Why Do I Need To Keep Receipts For Taxes

There are two reasons you need to keep receipts for tax purposes. The first reason is so you know exactly how much to claim on your taxes when tax season comes around. It can be incredibly frustrating and time-consuming to search for an old receipt you received a year ago. Plus, if you dont know the actual cost, you cant exactly claim it on your taxes.

The second reason is you need supporting documentation in the event that you get audited by the Canada Revenue Agency . The CRA has the right to audit anyones taxes, this can involve looking at the supporting documentation you used to prepare your tax return. If you cant provide receipts to back up what you claimed on your taxes, the CRA has the right to remove whatever it is you were trying to claim which could result in you owing additional taxes.

Does owning money to the CRA affect your credit score? Check out this article to find out.

What Is A Business Tax Receipt

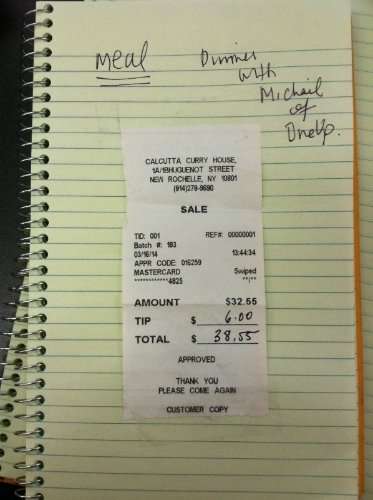

A business receipt is a receipt for anything that you purchased for your business. For example, if you purchase a desk for your business, the receipt for your desk would need to be saved since you can write-off your desk as a business expense.

Receipts are important for tax time because they are back-up documentation that support the business deductions your tax professional will help you take at tax time. In addition to receipts, other important back-up documentation for expenses and income includes sales slips, paid bills, invoices, deposit slips, canceled checks, cash register tapes, deposit information, receipt books, invoices, and 1099-MISC forms.

This documentation will also help you in the future if the IRS decides to audit your records. Many people fear being audited, but if you work with an honest tax professional and keep good records you shouldnt have anything to worry about.

Free Book Previewtax And Legal Playbook

Entrepreneur

Many Americans often ignore or quickly say “No” when asked whether they want a receipt, but not small-business owners. Is this because they spend hours upon hours organizing them during the year and look forward to turning them into their accountant? Um, not necessarily. Savvy business owners simply know how to keep receipts because if they don’t, their tax return could be in peril. The reality is: Receipts are audit protection and we have to take that seriously.

This past year Betty Ong, a real-estate broker in Northern California, was another casualty of tax court and lost to the Internal Revenue Service. Ong deducted thousands of dollars for travel, meals, entertainment, automobile and cellphone expenses, but like many small-business owners, didn’t keep the strict substantiation requirements of the IRS. While Ong was able to produce books and records proving the expenses were incurred, she failed to show receipts, notes and documentation that the expenses were business related. In the words of the court, the only evidence she presented to support the business purposes of her expenses was her “own broad self-serving testimony and uncorroborated notes.”

Sadly, Ong is just one of many business owners who didnt keep proper records and lose in audits or tax court every year. The reality is that you may be entitled to these deductions, but if you don’t follow the rules, you could be left out in the cold. Here are some basic tips:

Read Also: What Age Do You Have To File Taxes

Can I Claim On Expenses Without Receipts

While its always best to hold on to any receipt, you may still be able to claim on tax-deductible expenses if you dont have one. You just need to be able to satisfy a tax inspector by showing that you did make the purchase.

So, record the details around it what was bought, who from, and the amount it cost. If you still have the item, then its tangible existence will help prove its legitimacy as a claim.

Even if theres been no record, then you might still be able to meet HMRCs requirements, provided you made a sensible estimate of how much was spent.

How Long Do I Need To Keep Expense Receipts

As a basic rule of thumb, small businesses should hold on to their receipts for a minimum of five years after the 31st January Self Assessment tax return deadline for the given tax year.

Youll need to keep them even longer if:

- You file your return late

- HMRC have initiated a check of your records

- Youre buying and selling assets

This time period also varies depending on your reason for filing a return. The length of time is reduced to 22 months for individuals who arent carrying on a business, and extended to six years for those who also have Corporation Tax charges.

Its worth noting that an HMRC tax investigation can go back 20 years if they believe there has been deliberate tax avoidance. They can therefore look at two decades worth of tax returns and the accompanying records.

Also Check: How To Find Out Tax Identification Number

The Meal And Travel Exception

If you are self-employed, qualify as a northern resident or have moved to take a job, study at a post-secondary institution, or run a business at a new location, the CRA allows for a “simplified” method that does not require receipts for meal and vehicle expenses.

