Tax Laws Are Subject To Change

Perhaps the best lesson to learn when discussing quarterly payments is that tax laws will change from year to year. Whether youre an independent contractor or small business owner, youll want to stay up-to-date on current tax laws and IRS regulations. A variety of business-oriented websites publish articles regarding these changes. QuickBooks publishes articles relating to these changes in December and January.

For Fishermen And Farmers

You have special criteria to meet, but you may end up paying less in estimated taxes. You’re considered a qualified farmer or fisherman if you earn more than two thirds of your taxable gross income from farming or commercial fishing.

If you’re not sure you qualify, or how this all works, TurboTax can help you figure your taxable gross income and what fishing and farming income you can include as qualified income.

Dont worry about knowing which tax forms to fill out when you are self-employed,;TurboTax Self-Employed;will ask you simple questions about you and your business and give you the business deductions you deserve based on your answers.;TurboTax Self-Employed;uncovers industry-specific deductions. Some you may not even be aware of.

When Are Quarterly Taxes Due For 2021 And 2022

To avoid an Underpayment of Estimated Tax penalty, be sure to make your payments on time for tax year 2021:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

For tax year 2022, the following payment dates apply for avoiding penalties:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

Don’t Miss: How To Look Up Employer Tax Id Number

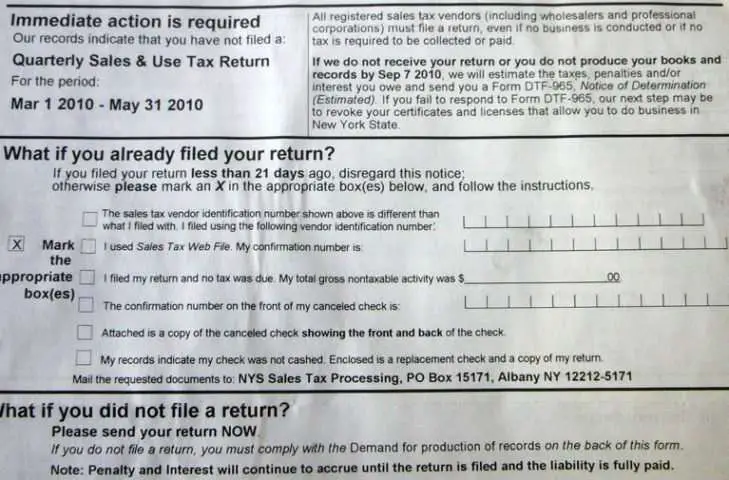

What Happens If You Dont Pay Quarterly Estimated Taxes But Should

If you shouldve paid estimated taxes but didnt, you may be subject to a penalty. The IRS will usually calculate the penalty for you, but if youre curious, you can calculate it yourself with Form 2201 Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Tax law is complex and the laws surrounding quarterly estimated tax payments are no exception. You can read the IRSs Publication 505 Tax Withholding and Estimated Tax for additional insight, but its a good idea to talk with a tax professional to make sure you and your business are compliant with applicable laws in order to avoid unwanted penalties.

How Can You Pay Your Taxes

The Internal Revenue Service has several means of payment available to taxpayers:

- Electronic Federal Tax Payment System . You can pay your federal taxes online or by phone with this system. The United States Department of the Treasury offers the EFTPS at no cost.;

This is the most suitable option for large businesses to be large sums.

- DirectPay.Taxpayers can use this platform at no cost to pay their taxes using a checking or savings account. After completing the payment, the system sends a confirmation.;

It is possible to schedule payments up to 30 days in advance.

- Quarterly taxes and annual taxes can be paid with credit and debit cards. The operation can be done online, by phone or through a mobile device.;

There is a possibility that your card issuer will charge additional fees for the transaction.

- Cash. Those who prefer to pay in cash can make the transaction through the IRS retail partners.;

This type of payment usually takes five to seven business days to be processed.

You May Like: How Do You Find Property Taxes By Address

What Are Quarterly Estimated Taxes

QETs are certainly a pain, but they do make some sort of sense. If you worked at an office, you would have your taxes taken out from each paycheck. Your individual sales through your online store or jobs you do for your freelance business dont have any taxes taken out.

However, you still owe taxes to the government! So every quarter you have to dip into your accounts and send a percentage out. If you dont, you owe even more during tax time in April as youll be hit with fees for failing to pay as you go.

Who Is Required To File Quarterly Taxes

If you work as a self-employed individual or small business owner, you likely need to pay quarterly estimated taxes. You’re considered self-employed if you work as:

- An independent contractor

- A sole proprietor in a trade or field

- A member of a partnership that conducts business, such as an LLC

- A person who runs a business as your own, including part-time

Don’t Miss: Can Home Improvement Be Tax Deductible

Who Has To Pay Estimated Taxes

You must pay estimated taxes if you expect to owe at least $1,000 in federal tax for the year. This collective group includes income tax, Social Security tax and Medicare tax.

However, if you paid no taxes last year, you donât have to pay any estimated tax this year, no matter how much tax you end up owing for the year. But this is true only if:

- You were a U.S. citizen or resident for the year, and

- Your tax return for the previous year covered the whole 12 months.

