When Is The Tax Filing Deadline

The final tax deadline for the US is Monday, April 15th. However, you should aim to file your taxes earlier, so you can take the weight off your mind. You can file your taxes with TurboTax the moment you get the relevant forms from your employer for this tax year.

Even if the IRS is not yet accepting filings, TurboTax will keep your tax return on file and submit it at the earliest possible opportunity.

Fourth: Start Filling Out Forms

With the required documents in hand, you can begin filling out the forms required to get your return. The most used federal form is the 1040 form, which pretty much everyone uses. There are several different types of 1040 forms. They can be found on the IRS website, and they have detailed descriptions to help you determine which version you need.

Some taxpayers can complete their filings with just Form 1040, but others need additional forms called Schedules. There are six schedulesâdetermine if any of them apply to you, fill them out, and attach them to your 1040.

- Schedule 1: student loan interest, self-employment tax deductions, unemployment compensation, capital gains, prize money, gambling wins

- Schedule 2: for those who owe alternative minimum tax or those who must repay advance premium tax credits, such as taking out too many Affordable Care Act subsidies

- Schedule 3: claims of nonrefundable tax credits, not counting the Earned Income Tax Credit

- Schedule 4: other taxes not including self-employment tax, additional tax on withdrawals from retirement accounts

- Schedule 5: claims of refundable tax credits not including the American Opportunity Credit, additional child tax credits, or other payments like excess social security tax withheld

- Schedule 6: for those with a foreign address or for those who have designated someone besides a certified tax preparer to file their taxes.

What Are Tax Deductions And Tax Credits

When you submit your tax forms, it’s important that you claim all of the deductions and credits you’re entitled to. Deductions and credits both provide tax savings but in different ways.

A deduction reduces the amount of income the government deems taxable and levies your income tax rate on. If you had $55,000 in taxable income and you claim a $1,000 deduction, your total taxable income is reduced to $54,000 because you subtracted the amount of the deduction from your taxable income.

The value of a deduction is determined by your tax rate because your savings come from not having to pay taxes on the deductible amount. So, if you were in the 22% tax bracket, a $1,000 deduction would save you 22% of $1,000, or $220.

A credit, on the other hand, reduces your taxes owed on a dollar-for-dollar basis. A $1,000 credit would reduce your tax bill by $1,000. If you’d have had a $2,000 tax bill and you claim a $1,000 credit, your tax bill comes down to $1,000. Tax credits are obviously more valuable than a deduction, although both provide savings. And while some credits only reduce your tax bill to $0, there are others that are fully or partially refundable so it’s actually possible to get money back from the IRS that exceeds what you paid into the tax system.

This 2021 guide to tax credits can help you find credits for which you’re eligible, while this guide to tax deductions can help you identify opportunities to take advantage of these valuable tax savings.

You May Like: How Do You Report Plasma Donations On Taxes

File Itr Without Form

If you have not received Form-16 from your employer due to some reasons, you can continue to file an IT return. Following is how to file ITR without Form-16.

- Step-1- Identify your income from all sources. It may include salary and pensions, capital gains, income from house property, income from other sources like fixed deposit interest, interest on refund, etc.

- Step-2- Get Form-26AS . You can download it from the TRACES website of the Income Tax Department.

- Step-3- Gather data related to various payments and investments and claim deduction under Section 80C and 80D of the Income Tax Act as applicable.

- Step-4- The next step in the process of how to file an income tax return without Form-16 involves claiming House Rent Allowance and other allowances.

- Step-5- After the deduction and claim are decided, the total taxable income has to be calculated. You can calculate the total taxable amount by subtracting the total deductions from the total income .

- Step-6- Next, calculate the tax liability per the applicable slab rate.

- Step-7- Determine the payable tax.

