There Is A Bit Of Relief For Bitcoin Taxes

Bitcoin taxes can be a bummer, but at least you can deduct capital losses on bitcoin, just as you would for losses on stocks or bonds. These losses can offset other capital gains on sales. When youre done tallying your winners and losers, you cant write off a loss of more than $3,000.

With drastic fluctuations in bitcoins price happening all the time, many bitcoin speculators will have losses. If you have losses on bitcoin or any other cryptocurrency, make sure you declare them on your tax return and see if you can reduce your tax liability.

Bitcoins Held As Capital Assets Are Taxed As Property

If Bitcoin is held as a capital asset, you must treat them as property for tax purposes. General tax principles applicable to property transactions apply. Like stocks or bonds, any gain or loss from the sale or exchange of the asset is taxed as a capital gain or loss. Otherwise, the investor realizes ordinary gain or loss on an exchange.

Turbotax Has You Covered

Don’t worry about knowing the tax implications of cryptocurrency transactions.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier is designed for you and can help you easily and accurately report your gains and losses. TurboTax is the only major online tax preparer that supports importing over 1500 stock and 2,250 cryptocurrency transactions at once, directly from financial institutions, saving you time and ensuring accuracy. TurboTax Premier has partnered with hundreds of financial institutions and investment platforms to allow you to auto-import your investment info seamlessly when doing your taxes. Increase your tax knowledge and understanding, all while doing your taxes.

Recommended Reading: How Do You Do Taxes For Doordash

What Is The Process For Filing Taxes For Cryptocurrency Investments

In general terms, filing taxes in relation to cryptocurrency investments is no different from filing taxes for any other type of investment income. You must report all taxable events on your federal returns , and you must pay either ordinary income or capital gains tax on all income that is subject to tax under the Internal Revenue Code.

However, filing taxes for cryptocurrency investments presents challenges for many individuals. This is because accurately reporting and calculating tax on cryptocurrency transactions requires the following information :

- The date of the original investment

- The purchase price of the initial investment

- The date of transfer

- The fair market value of the cryptocurrency at the time of transfer

In order to accurately file taxes for cryptocurrency, this information is needed for each individual cryptocurrency transaction. For someone who trades in cryptocurrency regularly, this could potentially mean hundreds or thousands of transactions over a multi-year period that need to be reported to the IRS. Since most exchanges and digital wallets do not track all of this information , cryptocurrency investors must track much of this information themselves in order to meet their tax reporting and payment obligations.

Northwest Territories Provincial Tax Rate

| Tax Rate |

|---|

| On the first $44,396 of taxable income |

| 8.6% |

| On the first $46,740 of taxable income |

| 7% |

| On the first $45,105 of taxable income | |

| 20% | |

| 25.75% | $109,756+ |

Considering Federal and Provincial Income Tax Rates, this can seem quite a high tax rate to pay – but remember for capital gains, you’ll only pay tax on half your gain. Unlike many other countries, short-term and long-term capital gains are taxed the same way in Canada.

You May Like: Is Selling Plasma Taxable

Do I Have To Report Cryptocurrency Losses To The Irs

Yes, you need to report your crypto losses to the IRSand doing so could actually save you a pretty penny, for two reasons.

One: Your exchange may be sending information about your transactions to the IRS, but that information is often incomplete and doesnt include any losses. This can make the IRS think you owe much more than you actually do. Correcting that mistake can be more expensive and troublesome than reporting properly to begin with.

Two: Capital losses offset capital gains, lowering the amount of tax owed. They can also be used to offset regular income and other capital gains , and can even be carried forward to offset future gains! Give us a call to learn more.

How Do You Report Crypto On Your Taxes

If youâre like most cryptocurrency investors, you likely have only bought, sold, and traded crypto via a cryptocurrency exchange. This crypto income is considered capital gains income and is reported as such.

On the other hand, if you earned cryptocurrencyâwhether that’s from a job, mining, staking or earning interest rewardsâthat earned income is generally treated as ordinary income and is reported as such.

We dive into the reporting for each of these income types below.

Recommended Reading: Employer Tax Id Lookup

Moving Cryptocurrency From One Wallet To Another

If youre simply moving your cryptocurrency from one wallet to another e.g. from Coinbase to GDAX or your own wallet then it would not be a taxable event as long as you havent sold any of your cryptocurrency during the process.

That being said, there might be some tax implications . . . sort of.

Lets say you paid a $10 transfer fee, well that would be a transaction cost which you could deduct from your capital gains later. The same applies to any fees you incur when you buy or sell your crypto.

Bitcoin Used To Pay For Goods And Services Taxed As Income

If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms.

