Our Fiscal System Redistributes $17 Trillion From The Rich To Everyone Else

A recent study by the Congressional Budget Office, The Distribution of Household Income, 2017, provides an insight into the tax codes progressivity and the redistributive effects of federal fiscal policyboth taxes and direct federal benefits. The report provides estimates of how much households in various income groups benefited in 2017 from social insurance programs as well as means-tested transfer programs , and contrasts these benefits with estimates of how much these households paid in total federal taxes.

One way to understand how much households receive in direct federal benefits compared to how much they pay in total federal taxes is to create a ratio. In other words, we can calculate how much in direct federal benefits do they receive for every $1 in total federal taxes paid.

As we can see in Table 1, in 2017, households in the lowest quintile received $67.67 in direct federal benefits for every $1 they paid in federal taxes. Households in the second quintile received $4.60 in benefits for every $1 of taxes they paid, while households in the middle quintile received $1.60 in total direct benefits for every $1 of taxes they paid.

Table 1. Ratio of Direct Benefits Received to Total Federal Taxes Paid| 2017 Income Group |

|---|

Low Taxes Or Just Regressive Taxes

This report identifies the most regressive state and local tax systems and the policy choices that drive that unfairness. Many of the most upside-down tax systems have another trait in common: they are frequently hailed as low-tax states, often with an emphasis on their lack of an income tax. But this raises the question: low tax for whom?

No-income-tax states like Washington, Texas, and Florida do, in fact, have average to low taxes overall. However, they are far from low-tax for poor families. In fact, these states disproportionate reliance on sales and excise taxes make their taxes among the highest in the entire nation on low-income families.

FIGURE 10

Figure 10 shows the 10 states that tax poor families the most. Washington State, which does not have an income tax, is the highest-tax state in the country for poor people. In fact, when all state and local taxes are tallied, Washingtons poor families pay 17.8 percent of their income in state and local taxes. Compare that to neighboring Idaho and Oregon, where the poor pay 9.2 percent and 10.1 percent, respectively, of their incomes in state and local taxes far less than in Washington.

Fact Check: Do The Rich Really Pay No Taxes

The investigative journalism website ProPublica published The Secret IRS Files, which gleaned information from illegally leaked income tax records that showed some of the 25 wealthiest Americans paid no income tax for one or more years.

Such reporting raises the question: Do the rich fail to pay their fair share of income tax? Is this normal?

What does the ProPublica story say?

ProPublica found that billionaires often managed to employ tax loopholes to legally avoid paying any income tax. Elon Musk paid no income tax in 2018. Jeff Bezos, Michael Bloomberg, and Carl Icahn paid no income taxes in two of the last 15 years. George Soros paid no income taxes for three years. The story compares the growth of their wealth during this time with the amount of income taxes paid to calculate their true tax rate.

Whats the problem with the ProPublica story?

There are several issues with the ProPublica story:

