What Is A Marginal Tax Rate

Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket.

For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

If you had $41,000 of taxable income, however, much of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would be 22%.

Did Tax Tables Change For 2021

Yes. Each year, the IRS adjusts the tax brackets to account for inflation. Below are the income thresholds for tax year 2021.

The top tax rate remains 37% for individual single taxpayers with incomes greater than $523,600 . Below are the other rates:

- 35%, for incomes over $209,425

- 32%, for incomes over $164,925

- 24%, for incomes over $86,375

- 22%, for incomes over $40,525

- 12%, for incomes over $9,950

The lowest rate is 10% for incomes of single individuals with incomes of $9,950 or less .

How To Calculate Taxable Income

Arriving at your taxable income requires a bit of arithmetic. Begin with your gross income, which is all the money you earned during the tax year: income from jobs, from owning a business, retirement withdrawals, Social Security), rents, and/or investment earnings.

Next up: determining your adjusted gross income . These are adjustments taken before any deductions are applied. These may include student loan interest, moving expenses, alimony you paid, tuition and fees, as well as contributions to a traditional IRA, among others. Subtract these expenses from your gross income to arrive at your AGI.

Finally, apply deductions.

Again, you may itemize your deductions by listing eligible expenses, or you may take the standard deduction. Everyone qualifies for the standard deduction, but if you think your allowable deductions exceed the standard deduction youre paying a lot in home mortgage interest; your property or state income taxes are high; medical expenses take a big bite out of your budget it would be make sense to take the time to itemize your deductions and see if it exceeds the allowable standard deduction.

The standard deduction for the 2020 tax year, due May 17, 2021

- Single filers: $12,400

- $12,400

- Heads of households: $18,650

Once of all that is calculated and subtracted from your AGI, youve arrived at your taxable income. But calculating how much you will pay in taxes isnt as simple as taking that number and multiplying it by your tax rate.

Recommended Reading: How To Get Tax Exempt Status

How To Reduce Taxable Income & Drop Into A Lower Tax Bracket

Two common ways to reduce your tax bill are by using . The first is a dollar-for-dollar reduction in the amount of tax you owe. The second trims your taxable income, possibly slipping you into a lower tax bracket.

Tax credits come in two types: nonrefundable and refundable.

Nonrefundable credits are deducted from your tax liability until your tax due equals $0. Examples include the child and dependent care credit, adoption credit, savers credit, mortgage interest tax credit, and alternative motor vehicle credit.

Refundable credits are paid out in full, no matter what your income or tax liability. Examples include the earned income tax credit , child tax credit, and the American Opportunity Tax Credit.

Which of these tax credits apply to your situation?

Deductions, on the other hand, reduce your taxable income. Accumulate enough of them in qualifying number or amount, and you can slide a tax bracket or two.

Popular deductions include:

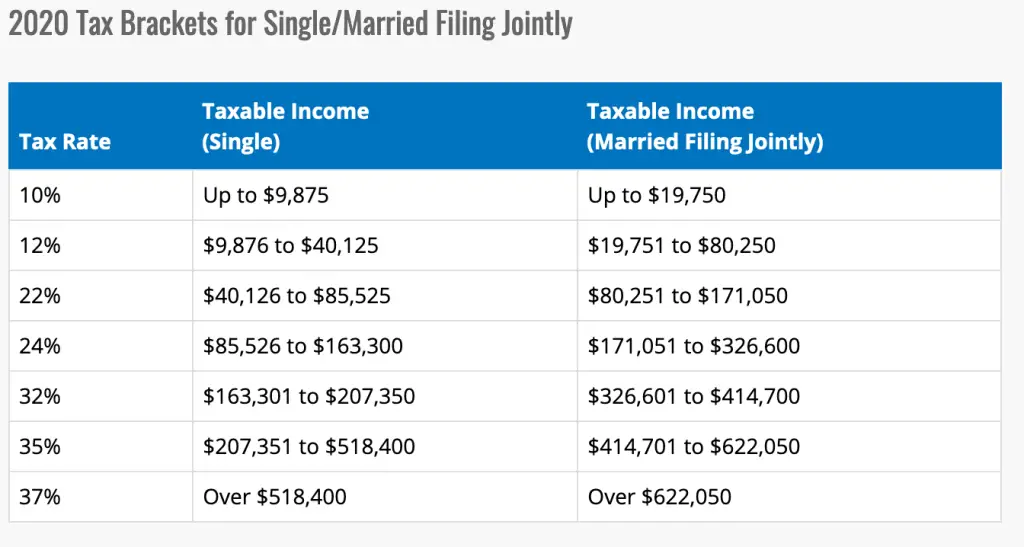

Upcoming Tax Brackets & Tax Rates For 2020

Note: This can get a bit confusing. The filing deadline for the 2020 tax year is April 15, 2021. Which means you account for your 2020 tax bill in 2021. Add the fact that the IRS released the ground rules for 2021 taxes in October 2020, and your head is swimming in a pool so perplexing that a state of confusion can be excused.

But wait. Come springtime, will Washington ponder another filing delay in response to a new or ongoing national emergency? You never know.

What we do know is the rates and brackets for the 2020 tax year are set.

Here is a look at what the brackets and tax rates are for 2020 :

2020 Tax Brackets| Tax rate |

|---|

Recommended Reading: What Is The Tax In Georgia

How The 2021 Us Tax Brackets Work

You’ve now seen the 2021 U.S. tax brackets, but there’s still a bit more you should know. These tax brackets aren’t as simple as finding where your income falls and multiplying it by the applicable 2021 tax rate. In other words, if you are single and make $50,000 in 2021, this puts you in the 12% tax bracket. However, you don’t simply take 12% of $50,000 and send it to the IRS.

Two important concepts to learn when it comes to the U.S. tax brackets are;taxable income;and;. So, let’s look at these one at a time.

How Do Tax Brackets Work

Tax brackets are based on your taxable income, which is what you get when you take all of the money youâve earned and subtract all of the tax deductions youâre eligible for.

Once youâve calculated your taxable income, itâs time to look at the IRSâs tax rate scheduleâa fancy term for âbig list of tax system bracketsââfor the year youâre doing your taxes for.

Letâs take the IRS tax brackets for individual single filers in 2021:

| Tax rate | |

|---|---|

| 37% | $523,600+ |

Unless you made $9,875 or less in taxable income in 2020, itâs likely you fall into at least two brackets. This means different parts of your income is taxed at a different rate.

For example, letâs say that your taxable income ends up being $20,000. That means youâll fall into two different tax brackets and get taxed at two different rates:

-

the $0 – $9,950 bracket, which taxes you at 10%

-

the $9,951 – $40,525 bracket, which taxes you at 12%

So youâll pay two different tax rates: 10% on the first $9,950 âchunkâ of your income, and 12% on every dollar you made above $9,950.

In equation form, weâd write this out as:

Total tax = +

Total tax = $995.00 + $1,206.00

Total tax bill = $2,202.00

We call the highest tax rate that you pay your . In this example, your marginal tax rate is 12%.