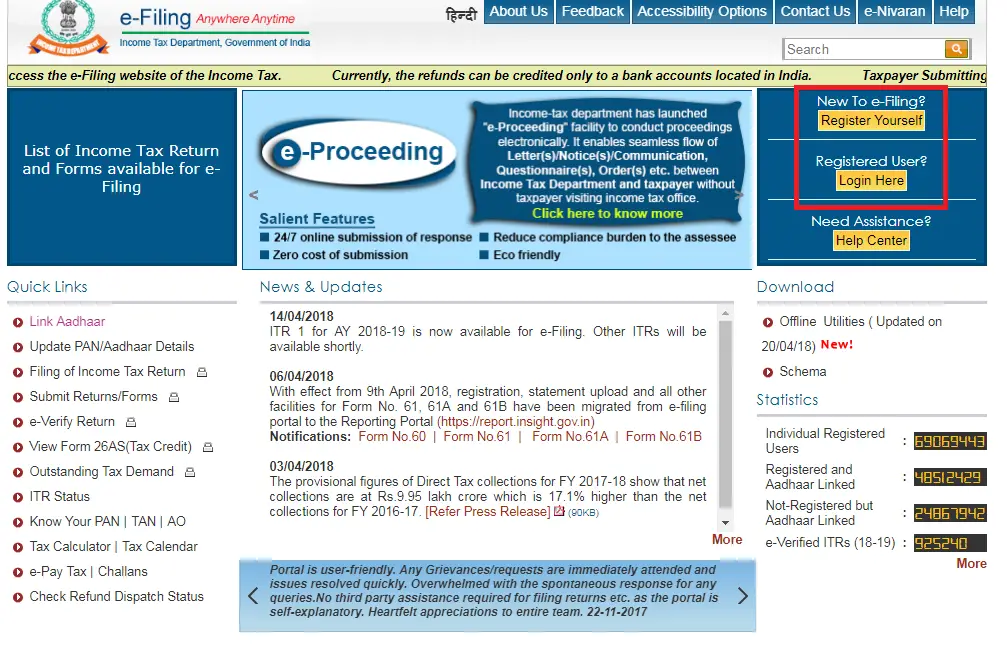

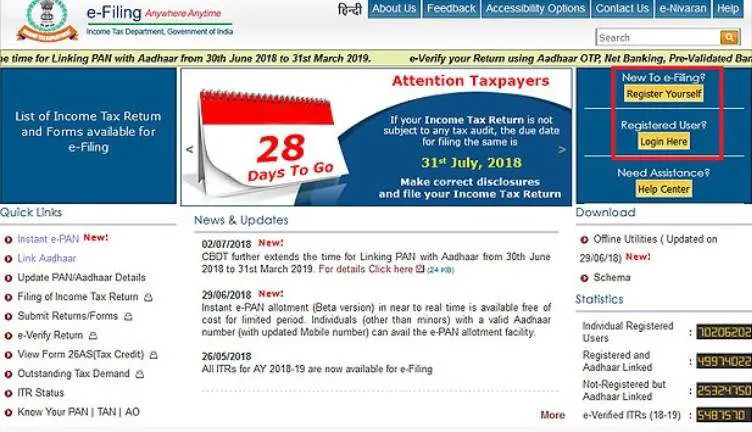

- Step-8- After you have finished doing all the above-mentioned steps, you can visit the official e-filing portal.

- Step-9- File ITR returns without Form-16.

- Step-10- Once you have completed filing ITR, you need to e-verify it.

If you complete all the procedures and do not e-verify, the submission will not start.

Benefits Of Filing Taxes Online

The IRS expects the number of individuals filing taxes electronically will grow to record numbers this year. E-filing offers:

- Faster refund Electronic filing is faster to process, which means a faster refund.

- Accuracy Although it may not prevent all mistakes, e-filing is software-based, so it’s able to check quickly for errors and scan for missing information. In fact, the IRS has reported that e-file returns are more accurate than paper ones.

- Early filing Taxpayers may e-file early, just as they can with paper returns. The sooner you e-file, the sooner the IRS will send you any refund you are owed. The difference, however, is that with early e-filing, it is not necessary to pay the balance of any taxes you owe until the filing deadline.

- Federal and state filing In most states you can e-file both federal and state tax returns with the IRS at the same time.

- Proof of filing The IRS will send you an acknowledgement when they have received and accepted your return.

