How The Irs Taxes Cryptocurrency And The Loophole That Can Lower Your Tax Bill

Although cryptocurrencies like Bitcoin can be used to make purchases of anything from hand-made crafts to, in the near future, a Tesla electric vehicle, if you convert that currency to cash rather than pay in the form of crypto, you could be liable for capital gains tax. Every time you convert Bitcoin to cash it is technically a taxable event, says Daniel Polotsky, CEO at CoinFlip, a Bitcoin ATM operator.

Find: Economy Explained How Does Cryptocurrency Work, and Is It Safe?

However, whether or not you earn money on the transaction determines whether you may have to pay capital gains tax or can declare a loss on your taxes, which could reduce your tax bill by offsetting other gains or up to $3,000 in your adjustable gross income. Most people only think about reporting transactions when they make money, Polotsky says. Reporting losses can help people save on their taxes, as well.

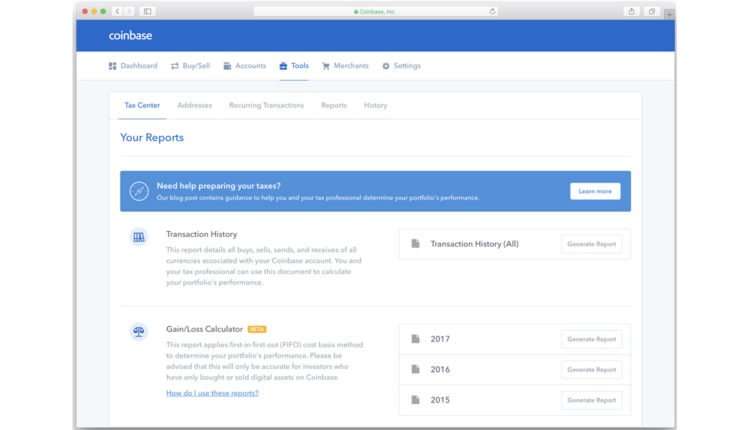

How To Calculate Coinbase Cost Basis

To you need to know the cost basis of each of your transactions. In laymans terms, this simply means what was the amount of dollars you originally spent to buy your bitcoin, and what was the dollar value when you sold it.

This cost basis is used to calculate your gains and your losses. The reports you can generate on Coinbase calculate the cost basis for you, inclusive of any Coinbase fees you paid for each transaction.

Coinbase uses a FIFO method for your Cost Basis tax report. They will give you a summary of all your crypto purchases and sales along with the cost basis and capital gains.

Sending and receiving crypto into your Coinbase wallet is treated as buying or selling that asset at market price so its important that you keep your own accurate records as well. If you sent bitcoin to your , or other hardware wallet, and then sent it back to Coinbase at a later date you would not want to file this as a sale of bitcoin.

Are Coinbase Fees High

Coinbase has the most expensive fees compared to other what we consider as Tier 1 Cryptocurrency Exchanges. Coinbase charges a 0.50% fee for cryptocurrency purchases and sales. The Coinbase Fee is the greater of a flat fee depending on order size; a variable percentage depending on your region and payment type.

Don’t Miss: Where Can I Get Taxes Done For Free

The Future Of Crypto Taxes

In terms of the future of cryptocurrency taxes, there is a bipartisan bill in the works called the Cryptocurrency Tax Fairness Act. This bill was introduced last September and might reclassify cryptocurrency as a currency, allowing Americans to not report any transactions that are under $600.

At this point, other countries are taking advantage of the strict US cryptocurrency tax rules by offering no long-term taxes in countries like Germany, and no taxes at all in countries like Denmark, Serbia, and Slovenia. Its therefore beneficial for startups to create cryptocurrency jobs created in the aforementioned countries; this is now a jobs issue for US-based politicians.

