Taxes On Larger Businesses

The state taxes businesses that do not file the E-Z Computation form at a rate of 0.75% on their taxable margins . It defines this as the lowest of the following three figures: 70% of total revenue, 100% of revenue minus cost of goods sold , or 100% of revenue minus total compensation.

Nearly all business types in the state are subject to the franchise tax. The only exceptions are sole proprietorships and certain types of general partnerships.

Small businesses with gross receipts below $1,180,000 pay zero franchise tax for tax year 2020.

For many businesses, the actual tax rates are much lower than the stated rates. For example, the franchise tax for retail and wholesale companies, regardless of the size of the business, is 0.375%. Businesses that earn less than $20 million in annual revenues and file taxes using the state’s E-Z Computation form pay 0.331% in franchise tax.

However, the E-Z Computation form does not allow a business to deduct COGS or compensation, or to take any economic development or temporary credits.

Tiered Partnerships: Comptrollers Rule 3587

A tiered partnership arrangement is an ownership structure in which any of the interests in one taxable entity treated as a partnership or an S corporation for federal income tax purposes are owned by one or more other taxable entities . This ownership scenario is typically seen in law and medical practices but can also be encountered in real estate ownership structures.

A lower-tier entity may exclude from its total revenue any amount of total revenue reported to an upper-tier entity, as long as the upper-tier entity is subject to the franchise tax ). The lower-tier and upper-tier entities must submit a report to the comptroller showing the amount of total revenue that each upper-tier entity should include with the upper-tier entitys own taxable margin calculation, according to the ownership interest of the upper-tier entity.

There are some limits to the tiered partnership election. First, the tiered partnership provision is not available if the lower-tier entity is included in a combined group. Second, the no-tax-due thresholds, discounts, and the E-Z computation method do not apply to an upper-tier entity if, before the attribution of any total revenue by a lower-tier entity to an upper-tier entity, the lower-tier entity does not meet the criteria.

Dont Forget To Keep Records

Its worth your time to create a system with which you can save relevant employee information and documentation. For example, youd likely want to have employee information on their earnings available if they quit or are fired. Your payroll records should include details such as:

- Full name and Social Security number of employee

- Address and ZIP code

- Total hours worked each day by employee

- Type of pay

Learn how long to keep payroll records and exactly which ones to keep.

Also Check: How To File California State Taxes

How Do Property Tax Comparisons By State Play Out

Property taxes across the US vary quite a bit. When you compare property taxes by state, there are many factors to take into account. Unlike Texas, most states must pay income tax, so while they may pay less in property taxes, they make up for it in income tax or through other means. Of the 50 United States plus the District of Columbia, the following are the five states with the lowest property taxes:

- Hawaii

- Louisiana

- District of Columbia

You may look at those numbers and wonder why these states have the lowest property tax percentage. Lets take a closer look. For example, while Hawaii has the lowest rate, they also have the highest state median home value at $615,300. And, unlike Texas, Hawaiians have to pay state income tax.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Recommended Reading: Does California Have An Inheritance Tax

What Is A Gross Receipts Tax

A gross receipts tax is a tax applied to a companys gross sales, without deductions for a firms business expenses, like costs of goods sold and compensation. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding.

Texas Income Tax Estimator

You can use the income tax estimator to the left to calculate your approximate Texas and Federal income tax based on the most recent tax brackets.

Keep in mind that this estimator assumes all income is from wages, assumes the standard deduction, and does not account for tax credits.

For a more detailed estimate that takes these factors into account, click “View Detailed Estimate” .

You May Like: How To Calculate Taxes Taken Out Of Paycheck

Who Sets The Appraisal Value For My Property

The value of your home is based on the appraisal of a tax assessor. Your local government hires the assessor, who bases the value of your home on similar homes in your area. You can get some idea of your homes value just by seeing what other houses in your neighborhood are selling for. This is one of the factors an assessor may use to value the property in your area.