You May Like: Is Money From Plasma Donation Taxable

What Other Documents Will You Need

For most income-earners, Form W-2 and Form 1099 will detail most or all of their annual earnings. However, you might need other documents, depending on your circumstances. This is particularly true if you plan to itemize your tax deductions .

Itemizing your deductions can maximize the value of your refund. However, its a process that can be heavy on documentation. Some of the things youll need to collect may include property tax statements, mortgage interest statements, and medical bills. You might also need to supply information about retirement account contributions, tuition payments, and tax-deductible donations to registered charities.

Shutterstock

What Income Is Tax Free

Individuals with a net taxable income of less than or equal to Rs 5 lakh would be entitled for a tax refund under Section 87A, which means that their tax burden will be zero under both the new and old/existing tax regimes, if they qualify. The basic exemption limit for non-resident Indians is Rs 2.5 lakh, regardless of their age.

Recommended Reading: Taxes On Plasma Donation

How Do You Choose The Right Tax Filing Status

When you submit your tax return, one of the most important steps is choosing the correct filing status. Your filing status determines your tax bracket and can affect the deductions and credits you can claim.

Your tax filing status options include:

You don’t want to choose single as your filing status if you qualify for head of household or widower because you move into a higher tax bracket at a lower income level when you file as single. There are also certain deductions that you can’t claim if you earn too much — and the threshold at which you lose those deductions is lower for the single filing status. Plus, if you file as single, your standard deduction is also smaller.

Explore all your options and choose the status that allows you to pay the least in taxes. This online IRS tool can help determine which status you qualify for.

Why Business Owners May Use An Accountant And How Much They Cost

The main reason for doing your tax return is to save money on accountancy bills. However, many business owners are too busy to do it themselves or lack a detailed understanding of the different allowances they can claim and find that using an accountant pays for itself quickly.

Chas Roy-Chowdhury, head of taxation at the Association of Chartered Certified Accountants , says: People can come unstuck if they cut corners to save money. Consulting an accountant should save money in tax savings, and in avoiding mistakes and penalties.

Tax rules change regularly, so using an accountant is a good way to ensure you are up to date. Plus, professionally qualified accountants have codes of conduct and ethics, continuing professional development requirements, and you will also have recourse if something goes wrong.

Roy-Chowdhury recommends shopping around to ensure you are paying the correct amount for an accountant. A typical fee would be between £100 and £200 an hour for a small to medium-sized practice.

Charges can also depend on where the business is situated and the complexity of the work. A smaller accountant might charge around £250 to £300 all-in for a straightforward tax return.

Sole traders and other self-employed people might be able to claim the costs for their accountant as an expense, and, appropriately, the accountant themselves will know if this is allowable.

As well as helping avoid errors, they can also help handle any disputes with HMRC, says Levine.

Also Check: What Home Improvement Expenses Are Tax Deductible

Can I File My Taxes For Free With Turbotax

TurboTax free file service is aimed at the average American with simple tax affairs.

More complex tax affairs will require you to purchase the upgraded service. There are three paid packages you can take advantage of.

Furthermore, youll be able to enjoy the benefits of specialist support and the chance to take advantage of filing your state taxes at the same time.

However, even with the free service, you get the guarantee of 100% accuracy with no mistakes. Plus, you can still take advantage of the live chat feature, which is run by professional tax preparers who know what theyre doing. You always have a limited amount of support, even with the free service.

