Where Tax Accountants Work

Every working adult and non-exempt entity needs to file IRS tax forms. Therefore, tax accountants can find employment in diverse work settings. Many tax accountants work at public accounting firms, including Deloitte, Ernst & Young, and PricewaterhouseCoopers. Tax accountants can work in-house or consult with private corporations. Tax accountants find jobs at government agencies, such as the Department of the Treasury and Internal Revenue Service. Financial institutions like banks, insurance carriers, and investment brokerages have tax accounting staff. Tax accountants can work at hospitals, colleges, K-12 school districts, manufacturing facilities, software startups, and more. Some tax accountants even work for mutual and hedge funds. Tax accountants have a flexible, full-time financial services career. About 7 percent of tax accountants are self-employed and telecommute from home offices.

Be A Foundation For Business

Becoming a CPA offers the opportunity to make a substantial impact in how a company operates, grows and succeeds. While the role offers high salaries, it also delivers the kind of satisfaction that can come from helping a business operate effectively and ethically. Find out more about how the University of North Dakotas online Master of Accountancy program can help you develop the knowledge and skills to pursue a career that can reward you in more ways than one even if you dont have any experience or a bachelors degree in accounting.

Ready To Make Your Move In Accounting Gain Insights For Every Career Stage In Our Free Accounting Career Guide

If you get your masters degree in accounting and earn your CPA you can also expect higher than average salaries. According to EMSI, the median advertised salary for a CPA with a masters degree is $82.8K, which is $11.3K higher than the government-recorded median salary for accountants and auditors.

This goes to show that as you earn more credentials, your salary typically goes up as well.

Also Check: How To File Multiple Tax Returns On Turbotax

Compare Cpa Vs Other Accountant Salaries

CPAs can compare their salaries with other accounting and auditing professionals by using a tool devised for the purpose by the AICPA. The salary comparison tool requires you to key in the country and the state in which you work and select an industry as well. After this, you need to enter your salary and bonus figures.

Based on the data that you enter, the tool will immediately provide a report that gives details of the amount that other CPAs in the state and the country earn. You will also be able to see the particulars pertaining to the average annual salary as well as the bonus percentage for your industry.

Remember that the results that the interactive salary tool provides are indicative and not 100% true to real life. They are based on a salary survey conducted by the AICPA in 2017.

Do Tax Accountants Need Cpa

![How Much Do Bookkeepers Charge? [Bookkeeping Rates & Fees] How Much Do Bookkeepers Charge? [Bookkeeping Rates & Fees]](https://www.taxestalk.net/wp-content/uploads/how-much-do-bookkeepers-charge-bookkeeping-rates-fees.png)

Job Descriptions Most tax accountants are Certified Public Accountants. Non-CPAs can prepare and compile financial statements, whereas CPAs can also assist their clients during IRS audits. In addition to preparing taxes, tax accountants assist individuals and businesses in financial planning and estate planning.

Don’t Miss: How Are Limited Partnerships Taxed

Strategy #: Serve The Most Efficient Clients

It is common for a solo accountant or a small firm to accept every client that happens to request your service. After all, each new client brings in additional revenue and may even bring in word of mouth referrals. But serving too many different types of clients is not efficient.

Specialization: The most efficient client mix depends on your skills, your team, and the market situation. The trick is in determining the correct level of specialization. If you specialize too narrowly, there may not be a sufficient market for you to serve. Too broad, and you cannot be efficient.

The optimum level of specialization is often impractical to determine. A more realistic strategy is to continue to shift your client mix towards services that you can deliver most efficiently. Your client mix should allow you to follow a very small number of common processes.

Client Demands: Some clients are just more demanding. They seem to act as if by retaining your service they own you. In other cases, they may just be so incompetent or disorganized that they fail to provide you the information you need from them in a timely manner. But they will blame you for missing any deadline or incurring penalties. In rare cases, their business needs may be so complex that you simply cannot serve them efficiently.