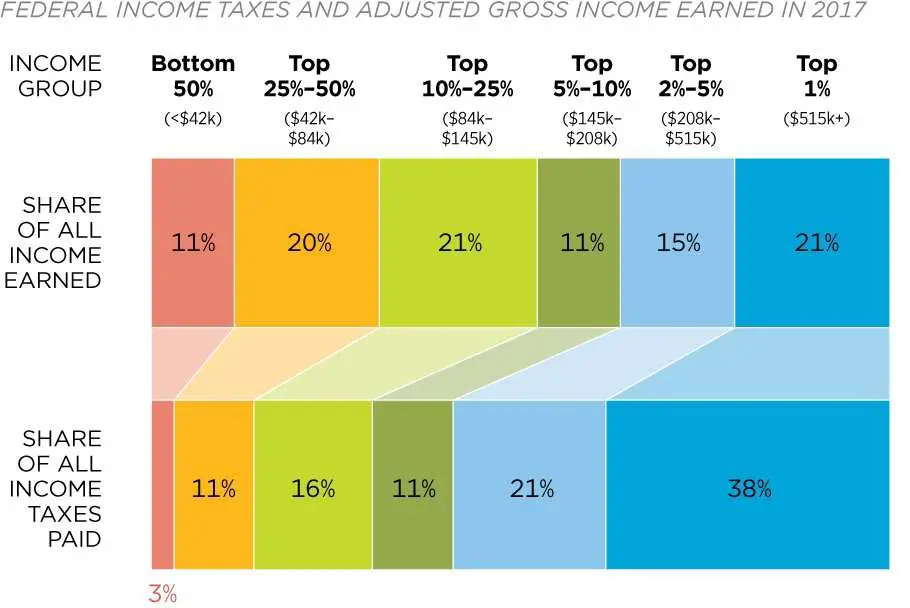

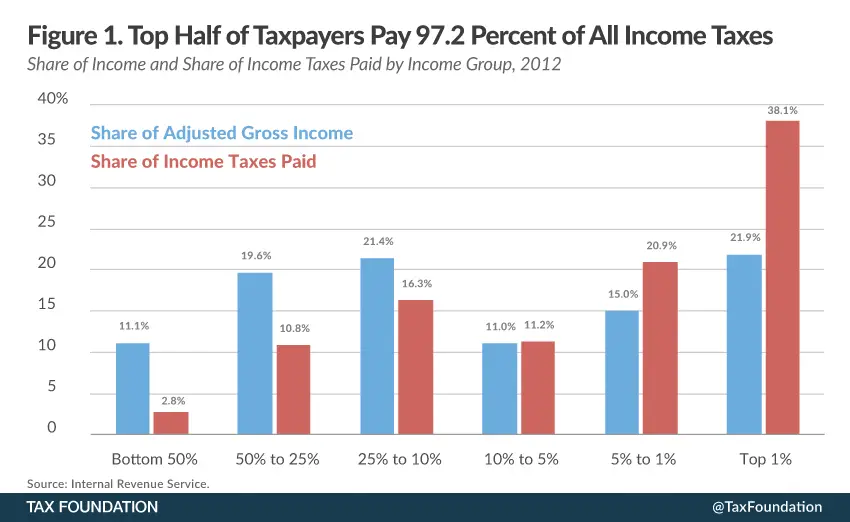

What percentage of income taxes do the wealthiest Americans pay?

The nonpartisan Tax Foundation analyzed U.S. income tax records for the year 2018, the latest year on record, and found that the amount of income earned by the top 1% fell, while their share of income taxes rose, and that the top 1% of earners paid more income taxes than the bottom 90%:

Why is this story controversial?

Whats the context driving this story?

How should we think of this story?

The views expressed in this piece are the authors own and do not necessarily represent those of The Daily Wire.

Recommended Reading: Are Donations To Churches Tax Deductible

Income Tax Provisions That Benefit Low

A key tool that states have available to enhance income tax fairness and lift individuals up and out of poverty are low-income tax credits. These credits are most effective when they are refundable that is, they allow a taxpayer to have a negative income tax liability which offsets the regressive nature of sales and property taxes and are adjusted for inflation so they do not erode over time.

Twenty-nine states and the District of Columbia have enacted state Earned Income Tax Credits . Most states allow taxpayers to calculate their EITC as a percentage of the federal credit. Doing so makes the credit easy for state taxpayers to claim and straightforward for state tax administrators.

Refundability is a vital component of state EITCs to ensure that workers and their families get the full benefit of the credit. Refundable credits do not depend on the amount of income taxes paid rather, if the credit exceeds income tax liability, the taxpayer receives the excess as a refund. Thus, refundable credits usefully offset regressive sales and property taxes and can provide a much-needed income boost to help families pay for basic necessities. In all but five states , the EITC is fully refundable. The use of low-income tax credits such as the EITC is an important indicator of tax progressivity: only two of the ten most regressive state income taxes have a permanent EITC, while all of the ten relatively progressive state income taxes provide a permanent EITC.

Lift The Social Security Payroll Tax Cap

Social Security is financed by a 12.4% taxon wages, split evenly between employers and employees. This payroll tax appliesto wages up to $132,900 in 2019. When Social Security began in the 1930s, about92% of earnings from jobs covered by the program were taxedbut as wages have grown,the cap hasnt kept up, so today about 83% of earnings are hit by the Social Securitypayroll tax.

One option is to raise the ceiling to $285,000and adjust it annually so 90% of earnings are taxed, with an increase in the SocialSecurity benefits these workers get in retirement. According to the CongressionalBudget Office, this would raise $805 billion over 10 years. Advocatesof lifting the cap say it will shore up Social Security finances so it can continueto pay all promised benefits beyond 2034, the year that SocialSecurity trustees say the trust fund will run dry. Advocates also pointto the fact that it would only affect higher-paid workers.

Opponents say this would cut cash wagesto the affected workersthe more taxes an employer pays the less it will be willingto pay in cash wages, economists say. It also reduces higher-income Americans incentiveto work while increasing incentives for employers to provide more untaxed benefitsinstead of cash wages.

Read Also: How To Find Tax Lien Properties

The Numbers Add Up To A Lot Of Redistribution

Another way to look at the data is in the aggregate, which allows us to measure how much various income groups receive in direct government benefits relative to how much they pay in total federal taxes. This will give us a sense of how much federal fiscal policy acts to redistribute income from some groups of American households to other groups.

