Who Is A Beneficial Owner

Beneficial owners of capital assets may be subject to the tax. For example, an individual is considered to be a beneficial owner of long-term capital assets held by a pass-through or disregarded entity for federal tax purposes. This includes a partnership, limited liability company, S corporation, or grantor trust, to the extent of the individuals ownership interest in the entity as reported for federal income tax purposes. It is important to note that a non-grantor trust may be deemed to be a grantor trust under certain circumstances. Therefore, long-term capital gains generated by these pass-through entities may be taxable to the beneficial owners.

What Can I Do To Save On Washington Estate Taxes

If your estate is worth more than the $2.193 million tax exemption, it is possible to pass a portion or all of this amount while avoiding estate taxes. For example, for a married couple, the first spouse to die could create a will or living trust that creates two shares upon their death. Generally speaking, the first share will hold the deceased spouses share of $2.193 million in what is known as a bypass or shelter trust.. The remaining share may pass to a QTIP or marital deduction trust. In short, the first share is excluded from the estate tax due to the exemption. The second share avoids estate tax as it passes under the unlimited marital deduction.

Your estate planning attorney can advise you of the various options that may be available to minimize your tax burden.

Dj Wilson March 22 2021

Answering the question of whether someone is taxed too much or perhaps not enough requires some level of comparison.

Answering this question in absolute terms is difficult for a host of reasons. So, invariably, the question of whether my individual tax burden is too high, too low, or just right rests on a different question: Compared to what?

So, in this second part of the two-part series, we answer this question of Compared to what? by looking at other states to see how Washington State compares when it comes an individuals relative tax burden.

Comparing various state tax regimes and how they work has been studied at length. So that gives us a few ways to think about how Washington State compares to other states on the topic of tax burden.

Perhaps the most prominent study is from the Institute on Taxation and Economic Policy. It reviews the contribution in tax revenues by quintile within each state, and is updated every two years. So, the study tells us how Washington compares to other states, as well as how each quintile of Washingtons population compares to other quintiles within the state.

If you think that equality of opportunity is a bedrock principle of America, then findings from ITEP arent pretty.

Washington State comes in first for having the most regressive tax regime in the country. The bottom 20% of income earners pay 17.8% of their income to state and local taxes. The top 1% pay a modest 3.0%.

So, are you and I taxed too much here in Washington State?

Also Check: How To File Federal Taxes For Free

Washington State Enacts Capital Gains Tax Beginning January 1 2022

- Tax strategies

- 7/1/2021

The state of Washington recently enacted a capital gains tax on individuals who recognize gain from the sale of long-term capital assets. This new tax could be especially impactful when considered alongside proposed federal capital gains tax rate increases. Washington does not currently impose a personal income tax.

Are Low Tax Rates Always A Good Thing

You might assume that while higher taxes are a pain, they mean that youre getting more and better public services for your dollars: smoother roads, higher-ranking public schools, and more beautiful parks.

But just because government officials have lots of tax dollars at their disposal doesnt mean that theyre spending them wisely. Similarly, low tax rates dont necessarily mean that public services are lacking. Politicians might be spending tax dollars carefully in those jurisdictions, and they might have turned over to the private sector certain services that the government normally provides.

As with any other purchase, you have to do more research to see what youre actually getting for your money, because a higher price doesnt always mean better quality, and a lower price doesnt always mean inferior quality.

Recommended Reading: When Can I Get My Tax Refund

Washington State Sales Tax

When a resident makes a purchase in Washington state, they will be charged sales tax. The state sales tax rate is 6.5 percent. The local county or city can add an additional sales tax. In Seattle, for example, the total sales tax is 10.1 percent. The average combined state and local sales tax rate in Washington state is 9.18 percent.

Sales tax in Washington state is not charged on:

- Food

- Sales to Indians or Indian tribes

- Manufacturers machinery and equipment

Sales tax is charged on the sale of tangible personal property, and also on services such as repair, cleaning, installation, construction and so on. It is also charged on the sale of digital products such as downloaded or streaming movies or music. It is the responsibility of the seller to collect the sales tax from the buyer and remit it to the state.

Retailers who ship or deliver goods into Washington state are required to collect Washington state sales tax based on the location to which the item is delivered. Since the sales tax can vary from county to county, this so-called destination-based sales tax can even affect local businesses like furniture stores and pizza shops that might deliver outside the county they are located in.

