If You’ve Been Overpaying

Unless you’re looking forward to a big refund, try increasing the number of withholding allowances you claim on the W-4.

Note that the IRS requires that you have a reasonable basis for the withholding allowances you claim. It doesn’t want you fiddling with its form just to avoid paying taxes until the last minute.

If you don’t have enough tax withheld, you could be subject to underpayment penalties.

Bear in mind that you need to have enough tax withheld throughout the year to avoid underpayment penalties and interest. You can do that by making sure your withholding equals at least 90% of your current year’s tax liability or 100% of your previous year’s tax liability, whichever is smaller.

You’ll also avoid penalties if you owe less than $1,000 on your tax return.

Federal Payroll Tax Rates

The steps our calculator uses to figure out each employees paycheck are pretty simple, but there are a lot of them. Heres how it works, and what tax rates youll need to apply.

Figure out each employees gross wages. Gross wages are the total amount of money your employee earned during the current pay period. The math works a little differently for salaried employees, hourly employees and contractors.

Deduct and match any FICA taxes: FICA, the Federal Insurance Contributions Act, is one of the many payroll acronyms youll soon get to know and love. It simply refers to the Medicare and Social Security taxes employees and employers have to pay:

Should I Be Making Quarterly Tax Payments To The Irs

If you expect to owe more than $1,000 on taxes, then you should be making quarterly estimated tax payments. This basically means you need to pay a portion of your expected tax bill four times per year, instead of all at the end of the tax year.

Feel free to use our free quarterly tax calculator to calculate exactly how much you should be paying . You’ll also find detailed instructions for how to pay quarterly taxes on the same page.

Don’t Miss: How Much Can You Get Back In Taxes

Caution For Employers Using Software Programs In

For Canada Pension Plan purposes,;contributions are not calculated from the first dollar of pensionable earnings.;Instead, they;are calculated using the amount of pensionable earnings;minus a basic exemption amount that is based on the period of employment.

As of 2019, the Canada Pension Plan is being enhanced over a 7 year phase-in. For more information, go to Canada Pension Plan Enhancement.

If used improperly, some payroll software programs, in-house payroll programs, and bookkeeping methods can calculate unwarranted or incorrect refunds of CPP contributions for both employees and employers. The improper calculations treat all employment as if it were full-year employment, which incorrectly reduces both the employee’s and employer’s contributions.

For example, when a part-year employee does not qualify for the full annual exemption, a program may indicate that the employer should report a CPP overdeduction in box;22; Income tax deducted of the T4;slip. This may result in an unwarranted refund of tax to the employee when the employee files his or her income tax and benefit return.

When employees receive refunds for CPP overdeductions, their pensionable service is adversely affected. This could affect their CPP income when they retire. In addition, employers who report such overdeductions receive a credit they are not entitled to;because the employee worked for them for less than 12;months.

Add The Employees Pay Information

You should see fields that say pay type, pay rate, hours worked, pay date,and pay period. Start with pay type and select hourly or salary from the dropdown menu.;

If the employee is hourly, input their hourly wage under pay rate, and fill in the number of hours they worked that pay period. If the employee worked more than 40 hours, and thus accrued overtime, record 40 here and save the rest for additional pay.

If the employee is salaried, both the pay rate and hours worked fields will disappear. Instead, youll need to know how much the employee makes each pay period. Youll put that into the field labeled amount.;

Then select the pay date and the employees pay frequencyor, rather, if you pay them weekly or every two weeks.;

Recommended Reading: How To File 2 Different State Taxes

How To Subtract Tax From A Total

Rather than charge customers tax on a purchase, you may choose to include tax in your purchase price. Even if you don’t explicitly charge tax to your customers, however, you’re still obligated to collect and remit any sales tax due to your state. Businesses that itemize sales tax on a receipt can keep an ongoing tally of sales tax liability. But if you include tax in your purchase price, you must perform an algebraic calculation to back out sales tax from your total sales receipts.

Extended Due Date Of First Estimated Tax Payment

Pursuant toNotice 2020-18, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to , the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

Recommended Reading: Is Past Year Tax Legit

How To Calculate Your Net Paycheck

What is FICA, and why am I paying so much? If youve ever asked yourself this question while examining your paystub, heres your answer: FICA is an acronym that stands for Federal Insurance Contributions Act, the law that created Social Security. Your share of FICA includes employee contributions for Social Security and Medicare. Employers also pay a share of the FICA tax for each employee.

FICA is just one of many potential paycheck reducers that represent the difference between your salary, or gross pay, and the actual amount you take home, your;net pay.

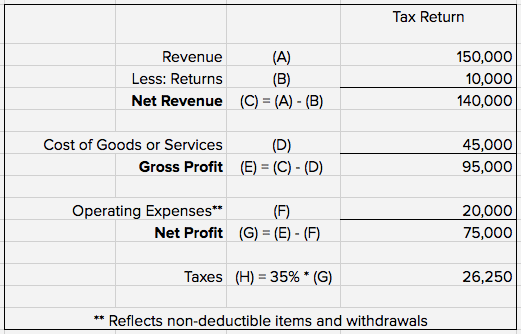

Example Of Gross To Net Calculation

Lets say your employee is a single-filer living in Phoenix, Arizona with zero claims on their Form W-4.