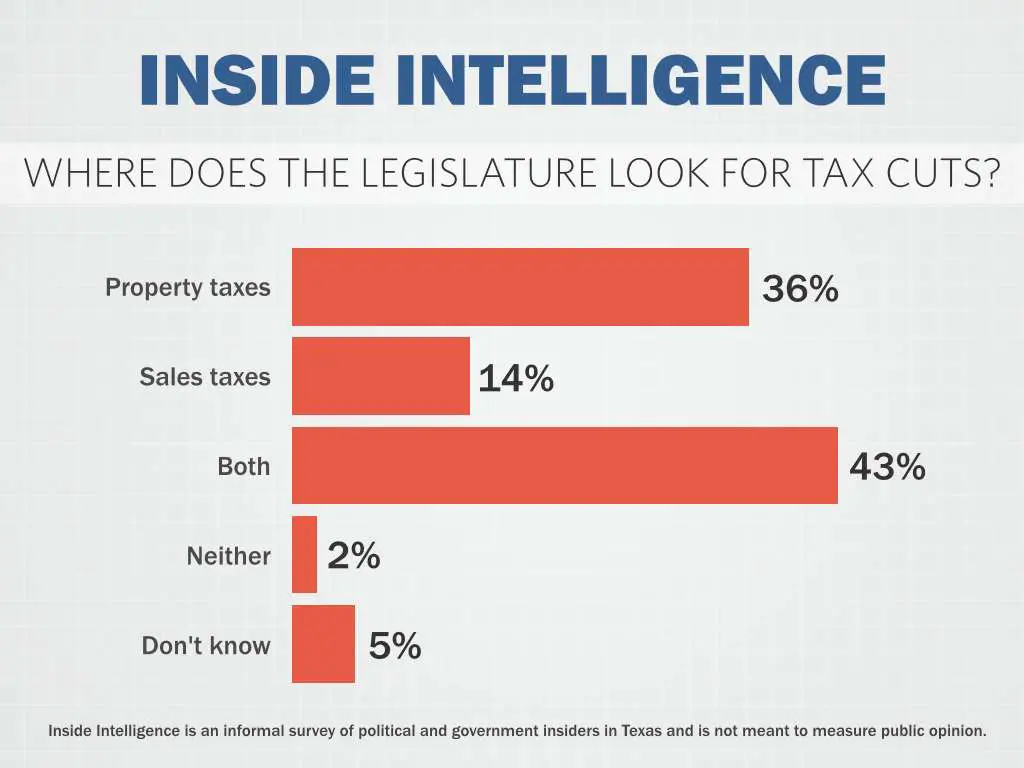

Quality Journalism Doesn’t Come Free

Perhaps it goes without saying but producing quality journalism isn’t cheap. At a time when newsroom resources and revenue across the country are declining, The Texas Tribune remains committed to sustaining our mission: creating a more engaged and informed Texas with every story we cover, every event we convene and every newsletter we send. As a nonprofit newsroom, we rely on members to help keep our stories free and our events open to the public. Do you value our journalism? Show us with your support.

Don’t Miss: Does Mortgage Include Property Tax

Property Tax Rates And Assessment

After the appraisal district submits its report on appraised values and tax exemptions, each taxing unit then sets its tax rate and assesses and collects taxes from property owners. The county tax assessor-collector is in charge of this function for county units. In counties with fewer than 10,000 residents, the sheriff serves as the tax assessor-collector unless voters approve the election of a separate tax assessor-collector. The county tax assessor-collector may, by contract, assess and collect taxes for non-county taxing units.

Cities with populations up to 5,000 can assess only $1.50 per $100 of taxable valuation cities with more than 5,000 residents can assess only $2.50 per $100.

School districts can collect up to $1.17 per $100 in taxable valuation for maintenance and operations . The base rate for M& O is $1.00, but schools can increase the rate by $0.04 without a vote and by a maximum of $0.13 with voter approval. The 2008 average M& O tax rate for all school districts in Texas was $1.052194. This is much less than the average of $1.478997 in 2005, before the rate was lowered to provide property tax relief. School districts are allowed to assess an additional amount of tax for interest and sinking fund debt service on building projects. The average I& S rate rose 39 percent from 2005 to 2008, when it was $0.157313.