Check Out These: States With No Sales Tax

What Is A Sales Tax

A sales tax is a consumption tax imposed by the government on the sale of goods and services. A conventional sales tax is levied at the point of sale, collected by the retailer, and passed on to the government. A business is liable for sales taxes in a given jurisdiction if it has a nexus there, which can be a brick-and-mortar location, an employee, an affiliate, or some other presence, depending on the laws in that jurisdiction.

Read Also: How To Do Taxes Freelance

The New Tax Bill Reduced The Deduction For State Income Taxes

Officials in states with higher individual income tax rates think California and New York are less than thrilled about a provision in the new tax code that capped the state and local tax deductions that residents can claim at $10,000.

The old tax code allowed taxpayers who opted to itemize instead of take the standard deductions formerly $6,350 for single filers and $12,700 for couples filing jointly to deduct all of the property taxes they paid to state and local government agencies as well as their tally from either sales taxes or individual income taxes.

Since most people rack up more individual income taxes, that is the category they choose to deduct. The changes leave some likely owing more, economists say.

Its more business as usual for people living in a state without individual income taxes because those residents were by default either taking the standard deduction or subtracting the amount they paid in sales and property taxes from their federal tax bills. Without making some big purchases or holding a substantial real estate portfolio, it will likely be harder to hit the new $10,000 cap.

A Silver Lining And The Fight Ahead

So, where do we go from here? First of all, we shouldnt give up on our Supreme Court justices. The UWs Spitzer believes they may be more amenable to taking up a state income tax case than a local one. My hunch is that if the Legislature took the responsibility of enacting an income tax, or the voters adopted it, its likely that the court would uphold it, he says. A statewide ballot battle is no picnic, as weve seen, and in recent history its been hard getting more than a handful of state legislators to even say the words income tax in public without promising, in the same breath, that they would never vote for such a thing. But never say never our world is changing rapidly, and I dont think its out of the question that a statewide progressive income tax law could be passed within the decade.

Of course, if the state Supreme Court were to strike such a law down, ruling once again that income is property, then wed be in a tight spot indeed. At that point a progressive income tax would be impossible without amending our state constitution, which requires a two-thirds supermajority vote of the House and Senate, followed by a majority vote of the people. Again, not an impossibility, but it would take a truly powerful and statewide popular movement to make this happen.

You May Like: How To Subtract Taxes From Paycheck

Washington State Judge Opens The Door For Income Taxes

Caleb Rash

The legal dam against state and local income taxes in Washington state has sprung a leak. On July 15, a division of the Washington Court of Appeals issued a surprising ruling teeing up for the State Supreme Court an opportunity to reconsider a longstanding constitutional precedent prohibiting nonuniform taxes on income.

The case involved a Seattle income tax levied on high-income city residents. The tax was successfully challenged at the trial court on the grounds that Seattle lacked both the statutory and constitutional authority to levy income taxes.

On appeal, Judge James Verellen affirmed the taxs invalidation but did so solely on constitutional grounds, paving the way for the State Supreme Court to weigh in.

The state constitutional provision at issue requires that taxes on property be uniform. The court dutifully applied longstanding State Supreme Court precedent holding that income is property. Because Seattles tax applied only to some taxpayers, the tax violated the constitutions uniformity requirement.

The statutory argument centered on a state law enacted in 1984 that prohibits any city from levying a tax on net income. The city attempted to construe the tax as one on gross income rather than net income, but the court rejected that characterization.

The statutory holding will be central to an appeal and provides the State Supreme Court with an outlet if it does not want to reach the constitutional question.

Was this page helpful to you?

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Also Check: How Do I Find My Lost Tax Id Number

How Your Washington Llc Will Be Taxed

The profits of an Washington LLC are not taxed at the business level like those of C Corporations. Instead, taxes for an Washington LLC work as follows:

Employers pay payroll tax on any salaries they pay to employees

Employees pay federal, state and payroll tax on their earnings

Items 1, 2 and 3 are taxed as pass-through income for any LLC owners, managers or members who receive profits from the business. Any profits are reported on federal and personal tax returns, and thats where you will pay those taxes.

Can You Work In Oregon And Live In Washington

The personal income tax benefit in this situation occurs only if you work partly in Oregon and partly in Washington, or if your spouse or other household members live with you in Washington and work in that state also. In that circumstance, you only pay personal income taxes for the work you do in Oregon.

