Why Do I Need A Sales Tax Permit

You can read more about how sales tax works here, but in general terms & depending on what you sell, getting a sales tax permit with your state is a requirement for doing business. Anytime you make a sale to a customer in your same state, you should be collecting sales tax. You then periodically remit this money to your state and/or local government.

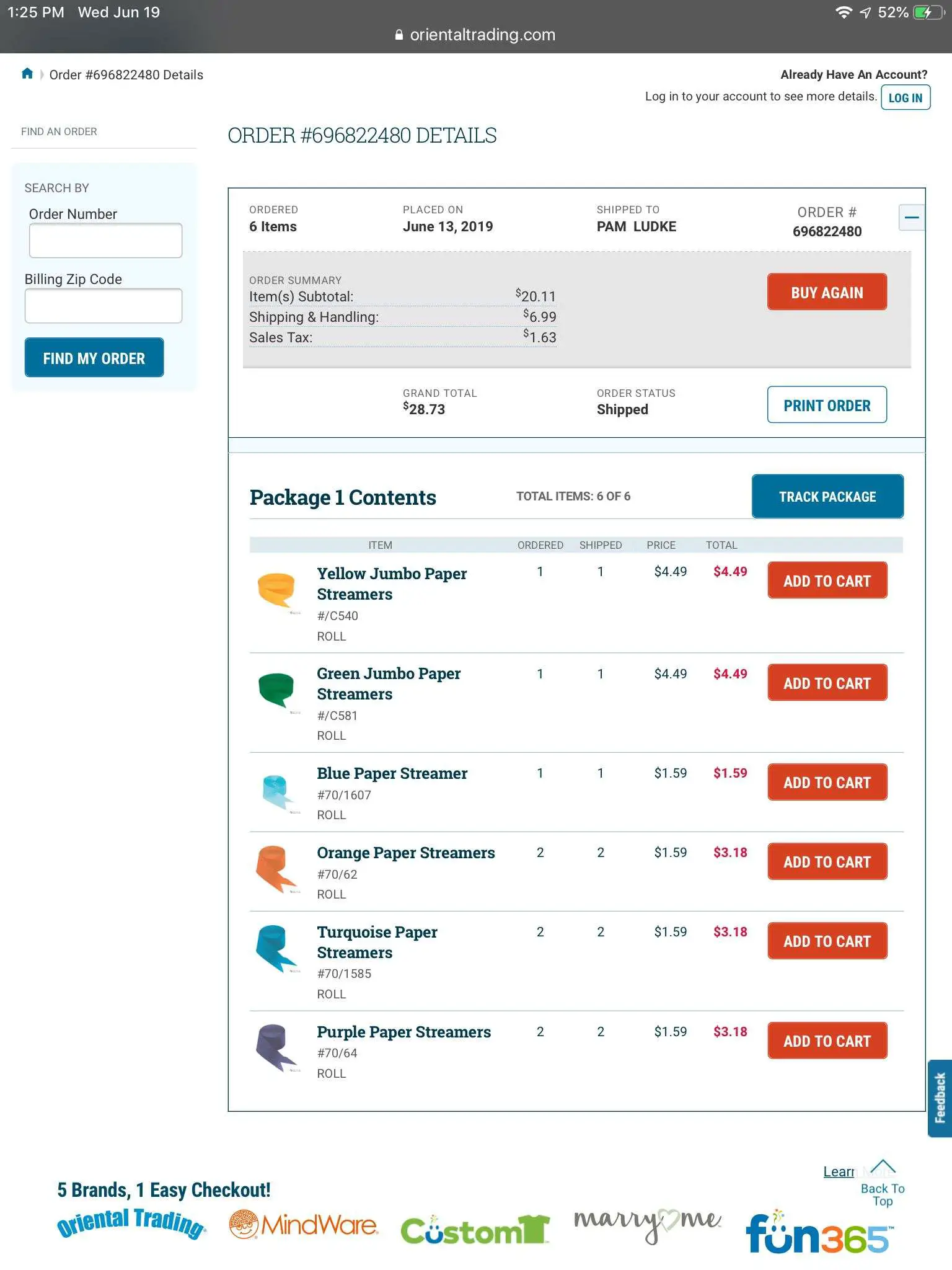

Fortunately, being known to your state government has also got its perks. If you purchase business goods or supplies from a wholesale seller, you can usually provide your sales tax ID , and you dont have to pay sales taxes on your purchase. If you want to attend a trade show or shop at certain wholesale supply websites online, you might be asked for your sales tax ID number or to show your sales tax permit.