- You must convert the Bitcoin value to U.S. dollars as of the date each payment is made and keep careful records.

- Wages paid in virtual currency are subject to withholding to the same extent as dollar wages.

Employees must report their total W-2 wages in dollars, even if earned as Bitcoin. Self-employed individuals with Bitcoin gains or losses from sales transactions also must convert the virtual currency to dollars as of the day received, and report the figures on their tax returns.

You May Like: License To Do Taxes

Looking To The Irs Guidance On Cryptocurrency

The best way to understand the specifics of the tax implications of cryptocurrency is to understand IRS Notice 2014-21, which provided guidance for paying taxes on cryptocurrencies like Bitcoin.

The report says:

Virtual currency is treated as property for U.S. federal tax purposes. General tax principles that apply to property transactions apply to transactions using virtual currency. Among other things, this means that:

- Wages paid to employees using virtual currency are taxable to the employee, must be reported by an employer on a Form W-2, and are subject to federal income tax withholding and payroll taxes.

- Payments using virtual currency made to independent contractors and other service providers are taxable, and self-employment tax rules generally apply. Normally, payers must issue Form 1099.

- The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer.

- A payment made using virtual currency is subject to information reporting to the same extent as any other payment made in property.

– End IRS –

FACT: The above guidance isnt the only document you need to consider. Also important is a 31-page report from the Treasury Inspector General for Tax Administration released Sept. 21, 2016.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Is Donating Plasma Taxable

How Much Tax Do You Have To Pay

The next important question is how much tax do you have to pay in a financial year. The answer to this question depends on two factors:

The crypto holding period is calculated from the next day of your cryptocurrency assets purchase or you make a cryptocurrency transaction, and it continues till the day you send, sell, trade, or exchange your capital asset. This is what decides whether your gains are short-term or long-term capital gains and losses.

The Crypto Tax Reporting Solution

The solution to the crypto tax problem hinges on aggregating all of your cryptocurrency data that makes up your buys, sells, trades, airdrops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all of your transaction data.

Once all of your transactions are in one spot, youâll be able to calculate cost basis, fair market values, gains/losses, and income for all of your investing activity.

You can aggregate all of your transaction history by hand by pulling together your transactions from each of your exchanges and wallets. Or you can avoid the manual work and automate this process with the use of crypto tax software.

You May Like: How Much Is Payroll Tax In Louisiana

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How Is Crypto Income Taxed

Crypto income is taxed as ordinary income at its fair market value on the date the taxpayer receives it.

Here are the most common examples of what’s considered crypto income:

- Receiving crypto as payment for providing a service

- Staking crypto and earning rewards

- Lending crypto and receiving interest payments

Read Also: Amended Tax Return Online Free

Do I Owe Crypto Tax If I Use An Overseas Exchange Or Wallet

In almost every case, offshore cryptocurrency holdings by US persons are still subject to stateside reporting and taxation. In fact, the IRS has a history of filingand winningJohn Doe warrants that compel foreign banks to hand over identifying information about accounts tethered to US citizens. Officials have relied on the process for decades. Now, the IRS is using it to unearth Bitcoin and altcoin holdings stashed overseas.

Do I Owe Taxes On Cryptocurrency

Whether you owe taxes on your cryptocurrency depends on how you got it and how you use it.

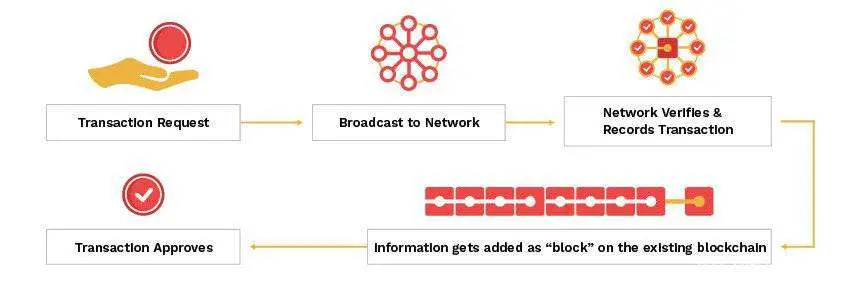

- Did you mine cryptocurrency? Mining crypto is when you use computers to solve complicated equations and record data on the blockchain. In exchange for this work, you may receive payment in new crypto tokens. You owe taxes on the entire value of cryptocurrency youve obtained by mining.

- Did you get crypto as a reward or an airdrop? If you receive cryptocurrency through a marketing promotion or an airdrop, it counts as taxable income.

- Did you receive payment for goods or services in cryptocurrency? If someone pays you crypto for goods or services rendered, the entire payment counts as taxable income, just as if they paid you in cash. Unlike a cash payment, though, your customer might also owe income taxes if their crypto provides them with greater value than they paid for it.

