How Do I Get An Update On My Child Tax Credit Check

You can expect recurring monthly payments to hit your bank account on the 15th through December. According to the IRS, you can use the Child Tax Credit Update Portal to see your processed monthly payment history. It’ll be a good way to watch for pending payments that haven’t gone through your bank account yet.

If you still haven’t received the money you’re owed, see if the Processed Payments section of the update portal has any information. If the payment was delivered, make sure your address and banking information are correct — especially if you’ve moved or changed banks.

To check on your payments online, you’ll need to register with your IRS username and ID.me account information. First-time users will need to have a photo ID .

If you’re checking your bank account, look for the deposit labeled CHILDCTC. If your bank has not received the deposit from the IRS, it won’t have any processing information for you if you’re trying to locate your check. If you think there’s an error, start by using the update portal to double-check the bank details the IRS has on file, including your account information and routing numbers.

How Can I Contact The Irs About My Child Tax Credit Questions

You may have questions about your child tax credit eligibility, a missing check or changes to your information. Your first thought may be to contact the IRS, but there’s limited live assistance due to the tax return backlog, delayed stimulus checks and unemployment tax refunds. The IRS has not announced a separate phone number for child tax credit questions, but the main number for tax-related questions is 800-829-1040.

Instead of calling, it may be faster to check the IRS website for answers to your questions. And remember that the Update Portal can help with eligibility, payment history and updating your personal information online.

How To Get A Faster Tax Refund

Here are four things that can help keep your “Where’s my refund” worries under control.

Avoid filing your tax return on paper. It’s a myth that your IRS refund status will be “pending” for a long time and that the IRS takes forever to issue a refund. In reality, you can avoid weeks of wondering “where’s my refund?” by avoiding paper. The IRS typically takes six to eight weeks to process paper returns. Instead, file electronically those returns are processed in about three weeks. State tax authorities also accept electronic tax returns, which means you may be able to get your state tax refund faster, too.

Get direct deposit. When you file your return, tell the IRS to deposit your refund directly into your bank account instead of sending a paper check. That cuts the time in waiting for the mail and having to check your IRS refund status. You even can have the IRS split your refund across your retirement, health savings, college savings or other accounts so that you dont fritter it away.

Don’t let things go too long. If you haven’t received your tax refund after at least 21 days of filing online or six weeks of mailing your paper return, go to a local IRS office or call the federal agency . But that wont fast-track your refund, according to the IRS. “Where’s my refund” will undoubtedly be a concern, but the thing to worry about here is refund theft. It isn’t corrected quickly, so you may be in for an even longer wait.

Also Check: How Much Does H& r Block Charge To Do Taxes

Why Didn’t I Get A Child Tax Credit Payment Here’s How To Track Your Check

Trying to figure out where your child tax credit check is? Follow these steps to help pinpoint its arrival.

The fourth child tax credit payment went out to millions of parents on Oct. 15. If you didn’t receive your payment via direct deposit, it could be coming by paper check in the mail through the end of October. If you haven’t received a child tax credit payment yet or if you’re missing money from one of the other months, we’ll help you figure out what’s going on.

Last month, the IRS ran into a technical issue that caused around 2% of eligible households to miss September’s payment. It mostly affected parents who had recently updated their bank account or address details through the IRS Update Portal. The IRS said those payments have gone out but some families may have received an overpayment. If that’s you, your October, November and December checks will be slightly adjusted.

The glitch is one of several child tax credit problems that parents are facing. We also found that if only one parent in a married household made a correction to banking info or a mailing address, it could have reduced the amount of the payment. Also, parents might have received more money than they qualify for due to outdated tax information from old returns, which could also affect their taxes next year.

About Where’s My Refund

Use Where’s My Refund to check the status of individual income tax returns and amended individual income tax returns you’ve filed within the last year.

Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount.

If you submitted your return electronically, please allow up to a week for your information to be entered into our system.