Many self-employed people also work as employees, whether full-time or part-time. They have taxes withheld from their pay by their employers. If you work as an employee, you donât have to pay estimated tax if the taxes withheld by your employer amount to at least 90% of the total tax you owe for the year.

So, you can avoid paying estimated taxes by asking your employer to increase your employee withholding. To do this, file a new Form W-4 with your employer. There is a particular line on Form W-4 for you to enter the additional amount you want your employer to withhold. Use the IRS Tax Withholding Estimator to make sure you have the right amount of tax withheld.

What If I Blow It Off And Just Deal With It Later

The IRS will charge penalties if you didnt pay enough tax throughout the year.;The IRS can charge you a penalty for late or inadequate payments even if you’re due a refund when you file your tax return.

The IRS might give you a break on penalties if:

-

You were a victim of a casualty, disaster or other unusual circumstance, or

-

Youre at least 62, retired or became disabled this year or last year, and your underpayment was due to reasonable cause rather than willful neglect

Some tax rules have changed due to coronavirusLearn more about what’s different for taxpayers as part of the federal government’s response to the coronavirus.See the changes

Don’t Miss: Where Can I Find My Agi On My Tax Return

Reporting An Underpayment Of Estimated Tax Penalty On Your Tax Return

Once you are done calculating your underpayment of estimated tax penalty, complete and enclose;Form M-2210;with your tax return.

You do not have to complete Form M-2210 if the balance due with your;tax return is $400 or less.;

If you owe a penalty, enter the amount in the box entitled M-2210 amount under;Form 1, Line 50 or Form 1 NR/PY, Line 54. Add the penalty amount to the tax you owe when making your payment.

Dont Forget To File Your Taxes

Depending on how your business is structured youll have to declare quarterly taxes or annual taxes.;

Corporations, partnerships, sole proprietorships, and LLCs must file taxes annually.

Contractors and sole proprietorships, whose incomes are not subject to any withholding tax, must declare and pay their taxes quarterly.;

The good news is that the IRS has different payment channels, such as virtual platforms; and that you can pay your obligations with credit and debit cards, through bank deposits or in cash.

Do you want to learn more about quarterly taxes? Continue reading:;

You May Like: How To Report Self Employment Income On Taxes

Should I Pay In Equal Amounts

Usually, you pay your estimated tax payments in four equal installments. But you might end up with unequal payments in some circumstances:

- If you had your previous year’s overpayment credited to your current year’s estimated tax payments

- If you don’t figure your estimated payments until after April 15 when the first one is due

- If you unexpectedly make a lot of money in one quarter

What Happens If You Overpay Estimated Taxes

Are you a self-employed who has never dealt with estimated taxes? Is this your first time doing business as a freelancer? If so, you need to get yourself familiarized with calculating and paying estimated taxes during the year so you donât end up paying penalties in the following year when you file your taxes for the prior year. Overpayment of quarterly taxes results in a tax refund. Underpayment triggers a penalty. Here is the low-down on everything you need to know about making your estimated quarterly taxes.

You May Like: Is Heloc Interest Tax Deductible

Yes You Can Pay Quarterly Estimated Taxes Online

When I was a newbie freelancer years ago, I was pretty confused by the concept of paying income taxes four times a year, instead of just once a year like employees do.

For more details on quarterly estimated taxes and how and why freelancers pay them, please see my Freelancers Guide to Quarterly Estimated Taxes.

*Disclaimer: I am not an accountant or tax professional, so this is not tax advice. Seek out a competent professional to make sure youre getting advice relevant to your situation.

How To Calculate Estimated Taxes

To calculate your estimated taxes, you will add up your total tax liability for the yearâincluding self-employment tax, income tax, and any other taxesâand divide that number by four.

You can calculate your estimated taxes on the IRSâ Estimated Tax Worksheet found in Form 1040-ES for individuals or Form 1120-W for corporations, will guide you through these calculations in detail.

You can also use our free estimated tax calculator.

Keep reading for a more in-depth explanation of how to calculate your estimated taxes.

Further reading: What is Self Employment Tax?

Recommended Reading: How To Get Social Security Tax Statement

What Happens If I Pay My Quarterly Taxes Late

Quarterly taxes usually refer to one of two types of taxesestimated income taxes or payroll taxes. Both businesses, depending on their structure, and individuals make estimated income tax payments on a quarterly basis. Only businesses are subject to payroll taxes, and those can be paid monthly, quarterly or annually depending on the size of the business. Payroll tax returns are filed on a quarterly or annual basis regardless of when the payment is made. ;

When To Pay Estimated Quarterly Taxes

For 2021, here’s when estimated quarterly tax payments are due:

|

If you earned income during this period |

Estimated tax payment deadline |

|---|

» MORE:Learn about important changes to this year’s tax-filing deadline

These dates dont coincide with regular calendar quarters, so plan ahead. And you dont have to make the payment due in mid-January if you file your tax return and pay what you owe by the end of the month.

You can make payments more often if you like, Kane says.