Expect the IRS to demand a list of cryptocurrency customers and transactions from many more cryptocurrency companies in the next few years, and to use sophisticated software products to find and fine those who have not paid taxes on crypto currency gains. The US government has a decent track record of investing in artificial intelligence-based software companies that can uncover data-based patterns. For example, the US government owns a venture-capital firm called In-Q-Tel that makes many AI-based software investments, and partners with top US venture-capital firms.

The bottom line: Seek professional assistance from an accountant and/or tax attorney if you are having issues understanding how to file taxes for your cryptocurrency investments.

Capital Gains Vs Capital Losses

Heres some good news for crypto taxes: You only owe taxes if you spend or sell it and realize a profit. If you sell or spend your crypto at a loss, you dont owe any taxes on the transaction.

If you bought $10,000 in Bitcoin and sold it for $13,000, for example, your taxable gain would be $3,000. But if you sold the same Bitcoin for $7,000 youd owe nothing in taxesand could even use part of your $3,000 in Bitcoin losses to offset other investment gains.

Read Also: Who Can I Call About My Tax Refund

Records You Must Keep

You must keep separate records for each transaction, including:

- type of tokens

- date you disposed of them

- number of tokens youve disposed of

- number of tokens you have left

- value of the tokens in pound sterling

- bank statements and wallet addresses

- a record of the pooled costs before and after you disposed of them

You may also want to keep other records such as wallet addresses.

HMRC might ask to see your records if they carry out a compliance check.

New Coinbase Transparency Report Shows The Irs Is Coming After Coinbase Users For Failure To Report Virtual Currency Holdings

In October 2020, Coinbase released its first-ever transparency report, and some of the information contained in this report should serve as a major wake-up call to taxpayers who have failed to report virtual currency held in this or another exchange in years past. The data shows that the IRS, and its Criminal Investigation Unit, has been one of the top receivers of information from Coinbase, alongside the FBI and CIA. This data makes it clear that the IRS is requesting information from Coinbase for the express purpose of checking it against its own taxpayer data and looking for discrepancies where holdings on Coinbase have not been reported on taxpayers returns.

If you have failed to report holding Bitcoin or other virtual currencies on your past returns or filed an incomplete or misleading picture of your cryptocurrency holdings, the time to act to correct this is now. Once an audit or investigation has begun, it will be too late to amend your returns or take advantage of a voluntary disclosure program. By reaching out to one of our skilled tax attorneys and CPAs at the Tax Law Offices of David W. Klasing, you can rest assured you will receive the best possible advice about how to correct past errors, mitigate any damage that has already occurred, and prevent future mistakes from occurring by adopting a system of best practices for keeping track of the numbers that must be reported on future returns involving cryptocurrency.

Read Also: When Can I Expect My Unemployment Tax Refund

What Kind Of Transaction Records Does The Hmrc Ask For

As far as record keeping is concerned, the HMRC correctly states that many exchanges do not keep detailed information about crypto transactions and the onus of maintaining these transactions accurately rests with the taxpayer. These;details;include:

- the type of crypto asset

- date of the transaction

- whether the crypto assets were bought or sold

- the number of units involved

- value of the transaction in pound sterling

- cumulative total of the investment units held

- bank statements and wallet addresses, as these might be needed for an enquiry or review

You should ensure you download reports regularly from your exchanges as they can lose your data or just delete it permanently after a certain period of data. Again, using tax software like Koinly can help you maintain such a ledger.

What If I Don’t File My Crypto Taxes

The HMRC is;quite active;in ensuring cryptocurrency traders pay their taxes. They regularly ask major exchanges like Coinbase for information on their UK based customers. This is usually followed up by notices to identified crypto traders who misreported their capital gains.

Traders receive email from Coinbase about HMRC’s request

With the cryptocurrency and Defi markets growing at such incredible rates the HMRC is unlikely to stop its pursuit so it’s best to be proactive and report/pay your crypto taxesi n time to avoid late penalties and prosecution.

