lived in another state, check tha

Using The Mail To Find Out How Much You Owe The Irs

If you have a copy of the latest notice mailed to you by the IRS, you can check that for your balance. Note that the amount shown does not include any interest or penalties assessed since the notice was sent. Also, many times the IRS will send notices that only contain one year of taxes owed, so if you owe taxes for multiple years it is likely that you will need to add up the balances on all of the notices . To get up-to-date information, you need to check online or by calling the IRS.

Recommended Reading: Michigan Gov Collectionseservice

Exceptions To Underpayment Of Tax Penalties

If you underpaid your taxes this year but owed considerably less last year, you typically dont pay a penalty for underpayment of tax if you withheld at least as much as you owed last year. That, of course, is only true if you pay by the due date this year.

TaxAct can help determine if the safe harbor rule reduces your penalties and interest. Simply enter last years tax liability and the software will do the calculations for you.

You may also reduce your penalties and interest using the annualized income method if you received more of your income in the latter part of the year.

Can I Apply A 2020 Return Overpayment To 2021 Taxes

For the latest developments, see Fiscal Year 2021 Publication 505, Withholding Taxes and Estimated Taxes and Choosing to Apply Overpaid 2020 from a payment made on May 17, requesting deferral of estimated taxes from 2021. Taxes must be paid when income is generated or earned during the year in the form of tax deductions or estimated tax payments.

Is private school tuition tax deductibleCan you deduct college tuition? It is no longer possible to deduct tuition fees. However, you can still cover your tuition with other deductions, such as the US tax credit and the student lifetime discount. Graduates can also withhold the interest they pay on student loans.Can You claim private school on taxes?There are no federal student loans or deductions for private elementary

You May Like: File Amended Tax Return Online Free

What To Do When You Owe State Taxes Can You Make Payments

What to do if you owe government taxes 1 Pay your taxes directly. If you pay your assessment notice when filing your tax return, there are no penalties or interest. 2 Receive installment payments. If you can’t pay your taxes in full, your state can provide you with an installment plan. Accept 3 installments. 4 Proposal for a compromise.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Read Also: When Does Doordash Send 1099

Fill Out A Sample Tax Return

Another option is to complete a sample tax return for the year, by either using tax software or downloading the forms you need from the IRS website and filling them out by hand.

This method should give you the most accurate picture of your annual tax liability.

If youre using last years tax software or IRS forms, make sure that there havent been significant changes to the rules or the tax rates that would affect your situation.

How To Get The Most Money Back On Your Tax Return

How Do I Check My Irs Balance

IRS online tool to check your account balance. You can check your balance online when you sign up for an IRS online services account. Visit your local IRS office to check your tax balance. You must visit the IRS website to find the nearest IRS office. Call the IRS to find out how much you owe. You can call the IRS at 18008291040 to find out how much you owe. IRS telephone assistance is available at 7 IRS Mailing: How to Check Your Mail Balance. Save all IRS tax notices you receive. Hire a tax professional to determine how much you owe the IRS.

Also Check: Is Donating Plasma Taxable

Video: Why Would I Owe Federal Taxes

OVERVIEW

Why would you owe federal taxes even though your employer withholds taxes from your paycheck throughout the year? Learn how the number of allowances you claim can affect your balance with the IRS on April 15th in this video on tax basics.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Individual Income Tax Return Payment Options

Use these options if you’re paying after you’ve filed your return. You can also pay at the time of filing through approved electronic filing options, and schedule your payment for any day up to the filing deadline.

Online, directly from your bank account

- Log in to your online services account.

- Dont have an account? Create one now.

Not ready to create an account?

You can pay using eForms.

- Individual return payment: 760PMT eForm

- Qualifying farmers, fishermen, and merchant seamen: 760PFF eForm

Make a return payment through Paymentus. A service fee is added to each payment you make with your card.

Check or money order

Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to:

Virginia Department of Taxation

Include your Social Security number and the tax period for the payment on the check.

Qualifying farmers, fishermen, and merchant seamen should use the 760-PFF voucher.

Note: If you filed a paper return with your local Commissioner, mail the voucher and check to the same place you sent your return and make the check payable to the local Treasurer.

Payment Fee – Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee . This fee is in addition to any other penalties and interest you may owe.