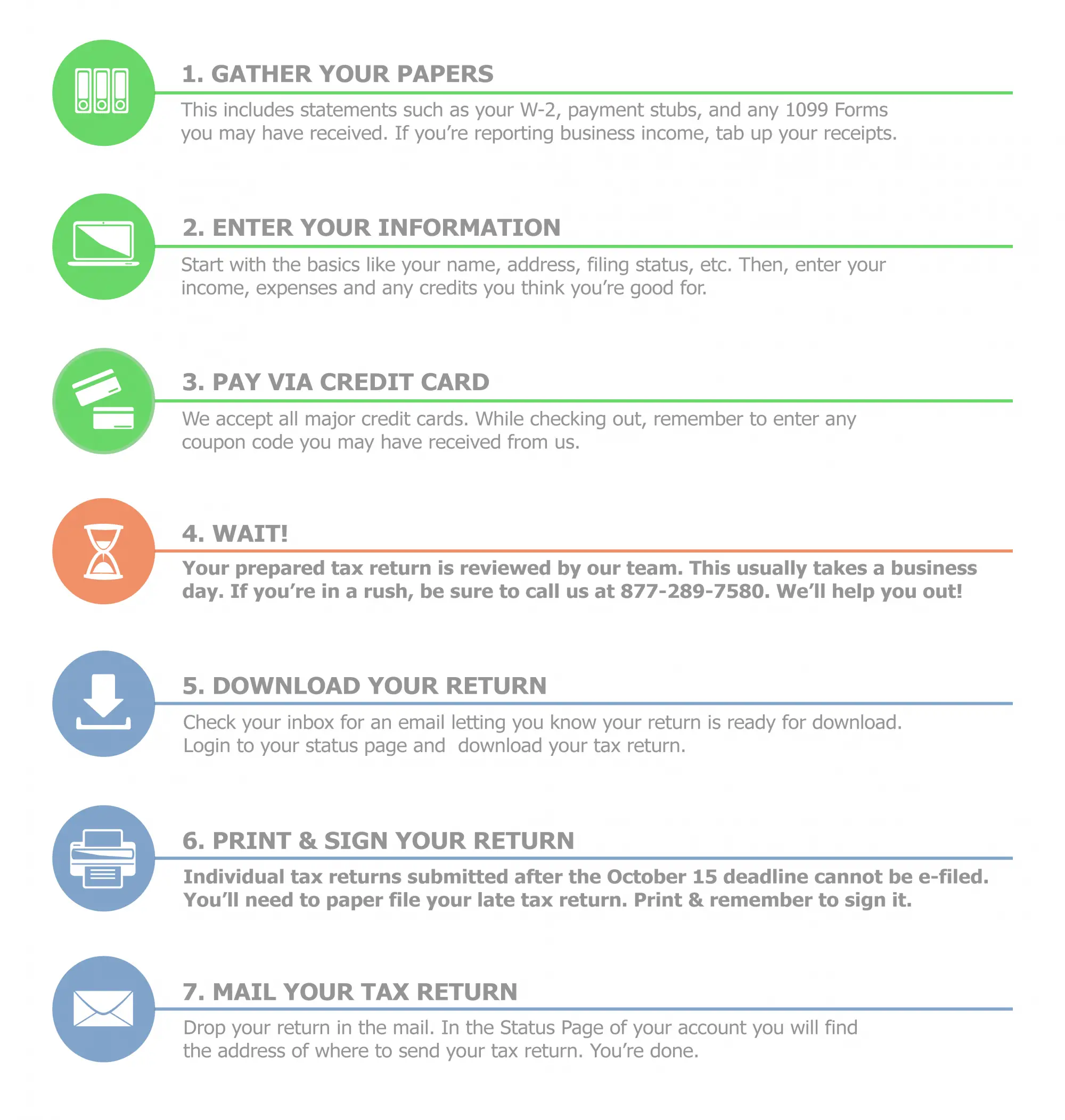

A File Taxes Online With Tax Software

If youve used tax software in the past, you already know how to prepare and file taxes online. Many major tax software providers offer access to human preparers, too.

TurboTax, H& R Block, TaxAct and TaxSlayer, for example, all offer software packages or support options that come with on-demand, on-screen or online access to human tax pros who can answer questions, review your return and even file taxes online for you.

The IRS Free File program can get you free online tax preparation software from several tax-prep companies, including major brands. You must have less than $72,000 of adjusted gross income to qualify.

» MORE:See our picks for the year’s best tax filing software

Recommended Reading: When Does Doordash Send 1099

Review Your Documents From Last Year

When doing taxes yourself, you might want to review the information from your previous years federal and state tax returns. Much of the information will likely be the same, including employer federal ID numbers, childrens Social Security numbers, and even some of your credit or deduction options. The IRS also uses your prior-year AGI to verify your identity when you e-file, which means youll want to make sure you have the information you submitted last year on hand.