- Meal expenses:If you decide to use the simplified method, you can expense a flat rate for meals of $17 per meal up to a maximum of $51 per day without receipts for the 2018 tax year. Note that while you do not have to keep meal receipts when using the simplified method, you will have to keep records of the trips for which you are claiming meal expenses If your meal expenses are higher than the simplified daily limits, you can use the detailed method to claim the actual amounts, in which case you must have receipts to back up your claim.

- Vehicle expenses:The simplified method for vehicle expenses allows you to claim a per-kilometer rate rather than keeping track of individual expenses such as fuel, repairs, and insurance. See meal and vehicle rates for the per-kilometer rates for each province or territory.

Gather Your Receipts Together

The biggest issue individuals suffer from are lost receipts. Very rarely do we ever keep them all in one spot. Receipts are most commonly found hidden in the following places.

Shoeboxes Email Car

When you are able to locate your receipts, be sure to focus on the ones dated within the tax year you are submitted for.

Also Check: How Much Are Annuities Taxed

Organize And Store Tax Records

Lastly, Wellybox helps you store your tax records for the recommended time. The information can be exported to your preferred cloud storage, such as Dropbox or Google Drive. You can keep them there for three years as recommended by the IRS, or you can share them directly with an accountant as needed.

How To Keep Track Of Your Receipts

With the detailed method of claiming your home office expenses, you may be required to produce receipts for purchases and services that you have paid for especially if you end up facing an audit.

Luckily, you are probably not going to be faced with piles of receipts that need to be organized as you would if you owned your own business.

However, instead of shoving these slips of paper in a random drawer, here are some ways that you can keep track of your receipts for your home office expenses:

- Make notes on your receipts. To keep your receipts organized, make a note on them to indicate whether they are for supplies or if they need to be calculated by percentage.

- Go paperless. There are many apps and programs out there that will help you input and organize your receipts electronically. You can also take a picture of your receipt on your phone and keep track of it that way.

- Establish a holding station for your receipts. When you bring a receipt home, youre probably going to toss it aside and deal with it later. Grab a jar or envelope as a holding station for your receipts until you get around to organizing them.

You can also create a Google Spreadsheet to track your expenses month to month. That way, when its time to file your taxes, you have all of the amounts available and can compare your receipts to what you spent.

Recommended Reading: Can I File Taxes If My Parents Claim Me

Always Keep Proof Of Tax

Make sure you always get a receipt for any expense you think you might be able to claim as a tax deduction. Remember, you cant claim a tax deduction unless you have proof of purchase. If you dont get a receipt for a payment at the time, follow up with the supplier until you get it.

Tip:If youre not sure whether you can claim an expense, keep a record of it and use our new Any other questions or documents section in the Etax tax return.

Make Copies Or Digital Images

If you are trying to make the shift to a “Paperless Office” like most of the modern world these days, you can scan expense receipts and store them with other digital accounting information. Some of the newer cloud-based accounting software applications have mobile apps that allow you to take a mobile phone snap of an expense receipt and record it on the fly.

For those conducting business in Canada, paper copies, or digital images of expense receipts are generally acceptable to the Canada Revenue Agency , provided they are legible. If not, the CRA may demand to see the original paper documents during an audit or routine request for documentation. Thus, the originals should always be kept for the prescribed time, which is on average for a suggested six years.

Also Check: What Is Low Income Tax Credit

Start Saving Receipts For Your Tax Return

Weve recently started a new tax year, so theres no better time to get organized. With the help of our software, you can be better prepared for next years tax returns. Download Wellybox today to keep records of your business expenses, credit card purchases, and more.

If you have any other questions about how to store your receipts, we encourage you to see our related articles.

Are you a self-employed individual looking for tax advice? Does your small business need help with deductions and credits? If you answered yes to either question, we recommend seeking help from a trained tax professional.

Final Tip On Saving Receipts For Taxes

There are many methods for how to store and organize receipts for taxes, both physical and electronic. We find that, in todayâs digital age, electronic record keeping allows you to organize and store receipts for your business expenses , making tax filing simpler and more straightforward.

Finding the best way to organize your receipts electronically may take some guesswork on your own, but a fully customizable app like Everlance makes filing and storing receipts for taxes easy and intuitive.

Recommended Reading: How To Read My Tax Return

How To Easily Organize Your Receipts

Keep all of your receipts is almost the first piece of tax advice everybody learns, and for good reason without an accurate, easily referenced record of the money youve spent, you may not be able to answer the Canada Revenue Agencys request for verification of your business expenses. Learning to organize receipts is especially important for entrepreneurs working in hospitality, auto repair, or other cash-intensive fields, where payments often fly under the radar and audits are frequent. By setting up a good system and sticking to it, you can ensure your company is ready when the inevitable letter comes from the CRA.

