Tax Return Filing Dates In 2022

Below are the estimated dates for key tax filing activities and deadlines. These will be updated as the IRS provides more information and you can subscribe to get notified of the latest updates.

Stay In the Know:or follow us on , and

An important point to note is that while you can file your taxes anytime after the beginning of the year, the IRS will not process any returns until IRS e-File goes live. This includes returns filed via the main tax software providers or directly via the IRS website for lower income filers. The IRS also reiterated that filing your taxes electronically is the most accurate way to file a tax return and the fastest way to get a refund. It is expected that more than over 80% of tax returns will be e-filed in the latest tax year.

Once your return is accepted the IRS processes your refund based on the IRS E-file Refund Cycle Chart. Exact refund dates are based on IRS processing times and can be found in IRS Publication 2043 and IRS Topic 152 for both e-filed and mailed returns. After filing and assuming your tax return is on order you should receive your federal refund between 8 and 21 days. If you did not select the electronic deposit option, getting a paper check mailed to you adds about a week. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date.

Don’t Forget Your Credits

Tax payers who don’t use a professional or online tax preparation service may not know what tax credits are available to them unless they read or follow tax-related news. Unclaimed 2017 tax credits represent part of the unclaimed $1 billion in the IRS’s coffers. Those with low or moderate incomes may be eligible for the Earned Income Tax Credit even if they didn’t have a tax bill.

If your 2017 income fell below these limits, you might be able to claim EITC by filing by May 17, 2021:

- $15,051 and no qualifying children

- $39,617 and one qualifying child

- $45,007 and two qualifying children

- $48,340 and three or more qualifying children

Those needing to claim refunds for the 2017 tax year have other possible tax credits in addition to EITC they may be able to claim including:

- Refundable Credit For Prior Year Minimum Tax

- Health Coverage Tax Credit

Can I Still File My Taxes From 2016 And Still Get A Refund

For federal taxes,

doesn’t say you can’t. Be prepared to pay any penalties that might be owed, though the penalties aren’t going to get any if you wait longer or get caught by the the IRS or other taxing authority will want you to file too)

Recommended Reading: Harris County Property Tax Protest Services

You Can Fall Behind On Your Taxes If You Dont File A Federal Income Tax Return Or Dont Pay Any Tax You Owe By The Due Date Generally April 15 For Most People

Owing back taxes can feel overwhelming. The prospect of facing penalties and interest, or just the sheer work of filing a past-due return, may tempt you to keep putting things off.

But we cant stress enough that being proactive is the way to go when it comes to dealing with the IRS. As soon as you realize you may owe back taxes, or youve missed a filing deadline, its important to file and pay those outstanding taxes as soon as possible to help minimize the consequences of falling behind.

Lets look at some things to know when you have to pay or file back taxes.

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Recommended Reading: Does Contributing To Roth Ira Reduce Taxes

How To Correct An Electronic Return

If we have accepted and processed your client’s T1 return, you may be able to amend and retransmit the T1 return using the ReFILE service. Also, your client can use My Account’s Change my return option. Alternatively, if you are an authorized representative for your client and you have a level 2 authorization on their account, you can also use Represent a Clients Change my return option.

We conduct a review on each return transmitted to us. If there are problems which will prevent processing, the system will indicate the fields you will have to correct. This means the electronic tax return was not accepted for processing and your client’s return is not considered to be filed.

Before signing off the system, print the EFILE web service response screen which contains the error messages. Review these messages or codes to determine what problems exist with the return.

For example, you may receive the following:

2037There is an entry on line 30300 on page 5 of the return for the spouse or common-law partner amount and, if applicable, on line 58120 on the provincial or territorial Form 428. Where your client was married or living common law during the year but on December 31st the marital status was other than married or living common law, enter 1 on line 55220.

You can usually get the full text description of each error clue from your tax calculation software package or by accessing chapter 2 of the RC4018 Electronic Filers Manual.

Overview Of Basic Irs Filing Requirements

You are only required to file a tax return if you meet specific requirements in a given tax year. The most common reason people need to file is when they earn over the income filing threshold. For the 2018 tax year, these amounts were as follows:

These amounts changed with the passage of the Tax Cuts and Jobs Act and have fluctuated over the years. Youll need to find the income filing threshold for the appropriate tax year to determine if you had a filing requirement. For example, use the 2016 income filing threshold to decide whether or not you should have filed a tax return in 2016.

You may still need to file a return even when you earn less than the filing threshold amount. Some other reasons you may need to file include the following:

You must file your tax return by the deadline set by the IRS each year, typically around April 15th.

Don’t Miss: Buying Tax Liens California

Where Do I Send Back Taxes

If the IRS mailed you a notice about your late taxes, you should mail your return to the address listed in that notice. Otherwise, where you mail your old tax returns depends on where you live and whether or not youâre including a payment with your return. The IRS instructions for Form 1040 of the year youâre filing for should also include the proper mailing addresses.

What If I Owe More Than I Can Pay

If youre facing a tax bill you cant afford to pay in full right away, you may have payment options.