You May Like: How To Pay My Federal Taxes Online

How The Irs Knows You Owe Crypto Taxes

WASHINGTON, DC – APRIL 15: The Internal Revenue Service building stands on April 15, 2019 in … Washington, DC. April 15 is the deadline in the United States for residents to file their income tax returns.

As another tax season arrives, one of the major questions crypto holders have is how does the IRS know if someone has cryptocurrencies. Before I describe the ways that the IRS knows about your crypto holdings, note that the US tax system relies on a voluntary compliance system. This means that the the IRS expects you to report all taxable transactions in a given year because it is required by the internal revenue code. Failure to do so may carry hefty penalties. While keeping that thought in mind, lets dive into 3 ways the IRS may find out about your crypto holdings.;

Do I Have To Report Cryptocurrency Losses To The Irs

Yes, you need to report your crypto losses to the IRSand doing so could actually save you a pretty penny, for two reasons.

One: Your exchange may be sending information about your transactions to the IRS, but that information is often incomplete and doesnt include any losses. This can make the IRS think you owe much more than you actually do. Correcting that mistake can be more expensive and troublesome than reporting properly to begin with.

Two: Capital losses offset capital gains, lowering the amount of tax owed. They can also be used to offset regular income and other capital gains , and can even be carried forward to offset future gains! Give us a call to learn more.;

Also Check: How Fast Can You Get Your Tax Refund

What Are Crypto Taxes

Cryptocurrency is considered property for federal income tax purposes. And, for the typical investor, the IRS treats it as a capital asset. As a result, crypto taxes are no different than the taxes you pay on any other gain realized on the sale or exchange of a capital asset.

When you purchase a capital asset be it a stock, bond, house, widget, Dogecoin, Bitcoin, or other investment you establish a basis equal to your cost to acquire it. When you sell, you compare your sales proceeds to the basis to determine whether you have a capital loss or a capital gain. If your proceeds exceed your basis, you have a capital gain. If reversed, you have a capital loss.

You’ll also need to consider the time period for which you held the asset. Depending on how long you hold your cryptocurrency, your gains or losses will be considered short-term or long-term. That distinction will also play a big role in how much you have to pay in crypto taxes.

A Note On Crypto Taxes

We know crypto taxes can be confusing sometimes. We got you covered on all-tax topics from taxes on crypto trades to the tax implications of purchasing goods or services with Bitcoin. Take a look at the guides we put together with the best tools in crypto and all clarifications on crypto taxes:

- Receiving a free airdrop? Watch out for taxes

Also Check: How Do I Pay My State Taxes In Missouri

Is It Business Income Or Capital Gain

The income you get from disposing of cryptocurrency may be considered business income or a capital gain. In order to report it correctly, you must first establish what kind of income it is.

The following are common signs that you may be carrying on a business:

- you carry on activity for commercial reasons and in a commercially viable way

- you undertake activities in a businesslike manner, which might include preparing a business plan and acquiring capital assets or inventory

- you promote a product or service

- you show that you intend to make a profit, even if you are unlikely to do so in the short term

Business activities normally involve some regularity or a repetitive process over time. Each situation has to be looked at separately.

In some cases, a single transaction can be considered a business, for example when it is an adventure or concern in the nature of trade. Whether you are carrying on a business or not must be determined on a case by case basis. For more information, please review our archived content on an adventure or concern in the nature of trade.

Some examples of cryptocurrency businesses are:

- cryptocurrency mining

- cryptocurrency trading

- cryptocurrency exchanges, including ATMs

When Youll Owe Taxes On Cryptocurrency

Because the IRS considers virtual currencies property, their taxable value is based on capital gains or losses basically, how much value your holdings gained or lost in a given period.

When you trade cryptocurrencies or when you spend cryptocurrency to buy something, those transactions are subject to capital gains taxes, because youre spending a capital asset to get something or get another asset, says Shehan Chandrasekera, CPA, head of tax strategy at CoinTracker.io, a crypto tax software company.