What Experience Do You Need For A Senior

If you are seeking a more senior role as a tax accountant, employers will typically look for several years of tax accounting experience.

Individuals who have earned a masters degree in business administration or accreditation, such as the CPA or Chartered Global Management Accountant designation, often have an advantage when pursuing more senior-level tax accountant positions, especially for management roles.

Note that many companies hiring for corporate tax accounting roles prefer to hire candidates with a public accounting background.

See this post to learn about more than 10 different finance and accounting certifications that many employers value today, and what it takes to earn them.

Also, be sure to check out this post, which is all about earning and maintaining a CPA license.

Also Check: What Is The Deadline For Filing Taxes In 2021

What Companies Hire Cpas

CPAs can work for companies ranging from small, local businesses to massive, international corporations. Just about every company in the world needs financial services, so the skys the limit when it comes to where you can land your dream job. Heres just a sampling of the industries in which you could find yourself as a CPA:

- Treasury/cash management

What Tax Accountants Do

Tax accountants are specialists who know Internal Revenue Service tax codes like the backs of their hands. Tax accountants are equipped to produce tax filings accurately. Tax accountants work with individuals and enterprises to report financial data to the government. Unlike tax examiners, a tax accountant doesnt review and audit tax filings to collect money. Unlike tax preparers, tax accountants can do more than write up tax returns. Tax accountants also help clients develop a profitable tax planning strategy. Tax accountants advise managers on ways to lower, defer, or completely cut tax payments. Tax accountants build step-by-step plans for clients to reduce taxable income and raise deductions year-round. Meeting clients financial growth goals by maximizing tax refunds within the law is their goal. Accountants can further specialize in tax accounting niches, such as mergers and acquisitions tax or estate tax.

Read Also: When Do I File Business Taxes

Here’s How Much Money Accountants And Tax Preparers Earn In Every State

1040 form with wooden cubes on table

Getty

With January over and February beginning, the 2019 tax filing season is in full-swing, after officially opening on Jan. 28, 2019. And this year marks a significant change: Its the first time the new tax legislation, the Tax Cuts and Jobs Act of 2017, will impact American taxpayers. According to the IRS, more than 18.3 million Americans claimed $12.6 billion in refunds in just the first week of the tax filing season.

Tax season can be very stressful, and most Americans dont particularly enjoy it except for receiving a tax refund, of course. However, certain segments of society definitely do enjoy this time of year, namely accountants and tax preparers. Using occupational data from the Bureau of Labor Statistics, we analyzed and put together a review of the average salary of accountants and tax preparers in each U.S. state for 2019.

Check out the full breakdown below of where accountants and tax preparers take home the least money, and where they earn the most.

Top Average Accounting Salaries By Job Title

There are many different accounting career paths. If you get a masters degree in accounting, even more doors will open to high-paying careers.

Lets look at 5 of the popular career paths for accountants with a master’s degree, as well as the salaries they should command in 2021 .

Accounting Manager

Median Salary: $95,750

Accounting manager is one of the most traditional career paths, focused on reliably tracking, monitoring and evaluating the financial status of an organization. With such a broad base of responsibilities, there is also a wide need for these professionals. EMSI reported nearly 20,000 job postings for accounting managers between September 2019 to September 2020.

Senior Tax Accountant

Median Salary: $90,500

A senior tax accountant is responsible for preparing and filing complex tax returns for companies. Responsibilities also include compiling supporting financial documents in case of inquiries from regulatory agencies and auditing work of more junior staff.

Controller

Median Salary: $121,500

Controllers are responsible for the overarching accounting operations of a company. These professionals oversee the creation of periodic financial reports, maintenance of accounting records, and a full set of controls and budgets that mitigate risk and enhance accuracy of financial results. Experienced professionals like these are in great demand, as EMSI reported over 20,000 jobs were posted for Controllers between September 2019 to September 2020.