Figure 3 shows that households in the bottom three quintiles collectively receive more than $1 trillion more in direct government benefits than they paid in all federal taxes in 2017. In other words, 60 percent of American households receive more in benefits than they pay in federal taxes.

The CBO data indicates that redistribution reduced the incomes of households in the top 1 percent by more than one-third, while lifting the incomes of households in the lowest quintile by 126 percent, those in the second quintile by 46 percent, and those in the middle quintile by 10 percent. Those are the results that you would expect from a highly progressive fiscal system.

A Roadmap To The State

The state pages show state-by-state estimates of the distribution of state and local taxes by income group for non-elderly taxpayers. For each state, two pages of tax information are presented.

The first page for each state shows the distribution of state and local taxes in tax year 2018, unless otherwise specified. In each distributional chart, the non-elderly population is divided into income quintiles . The highest-income quintile is further subdivided into three groups: the top 1 percent, the next highest 4 percent, and the next 15 percent. This is done because the highest-income quintile received 61 percent of all income in 2015 and because income is distributed unequally within the top quintile.

The large chart at the top of each page shows total average state and local taxes by income group. In a departure from past analyses, we no longer present this information post-federal offset due to policy changes under the federal Tax Cuts and Jobs Act that temporarily limited the extent to which the federal deduction for state and local taxes functions as a generalized offset of state and local taxes. Three smaller charts appear below it and show the distribution of each states sales and excise, personal income, and property taxes by income group.

Recommended Reading: Are Goodwill Donations Tax Deductible

Sales And Excise Taxes

Sales and excise taxes are the most regressive element in most state and local tax systems. Sales taxes inevitably take a larger share of income from low- and middle-income families than from rich families because sales taxes are levied at a flat rate and spending as a share of income falls as income rises. Thus, while a flat rate general sales tax may appear on its face to be neither progressive nor regressive, that is not its practical impact. Unlike an income tax, which generally applies to most income, the sales tax applies only to spent income and exempts saved income. Since high earners are able to save a much larger share of their incomes than middle-income families and since the poor can rarely save at all the tax is inherently regressive.

The average states consumption tax structure is equivalent to an income tax with a 7.1 percent rate for the poor, a 4.8 percent rate for the middle class, and a 0.9 percent rate for the wealthiest taxpayers. Few policymakers would intentionally design an income tax that looks like this, but many have done so by relying heavily on consumption taxes as a revenue source.

On average, states rely more heavily on sales and excise taxes than any other tax source. Sales and excise taxes accounted for 35 percent of the state and local taxes collected in fiscal year 2015. However, states that rely much more heavily on consumption taxes increase the regressivity of their state and local tax systems:

FIGURE 9

Increase The Estate Tax

The estate tax is levied on the assets of the very best-off Americans when they die. The Tax Cuts and Jobs Act increased the level at which the federal estate tax kicks in so that the taxat a rate of 40%applies only to estates over $11.2 million. Only two of every 1,000 people are wealthy enough to trigger the tax when they die, or about 1,900 estates in 2018, according to the Tax Policy Center. Only 80 small farms and small businesses paid the estate tax in 2017, again according to the Tax Policy Center. Estate and gift taxes brought the government about $19 billion in 2019, only 0.5% of all federal revenues.

One proposal would lower the threshold to estates worth $3.5 million and impose graduated taxes depending on the size of the estatefrom 45% up to 65%. It would raise more than $300 billion over 10 years. Advocatesof an estate tax hold that it is a good way to avoid dynastic wealth in the U.S.and make the U.S. a fairer place where merit matters more and the net worth of onesparents matters less. As the wealthy get wealthier, they say, a stronger estatetax is increasingly important.

When someone dies with stocks, property or other assets that are worth more than he or she paid for them, the heirs do not have to pay capital gains taxes on those profits. No one does the profits go completely untaxed. Former Vice President Joe Biden, among others, has proposed taxing these profits. Heirs would have to pay tax when they sell the assets they inherit.

You May Like: When Will I Get My Federal Tax Refund 2021

The Case For A Robust Attack On The Tax Gap

A well-functioning tax system requires that everyone pays the taxes they owe. Today, the tax gapthe difference between taxes that are owed and collectedtotals around $600 billion annually and will mean approximately $7 trillion of lost tax revenue over the next decade. The sheer magnitude of lost revenue is striking: it is equal to 3 percent of GDP, or all the income taxes paid by the lowest earning 90 percent of taxpayers.