The difference between the amount you spent when you bought or received the crypto and the amount you earn for its sale is the capital gain or capital loss what youll report on your tax return. Broadly speaking, if you bought $100 worth of Bitcoin and sold it for $500, youd see a capital gain of $400. If your Bitcoin lost value in that time, youd instead face a capital loss. If your losses exceed your gains, you can deduct up to $3,000 from your taxable income .;;

The amount of time you owned the crypto plays a part, too. If you held onto a unit of Bitcoin for more than a year, it would generally qualify as a long-term capital gain. But if you bought and sold it within a year, its a short-term gain. These differences can affect which tax rate is applied. The tax rate also varies based on your overall taxable income, and there are limits to how much you may deduct in capital losses if your crypto asset loses value.;

You May Like: What Can I Write Off On My Taxes For Instacart

Buying Goods Or Cryptocurrencies With Cryptocurrency

Heres where things get a touch complicated. Youre required by law to keep records of your trades. If you didnt keep records, you need to make your best guess and hope the CRA doesnt audit you.

These records are vital due to the capital gains you make. Now keep in mind that capital gains can apply in more than one circumstance.

Lets say you bought 1 Bitcoin for $100 but it has a current market value of $15,000. You decide to make renovations to your home and the contractor agrees to trade his services which are normally worth $15,000 for 1 Bitcoin.

In this case, both parties are liable for taxes. The original Bitcoin owner would pay capital gains on $7,450 while the contractor would still need to report business income of $15,000. The CRA covers the details of taxes for this transaction in this post.

When trading entire amounts, things are easy. However, if you purchase cryptocurrencies at various times at different prices, you need to log all those transactions and calculate your adjusted cost base when selling later.

Does Coinbase Report To The Irs

Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide

Does Coinbase report the IRS? Yes. Currently, Coinbase sends Forms 1099-MISC to U.S. traders who made more than $600 from crypto rewards or staking in the last tax year.

The exchange sends two copies of Form 1099-MISC: One to the taxpayer and one to the IRS. Thus, if you have received a 1099-MISC from Coinbase, so has the IRSand theyll be expecting you to file taxes on your cryptocurrency transactions.

Whats more, although the Form 1099-MISC only reports profits from rewards or staking, it signals to the IRS that a taxpayer is actively trading cryptocurrency and may have transactions other than rewards or staking to report.

Don’t Miss: How To Look Up Employer Tax Id Number

Earning Cryptocurrencies Through Mining

Cryptocurrencies are commonly acquired in two ways:

- bought through a cryptocurrency exchange

- earned through mining

Mining involves using specialized computers to solve complicated mathematical problems which confirm cryptocurrency transactions. Miners will include cryptocurrency transactions into blocks, and try to guess a number that will create a valid block. A valid block is accepted by the corresponding cryptocurrencys network and becomes part of a public ledger, known as a blockchain. When a miner successfully creates a valid block, they will receive two payments in a single payment amount. One payment represents the creation of new cryptocurrency on the network and the other payment represents the fees from transactions included in the newly validated block. Those who perform the mining processes are paid in the cryptocurrency that they are validating.

The income tax treatment for cryptocurrency miners is different depending on whether their mining activities are a personal activity or a business activity. This is decided case by case. A hobby is generally undertaken for pleasure, entertainment or enjoyment, rather than for business reasons. But if a hobby is pursued in a sufficiently commercial and businesslike way, it can be considered a business activity and will be taxed as such.

What Is A Disposition

This refers to the way you get rid of something, such as by giving, selling or transferring it. In general, possessing or holding a cryptocurrency is not taxable. But there could be tax consequences when you do any of the following:

- sell or make a gift of cryptocurrency

- trade or exchange cryptocurrency, including disposing of one cryptocurrency to get another cryptocurrency

- convert cryptocurrency to government-issued currency, such as Canadian dollars

- use cryptocurrency to buy goods or services

Also Check: How To Find Tax Lien Properties