Recommended Reading: Can You Refile Your Taxes

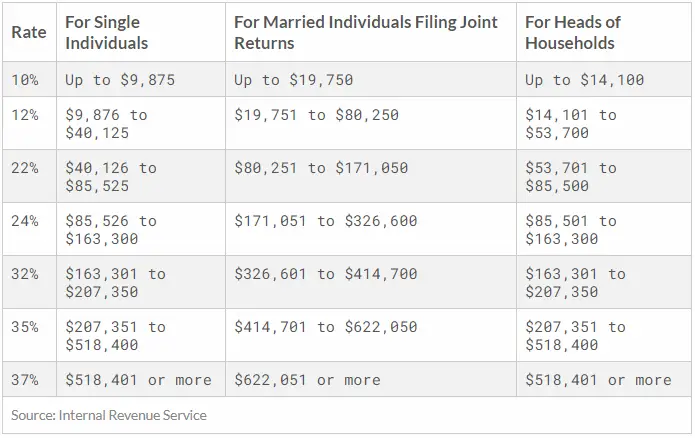

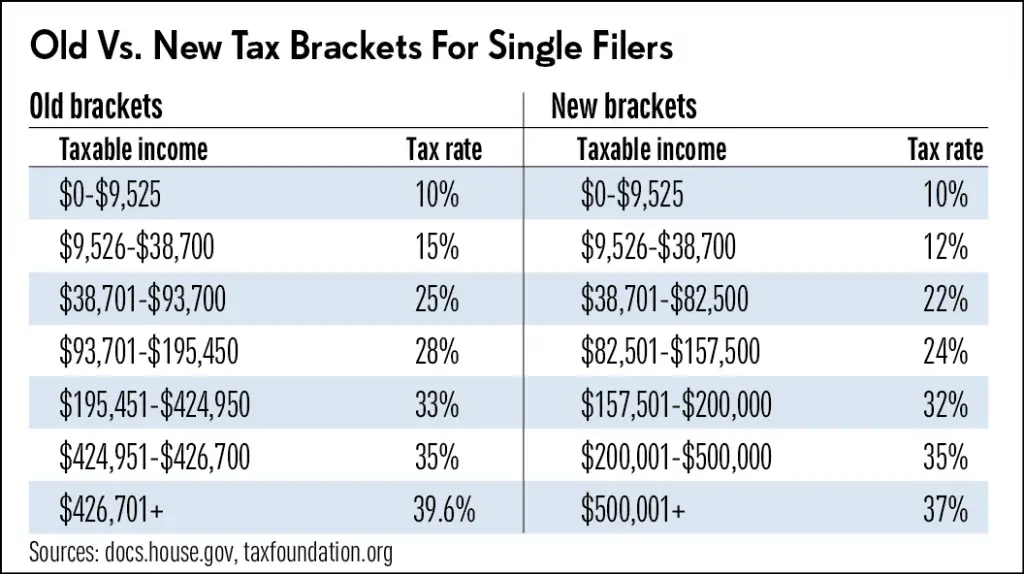

Tax Brackets And The Marriage Penalty

When people get married, their combined income would put them over the tax brackets they were in when unmarried. Because of this, the IRS uses a separate set of tax brackets for married couples filing joint returns that allows higher levels of combined income to be taxed at lower rates.

This tax benefit works really well for couples at different levels of income. If you earn $250,000 per year and your spouse earns $50,000 per year, if you file a joint return then your marginal tax rate for $300,000 of combined income is only 24%. It would’ve been 35% if you’d filed as an individual. See the rates tax brackets for each filing status above.

But if couples earn the same level of income, in some cases they may pay a so-called . The marriage penalty isn’t a real penalty; it’s a quirk of the progressive taxation system that occurs when each spouse is individually in the same marginal tax bracket and combining their income pushes them into the next highest bracket.

The Tax Cuts and Jobs Act mostly mitigated the marriage penalty. That’s because the maximum levels of income for married couples filing jointly in each tax bracket are now double the levels for individuals.

How To Lower Your 2021 Tax Bracket

You may be able to lower your income into another bracket by taking tax deductions.

Tax deductions lower how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction would save you $220.

Tax credits, such as the earned income tax credit, or child tax credit, can also reduce how you pay Uncle Sambut not by putting you in a lower tax bracket.

Tax credits reduce the amount of tax you owe, giving you a dollar-for-dollar reduction of your tax liability. A tax credit valued at $1,000, for instance, lowers your total tax bill by $1,000.

Many people choose to take the standard deduction, but a tax expert can help you figure out if youd be better off itemizing deductions, such as your mortgage interest, medical expenses, and state and local taxes.

Whether you take the standard deduction or itemize, here are some additional ways you may be able to lower your tax bracket:

;;Making year-end charitable contributions. For 2021, the IRS will allow people to deduct up to $300 in cash donations to qualifying charities, even if they dont itemize their deductions .

;;Delaying income. For example, if you freelance, you might consider waiting to bill for services performed near the end of the 2021 until January 2022.

Recommended: What Happens If I Miss the Tax Filing Deadline?

Don’t Miss: Do You Have To Do Taxes For Doordash

What Is A Tax Bracket

A tax bracket refers to a range of incomes;subject to a certain income tax rate. Tax brackets result in a progressive tax system, in which taxation progressively increases as an individuals income grows. Low incomes fall into tax brackets with relatively low income tax rates, while higher earnings fall into brackets with higher rates.

Understanding Income Tax Brackets

Depending on who you have a conversation with, you may get mixed information about how income tax brackets work and what the impact will be on your taxes. Contrary to the volume of misinformation that is out there, how tax brackets work is clearly laid out by the IRS and is quite simple to understand. The most important factors that those looking to file their taxes this year need to understand are what the 2019 tax brackets are, where their income falls along the scale, and what the impact will be on their refund or tax burden.