How Texas State Business Income Tax Works

Texas has a franchise tax that applies to most Texas businesses other than sole proprietorships and certain general partnerships . At the same time, Texas has no personal income tax. So, while your Texas business itself may be subject to the franchise tax, any remaining income after these taxes that passes through to you personally, for example, from an S corporation, LLC, or limited liability partnership , will not be subject to further taxation on your personal state tax return.

The Texas franchise tax rate for most businesses is .75% of the taxable margin. However, for qualifying wholesalers and retailers , the rate is 0.375%. Also, for businesses with $20 million or less in total revenue that elect to use the so-called E-Z Computation, the rate is 0.331%.

The taxable margin, on which the franchise tax is based, is equal to the least of the following four amounts:

- 70% of total revenue

- 100% of total revenue minus cost of goods sold

- 100% of total revenue minus compensation, or

- total revenue minus $1 million.

There is no minimum franchise tax. Moreover, if your business’s total tax due is less than $1,000 or your business’s annualized total revenue is less than or equal to the no-tax-due threshold , then you do not owe any franchise tax. Franchise tax returns are due each year on May 15th.

Note that various possible state credits and discounts that may apply to your particular business are not covered here.

Recommended Reading: How Do I Pay Taxes

Texas Retirement Tax: The Biggest Game

Before we get down to the nitty gritty of retiring in Texas, its important to highlight the biggest game-changer. While other states impose income taxes, Texas does not! As one of only seven states that dont have an income tax, Texas is an attractive retirement destination to those who want to maximize any income they make in addition to their social security benefits. Now, lets talk about some more tax benefits you can enjoy as a Texas retiree!

1. Tax-Free Income

So, weve already touched on the importance of Texas not imposing a personal state income tax, but the implications for retirees are big! If you, like many senior citizens, plan to continue earning income to supplement your retirement savings or social security benefits, this particular policy is a significant perk. When you take into account the added factor of our low cost of living here in Texas, choosing to retire here seems like a no-brainer!

2. Tax-Free Benefits

Your personal/retirement income isnt the only thing Texas taxes wont touch you will also be able to rest easy knowing your retirement benefits are safe. Whether its your social security savings, IRA, pension, or 401, much more of your hard-earned benefits will stay in your pocket, and out of Uncle Sams. In addition to tax-free retirement income and benefits, the sales tax in Texas is an attractive 6.25%, with an exemption for food and prescription/non-prescription drugs!

Total Tax Burden: 697%

This popular snowbird state features warm temperatures and a large population of retirees. Sales and excise taxes in Florida are above the national average, but the total tax burden is just 6.97%the sixth-lowest in the country.

Florida ranks 31st in affordability due to its higher-than-average housing costs. Still, Florida came in at 10 on the U.S. News & World Report Best States to Live In list.

In 2019 Florida was one of the lowest states in terms of school system spending, at $9,645 per pupil. In 2021 the ASCE gave Florida a C grade for its infrastructure. Six years earlier, Florida received the same grade from the Education Law Center for the fairness of its state school funding distribution. In 2014, its healthcare spending per capita was $8,076, $31 more than the national average.

Don’t Miss: How To File Taxes Online Step By Step

Total Tax Burden: 737%

Like many states with no income tax, South Dakota rakes in revenue through other forms of taxation, including taxes on cigarettes and alcohol. The home of the Lakota Sioux and the Black Hills has one of the highest sales tax rates in the country and above-average property tax rates. South Dakotas position as home to several major companies in the credit card industry, in addition to higher property and sales tax rates, helps to keep the states residents free from income tax, according to reporting by The Atlantic.

South Dakotans pay just 7.37% of their personal income in taxes, according to WalletHub, ranking the state eighth in terms of the total tax burden. The state ranks 14th in affordability and 15th on the U.S. News& World Report Best States lists.

South Dakota spent $8,933 per capita on healthcare in 2014, the 14th highest in the nation. Although it spent more money on education, at $10,139 per pupil in 2019, it spent less than any other neighboring Midwestern state. Additionally, it received a grade of F for its school funding distribution.