The employee makes $15 per hour and works 40 hours per week. You pay the employee weekly, and their total gross is $600. The employee does not work overtime.

The employees health insurance premium is $50 per week. Health benefits are exempt from Social Security, Medicare, and income tax withholding.

You will withhold the following to determine the employees net pay:

You May Like: What Tax Return Does An Llc File

How State Taxes Work

States that levy an income tax may set a flat rate or rates based on the amount of income you earn, as do local governments that levy an income tax. For both local and state income taxes, you generally pay tax on your compensation income based on the state and locality where you work, rather than where you live.

To avoid double taxation, you are generally given a credit for the state and/or local government where you paid the tax so you do not have to pay extra taxes where you live in addition to those you paid in the locality and state where you work.

If Not Enough Is Being Withheld

The W-4 form has a place to indicate the amount of additional tax you’d like to have withheld each pay period.

If you’ve underpaid so far, subtract the amount you’re on track to pay by the end of the year, at your current level of withholding, from the amount you will owe in total. Then divide the result by the number of pay periods that remain in the year.

That will tell you how much extra you want to have withheld from each paycheck.

You could also decrease the number of withholding allowances you claim, but the results won’t be as accurate.

Read Also: Who Needs To File Taxes

How To Calculate Payroll Taxes

The term payroll taxes refers to FICA taxes, which is a combination of Social Security and Medicare taxes. These taxes are deducted from employee paychecks at a total flat rate of 7.65 percent thats split into the following percentages:

- Medicare taxes 1.45 percent

- Social Security taxes 6.2 percent

These percentages are deducted from an employees gross pay for each paycheck. For example, an employee with a gross pay of $1,000 would owe $62 in Social Security tax and $14.50 in Medicare tax.

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

You May Like: How Does The Irs Tax Bitcoin

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2021 is $142,800 . Any income you earn above $142,800 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

How You Can Affect Your California Paycheck

Though some of the withholding from your paycheck is non-negotiable, there are certain steps you can take to affect the size of your paycheck. If you choose to save more of each paycheck for retirement, for example, your take-home pay will go down. Thats why personal finance experts often advise that employees increase the percentage theyre saving for retirement when they get a raise, so they dont experience a smaller paycheck and get discouraged from saving.

Should you choose a more expensive health insurance plan or you add family members to your plan, you may see more money withheld from each of your paychecks, depending on your companys insurance offerings.

If your paychecks seem small and you get a big tax refund every year, you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. The California DE-4 forms tells your employer how many allowances youre claiming and how much to withhold from each of your paychecks. If you take more allowances, you might get a smaller refund but you should get bigger paychecks. Conversely, if you always owe tax money come April, you may want to claim fewer allowances so that more money is withheld throughout the year.

Also Check: Where To Find Real Estate Taxes Paid

Optional How To Get Your Net Take Home Pay

To know how much money you’ll really keep and take to your home after all the taxes and deductions, well, you just have to subtract them all.

From your gross salary, the salary as reflected on your employment contract, subtract your monthly contributions and income tax.

So continuing on our example above that assuming your salary is 25,000 per month, a total monthly contributions worth 1,600 and income tax worth 513.4, here’s our computation:

Net Salary = Gross Salary - Monthly Contributions - Income Tax = 25,000 - 1,600 - 513.4 = 25,000 - 2,113.4 = 22,886.6

Your net-take home pay or net salary would be 22,886.6!

That’s the step by step guide on how you can compute your income tax and get your monthly net salary.

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

Don’t Miss: How To Calculate Net Income After Taxes

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

When To Pay Estimated Taxes

For estimated tax purposes, the year is divided into four payment periods. You may send estimated tax payments with Form 1040-ES;by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax.

Using the Electronic Federal Tax Payment System is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits , installment agreement and estimated tax payments using EFTPS. If its easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as youve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Corporations must deposit the payment using the Electronic Federal Tax Payment System. For additional information, refer to Publication 542, Corporations.

You May Like: How Much Income To File Taxes

Who Must Pay Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. See the worksheet in Form 1040-ES, Estimated Tax for Individuals, or Form 1120-W, Estimated Tax for Corporations, for more details on who must pay estimated tax.

Sales Tax Calculator And De

This calculator requires the use of Javascript enabled and capable browsers. There are two scripts in this calculator. The first script calculates the sales tax of an item or group of items, then displays the tax in raw and rounded forms and the total sales price, including tax. You may change the default values if you desire. Enter the total amount that you wish to have calculated in order to determine tax on the sale. Enter the sales tax percentage. For instance, in Palm Springs, California, the total sales tax percentage, including state, county and local taxes, is 7 and 3/4 percent. That entry would be .0775 for the percentage. The second script is the reverse of the first. If you know the total sales price, and the sales tax percentage, it will calculate the base price before taxes and the amount of sales tax that was in the total price. This is particularly useful if you sell merchandise on a “tax included” basis, and then must determine how much tax was involved in order to pay your sales tax, this is the ideal tool. Several state tax agencies actually suggest our calculator to merchants that could use it in that manner.If you need to calculate the sales tax percentage and you know the sales amount and the tax amount, use our Sales Tax Percentage Calculator. CALCULATE SALES TAX

Read Also: How To Review My Tax Return Online