I think it’s easier to make 12 smaller payments than four larger payments,” she says. “If you owe $1,200 for the year, I would rather pay $100 a month than $300 four times a year. And if we’re talking bigger numbers, it gets pretty extreme.

Also Check: Where To File Taxes For Free

Extended Due Date Of First Estimated Tax Payment

Pursuant toNotice 2020-18, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to , the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

What Are Quarterly Taxes And When Are Quarterly Taxes Due

Quarterly taxes are estimated tax payments to the IRS made throughout;the year . These payments are based on an estimation of your income for the current year. Most people use their previous years taxes as a guide.

Everyone is required to pay taxes.;If youre self-employed or work a typical 9-5 job your taxes are paid in one of two ways:

Withholding taxes from your paycheck – W-2 workers

Paying quarterly taxes – 1099 workers

Traditional W-2 employees usually don’t owe quarterly taxes because taxes are withheld from their pay.;However, if you are self-employed , taxes are not withheld from your pay. Which means you are responsible for paying taxes on your own.

Recommended Reading: How To Read My Tax Return

Add It All Together And Divide By Four

Now, the final step. To calculate her estimated quarterly tax payments for each quarter, Stephanie simply adds together her income tax and her self-employment tax for the year and divides this number by four. Voila.

$8,130.24 + $12,716.59 = $20,846.83 .

$20,846.83/4 = $5,211.71 .

If you filed your previous yearâs taxes with the help of a CPA, they should also be able to send you estimates for this yearâs payments. And if youâre paying estimated quarterly taxes for the first time, it canât hurt to run your numbers by a CPA before submitting.

Which Option Should I Choose

That depends on your situation.

The safest option to avoid an underpayment penalty is to aim for “100 percent of your previous year’s taxes.” If your previous year’s;adjusted gross income was more than $150,000 , you will have to pay in 110 percent of your previous year’s taxes to satisfy the “safe-harbor” requirement. If you satisfy either test, you won’t have to pay an estimated tax penalty, no matter how much tax you owe with your tax return.

If you expect your income this year to;be less than last year and you don’t want to pay more taxes than you think you will owe at year end, you can choose to pay 90 percent of your estimated current year tax bill. If the total of your estimated payments and withholding add up to less than 90 percent of what you owe, you may face an underpayment penalty. So you may want to avoid cutting your payments too close to the 90 percent mark to give yourself a little safety net.

If you expect your income this year to be more than your;income last year and you don’t want to end up owing any taxes when you file your;return, try to make enough estimated tax payments to pay 100 percent of your current year;income tax liability.

You May Like: What Is The Tax In Georgia

What If Youve Pad Too Little

The IRS imposes a money penalty if you underpay your estimated taxes.

You have to pay the taxes due plus a percentage penalty for each day estimated tax payments were unpaid. The percentage is set by the IRS each year. Currently, itâs about 6 percent. This is one of the smallest IRS interest penalties.

Some self-employed people decide to pay the penalty at the end of the tax year rather than take money out of their businesses during the year to pay estimated taxes.

If you do this, though, make sure you pay all the taxes you owe for the year by April 15 of the following year. If you donât, the IRS will tack on additional interest and penalties. The IRS usually adds a penalty of 1/2 to 1 percent per month to a tax bill not paid when due.

For more details on estimated taxes, refer to IRS Publication 505, Tax Withholding and Estimated Tax.

Do I Have To Make Estimated Tax Payments

If you intend to file as a sole proprietor, a partnership, S corporation shareholder, and/or a self-employed individual, youâll generally need to make estimated quarterly tax payments if you will owe taxes of $1,000 or more.

Businesses that file as a corporation generally need to make estimated tax payments if they expect to owe $500 or more in tax for the year. If you meet these IRS minimums, then youâll likely have to file estimated quarterly taxes.

If you need some help with your estimated taxes, check out Bench. Weâll get your books in order and take care of every tax form .

Read Also: How Much Is Tax In Washington State

Penalties For Not Filing Or Paying Taxes

Why is this important? The penalties for not filing a tax return are almost always more severe than those for not paying the tax. There are no real consequences for not filing an estimated tax form itself. Keep in mind that the federal government and various state and local jurisdictions all have different, specific rules in this regard. For purposes of this discussion we will focus on the IRS.

In general, the IRS penalties are as follows :

- Failure to file a tax return can result in a penalty of 5% of the tax not paid for each month or part of a month that the return is late up to a maximum of 25%. If fraud is involved, the penalty is more severe.

- Failure to pay the tax can result in a penalty of 0.5% of the unpaid taxes for each month or part of a month that the tax remains unpaid up to a maximum of 25%. Again, fraud is more severe.

- There is no penalty for not filing or paying an estimated tax payment. However, when a tax return is filed, and it is established that there has been an underpayment of taxes because of insufficient tax withholdings or estimated payments, the IRS can assess interest penalties on the amount of the underpayment.

Again, these are general rules. A competent tax professional can advise on specific situations. The point is clear, however, if you dont pay your taxes on time, the taxing agency involved can charge penalties and/or interest on the amount owed until it is paid.