Forensic Accountant

Recommended Reading: Where Can I Find Tax Id Number

Strategy #: Do Not Let Clients Slow You Down

Clients do not know your workflow. They may either have their own guess about how the service will be performed or may be basing their expectation on the previous firm they worked with. The client may proceed according to their preconceived process in an honest effort to avoid asking “unnecessary” questions that will waste your time. Having worked with just one accountant before you, they may genuinely not have imagined that your process might differ.

If you change your workflow for each client, it slows you down, creates chaos with how different tasks are performed, and increases the overhead for adding each new client.

Have a common well-defined process that you follow for every client of a given service type. For instance, all payroll clients follow the same process. Give an outline of this process in writing to your client immediately after they have engaged your service. For instance, after the initial engagement meeting, you may prefer to first get their paperwork and meet only after you have reviewed it. The client might think they need to meet you with the paperwork to explain what they have going on. Having a written process saves time for both you and your client. It is much better than wasting time on a meeting that you did not need. And less awkward than having to call the client in again because the earlier meeting was too soon for you to have asked the right questions .

Future Job Outlook For Tax Accounting

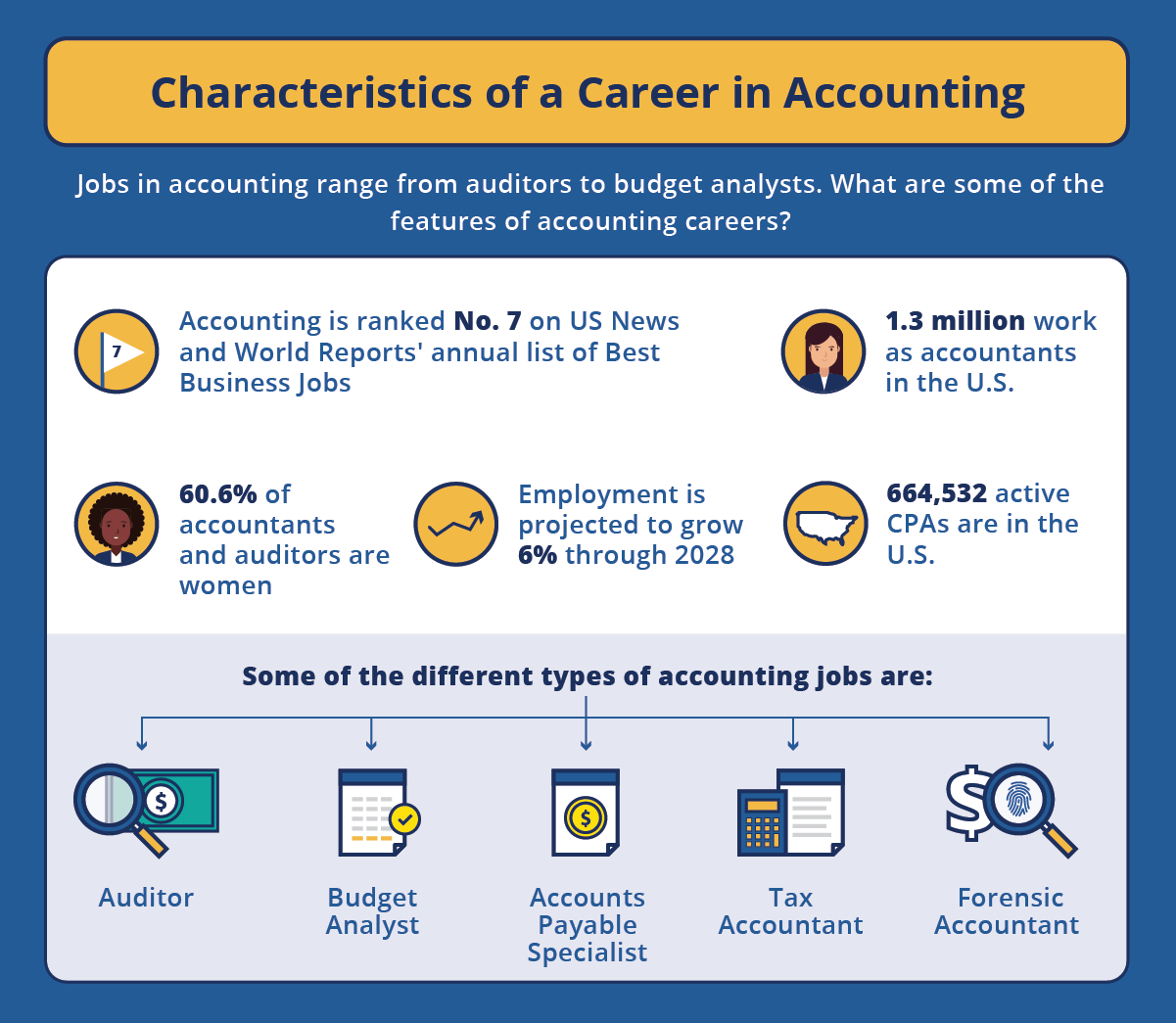

The U.S. News & World Report recognized tax accountants for having the 42nd best job. Current unemployment for tax accountants is a low 1.8 percent. Prospects are good for new tax accountants. The Department of Labor predicts the employment of tax accountants will rise 6 percent. Through 2028, the number of accountants will jump to 1.514 million. About 90,700 new accounting jobs are expected this decade. In comparison, the demand for tax examiners and collectors will drop two percent for 1,400 jobs lost. Accounting clerks will have a four percent hiring decline and lose 65,800 jobs. Tax accountants have one of the sunniest 10-year outlooks in financial services. Whats driving demand for tax accountants? Recent changes to the tax code and regulations are making more clients hire tax accountants. The healthy economy also has more businesses starting up and needing tax guidance.

