How To Register For Sales Tax In Kansas

Okay, so you have nexus! Now what?

The next crucial step in complying with Kansas sales tax is to register for a sales tax permit. Itâs actually illegal to collect tax without a permit. So to get all your ducks in a row, start with tax registration first.

You can find directions about how to register in Kansas on their Department of Revenue website.

When registering for sales tax, you should have at least the following information at hand:

- Your personal contact info

- Social security number or Employer Identification Number

- Business entity

- Bank account info where youâll deposit the collected sales tax

Do You Have Nexus In Kansas

The word ânexusâ refers to a commercial connection in the state. Nexus determines the following questions for a state tax agency: Do you do business here, what kind, and how much? And when you do have nexus, that means youâre obligated to collect tax on your sales there.

So the first question for you to answer is whether you have nexus in Kansas.

You probably have nexus in Kansas if any of the following points describe your business:

- A physical presence in Kansas: a store, an office, a warehouse or distribution center, storage space, you, an employee, a representative, etc.

- Online ads or links on a Kansas-based website, which channels potential customers and new business.

- A significant amount of sales in Kansas within twelve months. *

* This is called an economic nexus, a sales tax nexus determined by economic activity, i.e. – the amount of sales you make in a particular state. Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount.

The threshold in Kansas is $0 in annual sales or 0 separate sales transactions, whichever your business reaches first. To learn more about how this works, check out the Ultimate Guide to US Economic Nexus.

The 10 Basics Every Kansas Business Should Know About Sales Tax

What is the Sales Tax Rate in Kansas?

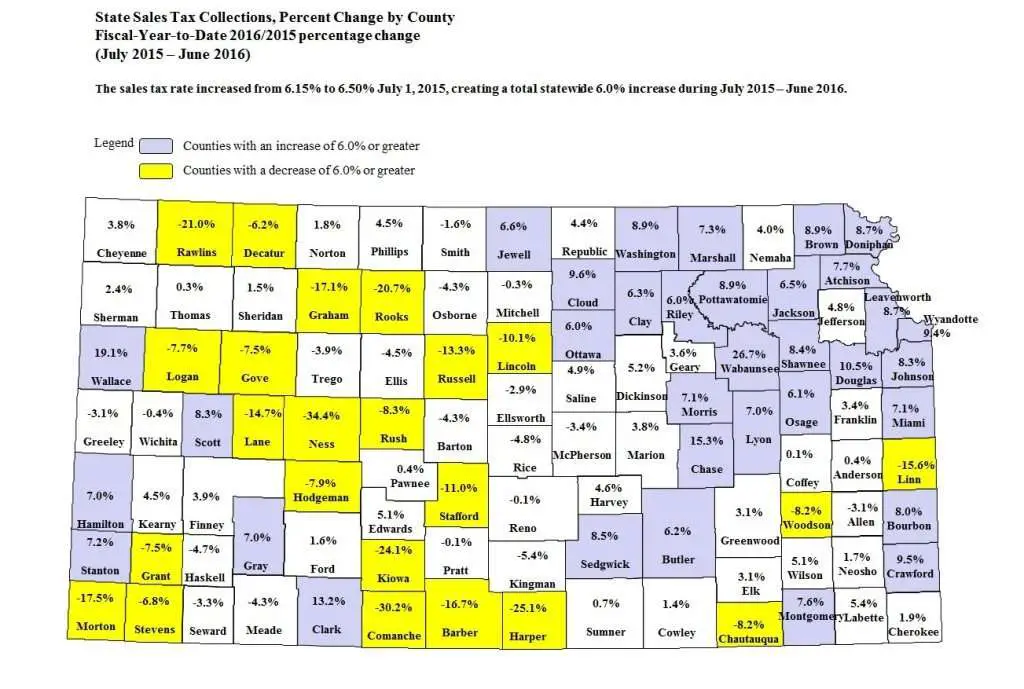

The state rate of Kansas is 6.5%. Cities and/or municipalities can add up to 3% to that rate.

What is Sales Tax in Kansas?

Kansas imposes sales tax on the retail sale, rental or lease of tangible personal property, labor services related to tangible personal property, and admissions to entertainment, amusement, or recreation places in Kansas.

Are All Goods and Services Taxable?

How Do I Know Whats Taxable and Whats Not?

This link can help you determine what is taxable and what isnt in Kansas. ;

Who Pays Sales Tax?