Don’t Miss: How Much Should I Set Aside For Taxes Doordash

Want To Know Why You Owe Taxes

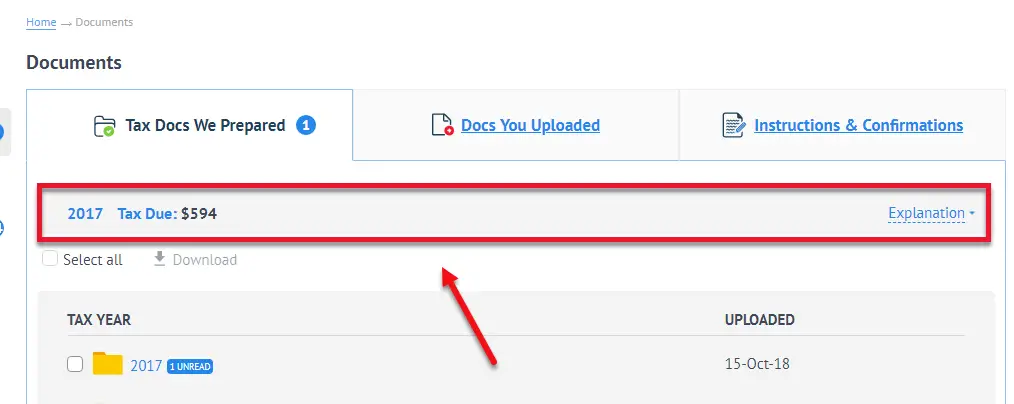

If you owe taxes well send an explanation of how much tax you owe and why you owe it. Browse to the Documents > Tax Docs We Prepared section, then click the year link.

At the top of the page, youll find your tax due for all years you’ve prepared with TFX

We always try to employ tax-saving strategies when preparing your tax documents. Click Explanation to find out which tax-saving strategies were employed, a list of reasons explaining why you owe tax, and explanation of why you owe more in taxes than you did the previous year . Click Explanation to hide the additional info.

How Do I Find Out If My State Withholds My Refund

If your refund was withheld or reduced because of a government tax liability, your name and address is most likely your government tax office. If you believe your federal tax refund is being withheld for late or late state taxes, you can contact your state tax office to find out how much is being withheld.

Read Also: 1099 Nec Doordash

Obtain Copies Of All Tax Returns That You Still Owe Taxes On

The first thing you’ll need to do is gather all of your relevant returns and documents that relate to each year you still owe back taxes for. Each of your tax returns will report the amount of tax you owe, but never paid. If you did file a return but no longer have a copy, you can obtain one from your accountant who prepared it for you or if necessary, you can order a duplicate copy from the IRS.

How Much Do I Owe The Irs 4 Ways To Find Out

No one wants to owe the Internal Revenue Service. Ideally, youd pay the exact right amount of income taxes and be on your way without a second thought. Or maybe youd just end up with a surprising but welcome tax refund once you file. But thats not always what happens.

Sometimes, an unexpected amount of back taxes can pile up. You may know you have a federal tax balance but still wonder, How much do I owe the IRS? Dont wait for those scary IRS notices to find out. We can help you figure it out, using one of four easy methods.

You May Like: Tax Lien Investing California

Most Creditors Need A Court Order To Garnish Your Wages

Unless you owe child support, back taxes, or student loans, your creditors, those to whom you owe money, cannot garnish your wages unless they first get a court order. For example, if you have defaulted on a loan, stopped paying your credit card bill, or have run up huge medical bills, your creditors cant just start garnishing your wages. They must first sue you, win, and get a court order requiring you to pay what you owe.

- Child Support and Alimony: Since 1988, all child support or alimony orders automatically include a wage withholding order. This means that if you are ordered to pay child support, your wages may be garnished without additional court action.

- Unpaid Income Taxes: If you owe back taxes to the IRS or your state and local governments, your wages can be garnished without having to obtain a court order against you. Just how much they can garnish depends on the number of dependents you have, your deduction amounts, and state law regarding wage garnishment limits.

- Student Loans: If you are behind on your federal student loan payments, the U.S. Department of Education can garnish your wages without a court order, which is referred to as administrative garnishment.

How Will I Know Why I Owe The Irs

Youve now read the answer to why do I owe money on my tax return? and more specifically, why do I owe taxes for 2020 returns?

As part of our commitment to keeping you informed, H& R Block is here to help you understand what could affect your refund or if youll owe tax.

- If you use our online tax filing options, youll be able to see your refund results in real time. Plus, we explain why your results move up or down.

- If you visit one of our tax offices, your tax pro can walk you through each credit and deduction to explain how it affects your refund.

Related Topics

Learn the tax implications of the first time home buyer tax credit and if you need to repay it from the tax experts from H& R Block.

Don’t Miss: Doordash Payable Account

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

How To Check Your Irs Tax Balance And Pay Back Taxes

At Solvable, we care about your financial well-being and are here to help. Our research, articles and ratings, and assessments are based strict editorial integrity. Our company gets compensated by partners who appear on our website. Here isSee More

- You can check your IRS tax balance online, over the phone, or by mail.

- Youll need to call or log in for the most up-to-date balance information.

- You can pay the amount due immediately or request a payment plan.

Whether you suspect that you owe the Internal Revenue Service a payment or you arent sure how to pay past-due tax bills, its important to address your IRS tax balance before it gets out of hand. Find out how to check what you owe and learn how to pay your IRS tax balance.

Read Also: Doordash Tax Percentage