How To Figure Your Property Tax Bill

Property taxes in Tennessee are calculated utilizing the following four components:

The APPRAISED VALUE for each taxable property in a county is determined by the county property assessor.

The ASSESSMENT RATIO for the different classes of property is established by state law .

The ASSESSED VALUE is calculated by multiplying the appraised value by the assessment ratio.

The TAX RATE for Davidson County is set by the Metro Council based on the amount of monies budgeted to fund the provided services. These tax rates vary depending on the level of services provided and the total value of the countys tax base. The tax rates are not final until certified by the State Board of Equalization.

To calculate the tax on your property, assume you have a house with an APPRAISED VALUE of $100,000. The ASSESSED VALUE is $25,000 , and the TAX RATE has been set by the Metro Council at $3.288 or $2.953 per hundred of assessed value. To figure the tax simply multiply the assessed value by the tax rate of $3.288 or $2.953 per hundred dollars assessed.

Are Property Taxes And Real Estate Taxes The Same

Essentially, property taxes and real estate taxes are the same thing. The term real estate tax refers to a tax on owned real estate. Real estate tax and property tax can usually be used interchangeably unless you are talking about personal property tax. Personal property tax includes movable assets like cars, boats and planes but excludes homes or real estate.

What Is Property Tax Used For

Whether you realize it or not, property taxes are used to fund many initiatives and services that may affect your daily life, like local governments activities, including law enforcement, fire protection, community pools, libraries, city road work and other community projects.

These services are what attract some home buyers to desire one particular neighborhood over another. For example, good school districts and safe neighborhoods are two of the many neighborhood amenities that can attract prospective homeowners to a particular neighborhood. But because homeowners in certain neighborhoods can enjoy these services, its only fair that the services are all funded by the taxes paid by current homeowners.

If youre a potential home buyer whos comparing different neighborhoods with different services offered to community members, make sure to take a hard look at your budget and consider how those property taxes will affect it. This might mean youll have to pick and choose what communal benefits are best for you and your family.

Recommended Reading: Cook County Appeal Property Tax

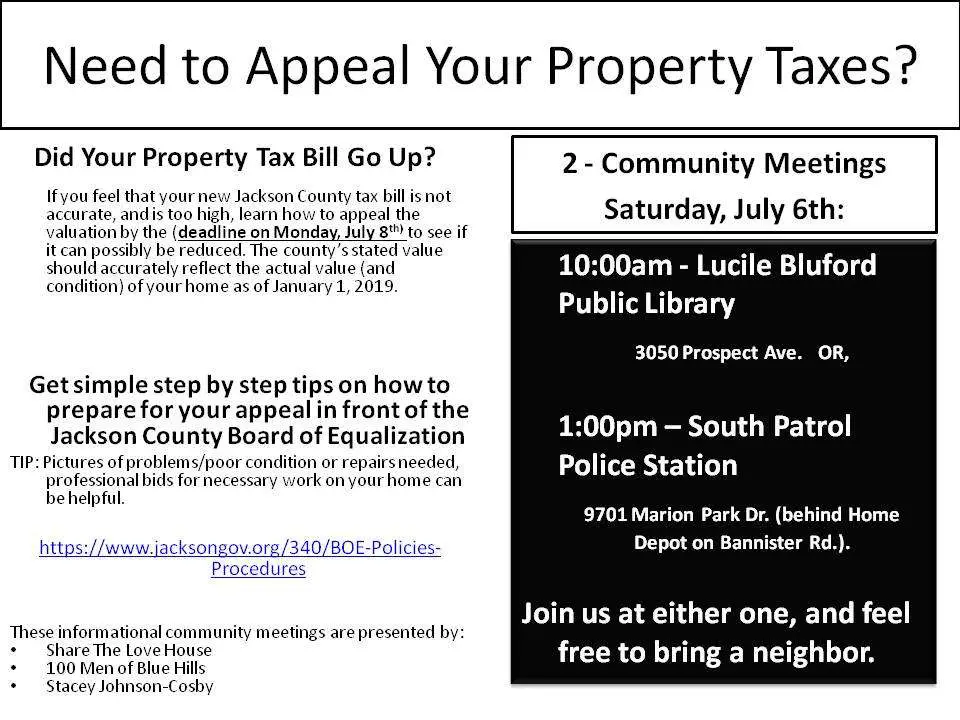

Can You Lower Your Property Tax Bill

If you disagree with a property tax bill on your home, you can contest it by challenging your homes assessed valuation. Youll need to show that the assessed value doesnt reflect your propertys true value. If successful, your appeal could result in a lower property tax bill.

