I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 22. So EITC/ACTC filers will not see an update to their refund status for several days after Feb. 15.

How Do I Use The Where’s My Refund Tool To Check The Status Of My Tax Refund

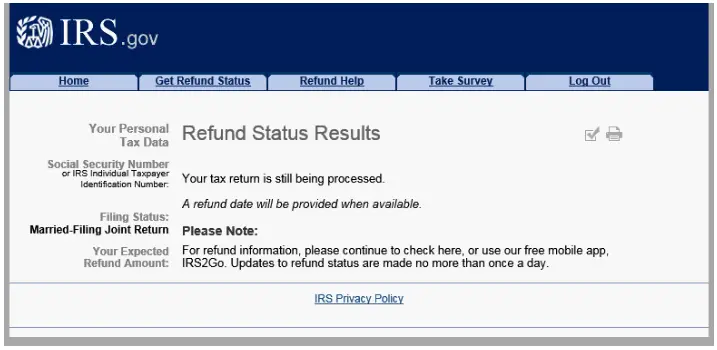

To check the status of your 2020 income tax refund using the IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.

Using the IRS tool Where’s My Refund, go to the Get Refund Status page, enter your SSN or ITIN, filing status and exact refund amount, then press Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called IRS2Go that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.

You can check on your refund through the IRS2Go mobile app.

How Long Will My Refund Say Processing

As one would expect, IRS employees are stretched thin working through the manual processing of these returns, Collins said Wednesday. So if a taxpayers return is pulled for manual processing, there will be delays. Typically, the IRS sends most refunds within 21 days or less of taxpayers filing their return.

Don’t Miss: Www.1040paytax.com

Wheres My State Tax Refund West Virginia

Check on your state tax return by vising the West Virginia State Tax Departments website. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to the refund status page. Enter your SSN, the tax year and the amount of your refund in order to check your status.

The state is implementing new security measures for the 2017 tax year, which may slow down the turnaround time for your refund. It advises only calling to ask about your refund if more than eight weeks have passed since you filed.

Checking Your Refund Status

Anxious to get your tax refund? You can find out the status of your federal tax refund by pushing the Refund Status button. To find out whether your refund is on its way, youll need to enter your Social Security number, your tax filing status and your anticipated refund amount.

The IRS says that it sends out most tax refunds in less than 21 days. If youve e-filed your tax return, you can check your refund status within 24 hours. If youve filed a paper tax return, however, you may not find out where your refund is for about four weeks.

Keep in mind that theres more than one way to check the status of your tax refund. The IRS offers a Wheres My Refund tool online. If you havent received your refund 21 days after filing electronically or more than six weeks after filing a paper return, you may need to contact the IRS by phone.

You May Like: Buying Tax Liens California

Wheres My State Tax Refund Nebraska

Its possible to check you tax refund status by visiting the revenue departments Refund Information page. On that page you can learn more about the states tax refunds and you can check the status of your refund. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund.

What If I Miss The Deadline

Taxes are due on Monday, April 18, 2022. If you file your return after the deadline, you could be charged late filing fees and other penalties. The good news is, if you need more time to file you can request an extension with the IRS. It is important to note that an extension does not give you more time to pay your taxes. It only gives you more time to file your return. In other words, if you owe money on your taxes, your payment is still due by April 18th. If you request an extension, will have six more months to send your return to the IRS. The deadline to submit extensions for tax year 2021 is October 17, 2022.

You May Like: Where’s My Tax Refund Ga

What Happens With The Child Tax Credit

Now the delays might cause some hiccups for some when it comes to receiving an advance payment of the Child Tax Credit, another new change this year.

Using a 2019 return if a 2020 return isn’t processed might give the wrong financial picture of a family in 2020 and the wrong head count for qualifying children.

Eligible families will receive up to $300 per month for each qualifying child ages 5 and younger and $250 per month for children ages 6 to 17. The monthly payouts will be sent by the IRS each month from July through December this year only.

An age test is applied as of Dec. 31, 2021, so a child who is 17 through most of 2021 but is 18 by Dec. 31 would not qualify, according to Mark Luscombe, principal analyst for Wolters Kluwer Tax & Accounting.

Monthly payments for the Child Tax Credit will be based on your 2020 tax return, if the IRS has processed it or your 2019 tax return.

Tax returns processed by June 28, according to the IRS, will be used when it comes to calculating the first batch of monthly payments scheduled for July 15.

CPA Smith expressed concern that some people could end up receiving more money than they’re qualified to get say if their income went up significantly in 2020 so they no longer qualify for the credit and the IRS is using a lower income from their 2019 returns.

On the other hand, others might receive less than they’re qualified to get now if their 2019 returns are used, and, for example, they adopted a child or had a baby in 2020.

You Claim Certain Credits

If you file on the early side and claim the earned income tax credit or the additional child tax credit , you will have to wait a bit for a refund. According to the law, the IRS has to wait until Feb. 15 to issue a refund to taxpayers who claimed either of those credits. Presidents Day and bank processing times can slow down your refund further. For 2020, the first refunds arent available in taxpayer bank accounts until the first week of March.

