Do You Ever Pay An Inheritance Tax In Oklahoma

April 18, 2017 by Larry Parman, Attorney at Law

If you inherit property in Oklahoma, or if you are leaving property to a loved one within this state, it is important to understand the rules for inheritance tax in Oklahoma. While the state does not impose an inheritance tax, or an estate tax, this does not mean that no taxes are assessed as a result of a death. You should talk with an experienced attorney about how best to protect your inheritance or the wealth you are leaving to loved ones so you can reduce taxes or avoid taxes altogether.

Parman & Easterday can provide invaluable assistance understanding your options for tax planning and making smart choices to protect wealth you are leaving to loved ones or that you are inheriting. To find out more about the ways you can plan for taxes connected to a death, give us a call today.

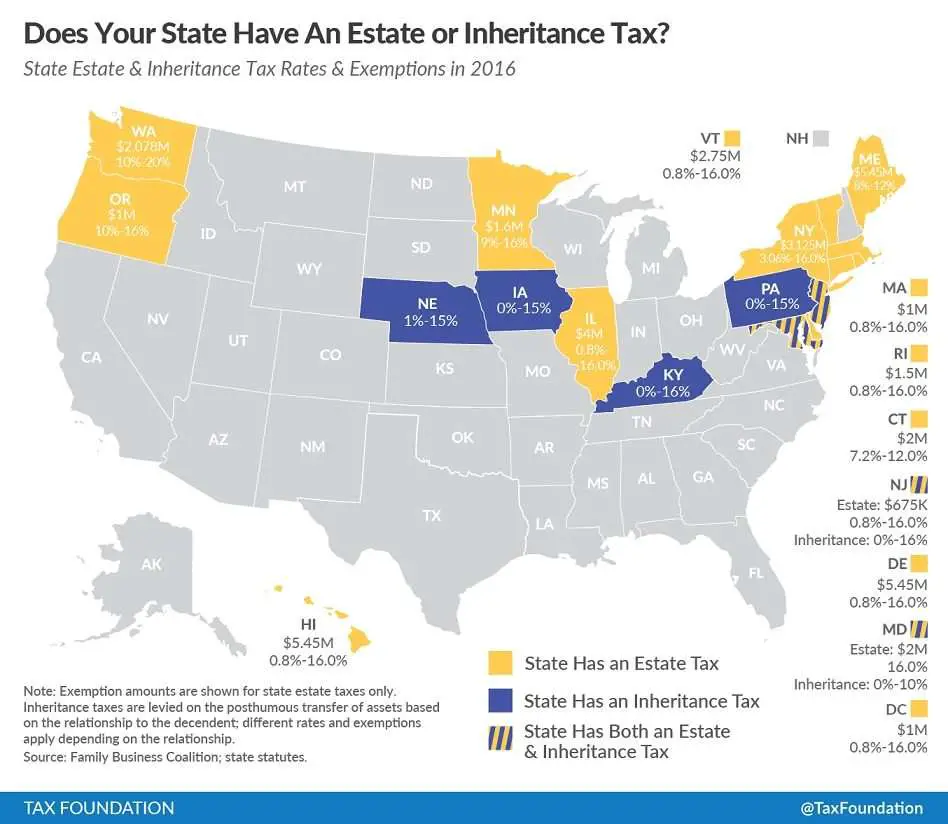

Who Has To Pay These States Have An Inheritance Tax

Inheritance tax rates differ by the state. As of 2021, the six states that charge an inheritance tax are:

- Iowa

- New Jersey and

- Pennsylvania .

Nebraska has the highest top inheritance tax rate 18 percent thats charged to nonrelative heirs. Children, however, are charged a 1 percent tax rate, while nephews and nieces get taxed at 13 percent.

Pennsylvania, meanwhile, is the only other state besides Nebraska that has decided to charge lineal heirs , with their tax rate being 4.5 percent.

An Estate Administration Lawyer Can Help You Navigate Through The Various Estate/trust Taxes

During the estate or trust administration, the personal representative of the probate estate and/or the successor trustee of a revocable trust serving as a will substitute makes decisions on how various taxes are handled. Some of the taxes are interrelated. Therefore, a decision made on one tax issue may influence the tax due on a different issue. Furthermore, the tax rates for the various taxes vary widely and it may be cheaper, for example, to pay income taxes then pay estate taxes. Thus, it is important that the person handling the estate or trust administration obtain competent counsel for guidance on these issues.