Read Also: Do You Have To File Your Unemployment On Your Taxes

Farmer Radicalism In The Emerging New Deal Coalition

By the 1930s all of Washington State was feeling the full effects of the Great Depression and the stock market crash of 1929. In an article in the Grange News, State Master Albert Goss describes the pitiful situation of many in Seattle during the time: ” Yesterday I walked through several blocks and alleys between First and Second avenues and Second and Third avenues in Seattle, and saw men running through the garbage cans looking for something to eat, not one but many. Last night I saw hundreds of men who had been standing in line possibly an hour, waiting for the doors of a soup kitchen to open where they could get a free bowl of soup. A few days ago I saw a crowd of men congregated before the Millionaires Club waiting for the tri-weekly distribution of dry bread, saw these men tear off the newspaper wrappings and devour a half loaf in a few moments like ravenous animals.”

This paper draws on Philip J. Roberts’ 2003 book, published by the University of Washington Press, which examines the social and political battles over tax policy in Washington State.

Gosss writing showed how farmers began to see their plight as connected to those of the poor and working classes in cities. At least the farmer didnt go hungry, touted the Grange. However, farmers had suffered for years under difficult economic conditions, and could find empathy and potential common cause with others.

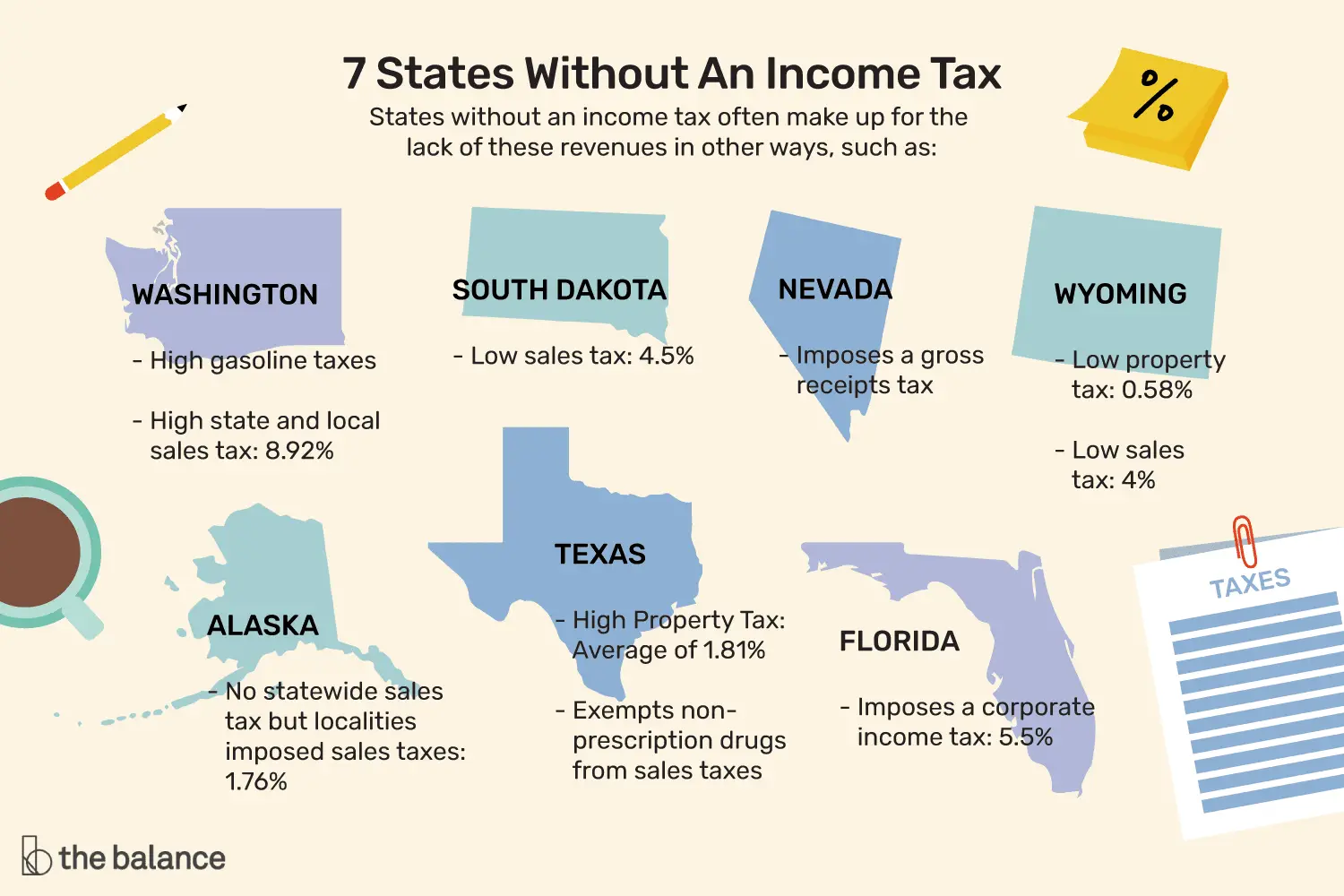

Other State Taxes Fill The Revenue Void

States have various ways to raise revenue, and those without state income taxes find different means to pay for roads, schools and other infrastructure. One typical source is sales taxes. Florida, for example, levies a 6 percent sales tax, and the average locality tacks on 1.08 percent, according to the Tax Foundation, for a combined average of 7.08 percent. Tennessee, at 9.55 percent, has the highest combined sales tax of any state in the U.S. Washington state levies a tax of 49.4 cents per gallon on gasoline, one of the highest rates in the nation.

Alaska has no statewide sales tax, although some localities have one. New Hampshire has no sales taxes at all.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Join today and get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Other states use property taxes as a revenue stream. In 2018 , New Hampshire got nearly 64 percent of its revenue from property taxes the highest rate of any state. In fact, three of the top five states that relied the most on property taxes have no income taxes. Alaska is second, and Texas is fourth.

Alaska also gets a big chunk of income from oil and its not the only state without an income tax to do so. Wyoming, too, collects significant revenue from so-called severance taxes, which are levies imposed on the extraction of natural resources.

Also Check: When Are My Taxes Coming