If the hold is because you filed before mid-February, there is no need to worry. The hold is not a result of mistakes or problems with your return. But if you filed later than that, the hold could also be because the IRS has questions or needs more information, in which case, you should receive a letter explaining what it requires.

If you claimed those credits, have been waiting weeks for a refund and have not received a letter from the IRS, you can check the status of your refund on the IRS website through its Wheres My Refund? tool.

You May Like: How To Buy Tax Lien Certificates In California

What Is The Irs Refund Schedule

The IRS typically sends out refunds on a schedule. This schedule varies by the method you sent your return in, when you file, and what credits you claim. See an estimated schedule in the chart below.

| Filing method and refund delivery method | How long it takes to receive your refund from the time your return is accepted |

| E-file and direct deposit |

| May 10 | May 17 |

Please note that the IRS issues your tax refund not TaxSlayer or any other filing service. This means that your filing service cant say for sure when youll get your refund. But you can use the IRSs Wheres My Refund tool to see exactly where your refund is.

Refund Offset Why Your Refund May Be Less Than Expected

Another area of confusion for those expecting a refund is that when they get a refund it is actually less than the amount they were expecting or provided by their e-filing tool. The reason for this is that the federal government has offset or deducted monies from your tax refund to cover debts you owe other federal agencies. Under the law, federal payments such as tax refunds can be collected against by approved agencies before being paid to you. You will get a letter from the IRS explaining this offset to your federal refund and why it differs from what was estimated in your filed return. They will give you an opportunity to dispute this collection, but you will have to prove you had no federal obligations. If you have questions regarding the offset of your refund you can call the Treasury Offset Program on 800-304-3107.

Read Also: How To Buy Tax Lien Properties In California

You Claimed Certain Tax Credits

Tax credits reduce your tax liability on a dollar-for-dollar basis. Certain tax creditsincluding the Earned Income Credit and the Additional Child Tax Creditoften draw scrutiny from the IRS due to taxpayers claiming these credits fraudulently. If you claimed either credit, that could be the reason your refund hasn’t arrived yet.

What Do These Irs Tax Refund Statuses Mean

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

Recommended Reading: Mcl 206.707

Youre A Victim Of Tax Fraud

One type of tax fraud involves someone using your personal information to file a fraudulent tax return and claim a refund in your name. For the 2019 tax-filing season, the IRS identified more than 58,000 fraudulent refund claims, with close to 14,000 of them tied to identity theft. If you think youre a victim of tax-related identity theft, you can contact the IRS and the Federal Trade Commission to report it.

Wheres My State Tax Refund Hawaii

Hawaii taxpayers can visit the Check Your Individual Tax Refund Status page to see the status of their return. You will need to provide your SSN and the exact amount of your refund.

Refunds can take nine to 10 weeks to process from the date that your tax return is received. If you elect to receive your refund as a paper check, you can expect it to take an additional two weeks. If you e-filed and have not heard anything about your refund within 10 weeks, call the states Department of Taxation.

You May Like: How To Buy Tax Forfeited Land

Wheres My State Tax Refund New Mexico

The Tax & Revenue department of New Mexico provides information on their website about tax returns and refunds. To the check the status of your return, go to the Taxpayer Access Point page and click on Wheres My Refund? on the right of the page.

Taxpayers who filed electronically can expect a a refund to take six to eight weeks to process. The state asks that you wait at least eight weeks before calling with inquiries about your return. Paper returns will likely take eight to 12 weeks to process. The state advises waiting 12 weeks before calling with refund status questions.