For over 35 years, the law firm of Franke Beckett LLC has concentrated on the law of estates and trusts including helping hundreds of clients with Maryland taxes during estate and trust administration. We prepare estate and trust federal and Maryland tax returns with our in-house CPA so we can offer seamless administration services from beginning to end. Our Maryland estate administration attorneys and staff have the experience, training and knowledge to guide clients through the process to ensure that the Maryland estate and trust administration is handled properly. In order to schedule a consultation, call to get in touch with our Annapolis office.

Also Check: How To Protest Property Tax Harris County

High Tax Kick Out Example

David is a high-income U.S. person who owns a rental property overseas. He received the home many years ago as a gift. When a person receives a gift there is no step-up basis. In other words, they take it at a Transfer Basis plus Gift Tax Paid.

In this example, Davids father purchased the home for $100,000. When he gifted it to David, it was worth $800,000.

When David receives the land and sells it at a later date, he will have to pay foreign Capital Gain on the difference between the basis he received it at $100,000 and sold it at

**Alternatively, if David had received it as an inheritance in a year it was worth $800,000, David, would have received a stepped-up basis value, so that his basis would be $800,000 and the resulting gain & tax liability would be significantly less.

Does An Inheritance Count As Taxable Income

For tax purposes, an inheritance isnt normally considered taxable income unless its generating frequent returns, such as a rental property or an asset that provides interest or dividend payments. It also applies to withdrawals youre taking from an inherited 401 or IRA.

You also want to watch out for capital gains taxes. If you sell any stocks, bonds, or other property that you received as part of an inheritance, capital gains taxes may apply to the profit you made.

Recommended Reading: Louisiana Payroll Calculator

Who Does Not Pay Inheritance Tax

Some gifts are exempt from Inheritance Tax.

Theres no Inheritance Tax to pay on gifts between spouses or civil partners. You can give them as much as you like during your lifetime, as long as they:

- live in the UK permanently

- are legally married or in a civil partnership with you

Theres also no Inheritance Tax to pay on any gifts you give to charities or political parties.

Inheritance Tax & Property

Since April 2017, there has been a new transferable allowance, known as the Residence Nil Rate Band , or sometimes the Additional Nil Rate Band. This is in addition to the standard Nil Rate Band.

To qualify, the person who died must have left their home, or a share of it, to their direct descendants, such as their children. A person does not have to leave the whole of the home to direct descendants.

The RNRB will gradually reduce, or taper away, for an estate worth more than £2 million.

This is a complex area of the rules and where an experienced IFA can assess your situation, and recommend a suitable course of action to make sure you leave your loved ones with as much as possible.

Don’t Miss: Do I Have To Report Plasma Donations On Taxes

At What Amount Does Inheritance Tax Kick In In The United Statesseptember 9 2004 : 51 Pm Subscribe

rainteaLaw & Governmentno taxLinkpageKwantsar8:11 PMcaddis8:25 PM> 4.7 Interest/Dividends/Other Types of Income: Gifts & InheritancesAre gifts, bequests, or inheritances taxable?Generally, property you receive as a gift, bequest, or inheritance is not included in your income. However, if property you receive this way later produces income such as interest, dividends, or rentals, that income is taxable to you.dhartung9:23 PMgokart4xmas9:28 PMcalwatch11:34 AMraintea10:35 PM« OlderNewer »

What Is The Estate Tax Rate

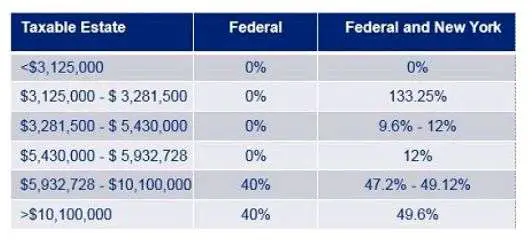

On the federal level, the portion of the estate that surpasses that $11.70 million and $12.06 million cutoffs will be taxed at a rate of 40%, as of 2021 and 2022, respectively.

Depending on where you live, the tax rate varies on the state level but 18% is the maximum rate for an inheritance that can be charged by any state.

Recommended Reading: Do I Have To Pay Taxes On Plasma Donation

Dying Without A Will In Idaho

Dying without a will isnt the best situation if what happens to your assets after your death matters to you. Idaho laws label these types of estates intestate, which means there is no will, or no valid will. The court then has to follow intestate succession laws to determine who inherits your property, and how much of it.