- Consider paying the IRS with a credit card or personal loan. Using credit to pay your tax debt likely means youll pay interest to the lender. But those costs may be less than the penalties and interest you might face if you fail to pay the IRS on time and in full.

- If you owe $50,000 or less, you can request an online payment agreement from the IRS. Short-term installment agreements give you 120 days or less to pay. A long-term agreement can give you up to 72 months to pay what you owe in monthly payments.

- If you meet certain criteria, you may be able to ask the IRS for an offer in compromise, which could allow you to settle your tax debt for less than what you owe.

- In dire cases when paying anything might prevent you from covering your basic life expenses, the IRS may agree to temporarily delay collection of your past-due tax debt.

Don’t Miss: Www Aztaxes Net

What Can Happen When I Dont File Taxes

When a taxpayer fails to file taxes, an array of consequences can be imposed following an audit or upon conviction of a tax crime. One the less serious side of the spectrum, a taxpayer can face fines for both their failure to file taxes and their failure to pay taxes. These penalties are computed for each full month or each part of a month where the tax obligation remained unfulfilled. Depending on the amount of the tax debt, these penalties and unpaid taxes can accumulate quickly.

One of the harshest consequences a tax non-filer can potentially face is tax evasion charges. Tax evasion is a felony and carries a federal prison sentence. Normally, one cannot face tax evasion charges for failures to take action or inaction. Thus, the question taxpayers sometimes ask is, How can I face tax evasion charges when I didnt do anything.

In truth, this characterization of not doing anything obscures the fact that prosecutors can bring tax evasion charges against tax non-filers when there is a last affirmative act of evasion. Essentially, a last affirmative act of evasion is any step or act that taxpayer takes to further their non-filing scheme or conceal their failure to comply with the U.S. Tax Code. Theoretically, a taxpayer who fails to file taxes for several years and then lies about it to an IRS agent could face tax evasion charges. Other acts in concert with tax non-filing that could potentially justify criminal tax evasion charges include:

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How To Get Tax Preparer License

Know The Rules For Amending A Federal Income Tax Return

PKS CPA

What should you do if you discover an error on a previously filed individual tax return? For example, you might have missed some tax-saving deductions and credits on your 2016 personal federal income tax return that you filed in February. Or you might have recently discovered that you failed to claim some legitimate tax breaks on your 2015 return that you filed last year. Here are the rules for filing an amended return.

The Basics

The first thing to know is that you should not attempt to correct the situation by filing another original return using Form 1040. That will just create confusion at the IRS and cause headaches for you. Instead, file Form 1040X, Amended U.S. Individual Income Tax Return.

How long do you have to file an amended return? The answer depends on whether youre asking for a refund or you owe additional taxes.

When claiming a refund. The sooner you file an amended return, the sooner youll receive any refunds due. So it doesnt pay to wait. If amending your return will produce a tax refund, the deadline for filing Form 1040X is generally the later of:

1. Three years after the original return for the year in question was filed, or

2. Two years after the tax for that year was paid.

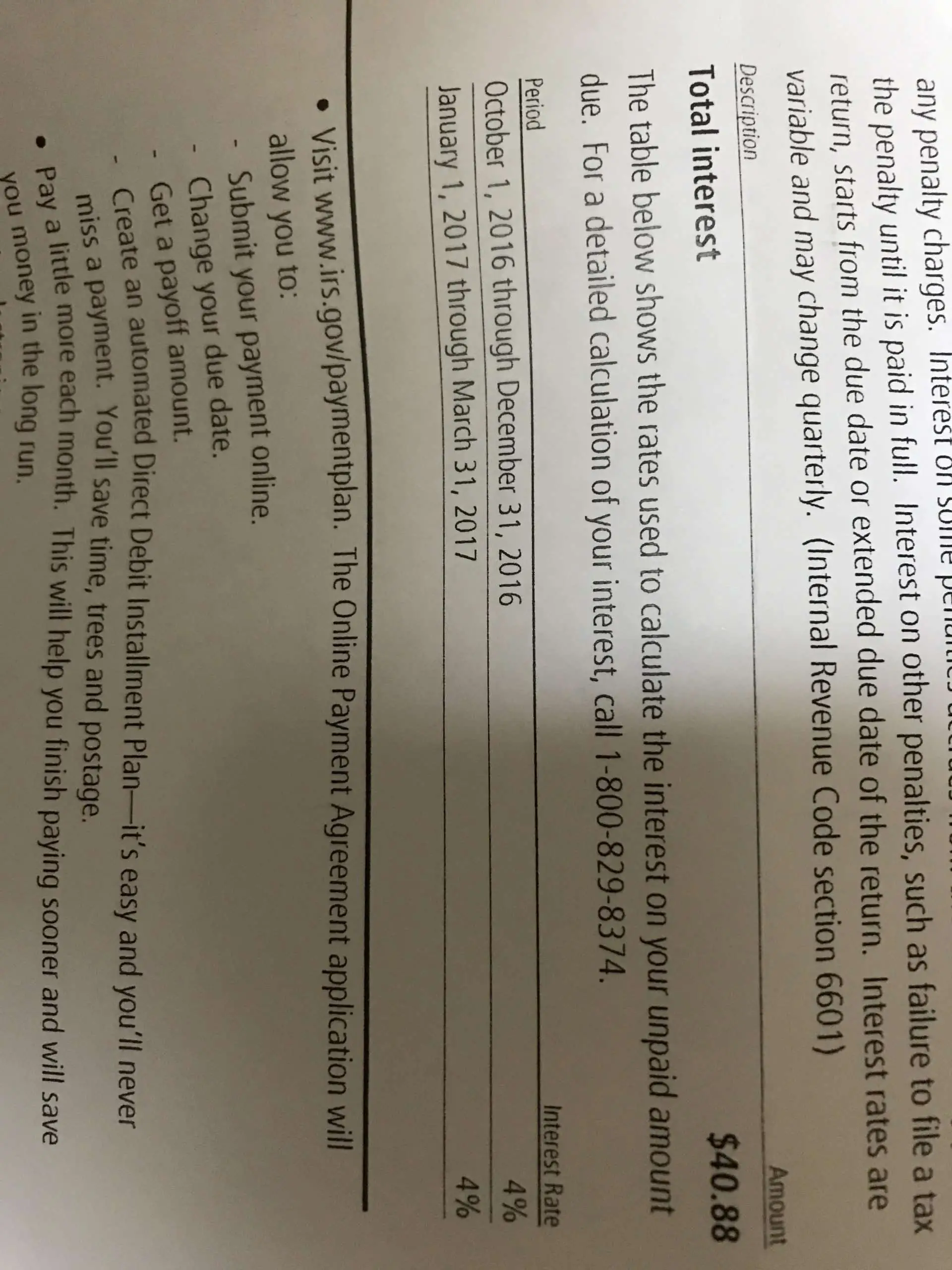

1. The unpaid tax amount plus interest, which is currently at a 4% annual rate, compounded daily, and

2. The additional failure-to-pay interest charge penalty at a 6% annual rate.

Bottom Line

John M. Stern, CPA/PFS, is the Managing Partner at

Does The Irs Ever Negotiate The Amount Owed

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”> Under certain circumstances, the IRS is authorized to resolve a tax liability by accepting less than full payment. An “offer in compromise” is an agreement between a taxpayer and the IRS that settles the taxpayer’s tax debt. There are three circumstances under which the IRS is authorized to compromise:

Form 656: Offer in Compromise Package should be completed to file an Offer in Compromise with the IRS. Included with the Form 656 package are Form 433-A, Collection Information Statement for Wage Earners & Self-Employed Individuals and Form 433-B, Collection Information Statement for Businesses.

- You may need to complete the appropriate Form 433 and should be prepared to provide other documentation and explanations as they are requested.

- Various options are available for accepted Offers in Compromise requests, such as a reduced total payment and scheduled monthly payments.

- Defaulting on an accepted offer in compromise can result in the IRS filing suit against you and reinstatement of the original tax debt, plus interest and penalties.

Don’t Miss: Where’s My Tax Refund Ga

A Tax Refund May Not Be The Only Reward

Besides the money, there may be two other advantages to filing old tax returns.

First, it could help keep the IRS out of your hair later. The IRS generally has only three years to audit a tax return, but it has forever to assess taxes when a return hasn’t been filed, Grigsby says.

Second, it may help prevent problems with loan applications, Social Security or certain benefits that require copies of your tax returns in order to claim. Grigsby says he recently had a client who learned that the hard way.

“The state basically comes and says, ‘Hey, well, you want a check from us? We’re not going to do anything unless there’s a tax return.'”

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the “Out of Country” circle on Page 1 of Form D-400. “Out of the Country” means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.

You May Like: How To Appeal Cook County Property Taxes

How Long Is My Extension Good For

If you filed an extension by May 17, 2021 , it extends your filing deadline to .

- An extension of time to file your return does not mean an extension of time to pay your taxes.

- If you expect to owe money, you’re required to estimate the amount due and pay it with your Form 4868. As long as you do that, the extension will be granted automatically.

If You Are Getting A Refund:

This is one of the great little secrets about the federal tax law. If you have a refund coming from the IRSas about three out of four taxpayers do every yearthen there is no penalty for failing to file your tax return by the deadline, even if you don’t ask for an extension. However, this might not be the case for state taxes.

That’s not to say there aren’t very good reasons for filing on time. Even if you have a refund coming, consider the following:

- You can’t get your money back until you file, so you should file as soon as you can to get your money as soon as possible.

- The statute of limitations for the IRS to audit your return won’t start until you actually file your return. So, the sooner you file, the sooner the clock starts ticking.

- Some tax elections must be made by the due date, even if you have a refund coming. This applies to a very tiny percentage of taxpayers.

Also Check: Do I Need W2 To File Taxes