Read Also: Where Can I Get An Income Tax Loan

Penalties For Missed Or Late Payments

The IRS charges a late fee if you dont deposit the employment tax you owe on time, called a Failure to Deposit Penalty. Youll receive a notice from the IRS if you owe a penalty.Payroll tax penalties are:

- One to five days: 2% of unpaid amount

- Six to 15 days: 5% of unpaid amount

- More than 15 days: 10% of unpaid amount

- More than ten days after your first notice: 15% of unpaid amount

Featured Partners

On Onpay’s Website

How Much Do Tax Accountants Make

Tax Accountant Salaries

| Rothstein Kass Tax Accountant salaries 29 salaries reported | $83,203/yr |

| Deloitte Tax Accountant salaries 28 salaries reported | $65,989/yr |

| SurePrep Tax Accountant salaries 25 salaries reported | $55,364/yr |

| RubinBrown Tax Accountant salaries 23 salaries reported | $62,017/yr |

Also Check: Can I File My Taxes Without My Social Security Card

Year Junior Accountant Salary

Accountants are typically promoted to the junior level within the first two years of being hired. Some even reach this level during the first year of employment. As a junior accountant without a CPA license in corporate accounting, you can expect to earn between $50,000 and $75,000 based on the size of your company.

Explore Job Roles: Tax Accountants

Learn about the average salary, relevant studies, related questions, and common path after college to becoming a Tax Accountant.

What is a Tax Accountant?

Tax Accountants are Accountants that specialize in tax-related services to their clients. Their responsibilities include helping to prepare and file tax returns.

Where does a Tax Accountant work?

- Accounting firms

- Organizations and agencies of all kinds

- As contracted consultants

How much does a Tax Accountant make?

Based on real new grad salaries reported through Handshake, the median annual salary for a Tax Accountant is $57,000.

What majors are typically interested in becoming Tax Accountants?

Ones major doesnt necessarily determine their career, but these are some common majors of those who end up pursuing this career path.