Your sales tax ID number can sometimes be referred to as your resale or reseller number. I live in Texas and have used my sales tax ID number from my sales tax permit for every craft show Ive sold at, every trade show Ive purchased supplies at, and every wholesale website Ive purchased from for my business. However, another state-by-state caveat some states issue separate wholesale account numbers that you might use in similar situations instead.

What Is A Tax Identification Number

Have you been asked for a Tax Identification Number, and youre not sure what it is, or where to find it? Today were continuing our series of blog posts that look at some of the biggest concerns for small businesses, and since were all obligated to pay taxes as we earn money, were talking about Tax Identification Numbers .

Before we get going, we need to point out that although were experienced in business, we are not tax professionals. While weve provided information here that we know to be accurate to date, and we will endeavour to update the post when things change, you should always do due diligence and ensure what we have here is in line with current rules and regulations. It is a good idea to check with your accountant or tax professional to ensure your tax information is correct, and check with HMRC if you are unsure whether you have the right number to file your taxes.

Example Of The Sales Tax Calculation

As an example, assume that all of the items in a vending machine are subject to a sales tax of 7%. In the most recent month the vending machine receipts were $481.50. Hence, $481.50 includes the amounts received for the sales of products and the sales tax on these products. The use of algebra allows us to calculate how much of the $481.50 is the true sales amount and how much is the sales tax on those products:

Let S = the true sales of products , and let 0.07S = the sales tax on the true sales. Since the true sales + the sales tax = $481.50, we can state this as S + 0.07S = 1.07S = $481.50. We solve for S by dividing $481.50 by 1.07. The result is that the true product sales amounted to $450. The 7% of sales tax on the true sales is $31.50 . Now let’s make sure this adds up: $450 of sales of product + $31.50 of sales tax = $481.50, which was the total amount of the vending machine receipts.

Don’t Miss: How Can I Make Payments For My Taxes

Deposits And Conditional Sales

Deposits

Do not collect the GST/HST when a customer gives you a deposit towards a taxable purchase. Collect the GST/HST on the deposit when you apply it to the purchase price.

If the customer does not make the purchase and loses the deposit, the forfeited deposit is subject to the GST/HST. If the customer is a GST/HST registrant, the customer can claim an ITC for the GST/HST paid on the forfeited deposit.

Calculate the GST/HST on the forfeited deposit as follows:

- the GST is equal to the forfeited amount multiplied by 5/105 and

- the HST is equal to the forfeited amount multiplied by:

- 13/113 where the rate of 13% applies

- 14/114 where the rate of 14% applies and

- 15/115 where the rate of 15% applies.

Example

A customer gives you a deposit of $50 towards the purchase of an item that is taxable at 5% GST, but does not pay the balance owing and forfeits the deposit. We consider you to have collected the GST equal to 5/105 of the forfeited deposit. As a result, you have to include GST of $2.38 in your net tax calculation. If the customer is a GST/HST registrant, that person may be entitled to claim an ITC for the GST you collected on the forfeited deposit.

If you are in a participating province, the HST collected is equal to:

- $5.75 where the HST rate of 13% applies

- $6.14 where the HST rate of 14% applies or

- $6.52 where the HST rate of 15% applies.

Exception

These rules do not apply to deposits for returnable containers. For more information, see Returnable beverage containers.

How To Make Instalment Payments

You can make instalment payments electronically using your financial institutions online or telephone banking services. You do not need a remittance voucher to pay online.

You can also make instalment payments electronically using the My Payment option on the CRA website. My Payment allows individuals and businesses to make payments online from an account at a participating Canadian financial institution. For more information, go to My Payment.

Another online option is to authorize the CRA to withdraw a pre-determined payment from your bank account to pay tax on a specific date or dates. You can set up an agreement at My Business Account.

For more information and payment options, go to Make a payment to the Canada Revenue Agency.

Statement of interim payments

If you make instalment payments, we will send you this statement once a year to:

- confirm we received your payment

- provide your instalment credit balances by period

- show transfers in and out of your instalment account and

- show how we applied your instalment credits to assessments.

We will also send four copies of Form RC160, Interim Payments Remittance Voucher, one copy for each of your next four instalment payments.