-

Make sure the assessment data is accurate and matches with the details of your property.

-

Gather comparable listings or ask a real estate agent to pull records of comparable sales for you. Often, tax records are available online from the local tax assessor.

-

If youre unsatisfied, you might be able to pursue the case with an independent tax appeals board.

Learn more ways to capitalize on your home

-

Our home affordability calculator will show how much house you can afford to buy.

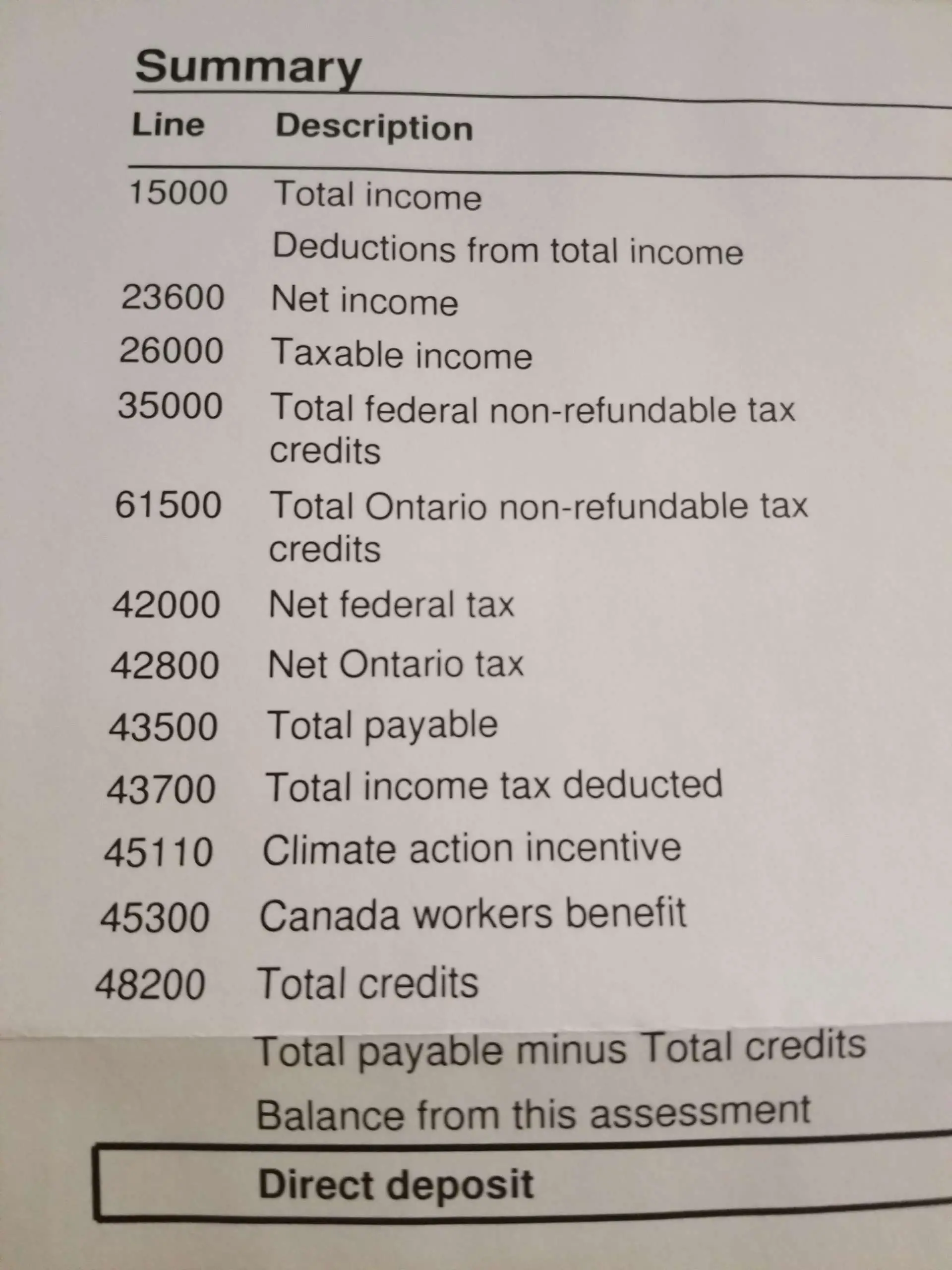

Understand Your Tax Bill

If you feel you are paying too much, it’s important to know how your municipality reaches that figure on your bill. Sadly, many homeowners pay property taxes but never quite understand how they are calculated. It can be confusing and challenging, especially because there may be a disconnect between how two neighboring towns calculate their property taxes.

Property taxes are calculated using two very important figuresthe tax rate and the current market value of your property. The rate at which taxing authorities reset their tax rates is based on state lawsome change them annually, while others do so in different increments, such as once every five years. Municipalities set their tax ratesalso known as millage or mill ratebased on what they feel they need to pay for important services.

An assessor, hired by the local government, estimates the market value of your propertywhich includes both the land and structureafter which you receive an assessment.

The assessor may come to your property, but in some cases, an assessor may complete property assessments remotely using software with updated tax rolls. Your local tax collector’s office sends you your property tax bill, which is based on this assessment.

In order to come up with your tax bill, your tax office multiplies the tax rate by the assessed value. So, if your property is assessed at $300,000 and your local government sets your tax rate at 2.5%, your annual tax bill will be $7,500.

Also Check: Can Home Improvement Be Tax Deductible

Ask For Your Property Tax Card

Few homeowners realize they can go down to the town hall and request a copy of their property tax cards from the local assessor’s office. The tax card provides the homeowner with information the town has gathered about their property over time.

This card includes information about the size of the lot, the precise dimensions of the rooms, and the number and type of fixtures located within the home. Other information may include a section on special features or notations about any improvements made to the existing structure.