The Origins Of The States Regressive Tax System

In 1932, a vast Hooverville stretched south of downtown Seattle. Farmers across the state had suffered through years of plummeting prices, drought and high property taxes then the primary source of revenue for state and local governments. The Washington State Grange, the farmers association, was a leading voice for progressive tax reform. Gov. Roland Hartley had recently vetoed personal and corporate net income tax bills approved by the Legislature, so the Grange turned to the people. Initiative 69 promised a graduated income tax to fund schools and reduce or eliminate state property taxes. The measure won urban support from labor groups and the new Unemployed Citizens League, and it passed with a landslide of 70% an income tax proved more popular than Franklin D. Roosevelt or the repeal of the Bone Dry Law , both on the same ballot.

But it wasnt to be. Business interests quickly sued, and, in 1933, the state Supreme Court overturned the new law in a surprise 5-4 ruling possibly because the justices had by then, like everyone else, received their tax forms in the mail. The court held that income is a form of property and, therefore, subject to the uniformity clause in our states constitution, which says that property may be taxed only at a flat rate. In other words, no graduated or progressive tax allowed.

Employer And Employee Taxes For Your Washington Llc

If you pay employees, there are some slightly different tax implications. Speak to your accountant to get clear guidance for your own unique situation.

All employers must collect and withhold payroll tax from their employees when they receive their salaries. You would normally withhold 7.65 percent of the taxable salary that you pay to your employees.

You may also choose to withhold federal income tax on the wages you pay to employees. Speak to your accountant for more information.

Regardless of whether you withhold federal income tax, your employees may need to file their own tax returns.

You may also need to pay insurance for any employees, like employee compensation insurance or unemployment tax. There will also be other requirements you have for employees.

Depending on the industry you are in, your Washington LLC may be liable for certain other taxes and duties. For example, if you sell gasoline you may need to pay a tax on any fuel you sell. Likewise, if you import or export goods you may need to pay certain duties. Speak to your accountant about any other taxes you may need to withhold or pay.

Most Washington LLCs will need to pay estimated taxes throughout the year, depending on the amount of income and profit you expect to make.

The most common types of estimated taxes are:

- Federal income tax

- Federal self-employment tax

Most Washington LLCs will pay estimated taxes four times a year. Speak to your accountant for more information.

Also Check: What Is Tax In Nevada