If there isnt a will, the court will appoint someone, usually an adult child or surviving spouse, to be the executor, commonly known as the personal representative. It is the job of the executor or personal representative to protect the decedents property until taxes and debts, if any, have been paid, and then transfer what is left to the heirs.

Although there are often extenuating factors when someone dies intestate, but its best not to die intestate and put your loved ones through that kind of stress. If youre not sure what kind of estate plan you want to make, you can seek the help of a financial advisor specializing in legacy planning.

Comparison With Estate Tax

The key difference between estate and inheritance taxes lies in who is responsible for paying it.

- An estate tax is levied on the total value of a deceased person’s money and property and is paid out of the decedents assets before any distribution to beneficiaries.

- However, before an inheritance tax is due, the value of the assets must exceed certain thresholds that change each year, but generally its at least $1 million. Because of this threshold, only about 2% of taxpayers will ever encounter this tax.

Recommended Reading: Wheres My Refund Ga State

Which Turbotax Is Best For You

When a loved one has passed, all the paperwork and legal jargon can seem a little confusing or daunting to deal with. But with the right information ahead of time, you can still navigate the tax waters to file your return with TurboTax Online.

However, if you feel a bit overwhelmed, consider TurboTax Live Assist & Review and get unlimited help and advice from a real person as you do your taxes. Plus, theres a final review before you file. Or, you can choose TurboTax Live Full Service and have one of our tax experts do your return from start to finish.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Idaho Inheritance Laws: What You Should Know

Idaho has no state inheritance or estate tax. However, like all other states, it has its own inheritance laws, including the ones that cover what happens if the decedent dies without a valid will. This article goes over topics that include probate, how to successfully create a valid will in Idaho, and what happens to your property if you die without a will. If you want professional guidance for your estate planning after reading this article, or just need help investing your inheritance, its a good idea to work with a financial advisor. The SmartAsset advisor matching tool can find you a financial advisor in your area who meets your needs.

Read Also: Tsc-ind

If You Make Regular Payments

You can make regular payments to help with another persons living costs. Theres no limit to how much you can give tax free, as long as:

- you can afford the payments after meeting your usual living costs

- you pay from your regular monthly income

These are known as normal expenditure out of income. They include:

- paying rent for your child

- paying into a savings account for a child under 18

- giving financial support to an elderly relative

If youre giving gifts to the same person, you can combine a wedding gift allowance with any other allowance, except for the small gift allowance.

For example, you can give your child a regular payment of £60 a month as well as using your annual exemption of £3,000 in the same tax year.

Other Necessary Tax Filings

When you die, there are many federal and estate tax situations that need to become a priority for those who survive you. Besides the state estate tax, you need to look out for the following:

- Final individual federal and state income tax returns the federal and state tax returns are due by Tax Day of the year following the individuals death.

- Federal estate/trust income tax return due by April 15 of the year following the individuals death

- Federal estate tax return due nine months after the individuals death, though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period

- This is required only of individual estates that exceed a gross asset and prior taxable gift value of $11.58 million in 2020

To file any of these estate-based returns, youll need to apply for an employer identification number with the IRS. You can do this online, by fax or via mail.

Recommended Reading: Do I Need W2 To File Taxes

Exemptions From Inheritance Tax

You do not pay inheritance tax on a surviving dependants pension or state pension. The surviving dependants pension, however, is deducted from the partners exemption. In certain special situations you pay less or no inheritance tax. Contact the Tax and Customs Administration for more information.

Ways To Cut Your Tax Bill Including Giving Money Away

Money given away before you die is still usually counted as part of your estate, UNLESS you live for a further seven years or more after making the gift. People you give gifts to will be charged inheritance tax if you give away more than £325,000 in the seven years before your death therefore early planning of how to pass on your assets is important.

If you make large lifetime gifts in other words, you give gifts during your lifetime, not on your death the beneficiaries could take out life insurance against the potential inheritance tax bill. Most gifts into trust are now subject to inheritance tax even if made during your lifetime, but this is an area where you would need specialist advice.

Don’t Miss: Pastyeartax.com Review

What Is An Inheritance Tax And Do I Have To Pay It

8 Minute Read | October 18, 2021

Aunt Edna always said you were her favorite . And when she died, she left you $10,000 and her collection of Precious Moments figurines. Youd give it all up just to spend an hour chatting with her at her kitchen table.