Make Notes On The Back Of Receipts

While COVID-19 is keeping a lot of us indoors, you might have meal and entertainment receipts from before the pandemic. And you could be in a position to meet with clients just a few months from now.

For these expenses, write who you met with and the purpose of the meeting on the back of the receipt right after the meeting so youre not struggling to remember details later.

Reminder: You can deduct 50 percent of your total meal and entertainment expenses for business purposes.

Also Check: Where To Find Real Estate Taxes Paid

When Is A Verbal Agreement Legally Binding

For any contract to be binding, there are four major elements which need to be in place. The crucial elements of a contract are as follows:

Therefore, an oral agreement has legal validity if all of these elements are present. However, verbal contracts can be difficult to enforce in a court of law. In the next section, we take a look at how oral agreements hold up in court.

Am I Eligible To Claim Home Office Expenses

If you worked from home because of the pandemic more than 50% of the time over a period of at least four consecutive weeks, you can claim home office expenses.

However, if you were reimbursed by your employer for any home office expenses, these cannot be claimed.

For example, if your employer paid for your computer, desk and chair, these purchases cannot be claimed on your taxes.

Any purchases out of your pocket, as well as the space in your home you use to work, can be claimed on your 2020 taxes.

In order to make these claims, there are two methods of filing you can choose from:

Don’t Miss: How To Find Tax Amount

Properly Dispose Of Paper Documents

Youll put yourself at risk of fraud or identity theft if you simply throw away a large pile of private documents, such as financial statements. Invest in a cross-cut shredder that will eliminate all traces of your personal information, or search for free shredding events in your community. Having paperless statements and documents can help reduce the risk of identity theft posed by lost or stolen mail.

Do You Need To Save Your Receipts For Taxes

Many people often ask if they really need to keep all of their receipts for taxes, and the short answer is yes. If you plan to deduct that expense from your gross income, you need to have proof that you made the purchase. Though keeping your receipts is a tedious project at best, it is necessary for many business owners.

However, there are exceptions to the rule. If you are an individual filing a federal income tax return, you can opt for the standard deduction. For a single filer, the amount is $12,400. If you are filing jointly, then the amount goes up to $24,800. We recommend choosing the standard deduction if it is equal to or greater than your itemized deductions. In this case, it wouldnt be necessary to keep your receipts because the expenses wouldnt be claimed.

If you suspect that your itemized deduction would be greater, then you would need to keep receipts. However, you only need to keep track of receipts relevant to your taxes. For example, you dont need to keep a Valentines Day dinner receipt for three yearsunless it were for sentimental reasons!

Recommended Reading: Where To File Georgia State Taxes

Keep A Daily Business Journal

A daily journal for your business may sound like overkill, as if you weren’t all busy enough. However, it can be simply accomplished by keeping a good calendar in your Outlook or Google Calendar. I was in an audit representing a taxpayer about two years ago, in which the auditor actually asked for a printout of my client’s Outlook calendar to substantiate various deductions being claimed. Several good legal and other reasons to keep a detailed schedule of your day exist, even if you add these details at the end of the day.

What Records Should You Keep

You should keep copies of your tax returns, and all supporting documentation. The list below includes some of the tax records you should maintain.

- Income: Keep forms W-2 , Forms 1099, financial statements, bank statements, contacts, and other documents to verify income reported on your returns.

- Deductions and credits: Keep cancelled checks, bank statements, paid invoices, sales receipts, Forms 1098 , loan documents, financial and legal documents, mileage logs, appointment books, credit card statements, tax credit certificates, and other documents to verify expenses and credits claimed on your returns.

Also Check: How Do I Protest My Property Taxes In Harris County

Spend Time Reviewing Your Receipts Once A Month

We always recommend to our Members that they sit down for 30 minutes every month to review and categorize their receipts. This keeps things manageable as the year progresses and keeps you on top of your spending, so you dont miss out on any tax deductions.

Purchase an accordion folder every year to house all business receipts. These inexpensive folders are easy to obtain and allow you to organize your receipts by category and year, so finding a specific receipt is a snap in the future.

How To Keep Tax Receipts Organised

You know tax time is here when you get a nudge from your accountant or the ATO reminding you to pull all your records together. If you have been on your game throughout the year, you may have everything you need but more often than not, you’ll have a pile of paperwork, some of it relevant, some of it not. You’ll suddenly also remember the things you purchased where the receipt is lost or went into the bin. It can be tempting to throw in the towel and with it, any potential deductions. If this scenario sounds familiar, you are not alone. When it comes to keeping records, most individuals and small Australian businesses are in the same boat.

Having organised tax records can help you get better returns. Refunds aside, the ATO is cracking down on dodgy deductions so if you plan to claim it, you need to be able to prove it. Here are a few tips to help you ditch the shbox and get your records in order:

Don’t Miss: Does Llc Pay Self Employment Tax