- Accounting majors

Don’t Miss: How To Calculate 1099 Taxes

Average Salary For Cpas

Requiring particular expertise and additional training, CPAs often earn higher salaries than general accountants. Their knowledge and skills are useful and in-demand in crucial areas such as defending against the IRS. Similar to general accountants, CPA salaries vary depending on experience and location.

-

Salary in the U.S.: $67,915 per year as per salaries on Indeed

What Determines How Much An Accountant Will Make

There are many factors that go into determining how much an accountant can make. The biggest influences on salary include:

Why is a masters degree so important? A masters degree in accounting will not only raise your salary prospects, it will also increase your job stability and desirability as a candidateeven during challenging economic times.

Also Check: When Is Income Tax Due This Year

Annual Salaries Of Accountants And Auditors By State

Source Bureau of Labor Statistics

As you would expect, salaries differ within a state as well. Data provided by Robert Half reveals that different cities have widely varying salaries for the same type of job. For example, starting salaries in California range from 13% below the national average to 41% above it, depending on the city in which you work.

States With Projected Increase In Employment

Over the next 3 years, openings for accountant and auditor positions are projected to increase. Here is a breakdown of the US states that are expected to see the greatest increases.

Projected Percentage Increase of Accountant and Auditor Positions

| STATE |

|---|

*Sources: U.S. Department of Labor Statistics, Robert Half

The two major factors that contribute to a CPAs yearly salary are the employees experience and the size of the company. On average, CPAs earn 1015% more than their uncertified counterparts.

Also Check: How Much Taxes On 1099 Form

Average Salary Of A Tax Accountant

The Bureau of Labor Statistics reports a mean annual wage of $79,520 for tax accountants. Americas 1.28 million accountants, including tax accountants, make $38.23 per hour on average. The lowest 10 percent of tax accountants have a $44,480 median paycheck. The top 10 percent of tax accountants receive median compensation of $124,450. Most tax accountants fall into the $55,900 to $94,340 income range. To compare, tax preparers have mean earnings of $46,860. The average salary for tax examiners and collectors is $60,960. Tax accountants at public accounting firms have an $83,460 median yearly wage. Tax accountants in local government bring home $69,180 average pay. The federal executive branch provides an annual mean income of $100,260. Tax accountants in the business transportation industry have the highest earnings average of $104,110.

What Is An Enrolled Agent

An Enrolled Agent is licensed at the federal level and solely focuses on taxation. They can provide tax advice, file tax returns for any entity that must report taxes, and represent clients in IRS proceedings.

Those wishing to obtain EA certification must pass a three-part test, apply to become an EA with the IRS, and pass a background check. EAs must complete 72 hours of continuing education every three years to maintain their certification.

You May Like: Where To Pay Irs Taxes

Are You Ready To Find A School That’s Aligned With Your Interests

According to a 2022 Bloomberg Tax article, accountants have earned consistent salary increases in the past several years. Educational institutions have also noted rising demand for specialized accountants. Together, these factors create favorable labor market conditions for aspiring tax attorneys.

Tax accountants benefit from ongoing demand in the public and private sectors. Government agencies employ these professionals to collect revenues, manage public finances, and investigate fraud. Private organizations and individuals also hire them to apply their deep knowledge of tax regulations to find savings opportunities.

This guide explores the influences shaping current tax accounting salary trends. Considering factors such as education, experience, location, and employment industry can help aspiring tax accountants understand their earning power.

What Is A Certified Public Accountant

Certified public accountants are a type of accountant with special training in taxes. In the U.S., CPAs are certified by their individual states and prepare and sign tax returns for both individuals and businesses. During an audit by the IRS, CPAs represent their employers. They also offer consulting services, addressing employer concerns and offering objective advice in financial and strategic planning.

Related:16 Accounting Jobs That Pay Well

Read Also: What Is Federal Work Opportunity Tax Credit