Georgia Increases The Amount Of The Adopted Foster Child Credit

Georgia increases the amount of the adopted foster child credit. The credit provides that for adoptions occurring in all taxable years beginning on or after Jan. 1, 2021, the credit for the adoption of a qualified foster child is increased to $6,000 per taxable year commencing with the year that the adoption becomes final. In addition, the new law, effective July 1, 2021, provides that the $6,000 credit will be for the first five taxable years, and will be $2,000 per taxable year thereafter. The foster child credit will end in the year the adopted child reaches age 18.

Who Pays Georgia Income Tax

Georgia income tax, in particular, is a tax levied on income you earn within the state. In Georgia, income tax is a amount of money you pay to the state government based on a percentage of the income you make at your job. So, if you earn an income connected to Georgia, you must pay Georgia income tax.

Similar to federal taxes, Georgia income tax is self-assessed. And, if you work remotely, you generally will pay taxes to the state in which the work is performed. Employers will generally also pay taxes on wages paid to these workers to the same state, even if the employer has no physical presence in that state. These rules may change if you are working from home due to COVID.

Georgia Increases The Standard Deduction Amount On Or After Jan 1 2022

Beginning July 1, 2021, Georgia increases the standard deduction amount for taxpayers for all taxable years beginning on or after Jan. 1, 2022. The new standard deduction amounts are: $5,400 for a single taxpayer or head of household; $3,550 for a married taxpayer filing a separate tax return; and $7,100 for a married couple filing a joint return.

Recommended Reading: What Is The Federal Inheritance Tax

Annual Registration And Fee

The State of Georgia requires you to file an annual registration for your LLC along with paying a $50 fee. You should file the registration online at the SOS website. Your initial annual registration is due between January 1 and April 1 of the year following the calendar year that your LLC was formed. Subsequent registrations are due by April 1 each year. The state should mail you a reminder notice.