Losing a loved one is tough, and an inheritance is little comfort when it comes to grief. But to top it all off, you might have to pay an inheritance tax.

Whether youve received an inheritance, or youre considering leaving an inheritance and wondering how taxes could affect it, well walk you through how it works.

Lets start with the basics.

How Do Inheritance Taxes Work

Now for some good news. Uncle Sam doesnt have an inheritance tax and inheritances are not considered taxable income in most casesso you won’t have to report your inheritance on your state or federal income tax return.

For example, if your father-in-law from Tennessee, a no-inheritance-tax state, leaves you $50,000, and you live in, say, New Jersey a state with an inheritance tax exemption threshold of $25,000 for children-in-law that wouldnt be considered income, and you would be free to enjoy the inheritance without worrying about taxes.4

On the other hand, lets say your father-in-law lived in New Jersey, and he left you $50,000. You would pay an inheritance tax of 11% on $25,000 when it passes to you.5

Each state is different and taxes can change at the drop of a hat, so its a good idea to check tax laws in your state, or better yet, talk to a tax pro!

Also Check: Www.michigan.gov/collectionseservice

Recent Estate Tax Legislation

During the 2012 Legislative Session the Maryland General Assembly enacted the Family Farm Preservation Act of 2012, which adds a new subsection to Title 7 of the Tax-General Article allowing for the exclusion of up to $5,000,000 of the value of qualified agricultural property from the value of the gross estate for decedents dying after December 31, 2011. The new provision also provides that the Maryland estate tax may not exceed 5% of the value of specified agricultural property exceeding $5,000,000. Maryland qualified agricultural exclusion forms may be obtained by calling the Estate Tax Unit at 260-7850.

Legislation enacted during the 2014 legislative session gradually conforms the Maryland estate tax exemption amount to the value of the unified credit under the federal estate tax, thereby increasing the amount that can be excluded for Maryland estate tax purposes. The increase in the amount that can be excluded for Maryland estate tax purposes is phased over five years and is equal to $1.5 million for a decedent dying in calendar year 2015 $2.0 million for a decedent dying in calendar year 2016 $3.0 million for a decedent dying in calendar year 2017 $4.0 million for a decedent dying in calendar year 2018 and $5.0 million for a decedent dying on or after January 1, 2019. Check the Internal Revenue Service website for information on the federal estate tax exemption.

Estate And Inheritance Taxes

Today, Virginia no longer has an estate tax* or inheritance tax.

Prior to July 1, 2007, Virginia had an estate tax that was equal to the federal credit for state death taxes. With the elimination of the federal credit, the Virginia estate tax was effectively repealed.

However, certain remainder interests are still subject to the inheritance tax. See the Virginia Estate and Inheritance Taxes section of Public Document 15-93 for more information.

Also Check: How Much Does Doordash Take In Taxes

What About Retirement Accounts And Real Estate

One important note: Someinheritances on retirement accounts or a traditional IRA) are subject to other pesky taxes, like income taxes. Retirement accounts like these can get sticky, and distributions are typically taxable. We know, its a lot, but hang in there.

Similarly, if you inherit a piece of property and sell it, you may have to pay a capital gains tax. That just means youre taxed on any profit you make above the value of the property at the time of your loved ones death and when you inherited it.

Both of these situations can get really confusing really fast, so you should get with a tax pro to make sure youre covering all your bases.

How To Minimize Estate Taxes

Keep the planning simple and the total amount of the estate below the threshold to minimize estate taxes. For most families, that’s easy. For those with estates and inheritances above the threshold, setting up trusts that facilitate the transfer of wealth can help ease the tax burden.

One way to reduce estate tax exposure is to use an intentionally defective grantor trust , which is a type of irrevocable trust that allows a trustor to isolate certain trust assets so as to separate income tax from estate tax treatment on those assets. The grantor pays income taxes on any revenue generated by the assets but the assets can grow tax-free. As such, the grantor’s beneficiaries can avoid gift taxation.

You can reduce your estate taxes if you own a life insurance policy as well. On their own, life insurance proceeds are income-tax-free at the federal level when they are paid to your beneficiary. But when the proceeds are included as part of your taxable estate for estate tax purposes, they might push your estate over the cutoff. One way to make sure that doesn’t happen is to transfer ownership of your policy to another person or entity, including the beneficiary. Another possibility is to set up an irrevocable life insurance trust .

Also Check: 1099 Nec Doordash