Consumers pay sales tax. ;Merchants do not pay sales tax out of their own pockets. ;Its commonly referred to as a pass through tax.

What Am I Responsible For?

You are required to collect sales tax, hold it secure and send it to the State on-time and in-full.

When Is My Sales Tax Payment Due in Kansas?

Kansas Sales Tax is due on the 25th of the month following the reporting period. Filing frequency is determined by the amount of tax remitted. .

How Do I Know How Much Sales Tax to Charge?;

The sales tax rate in Kansas varies based on location. Find more information here. ;The final and definitive answer is always the sales tax rate posted on the State Department of Revenue website. ;Rates posted on the web are often not up-to-date and incorrect. Its always the merchants responsibility to charge the correct sales tax rate.

Who Gets the Sales Tax Money?

How Do I Manage Tax Exempt Sales?

Don’t Miss: Can I File For Another Extension On My Taxes

How Are Rebates And Dealer Incentives Taxed

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000.

Kansas taxes vehicle purchases after rebates or incentives are applied to the price, which means that the buyer in this scenario will only pay taxes on the vehicle as if it cost $9,000.

How Do You Get Temporary Plates

Depending on where you live, you may be allowed to drive the car without plates for a few hours, days, or at least from the point of sale to your home or local DMV. While you wait for your official plates to arrive typically by mail you’ll need to apply for temporary plates or a temporary permit.

Also Check: How To Calculate Payroll Taxes In California

Are Finance Charges Included In The Kansas Sales Tax Basis

Many businesses offer customers financing on higher-value products, and include financing charges in the overall cost of the item. These finance charges may also be subject to sales taxes. Kansas policy states:

Finance charges are generally included in the taxable price of a tangible product.

Note: Must be separately stated

Kansas Sales Tax On Car Purchases:

Vehicles purchases are some of the largest sales commonly made in Kansas, which means that they can lead to a hefty sales tax bill. This page covers the most important aspects of Kansas’ sales tax with respects to vehicle purchases. For vehicles that are being rented or leased, see see taxation of leases and rentals.

Kansas collects a 7.3% to 8.775% state sales tax rate on the purchase of all vehicles. There are also local taxes up to 1%, which will vary depending on region.

In addition to taxes, car purchases in Kansas may be subject to other fees like registration, title, and plate fees. You can find these fees further down on the page.

Read Also: Do You Pay Income Tax On Unemployment

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Brown County Kansas Sales Tax Exemptions

In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate.Many municipalities exempt or charge special sales tax rates to certain types of transactions. Certain purchases, including alcohol, cigarettes, and gasoline, may be subject to additional Kansas state excise taxes in addition to the sales tax.

Note that in some areas, items like alcohol and prepared food are charged at a higher sales tax rate than general purchases. Kansas’s sales tax rates for commonly exempted categories are listed below. Some rates might be different in Brown County.

Groceries:

Also Check: How To Report Self Employment Income On Taxes

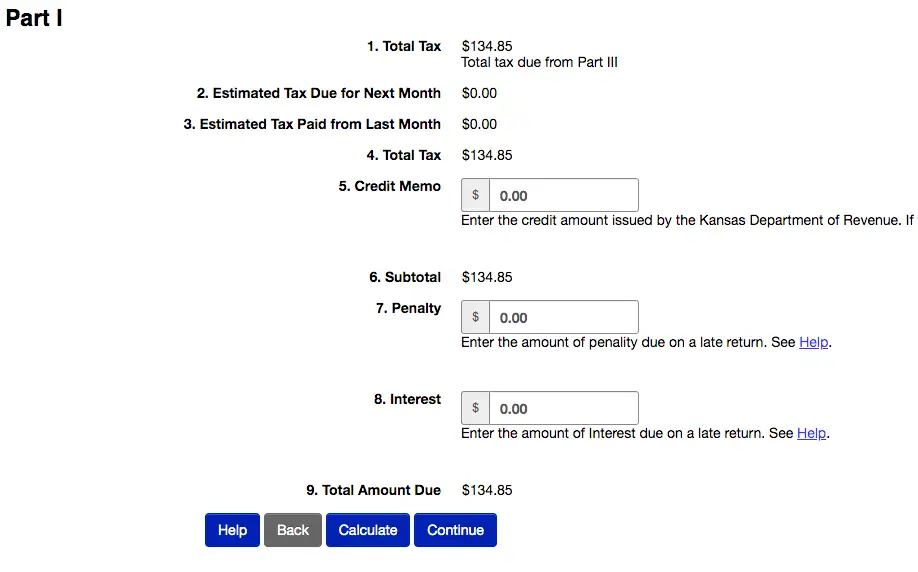

File Your Sales Tax Return

Now that youve registered for your Kansas seller’s permit and know how to charge the right amount of sales tax to all of your customers, you are all set to file your sales tax return. Just be sure to keep up with all filing deadlines to avoid penalties and fines.