Filing Your State Taxes

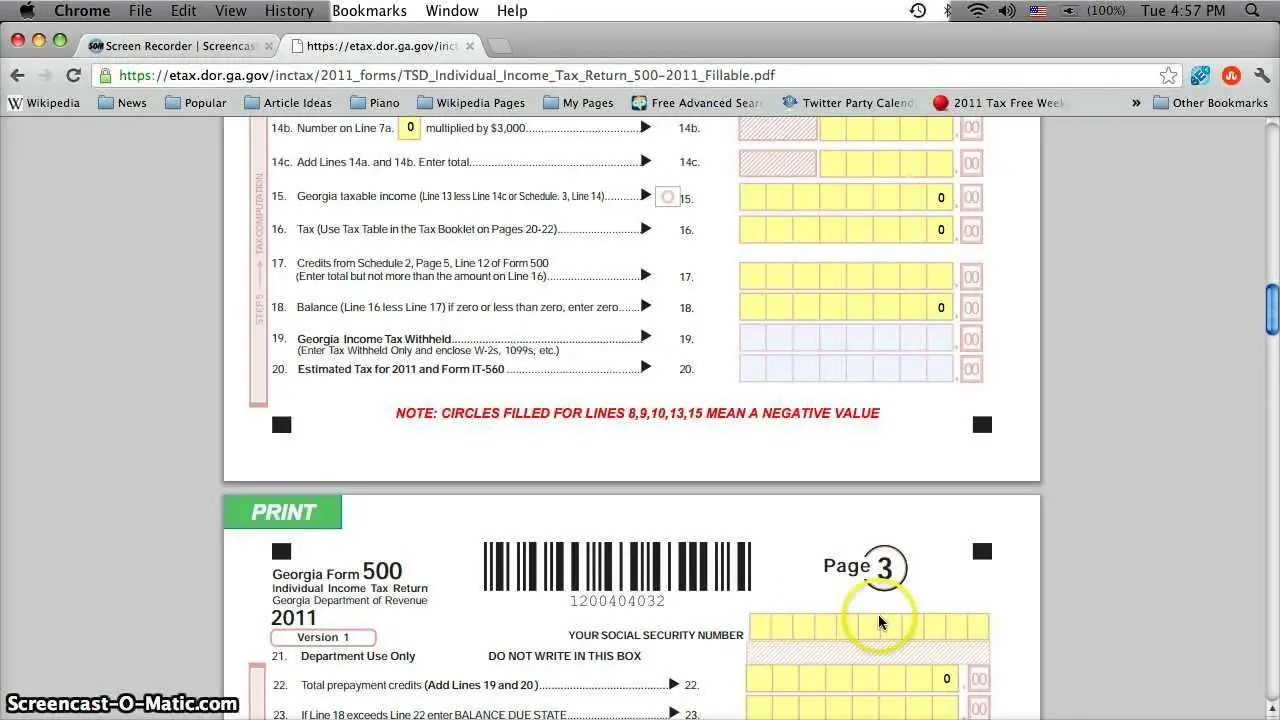

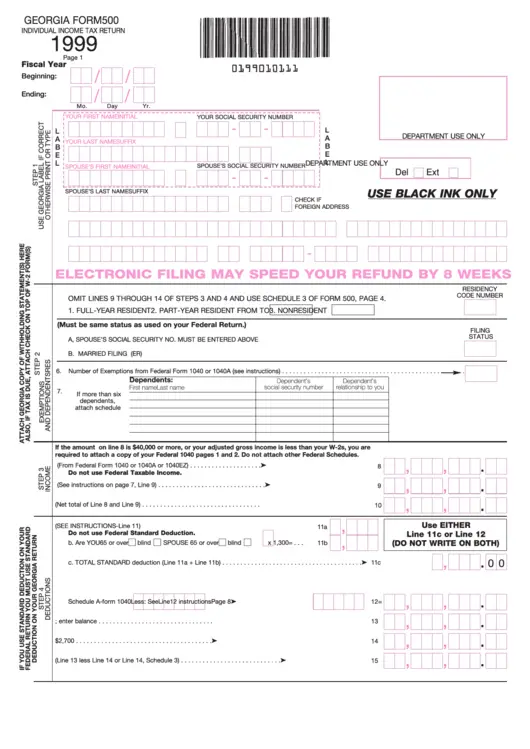

If you had taxable income last year, you may need to complete a Georgia Form 500 return to report the income. If you earned income or resided in a state other than Georgia, you may also have a filing requirement in that state in addition to filing in Georgia.

With Sprintax you are able to prepare your state tax returns in the software and print and file.; You will have to pay a small fee to prepare your state returns, but you will no longer have to prepare the forms by hand.; Sprintax will provide instructions and mailing addresses for the state returns once they are generated.

Recommended Reading: What Does Agi Mean For Taxes

Filing Requirements For Georgia Residents

Each state has its own specific tax requirements, so it’s important to familiarize yourself with those if you’re new to living in Georgia. Failure to pay taxes correctly could result in penalties from the office of revenue. The following individuals who live in Georgia must file a tax return:

- Those who filed a federal tax return

- Single head of household individuals or married couples filing separate returns with gross income of more than $9,750

To qualify as a Georgia resident for tax purposes, a person must have been in the state for at least 183 days in the last 12-month period, except for military personnel serving overseas. Qualifying days include time spent within or outside the state for study, business trips, vacations, or medical care. This rule does not apply to diplomats and their family members, staff members of international organizations and their family members, and those here only for medical care.

Resident status is established independently for each tax year. Certain individuals may be granted residency beyond the above criteria, such as high net worth individuals and foreign citizens as designated by the state’s minister of finance. Income that Georgia residents earn overseas is tax-exempt. Grant funding, state pensions, scholarships, alimony, Olympic winnings, and property received in the course of a divorce are also tax-exempt, as are inherited property, gains on income and securities, and several other income categories.

Georgia Individual Income Tax Deadline Extended To May

The Georgia Department of Revenue announced today, in conformance with the U.S. Treasury Department and Internal Revenue Service , that the state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15, 2021 to May 17, 2021, without penalties or interest.

Aligning with this decision makes filing and paying both state and federal taxes as easy as possible for Georgia taxpayers, stated State Revenue Commissioner David Curry.

Like the IRS, the relief provided by this extension is only for tax year 2020 individual state income tax payments and state individual income tax returns due on April 15, 2021. At the state level, Georgias income tax forms and integrated tax system rely on federal tax information to establish a taxpayers state liability. This, in practice, means that a taxpayer would need to complete their federal income tax filing before they would have the necessary information to begin their state income tax filing. Because of this, the state encounters significant challenges if the state deadline falls before the federal filing deadline.

Individual taxpayers do not need to file forms or call DOR to qualify for this automatic tax filing and payment extension.

Please note that state estimated income tax payments due on April 15, 2021, are not included in the extension. These estimated payments are still due on April 15th.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Who Must File Income Taxes In Georgia

The State of Georgia has its own requirements for who needs to file a state income tax return in the state. This isn’t unusual. All states can set their own requirements for who needs to file and who doesn’t. You need to understand what those requirements are so you don’t wind up on trouble with the Georgia Office of Revenue.