Also Check: Do I Have To Report Roth Ira Contributions On My Taxes

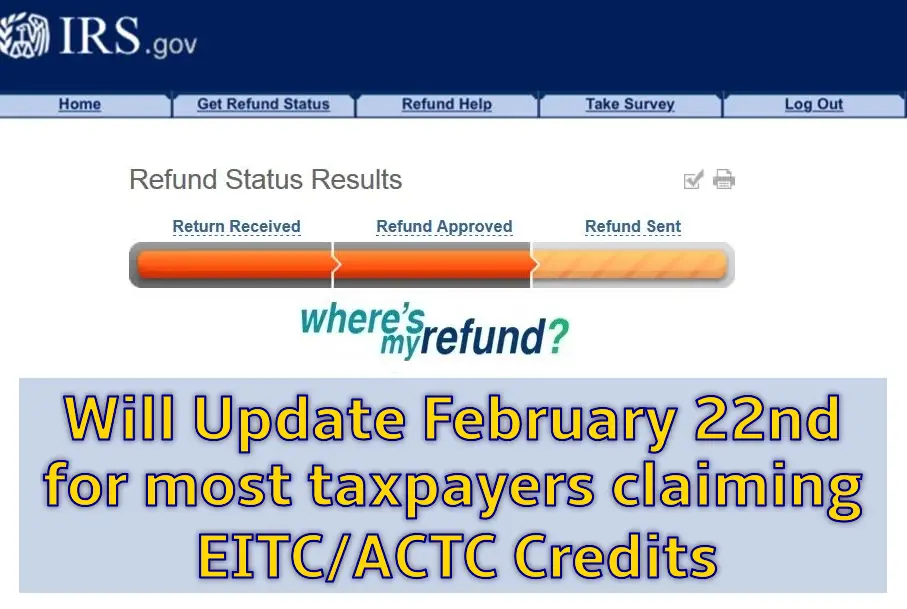

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Is It Possible To Stop The Two Remaining 2021 Payments

The child tax credit requirements are different from previous years. If you ultimately receive more money than you’re eligible for, you might have to pay the IRS back. That’s why it’s important to use the Child Tax Credit Update Portal to inform the IRS of changes to your household circumstances so adjustments can be made.

You may choose to opt out of advance monthly child tax credit payments to get one lump sum during tax time in 2022. It also may be the safest option to avoid repaying the IRS if you’re ineligible for the monthly payments, especially if your income changes this year. You can use the Child Tax Credit Update Portal to opt out of the program anytime. You’ll only need to unenroll once, and you should be able to reenroll later this month if you need to.

If you or your spouse unenrolled from the child tax credit program but still got the money, it’s possible you didn’t opt out in time. You need to do so at least three days before the first Thursday of the month because it takes up to seven calendar days to process the request. The next unenrollment deadline is Nov. 1. Note that if you file taxes jointly, both parents need to unenroll. Otherwise, the spouse who doesn’t opt out will receive half of the joint payment.

Here are the deadlines for unenrolling:

Read Also: Can You File Missouri State Taxes Online

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once you return to the processing stage, your return may be selected for additional review before completing processing.

Understanding Your Refund Status

As you track the status of your return, you’ll see some or all of the steps highlighted below. For more information about your status and for troubleshooting tips, see Understanding your refund status.

Want more information about refunds? See these resources:

Respond to a letter Your refund was adjusted

Also Check: How Do I Get My Pin For My Taxes

How To Check Check The Status Of Your Tax Refund

Online

Visit Refund Status on MassTaxConnect.

You will be asked to:

- Choose the ID type,

- Choose the tax year of your refund, and

- Enter your requested refund amount.

To check the status of your tax refund by phone, call 887-6367 or toll-free in Massachusetts 392-6089 and follow the automated prompts.

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Includes errors such as an incorrect Recovery Rebate Credit amount

- Is incomplete

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income.

- Includes a Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process

- Needs further review in general

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return.

Don’t Miss: Do You Report Roth Ira Contributions On Taxes

How Long Will My Refund Information Be Available

- For U.S. Individual Income Tax Returns filed before July 1: Around the second or third week in December.

- For U.S. Individual Income Tax Returns filed on or after July 1: Throughout the following year until you file a tax return for a more current tax year.

If your refund check was returned to us as undeliverable by the U.S. Post Office, your refund information will remain available throughout the following year until you file a tax return for a more current tax year.

How Long Will I Have To Wait For My Federal Refund Check To Arrive

The IRS usually issues tax refunds within three weeks, but some taxpayers have been waiting months to receive their payments. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be lengthy. If there is an issue holding up your return, the resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to its website.