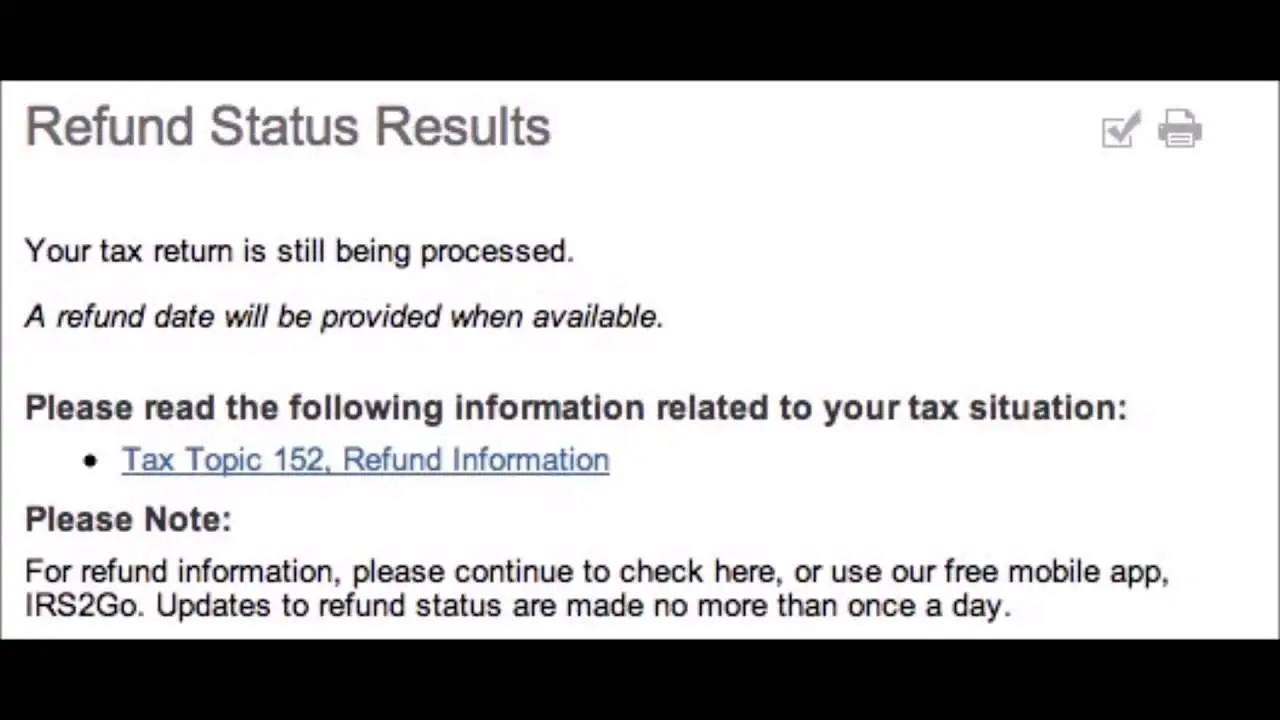

What Does Code 152 Mean From The Irs 2020

Tax Topic 152 means youre getting a tax refund. The IRS has given guidelines this year that 90% of tax filers should receive their refund within 21 days of filing. The IRS works weekends during tax season, so its 21 days, not business days. If you want a good estimate, check out our tax refund calendar for 2020.

Also Check: How Much Does H & R Block Charge To Do Taxes

Your Refund Was Sent To The Wrong Bank

Filing your return electronically is the fastest way to get your refund, especially if youre using direct deposit. That assumes, however, that you plugged in the right numbers for your bank account. If you transposed a digit in the routing or account number, your money could be sent to someone else’s account.

If your refund ends up in someone else’s bank account, you’ll have to work with the bank directly to get it back. The IRS says it can’tand won’tcompel the bank to return your money to you.

Wheres My State Tax Refund Utah

You can check the status of your refund by going to the states Taxpayer Access Point website. On that page you can find the Wheres My Refund? link on the right side.

Due to identity protection measures, the Utah State Tax Commission advises that taxpayers should allow 120 days for a refund to get processed. The earliest you can hope for a refund is March 1.

You May Like: How Much Time To File Taxes

Returns That Require Review

Most straightforward tax returns are being processed in 21 days or less, but some will take longer, even during normal times. Mailed paper tax returns, for example, will take much longer as they are among the multitude of mail pieces still being opened and processed. The IRS estimates that it can six to eight weeks to receive a tax refund when you submit your tax return by mail rather than electronically.

If your returns requires a review, that will cause a further delay. You may have your return reviewed for determining recovery rebate credit amounts for the first two stimulus payments, figuring earned income tax credits, and figuring additional child tax credits.

Other reasons your tax return is still being processed and your refund is delayed include:

- The return itself is incomplete. You may be missing a number or a signature, for example.

- Your return contains errors.

- You are a victim of identity theft or fraud that has affected your tax return.

- You included Form 8379, for an injured spouse allocation, which can delay processing for up to 14 weeks.

- Your return needs further review for other reasons as flagged by an IRS representative.

Wheres My State Tax Refund New York

You can use this link to check the status of your New York tax refund. You will need to enter the exact amount of your refund in whole dollars in order to log in. This amount can be found on the state tax return that you filed.

Dont forget that if you paid any local income taxes for living in New York City or Yonkers, those taxes are included in your state return.

Recommended Reading: How Much Does H& r Block Charge For Doing Taxes

Wheres My State Tax Refund Oklahoma

In order to check the status of your state tax refund, visit Oklahoma Tax Commission page and click on the Check on a Refund link. From there you can get to the Oklahoma Taxpayer Access Point. You will need to log in with the last seven digits of your SSN or ITIN, the amount of your refund and your zip code.

If you e-filed, you can generally start to see a status four days after the Oklahoma Tax Commission receives your return. Paper filings will take longer an you should wait about three weeks before you start checking the status of a refund. Once a refund has been processed, allow five business days for your bank to receive the refund. If you elect to get a debit card refund, allow five to seven business days for delivery.

Reasons For A Late Tax Refund

Many things can hold up the processing and delivery of your tax refund. For example, it could be delayed if you filed your return too early or waited until the last minute. If you tried to file in January, for example, a last-minute change to the tax code could have triggered an error on your return that slowed down the processing. Similarly, waiting until the very last minute to get your return in can mean a longer wait for your refund if the IRS is clogged up with a larger than usual volume of returns.

Also, keep in mind that filing a paper return can slow things down. The fastest way to fileand to get your refundis to do it electronically online.

Beyond those possibilities, here are some of the most common causes of delay.

Recommended Reading: How To Buy Tax Liens In California