As you review this card, note any discrepancies, and raise these issues with the tax assessor. The assessor will either make the correction and/or conduct a re-evaluation. This tip sounds laughably simple, but mistakes are common. If you can find them, the township has an obligation to correct them.

How Often Is My Property Reassessed

Cook County is reassessed triennially, which means one-third of the county is reassessed each year. This year, the south suburbs will be reassessed. The City of Chicago will be reassessed in 2021. The northern suburbs will be reassessed in 2022. Your property may also be reassessed if there are significant changes due to a permit application, property division, demolition, or other special application.

Don’t Miss: How To Look Up Employer Tax Id Number

Farmland: A Special Case

Farmland is one of the few types of property/land that are assessed under a regulated system rather than a market value. They also have some of the lowest property taxes relative to market value. They are valued based on the productive value of the land compared to a baseline set in 1995. The relative productivity is then multiplied by the baseline assessment value of 1995. This would be $450 per acre for irrigated arable land, $350 per acre for dry arable or dry pasture land, and $135 for woodlot lands. This value is then multiplied by an assessment year modifier published every year by the Ministry of Municipal Affairs to arrive at the assessed value.

Farmland Regulated Assessment Values are Significantly Lower than Market Prices

The assessment year modifier set by the Ministry of Municipal Affairs hasremained unchanged at 1.00 to 1.03 since 1995. This means that farmland today is still valued at 1995 prices and with a maximum of $450 per acre. In contrast, sale prices have ranged between$600-$3,000 an acre for agricultural farmlandand between $6,000-$10,000 for farmland closer to residential districts. This is a difference in valuation of up to more than 2,000%.

Farmland Exemptions to Buildings and Improvements

Property Assessments In Alberta

Properties in Alberta are assessed every year by municipalities according to guidelines by the Ministry of Municipal Affairs and the Alberta Assessment and Property Tax Policy Unit. This is different from BC and Ontario where property assessments are conducted by a provincial entity. Most properties are assessed using a market value-based approach. There are three ways that municipalities can use to determine a propertys market value:

1.Sales Comparison Approach

Most properties are valued under this approach. This compares the sales of similar properties in the assessment year to determine a valuation for the property. The assessed value may not equal the actual market value or sale value of a property.