Recommended: Hiring a business accountant can help your business file tax returns as well as issue payroll and manage bookkeeping. Schedule a consultation with a business accountant today to save thousands of dollars on your taxes.

How To Collect Sales Tax In Kansas

Now itâs time to tackle the intricate stuff! Tax rates can vary based on the location of your business and the location of your customer, plus the levels of sales tax that apply in those specific locations.

The state-wide sales tax in Kansas is 6.5%.

There are additional levels of sales tax at local jurisdictions, too.

Kansas has a destination-based sales tax system, * so you have to pay attention to the varying tax rates across the state. Charge the tax rate of the buyerâs address, as thatâs the destination of your product or service.

* Important to note for remote sellers: While this is generally true for Kansas, some state have peculiar rules about tax rates for remote sellers. Contact the stateâs Department of Revenue to be sure.

Don’t Miss: How Much Is Tax In Georgia

How Do I Find Out My Personal Property Tax On My Car

To find the amount of taxes due, divide the assessed value by $100, and then multiply the result by the tax rate. Your family has to pay more than $1,000 each year in personal property taxes for your vehicles. If you live in a state with personal property tax, consider the long-term cost when you buy a vehicle.

Sales Tax Rates In Other Kansas Cities

There are 25 first class cities in Kansas. A first class city has a population of at least 15,000 residents. Manhattan’s sales tax rate of 8.95% ;ranks 16th highest out of 25. In 2023, if all other sales tax rates of first class cities remain constant, Manhattan’s sales tax rate would remain the 16th highest within Riley County, and 6th highest within city limits of Pottawatomie County. ;

Recommended Reading: Did The Tax Deadline Get Extended

Kansas Sales Tax Software

There are quite a number of elements to consider when determining your sales tax liability in Kansas. With so many factors to take into account concerning when and how much sales tax you need to collect on your sales in the state, it can be helpful to have a tool designed to guide you through the process. TaxTools is just such a system, and it offers a variety of resources designed to help you keep track of filing deadlines, local tax rates, and tax holidays. It also stays up to date on any changes to tax laws in the state so you dont have to.

TaxTools also integrates seamlessly with whatever eCommerce platform you use to provide you with up-to-date sales data and payment information so you can be sure your records are accurate and payments are made on time. This is a particularly valuable tool if you sell in multiple states, as it can track the applicable sales tax data for each state accurately and efficiently.

So if youre ready to begin streamlining your sales and tax collection processes, or to of TaxTools today.

AccurateTax believes that sales tax automation should be affordable for all businesses. The laws don’t make compliance easy, but our software helps. See how much time you can save by using AccurateTax.

Solutions

Sales Tax Rate Changes

Access the latest sales and use tax rate changes for cities and counties. Local sales taxes are effective on the first day of the second calendar quarter after the Department of Revenue receives notification of the rate change . Local taxes can also have an expiration date, lowering the sales or use tax rate for that particular city or county. Expirations also take place on the first day of a calendar quarter .

Recommended Reading: How Much Is Tax In Washington State

How Can I Get Reimbursed For Sales Taxes Paid On Items That Are Returned Or Repossessed

If a taxable good for which sales tax has been collected is returned or reposessed by the merchant, the state may allow the amount of sales tax collected to be either deducted from the merchant’s current sales tax balance or refunded to the merchant by the state. Kansas’ policies state that returns and repossessions are:

Deductible, if the amount charged including tax is refunded to the purchaser

Note: Resales of repossessed goods by a retailer are reportable as part of the retailer’s gross receipts; retailers and financial institutions accrue tax on the use of repossessed goods other than for retention, demonstration, or display in the regular course of business

Brown County Sales Tax Region Zip Codes

The Brown County sales tax region partially or fully covers 5 zip codes in Kansas. Remember that ZIP codes do not necessarily match up with municipal and tax region borders, so some of these zip codes may overlap with other nearby tax districts. You can find sales taxes by zip code in Kansas here

66424Help us keep our data updated!