The date you get your tax refund also depends on how you filed your return. For example, with refunds going into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it took the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your money. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

Read Also: How Can I Make Payments For My Taxes

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

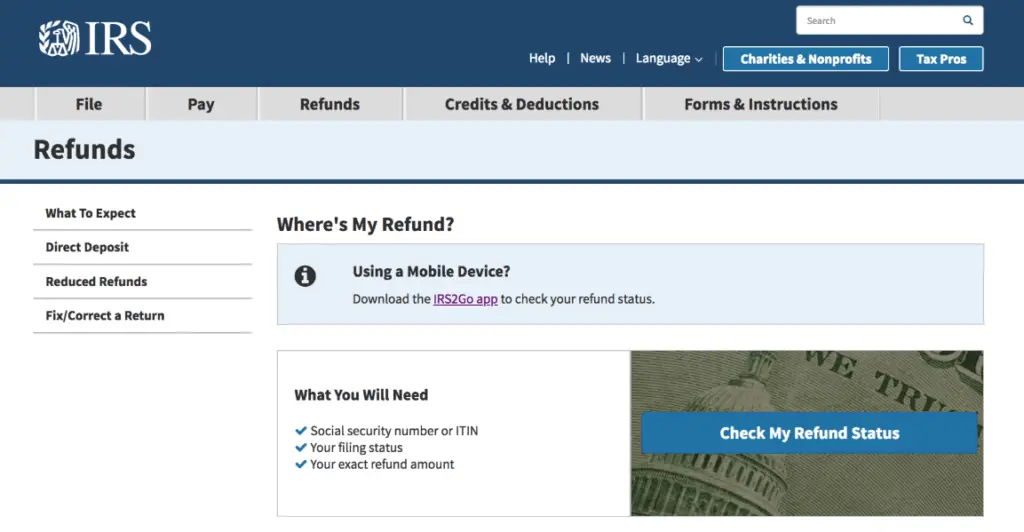

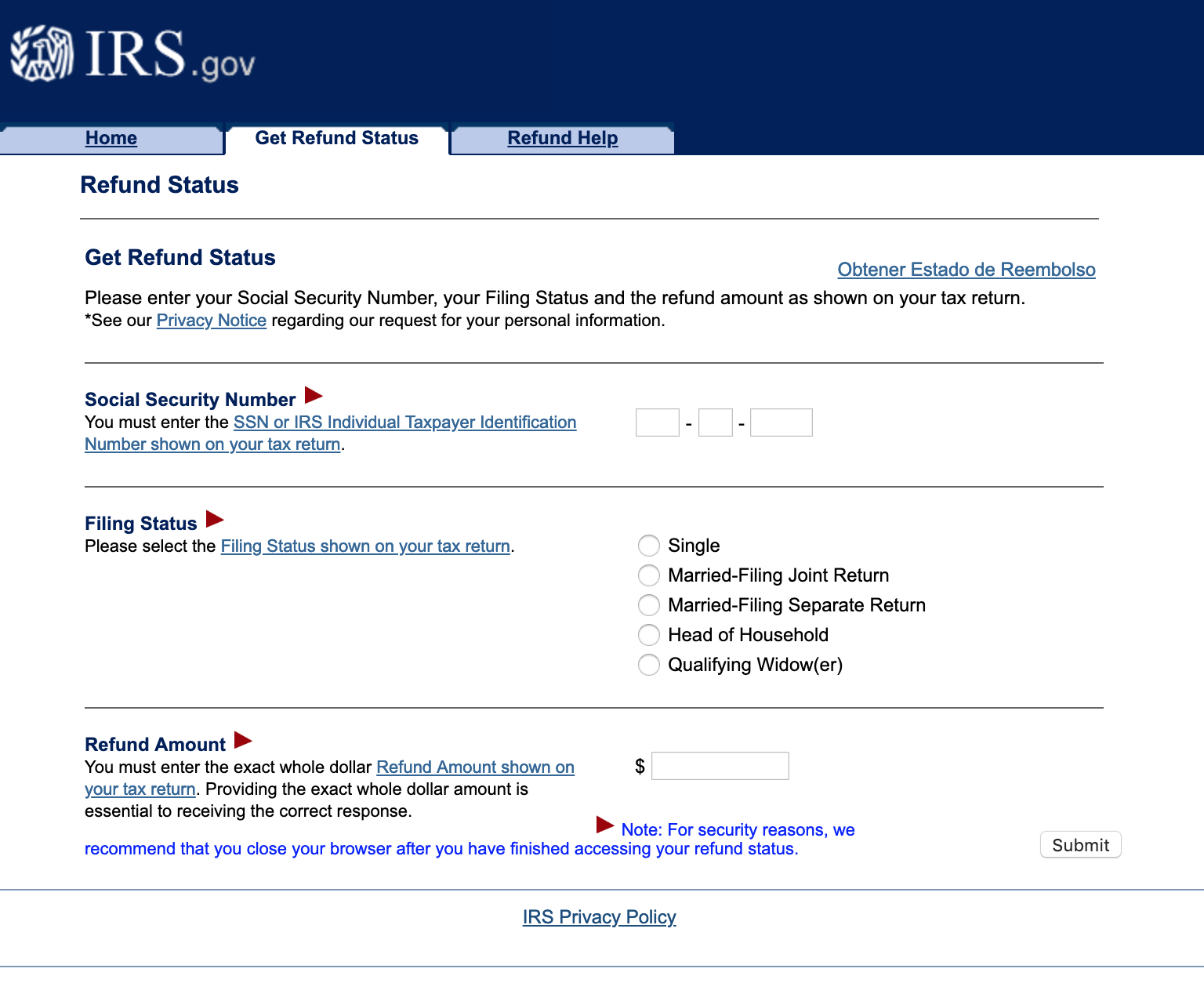

Check The Status Of Your Refund

The best way to check the status your refund is through Where’s My Refund? on IRS.gov. All you need is internet access and this information:

- Your Social Security numbers

- Your filing status

- Your exact whole dollar refund amount

You can start checking on the status of you return within 24 hours after the IRS received your e-filed return, or four weeks after mailing a paper return.

Generally, the IRS issues most refunds in less than 21 days, but some may take longer.

On the go? Track your refund status using the free IRS2Go app. Those who file an amended return should check Wheres My Amended Return?

Recommended Reading: Do I Need To Report Roth Ira Contributions On My Tax Return

When Will My Return Information Be Available

Please Note: The IRS began accepting and processing 2020 tax year returns on Friday, February 12, 2021. Since e-filed state returns are first sent to the IRS, we ask that you consider and recognize this adjustment to the processing timeline for the 2020 tax year returns. Your patience is greatly appreciated.

- Up to 5 business days after filing electronically

- Up to 3 – 4 weeks after mailing your paper return

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then BFS will send the entire amount to the other government agency. If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. BFS will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

You May Like: How To Buy Tax Liens In California

I Still Dont Have My Refund What Should I Do Next

If you have waited the maximum number of weeks it should take to process a refund, we encourage you to check the status of your return or refund online one more time before contacting the Department.