To view the up-to-date account balance and transactions and to transfer payments, go to My Business Account, or Represent a Client.

Read Also: How Much Does H& r Block Charge To Do Taxes

Branches Or Divisions Filing Separate Returns

Although you have to register your business as a single entity, you can apply to have your branches or divisions file their own returns. To do this, use Form GST10, Application or Revocation of the Authorization to File Separate GST/HST Returns and Rebate Applications for Branches or Divisions.

To qualify, your branches or divisions have to be separately identified either by their location or by the nature of their activities, and separate records must be kept. The branches and divisions have to keep the same reporting periods as the head office.

Note

If you make this application and you are required to file electronically or you are required to file using a specific method, all of the branches or divisions identified in the election also have to file electronically.

As A Canadian Business

If you are a Canadian business, you are required to collect sales tax if your sales exceed $30,000 CAD in a single calendar quarter . Before this, you are not required to register for a GST/HST number.

Once youve exceeded sales of $30,000 in a quarter, you are obligated to register for a GST/HST number. Once youve registered, you are now required to collect tax on all following periods after as well.

Don’t Miss: Www.1040paytax

Using A Rebate Or Refund To Decrease An Amount Owing On Your Gst/hst Return

You can offset the net tax you owe on your GST/HST return with certain GST/HST rebates to which you are entitled. For more information on the types of rebates that can be applied to an amount owing on your GST/HST return, go to GST/HST.

If you file your return and rebate application together, or if you file your return electronically, remit only the difference between the amount of the rebate and the GST/HST you owe on your return. If the rebate is more than the amount of the GST/HST you owe, we will refund you the difference.

If you file your GST/HST return electronically, send the rebate application by mail to the Prince Edward Island Tax Centre or Sudbury Tax Centre as indicated on the rebate application. Some rebates can be filed electronically with your return. See How to file rebate applications for electronic returns.

If you file a paper return, write the amount of your rebate on line 111 of your return, and include your completed rebate application with the return.

Unless you are required to file electronically , you can also file two or more returns together, offsetting the net tax you owe on one return with a refund claimed on the other. For example, if your business has branches that file separate returns, you can offset your GST/HST remittance by the amount of any refund to which any of your branches are entitled. To do so, file the returns together.

How To Confirm A Gst/hst Number

The CRA is reportedly cracking down on ITCs so its important to make sure your documentation is aboveboard before submitting. Obviously, or so it would seem, you can only get an ITC from businesses that are permitted to charge HST.

Receipts from retail stores are almost never a problemif you look closely youll see that they do list their HST number at the bottom, along with the date, and good purchased.

The trouble is, some smaller companies either mistakenly charge HST, lie about their number so they can get extra cash, or give incomplete invoices.

Take the extra effort to check over each invoice from a new vendor or supplier. You dont want to have the CRA breathing down your neck because they caught you claiming an ITC from an unauthorized source

Youll want to check both that the number is authorized and the invoice is documented correctly.

A vendor invoice must have their business name spelt correctly, a description of the good/service provided, service total, HST total, and the HST number. You can easily confirm an HST account online: Just type in the number provided, the company name, and the transaction date.

Recommended Reading: Form 5498 H& r Block

Do I Need A Tin For My Dropshipping Business

All businesses will need to pay tax, and the type of business that you have, and where your business operates will depend on the type of tax that you pay, and may affect the type of Tax Identification Number that you will need. If youre in the UK, youll have a UTR for yourself, and for your business. We took a look at some of the required steps for setting up a business previously in this post, so if you are in the process of getting set up we strongly recommend checking that post.

As we noted at the start of the post, it is always a good idea to consult with an accountant or tax professional, or contact the body that collects taxes in the country that your business operates in if you are unsure.

The Takeaway

The Tax Identification Number is a pretty straightforward thing to understand it is just a number that identifies an individual or business for tax purposes. Theyre different in each country, and so youll need to know what type of TIN is used in the country that you need to pay taxes. In the UK, all individuals receive a National Insurance number, while anyone who has a business or needs to complete Self Assessment will need a UTR.

Tax On Supplies Of Property And Services Made In Provinces Place Of Supply Rules

Specific rules apply to determine whether a supply that is made in Canada is made in or outside of a participating province. The province of supply then determines whether suppliers must charge the HST, and if so, at which rate. Unless otherwise indicated, the supplies referred to throughout the section are taxable supplies.