2.Cost Approach

New properties are valued under this approach. This uses the cost of the property if someone were to rebuild it to determine a valuation for the property. This includes the price of the land and the price of all improvements on top of it. While this takes into account the market value of the land, it does not consider the market value of the property as a whole.

3.Income Approach

For properties that are dedicated to generating income like rental properties or offices, an income-based approach is used. In these cases, it may not be possible to find recent sales of comparable properties. This approach uses the income generated by the property to determine its assessed value.

Read Also: Pastyeartax.com Reviews

Secured Property Taxes Terms

Annual Secured Property Tax BillThe annual bill, which includes the General Tax Levy, Voted Indebtedness, and Direct Assessments, that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1, due in two installments.

Adjusted Annual Secured Property Tax BillA bill that replaces the Annual Secured Property Tax Bill due to the following reasons: a change or correction to the assessed value of the property the allowance of an exemption that was previously omitted the correction of a Direct Assessment placed on the property from a municipality or special district or the inclusion of a penalty for failure to comply with certain requirements of the Office of the Assessor prescribed by law .

Ad ValoremAccording to the value Based on value. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property.

Non-Ad Valorem Not according to the value.

AssessmentThe rate or value of a property for taxation purposes.

Assessors Identification Number A 10-digit number that identifies each piece of real property for property tax purposes, e.g., 1234-567-890.

California Relay ServiceA telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

Current YearThe current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill.

Testate

Your Tax Bill May Vary Each Year

The total amount of your tax bill will likely change every year due to changes at the school district or local government level. Changes to the following will directly impact the amount of taxes you owe each year:

- budgets

- tax levy distribution among multiple municipalities

Changes in your assessment or exemptions can also impact your tax bill.

You May Like: Have My Taxes Been Accepted

What Is The Difference Between My Assessment Notice And My Tax Bill

Your reassessment notice usually arrives once every three years after your township has been reassessed. Our schedule of reassessment mailing dates can be found here along with corresponding appeal dates. It does not require any action on your part though you may appeal if you believe the assessment is too high .

Your annual tax bill comes from the County Treasurers Office in two installments: the first installment is due in March, and the second installment is due in August.

Your reassessment will affect the second installment tax bill the following year. So if your reassessment notice arrives in 2020, the tax bill reflecting this assessment will arrive in July of 2021. Any appeals of your reassessment value will be reflected in the second installment tax bill the following year.

If I Believe The Information On This Notice Is Incorrect How Do I Appeal

If the characteristics listed for your home are wrong, if you think your home is worth less than the fair market value on this notice, or if you think there is information about your home that was not taken into account, you can file an appeal of your assessment.

Appeals can be filed with our office or with the Cook County Board of Review. Please see our Appeals section for information on how and when to file an appeal with our office. Visit cookcountyboardofreview.com for information and deadlines about appeals with their office.

Don’t Miss: How To Buy Tax Lien Properties In California

Assessment Procedures Manual Revisions

An overview of the Arizona property tax assessment system including property classification and assessment ratios, appeals, standard appraisal methods, statutory valuation procedures, exemptions and a discussion of full cash and limited property value. In 2018, the manuals team deployed a major update project comprising all manuals and guidelines produced by the Local Jurisdictions District. The following definitions are being incorporated as intrinsic project elements:

- Review: Manual conforms to standard style and formatting. Legislative and other citations have been verified. No changes to content, methodology, policy or practice.

- Revision: Includes all review processes manual is a newly edited version. Manuals are also considered revised when conforming to a non-substantive legislative change. Information that does not alter valuation methodology may have been added or deleted.

- Rewrite: Includes all review processes major substantive changes have been made to any combination of content, valuation methodology, policy or practice.

The Updated Assessment Procedures Manual material available on the website supersedes prior electronic and/or hardcopy versions of these chapters, guidelines, memoranda or directives which may conflict with the updated material.

How Do I Make A Property Tax Payment

You can choose one of the following methods of payment:

- Internet/Online Banking and Telpay through your local bank or credit union.