If you notice that any of our provided data is incorrect or out of date, please notify us and include links to your data sources . If we can validate the sources you provide, we will include this information in our data.

Data Accuracy Disclaimer

Tax-Rates.org provides sales tax data for “Brown County” on an AS-IS basis in the hope that it might be useful, and we can offer NO IMPLIED WARRANTY OF FITNESS. While we attempt to ensure that the data provided is accurate and up to date, we cannot be held liable for errors in data or calculations we provide or any consequence or loss resulting from the of use of the Data or tools provided by Tax-Rates.org.

Read Also: Where Can I Find My Agi On My Tax Return

How 2021 Sales Taxes Are Calculated In Kansas

The state general sales tax rate of Kansas is 6.5%. Cities and/or municipalities of Kansas are allowed to collect their own rate that can get up to 3% in city sales tax.Every 2021 combined rates mentioned above are the results of Kansas state rate , the county rate , the Kansas cities rate , and in some case, special rate . The Kansas’s tax rate may change depending of the type of purchase. Some of the Kansas tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Kansas website for more sales taxes information.

State Sales Tax Rates

California has the highest state-level sales tax rate, at 7.25 percent.;Four states tie for the second-highest statewide rate, at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee. The lowest non-zero state-level sales tax is in Colorado, which has a rate of 2.9 percent. Five states follow with 4 percent rates: Alabama, Georgia, Hawaii, New York, and Wyoming.

No state rates have changed since April 2019, when Utahs state-collected rate increased from 5.95 percent to 6.1 percent.

While it did not increase the overall state rate, voters in Arkansas made the temporary 0.5 percent transportation sales tax permanent via a ballot measure in November.

You May Like: What Is Deduction In Income Tax

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Penalties For Late Payment

The state will impose a penalty of 1% of the total tax due for each month that youre behind in filing or paying, up to a maximum of 24%. However, there may be more extreme penalties for ongoing or repeat offenses, up to and including possible criminal charges for fraud. Kansas does require that you file zero returns for periods in which you collect no sales tax in the state when you hold a Kansas sales tax permit. You can file your tax return online through the Kansas Department or Revenue website, or you can mail the completed form, and the online filing system also allows you to make your payments at the same time.

You May Like: Does Contributing To Roth Ira Reduce Taxes

How Can I Get Reimbursed For Sales Taxes Paid On Bad Debts

If a merchant offers goods to a consumer on credit and the payment for those goods becomes delinquent, the merchant may be eligible to be reimbursed any sales tax they paid to the state on the consumer’s behalf when the transaction was made. The method of reimbursement varies state by state.

Tax paid on bad debts can generally be recovered by the merchant as a deduction.

Sales Tax On Shipping Charges In Kansas

Kansas does apply sales tax to shipping costs. The rule of thumb is that if what youâre selling is subject to tax, then the shipping charges are also subject to tax.

If you happen to be shipping products that are both taxable and nontaxable, then shipping charges for the entire shipment are subject to tax.

Recommended Reading: How To Apply For Irs Tax Forgiveness

Applying The City Or County Sales Tax

Yes, with the exception of residential and agricultural use utilities. Residential and agricultural use utilities are subject to local sales taxes but not state sales tax.

No, a city or county must follow the taxability laws established by the state.

Sales taxes are imposed on gross receipts from:

- the retail sale, rental, or lease of tangible personal property;

- charges for labor services to install, apply, repair, service, alter, or maintain tangible personal property; and

- admissions to places providing amusement, entertainment, or recreation services.

Kansas sales tax rates are published with the state and local rate combined. Retailers are not required to separate which portion of the tax collected is for each entity.

If you sell tangible personal property, admissions, or provide taxable services you must be registered with the Kansas Department of Revenue to collect state and local sales taxes.

Kansas combines the state and local rates so that all sales taxes collected are remitted on one return. A business may file annually, quarterly, monthly, or pre-paid monthly based on the estimated sales tax liability of the business. Refer to KDOR publication KS-1510 Sales Tax and Compensating Use Tax for further information on collecting and remitting sales tax.

LATEST TWEETS