Starting with an old return can help you enter information quickly and accurately. One great tip for doing your own taxes is to use a software program such as TaxAct that can often import old tax data. That way you dont have to enter it again, which can save time and reduce the potential for typos and other errors.

What Are The Deadlines For Filing Your Taxes

There are deadlines for filing your taxes that you must meet. Typically, Tax Day is April 15, meaning that’s the last day to e-file or mail your tax return. Monday, April 15, 2021, is when your 2020 taxes are due.

Sometimes April 15 falls on a weekend or on a holiday, so the deadline for filing your taxes is moved to the next business day. And the deadline for 2019 taxes was delayed substantially due to COVID-19, with 2019 taxes not due until .

There is no reason to wait for the deadline — the IRS will begin accepting returns for the 2020 tax year as early as January 27, 2021.

Don’t Miss: Doordash Tax Rate

How To Register For First

For individuals, choose Borang Pendaftaran Online under Daftar Individu.

Under Daftar Individu, click Borang Pendaftaran Online.

Fill in the form.

The site will show your application number. Please write it down for future reference.

Scroll down and click Muat Naik Disini. Upload a copy of your identity card.

You can then obtain the e-Filing PIN via visiting the nearest LHDN branch or online.

Third: Keep The Proof In Case Of An Audit

Itâs important to keep all of your forms and documents on hand for at least seven years in case youâre audited. An audit is an investment the IRS performs if there are any suspicions that you were not eligible for the deductions or credits you claimed. Keeping receipts and other proof around for this long will enable you to provide evidence if audited.

Donât be too worried about an audit, however. If youâre doing your taxes correctly, you donât have to be worried. Additionally, itâs extremely rare. Only about 0.5 percent of all returns are audited.

Don’t Miss: How Do Doordash Taxes Work

Learn About Paying With Web File

You can pay directly from your bank account when you Web File your sales tax return, or make payments in advance of filing. Both options conveniently save your bank account information for future use.

If you pay when you Web File, you can still schedule the payment in advanceas long as you’re filing before the due date.

To help you remit the correct amount, organize your sales data with our Sales Tax Web File worksheets.

How Can I File Itr Online By Myself

How to submit an ITR online for the fiscal year 2021-22

You May Like: How To Do Taxes With Doordash

How Do You Decide Whether To Claim The Standard Deduction Or To Itemize

In addition to filing status, the choice of whether to itemize or take the standard deduction is one of the two most important decisions you’ll make when filing taxes.

When you take the standard deduction, you are able to deduct a set amount of income from your taxes based on your filing status. For the 2020 tax year, the standard deduction is:

- $12,400 if you file as single or married filing separately

- $18,650 if you file as head of household

- $24,800 if you file as married filing jointly

If you take the standard deduction, you are allowed to take a few additional tax deductions as well, such as a deduction for contributions to an IRA or a deduction for student loan interest. There are many other deductions you can only claim, though, if you itemize.

If you choose to itemize instead of taking the standard deduction, you deduct from your taxable income for specific things — but you do not deduct the $12,400, $18,650, or $24,800 standard deduction. You should itemize only if the total combined value of your itemized deductions exceeds the standard deduction.

Some of the deductions you can only claim if you itemize include deductions for:

- State and local taxes paid

- Mortgage interest

- Medical expenses that exceed a certain percentage of income

- Investment expenses

How To Pay Your Tax

When filing online, once you have completed your Self Assessment return, HMRC will tell you how much tax you owe.

Each of the two payments on account is half your previous years tax bill. If you still owe tax after making your payments on account, you must make a balancing payment by midnight on 31 January the following year.

If youre paying your tax bill by debit card, allow two working days for the transaction to clear.

If you prefer to pay more regularly throughout the year such as weekly or monthly you can use HMRCs budget payment plan, but only if your previous payments are up to date and if you are paying in advance.

You May Like: How Do You Pay Taxes With Doordash

How Can I File My Income Tax Return In Pakistan

A person can fill out the income tax return form online by inputting all of the necessary information, and then submit the form online as well, using the entirely online manner described above.. If you want to follow in my footsteps, follow the instructions below.

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

You May Like: Do You Pay Taxes On Doordash