Need Help? Recommended Online Tax Services:

In this article

Recommended Reading: How To Pay Llc Taxes

What Is A Surtax

You may look at the Ontario and PEI tax rates, and think to yourself, well, thats pretty low. But personal income in these two provinces is taxed a second time with a surtax.

For PEI residents, the surtax is 10%, if your income is more than $12,500 annually. Take your income and multiply it by 0.10 to calculate the surtax.

For 2020, the Ontario surtax is a bit more complicated . If your base provincial tax is below $4,830, you pay no surtax. If your base provincial tax is between $4,830 and $6,182, you pay 20% on the portion of provincial tax owed that is over $4,830. Finally, if your base provincial tax exceeds $6,182, you pay 20% on the portion of provincial tax owed that is between $4,830 and $6,182 , plus 56% on the portion of provincial tax owed over $6,182.

Thankfully, most personal tax programs figure this out automatically.

| Provincial Tax Owed |

|---|

| 56% |

For Married People Who Are Filing Jointly

Tax rate of:

;;10% for people earning $0 to $19,900

;;12% for people earning $19,901 to $81,050

;;22% for people earning $81,051 to $172,750

;;24% for people earning $172,751 to $329,850

;;32% for people earning $329,851 to $418,850

;;35% for people earning $418,851 to $628,300

;;37% for people earning $628,301 or more

You May Like: Do You Have To Claim Social Security On Taxes

Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $9,875 he makes; then 12% on anything earned from $9,786 to $40,125 ; then 22% on the rest, up to $80,000 for a total tax bill of $13,774.

Effectively, this filer is paying a tax rate of 17.2% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 14.9% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions; certain business-related expenses; alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

Tax Brackets Filing Jointly Vs Single

The biggest difference in how you’re placed in a tax bracket is whether you are single or have other people to consider.

If you are an individual with no dependents or spouse, the lowest of the seven tax brackets goes from a yearly income range of $0 to $9700. That bracket pays a tax rate of 10%. The highest of the tax brackets is for anyone making more than $510,300 a year in taxable income; anything above that is taxed at a rate of 37%.

For married people jointly filing their taxes, the income range is usually doubled. For example, whereas the lowest tax bracket for single people is $0-$9,700, for joint married couples it’s $0-$19,400. At the highest end of it, though, that tapers off; income over $612,350 gets taxed at 37%.

You May Like: Can You File Missouri State Taxes Online

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

What Are Some Other Inflation Adjustments I Should Look Out For

We mentioned earlier that the IRSâs tax brackets apply to your taxable income, which is what you get when you apply certain adjustments and deductions to your revenue.

One other way that the IRS helps guard against bracket creep is by adjusting the values of deductions to keep up with inflation. Here are the main ones you should look out for:

Also Check: Where To Find Real Estate Taxes Paid

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits directly reduce the amount of tax you owe; they don’t affect what bracket you’re in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

You May Like: Where To File Taxes For Free

What Are The Expanded Child Tax Credit Changes

Bidens American Rescue Plan increased the child tax credit for the 2021 tax year only.; The credit for qualifying children increased from up to $2,000 to up to $3,600 for children under the age of 6 and up to $3,000 for children ages 6 to 17. The credit is now fully refundable.

Previously, the credit was only partially refundable, and provided a maximum of $2,000 per qualifying child under 17.

When Does Bc Tax Have To Be Paid

BC tax is paid along with your federal tax by April 30 if you are employed. Because of the Covid-19 pandemic the tax deadline for paying 2019 taxes was extended to September 1, 2020.

Article Contents8 min read

This article is provided for informational purposes only. It does not cover every aspect of the topic it addresses. The content is not intended to be investment advice, tax, legal or any other kind of professional advice. Before taking any action based on this information you should consult a professional. This will ensure that your individual circumstances have been considered properly and that action is taken on the latest available information. We do not endorse any third parties referenced within the article. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.

We provide investment services and other financial products through several affiliates.

Wealthsimple Trade is offered by Canadian ShareOwner Investments Inc. , a registered investment dealer in each province and territory of Canada, a member of the Investment Industry Regulatory Organization of Canada and a member of the Canadian Investor Protection Fund , the benefits of which are limited to activities undertaken by ShareOwner.

You May Like: Do You Need To Claim Unemployment On Taxes