South Dakota hasnt received an official letter grade from the ASCE, though much of its infrastructure is notably deteriorated, with 17% of bridges rated structurally deficient and 90 dams considered to have high hazard potential.

Which Counties Have The Lowest Property Taxes In Texas

Each county in Texas is responsible for setting its own property tax rates, resulting in taxes in Texas that vary across the state. When you compare property taxes with other counties, keep in mind that, typically, counties with low property taxes have smaller populations. As of 2020, the five counties with the lowest property tax rates in Texas were:

- Borden

- Crockett

Read Also: How Much Is Maryland Sales Tax

Paychecks And Retirement Benefits Are Safe From State Taxes If You Live Here

by John Waggoner, AARP, Updated March 9, 2022

En español | Saving for retirement is important, but saving money in retirement is important, too. One possible way to save money is to move to a state with no income tax. For retirees, that can mean no state tax on Social Security benefits, pensions and other sources of retirement income.

Nine states Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming have no income taxes. New Hampshire, however, taxes interest and dividends, according to the Tax Foundation. It has passed legislation to begin phasing out that tax starting in 2024 and ending in 2027.

Total Tax Burden: 684%

New Hampshire does not tax earned income but does tax dividends and interest. New Hampshires Senate passed legislation to phase out the investment income tax by 1% per year over five years, with full implementation by 2027. The state has no state sales tax but does levy excise taxes, including taxes on alcohol, and its average property tax rate of 1.86% of property values is the third highest in the country.

Even so, New Hampshires total tax burden is just 6.84%, according to WalletHub, ranking the state fifth in the nation. The state ranks fourth on the U.S. News & World Report list of Best States to Live In and 38th in the nation for affordability.

Though New Hampshire spent more on education than any other state on this list at $17,462 per pupil in 2019, its outlay was among the lowest in the northeastern region of the U.S. Additionally, in 2015 it earned a grade of D from the Education Law Center for its school funding distribution.

New Hampshire received a marginally better grade of C- for its infrastructure in 2017. At $9,589 per capita in 2014, its healthcare spending is the ninth highest in the nation.

Don’t Miss: When Is The Irs Sending Out Tax Returns

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Nership And Sole Proprietorship Taxes

Most Texas small businesses that are partnerships pay the franchise tax, while sole proprietorships do not. The litmus test in a partnership is whether the business is directly owned by individuals, with the business income distributed directly to those individuals. In these situations, Texas treats partnerships like sole proprietorships and does not impose the franchise tax.

In such cases, the business owners must pay federal income tax on this income but not state tax, since Texas does not tax personal income.

The majority of partnerships in Texas, including LPs and LLPs, are subject to the franchise tax.

For business owners in Texas considering forming a partnership, a qualified tax accountant can help determine how to structure the partnership for the most favorable tax treatment given the individual circumstances.

Don’t Miss: How To Start Filing Taxes On Turbotax

Texas Comptroller Provides Rules On The Texas Franchise Tax

In 2006, a special legislative session ordered by the governor of Texas passed House Bill 3 , also known as the revised franchise tax or margin tax, which made sweeping changes to the business tax structure in Texas.

A current movement in state taxation is the introduction of a gross receipts or modified gross receipts tax in place of a net income tax. For example, Ohio, Kentucky, and New Jersey have all enacted some form of gross receipts tax in this decade. By joining this select crowd, Texas modified its old franchise tax, which was based on the capital or earned surplus of corporations and limited liability companies conducting business in Texas.

Under the new law, the franchise tax is based on a taxpayers margin, which is calculated as total revenue less the greatest of three deductions, as elected by the taxpayer on an annual basis ). The three deductions are cost of goods sold, compensation and benefits, and 30% of revenue ).

In addition, taxable entities include not only corporations and LLCs, but generally any entity with limited liability protection. Also introduced for the first time in Texas is the idea of unitary filing, something very alien to Texans. The only things that did not change are the due date of the tax, May 15 of each year, and the taxs accounting period rules.