Please note that our tax examiners do not have information about the status of your refund beyond what is available to you from our website. Although the Department is always available to answer your questions and concerns, calling us will not speed up the process. If you would still like to contact the Department, you may reach us at:

Phone: 828-2865 or .

Our staff is working hard to process your return. Our precautions may increase processing time, and we would like to ask for your patience as we strive to provide the protection you have come to expect and deserve.

We appreciate your patience and welcome your feedback in order to help us continue to improve our services.

What Do These Irs Tax Refund Statuses Mean

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

Don’t Miss: Where’s My State Refund Ga

Log In Or Create An Account

Once you’ve logged in to your Online Services account:

Filing Information sample form: Field 5: State/ProvinceField 6: Zip/Postal CodeField 7: Filing Method Option 1: Gross Weight Method Option 2: Unloaded Weight MethodField 8: Number of Vehicle Records to Report

Header cel: Electronic notification optionsBills and Related Notices-Get emails about your bills.Other notifications-Get emails about refunds, filings, payments, account adjustments, etc.Header cell: Receive email

What Is The Best Tax Software

Filing taxes has always been for lack of a better word, taxing for everyone. Tax season is always a stressful time of year..

This is why many people hire an accountant to help them out. But if you dont want to hire an accountant, there are plenty of other options.

One of the most popular ones is to do your taxes yourself with the help of tax software. And there are a lot of software options out there.

So what is the best tax software out there? Well, some of that comes down to personal preference and your situation. However, the list below will give some of the best options to check out.

Read Also: How To File Missouri State Taxes For Free

What You Can Do To Help Us Stop Fraud

If we suspect fraud is being committed against you, we will send you a letter requesting verification of your identification. Please respond to our letter as soon as possible. The quickest way to respond is to visit myVTax and click Respond to Correspondence.

Learn more about identity theft and tax refund fraud, how to detect it, how to avoid it, and how to report it if you believe you are a victim.