The tax gap can be a major source of inequity. Todays tax code contains two sets of rules: one for regular wage and salary workers who report virtually all the income they earn and another for wealthy taxpayers, who are often able to avoid a large share of the taxes they owe. As Table 1 demonstrates, estimates from academic researchers suggest that more than $160 billion lost annually is from taxes that top 1 percent choose not to pay.1

Table 1: Distribution of the Tax Gap

The United States collects less tax revenue as a percentage of GDP than at most points in recent history, in part because owed but uncollected taxes are so significant. The tax gap also has meaningful implications for fiscal policy. These unpaid taxes mean policymakers must choose between rising deficits, lower spending on important priorities, or further tax increase to compensate for lost revenuewhich will only be borne by compliant taxpayers.

Table 2: Distribution of Proprietorship, Partnership, and S-Corporation Income

|

Corrected Adjusted Gross Income |

The 10 Most Regressive State And Local Tax Systems

Ten states Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming are particularly regressive, with upside-down tax systems that ask the most of those with the least. These Terrible 10 states tax their poorest residents those in the bottom 20 percent of the income scale at rates up to six times higher than the wealthy. Middle-income families in these states pay a rate up to four times higher as a share of their income than the wealthiest families.

FIGURE 4

What characteristics do states with particularly regressive tax systems have in common? See Figure 4 for a look at the ten states with the most regressive tax systems. Several important factors stand out:

Recommended Reading: How Does Unemployment Tax Work

The Us Tax System Is Progressive

As a whole, the U.S. tax code remains progressive with higher-income taxpayers paying a greater share of their income in taxes. That is true despite the fact that high-income Americans benefit disproportionately from tax breaks, otherwise known as tax expenditures.

Major tax expenditures such as lower rates on capital gains and dividends, deductions for charitable contributions, and deductions for state and local taxes tend to benefit higher-income taxpayers more than lower-income groups. CBO estimates that the top quintile of taxpayers receive 51 percent of the value of major tax expenditures, while only 8 percent goes to the bottom quintile. However, even with substantial tax expenditures, the top one percent of American taxpayers still pay an effective tax rate of 29 percent, on average, while the bottom 20 percent of the population pay an average of 3 percent.

TPC estimates that 68 percent of taxes collected for 2019 came from those in the top quintile, or those earning an income above $163,600 annually. Within this group, the top one percent of income earners those earning more than $818,700 per year will contribute over one-quarter of all federal revenues collected.

While the fairness of the tax system is much debated, many economists agree that simplifying the tax code would help the economy. Further tax reform could promote economic growth while also making the code more simple, transparent, and fair.

How To Reduce Taxable Income & Drop Into A Lower Tax Bracket

Two common ways to reduce your tax bill are by using . The first is a dollar-for-dollar reduction in the amount of tax you owe. The second trims your taxable income, possibly slipping you into a lower tax bracket.

Tax credits come in two types: nonrefundable and refundable.

Nonrefundable credits are deducted from your tax liability until your tax due equals $0. Examples include the child and dependent care credit, adoption credit, savers credit, mortgage interest tax credit, and alternative motor vehicle credit.

Refundable credits are paid out in full, no matter what your income or tax liability. Examples include the earned income tax credit , child tax credit, and the American Opportunity Tax Credit.

Which of these tax credits apply to your situation?

Deductions, on the other hand, reduce your taxable income. Accumulate enough of them in qualifying number or amount, and you can slide a tax bracket or two.

Popular deductions include:

Also Check: How To Do Taxes Freelance

Top 1% Dodge $163 Billion In Annual Taxes Treasury Estimates

- The top 1% of Americans may be dodging as much as $163 billion in annual taxes, according to the U.S. Department of the Treasury.

- This estimate widens the tax gap the shortfall between whats owed and collected to $600 billion every year.

- The report comes as Congress weighs a slate of budget proposals, including increased IRS funding.

The top 1% of Americans may be dodging as much as $163 billion in annual taxes, according to a report from the U.S. Department of the Treasury.

This estimate widens the so-called tax gap the shortfall between how much is owed and collected to $600 billion every year, Tuesday’s report outlines.

The Treasury doesn’t define income levels on its analysis of the top 1%, but says the lost revenue is equal to all the levies paid by the lowest-earning 90% of taxpayers.

“I think it’s a timely report because it’s crunch time right now,” said Chuck Marr, senior director of federal tax policy at the Center on Budget and Policy Priorities.

More from Personal Finance:Democrats eye reforms to Trump tax break for businesses

The report comes as Congress weighs a slate of budget proposals, including calls from President Joe Biden to boost IRS funding by $80 billion over the next decade to fight tax evasion from wealthy Americans.

IRS funding has dropped by 19% since 2010, according to the Center on Budget and Policy Priorities. The agency lost more than 33,378 full-time employees from 2010 to 2020.