The following sections explain the place of supply rules and tax on property and services brought into a participating province. For more information on the place of supply rules, see Draft GST/HST Technical Information Bulletin B-103, Harmonized Sales Tax Place of supply rules for determining whether a supply is made in a province. For more information on tax on property and services brought into a participating province, see GST/HST Notice 266, Draft GST/HST Technical Information Bulletin, Harmonized Sales Tax Self-assessment of the provincial part of the HST in respect of property and services brought into a participating province.

Goods

Sales

You collect the HST if you sell goods and deliver or make them available to the customer in a participating province. Goods are also considered to be delivered in a province if you:

- ship the goods to a destination in the province that is specified in the contract for carriage of the goods

- transfer possession of the goods to a common carrier or consignee that you retain on behalf of the customer to ship the goods to such a destination or

- send the goods by courier or mail to an address in the province.

Note

Read Also: How To Buy Tax Lien Certificates In California

Gst/hst Returns Filed By Non

If you are a non-resident, complete your GST/HST return in Canadian dollars, sign the return, and remit any amounts owing in Canadian dollars.

If you choose to make your payment in foreign funds, the exchange rate you receive for converting the payment to Canadian dollars is determined by the financial institution processing your payment, and may be different from the exchange rate that we use.

Sales Tax: How It Works

The amount is usually a percentage on top of the selling price of the item/service. Lets say you go to Starbucks and purchase a coffee for 5 dollars in an area where there is a 10% sales tax.

In this case, Starbucks would charge you $5.50 Total .

Whether a person is a local resident or a visitor from a different country, the business has to charge tax either way if they are physically coming to the point of sale to do the transaction. There are certain instances where sales tax is exempt or reduced such as for Indigenous People & those who have served in the military.

At the end of the tax period, the seller who collected this tax will have to remit it to the government.They can not keep this amount for themselves and that would be considered illegal.

Also Check: Www Michigan Gov Collectionseservice

How To Get Your Number

Contact your state’s tax authority or department of revenue. States usually allow you to apply for your sales tax number online. You’ll want to take this step as soon as possible, because your state may not allow you to conduct sales until your number has been issued, usually in the form of a paper certificate.

Depending on your state’s rules, you may be required to provide:

- The name of your business as well as its owners

- Bank account information

- Contact information

Additional Example Of The Sales Tax Calculation

Now let’s assume that total amount of a company’s receipts including a 7% sales tax is $32,100. The true sales will be S, and the sales tax will be 0.07S. Therefore, S + 0.07S = 1.07S = $32,100. The true sales, S, will be $30,000 . The sales tax on the true sales will be 0.07 X $30,000 = $2,100. Our proof is $30,000 of sales + $2,100 of sales tax = $32,100. In general journal form the accounting entry to record this information is: debit Cash $32,100 Sales $30,000 Sales Tax Payable $2,100.

Don’t Miss: How Much Is H& r Block Charge

What If I Dont Have Either Of These

Not all resident taxpayers or nationals will have either of these, and sometimes they may receive a PAYE Temporary Reference Number which is used when an individuals National Insurance Number cant be found or held. This number is made up of two numbers, one letter, then five numbers.

Companies have Unique Taxpayer References, and are also issued with a Corporation Tax number upon registering their company with Companies House. Dont get your Company UTR mixed up with your Company Registration Number though. The CRN is issued when your company is incorporated . A CRN is a combination of 8 alpha-numeric characters, and are used to identify your company and to verify incorporation with Companies House.

You Must File Sales Tax Returns

Once you receive your Certificate of Authority, you are considered to be in business for sales tax purposes even if you never make a sale or never open the doors of your establishment. Therefore, it is very important that you file your sales tax returns on time, even if you have no taxable sales. There are penalties for late filing even if you owe no tax. You can file your sales tax returns online using the Tax Departments Online Services, located on our website. To learn more about the filing requirements, see Tax Bulletin Filing Requirements for Sales and Use Tax Returns .

Recommended Reading: How To Get Pin To File Taxes

What To Do If You Lose Or Misplace Your Ein

Your EIN will stay the same until your business either closes or reorganizes and applies for a new sales tax number. If you happen to lose your EIN, you can find it by contacting your bank or credit union which keep EINs on file with business account information. If that doesnt work, then you can contact the IRS, which can provide EINs to your business officials, as long as they are able to answer the questions from the original application correctly this is done as a security measure.

Click here for important legal disclaimers.

- 18.09.19