Payee name:Manitoba IMR Property Tax. The account number would be your municipality number plus your roll number which you can find on your tax bill. It should be a total of 12 digits. Example:Municipality number: 702, Roll number: 0123456.000, In this case, delete the first zero in the roll number. Account number is 702123456000.

The most efficient way to pay your property tax bill is to make an online payment. Some payments may take 2-3 days. If you have questions about the on-line banking process, please contact your bank for further assistance.

- Chequesand Money Orders by Mail, including postdated cheques. Please make cheques payable to Minister of Finance as well as indicating your roll number to where the payment is being applied. Please send your cheques to:

Property TaxationManitoba Indigenous Reconciliation and Northern Relations400-352 Donald Street

- In office payments such as:

- Cash:Please do not mail

- Debit:No credit cards are accepted

- Cheques and Post dated Cheques:Payable to the Minister of Finance

- Address: Manitoba Indigenous Reconciliation and Northern Relations, 59 Elizabeth Drive, Thompson MB

Please note that, as a result of social distancing due to the pandemic, the office may not be open to in-person payments without an appointment. Please call our office by toll free number at 1-888-677-6621.

Also Check: How To File Taxes Without Income To Get Stimulus Check

Property Assessment Update And Covid

As a result of the pandemic surrounding COVID-19, the reassessment originally scheduled to be completed for the 2021-2024 taxation years has been postponed.

Please visit the following link to the Municipal Property Assessment Corporation for updates regarding the reassessment.

For the 2021 taxation year, your propertys assessed value will be the same value as that from the 2020 taxation year unless there have been changes to your property.

For information regarding an appeal of your property assessment, please visit the appeals page.

What Happens If I Fail To Pay My Property Taxes

If you fail to pay your property tax bill for some reason, your municipality will place a tax lien on your home. Therefore, its very important that as a homeowner, youre able to afford your property tax payments and stay up to date on them.

When there is a tax lien on your home, the creditors will be notified that the government has legal rights to your home. If you still fail to pay after this, the tax lien can become a levy, which means the government can actually seize your property to satisfy the debt. In some cases, your property taxes may be taken out of the profits from a sale.

There are many other consequences for refusing to pay or paying your taxes late. Under some circumstances, the taxing authority may transfer your account to a private collection company. A private tax collector may use aggressive tactics to get you to pay, so as mentioned earlier, its best to avoid failing to pay if possible.

Don’t Miss: Have My Taxes Been Accepted

Example : Increase In Municipal Costs

If your municipality needs more money, your property taxes may increase.

Using the original property values of $125,000, $175,000 and $200,000, an increase in municipal costs to $2,500 increases the overall tax rate to 0.5%.

The total value of the three properties is $500,000 and the cost of services is now $2,500, so the tax rate is 2,500/500,000 = 0.005, or 0.5%. Therefore:

- The owner of the $125,000 property pays 0.5%, or $625.

- The owner of the $175,000 property pays 0.5%, or $875.

- The owner of the $200,000 property pays 0.5%, or $1,000.

- The total of the tax paid by the three property owners is $2,500.

Where To Find Property Taxes

Thankfully, in many cases, you may not have to calculate your own property taxes. You can often find the exact amount youll pay on listings at realtor.com®, or else you can enter a homes location and price into an online home affordability calculator, which will not only estimate your yearly taxes but also how much you can anticipate paying for your mortgage, home insurance, and other expenses.

Don’t Miss: Have My Taxes Been Accepted

How To Pay Your Surrey Property Taxes Online

Pay by Pre-Authorized Pre-Payment Plan

Put money towards next year’s Annual Utilities and Property Taxes with a monthly withdrawal from your financial institution with the Pre-Authorized Pre-Payment Plan . With PAPP, you’ll start paying your taxes for 2021.

The pre-payment plan will accumulate 10 monthly withdrawals from your bank account, interest prescribed by the Province, and apply the funds towards your:

- annual utilities balance in February, due April 2 , and

- property taxes balance in May.

Be sure to get familiar with the payment withdrawal dates and details to avoid penalties. In particular, mark the July manual payment date in your calendar.

Metered utilities are not covered by PAPP. See your metered utilities payment options, or learn about the auto-debit payment plan.