- Did you sell cryptocurrency to realize an investment gain? If you sell crypto for more than you paid for it, you owe tax on the gain as you would with stocks or mutual funds.

- Did you convert or exchange one crypto for another? When you convert or exchange cryptoswapping bitcoin for ethereum, for exampleyou owe taxes on any gains you earn in the transaction. If you purchased $400 worth of bitcoin and used it to buy $1,000 worth of ethereum, youd owe taxes on $600 in realized profit, even though youre just exchanging one crypto for another.

Also Check: 1040paytax.com Safe

How Are Forks And Airdrops Taxed

In 2019, the IRS issued Revenue Ruling 2019-24, which provides guidance on the taxation of hard forks and airdrops of cryptocurrency. Airdrops are taxed as income and must be reported on your Schedule 1 tax form. The fair market value of the airdrop on the day it was received is the amount you should report on your Schedule 1. This is also considered your cost basis if and when you sell the airdropped coins. If a fork does not result in an airdrop, its not considered a taxable event.

How Do You Account For Cryptocurrency On Your Taxes

The accounting for cryptocurrency on taxes is a bit more complicated than traditional transactions. Vendors that accept digital currencies, such as Bitcoin or Monero, will use the market value of these cryptocurrencies when determining their income statement and balance sheet because they are treated like other assets for tax purposes rather than an inventory item.

This can make it challenging to determine what you owe in taxes with regard to crypto-assets. For example, if one sells $100 worth of bitcoin at the end of December 2017 which was valued at $20K per coin then your gain would be calculated by multiplying this amount . However, the exact amount you owe would depend on the date you sold the cryptocurrency and whether its subject to short-term capital gains, or long-term capital gains, along with state taxes.

Due to the complexity of each individual transaction, its crucial to keep track of all trades and their respective market value when calculating capital gains tax in order to avoid paying a lot more than you should or claiming far less for the year because your cryptocurrency was not accounted for correctly on your taxes. Thats why having a dedicated team member to focus on accounting for cryptocurrency is so important.

Read Also: How To Protest Property Taxes Harris County

Are Crypto To Crypto Exchanges Taxable

Crypto to crypto exchanges are taxable events. The IRS has definitively stated that like-kind exchange does not apply to crypto for tax years 2018 onward. However, even for years before 2018, its nearly impossible to argue that crypto-to-crypto is not taxable . Watch a detailed breakdown in the video below.

Convertible Virtual Currency Is Subject To Tax By The Irs

Bitcoin is the most widely circulated digital currency or e-currency as of 2021. It’s called a convertible virtual currency because it has an equivalent value in real currency. The sale or exchange of a convertible virtual currencyincluding its use to pay for goods or serviceshas tax implications. The IRS answered some common questions about the tax treatment of virtual currency transactions in its recent IRS Revenue Ruling 2019-24 and its Frequently Asked Questions article. Tax treatment depends on how a virtual currency is held and used. Below are some tips using Bitcoin as an example:

Don’t Miss: Are Raffles Tax Deductible

If I Only Sold A Little Bit Of Bitcoin Do I Still Need To Report It

Yes. A profit of any amount needs to be reported to the IRS. For the first time, this tax season’s 1040 form includes a question about virtual currencies on the front page asking taxpayers if “at any time during 2020, did receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

“The IRS thinks there’s massive, massive underreporting in this area,” Ryan Losi, a certified public accountant with Piascik tells Make It. “And they’re going to start targeting it.”

Indeed, the cryptocurrency question is the first item on the 1040 form, just below the individual’s contact information.

In the past, taxpayers may have been able to feign ignorance about their obligation to report crypto gains, but that won’t fly anymore. “Everyone who signs the tax return is signing that under penalty of perjury from the U.S. government,” Losi says. “Now folks can’t say ‘I didn’t see the question’ or ‘it was buried on the document.'”

How Much Does Cryptotaxcalculator Cost

CryptoTaxCalculator works with an annual subscription model which you can use to generate reports for all previous tax years, instead of paying for a single annual report.

This means that if you need to amend a report due to forgetting to add a waller or similar incident, you wont need to pay extra.

There are 4 tiers to choose from, with all of them including a 30-day money-back guarantee that you can take advantage of if you are not satisfied with how the platform works.

Pricing Options

At this time. these tiers start at $49 a year and can go up to $299, with the difference being the number of transactions supported.

The Rookie, Hobbyist, and Investor tiers offer the same features but different transaction limits of 100, 2500, and 1000 transactions respectively. The features included on these tiers are:

Unlimited Exchanges

Recommended Reading: How Much Will A Roth Ira Reduce My Taxes