Read Also: How To Subtract Taxes From Paycheck

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Do I Need To File State Taxes In Ga On A Rental Property That I Had A Net Loss On For The Year

No, you will not be required to file a Georgia return.;;Since you do not have a gain on your rental, you don’t have any income to file as a Georgia;nonresident.;;However, you may;choose;to file and report the loss.; You may decide to do this, for instance, if you have had rental;gains;in prior years, as Georgia may be curious as to why you didn’t file a GA return this year.; However, without a gain to be taxed, you will not actually be;required;to file a Georgia return.; Click on this GA website link for additional information on this topic:;;Filing Requirements – Department of Revenue – Georgia.gov

Also Check: How Do I Know What Form I Filed For Taxes

Challenge The Assessment/state Tax Execution

Proposed Assessments: If the taxpayer has a proposed assessment for additional income tax due, they may file a protest with the DOR within 30 days from the date of the proposed assessment. Taxpayers can request this protest online via their Georgia Tax Center accounts or by mail .;Taxpayers cannot appeal proposed assessments to the Georgia Tax Tribunal.

Official Assessments: Official assessments can be appealed to the Georgia Tax Tribunal or in a local Georgia Superior court within 30 days from the issue date on the official assessment notice.

State Tax Execution: As discussed above, if a taxpayer does not appeal or pay an official assessment within the 30 days the DOR may issue a state tax execution . Taxpayers can appeal this action with either the GTT or in an appropriate Georgia Superior court.

Taxpayers can find more information regarding filing appeals with the GTT here. While taxpayers have the option to file in Georgia Superior court, there are particular requirements for doing so. Taxpayers considering this option should consult with an attorney.

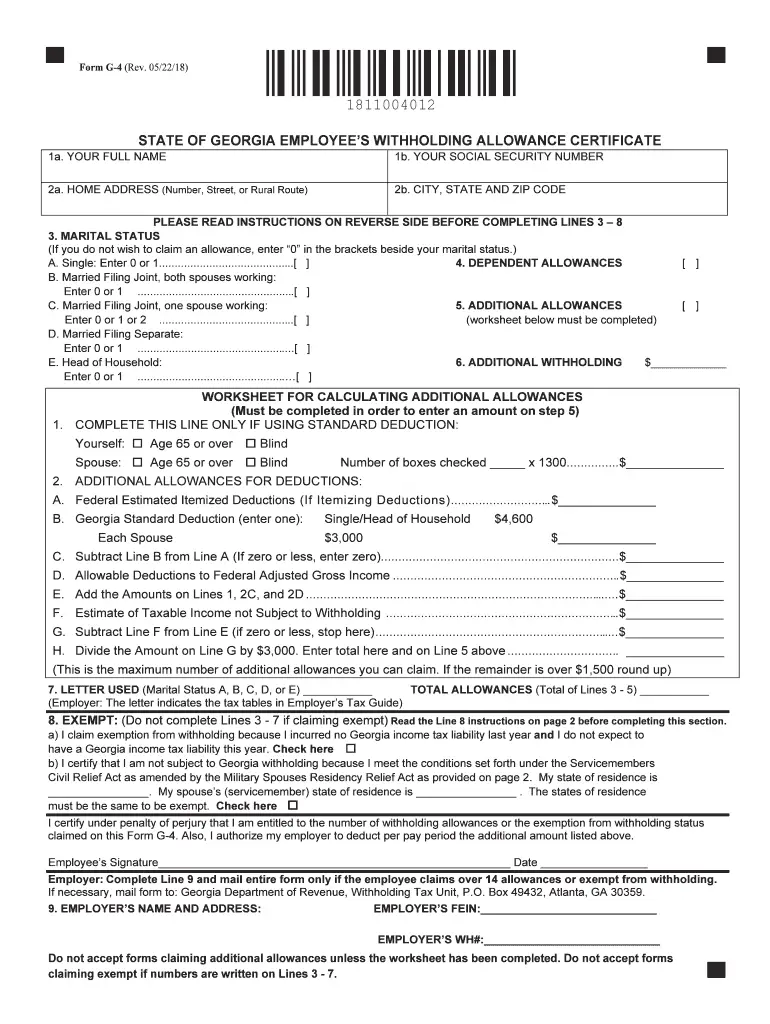

How You Can Affect Your Georgia Paycheck

If you were slapped with a huge tax bill or received a big lump sum refund during tax season, you may want to make adjustments to your tax withholding. Having to pay a tax bill in April could strain your budget; and while a big refund seems great, you could have had that money earning interest in a savings account all year.

One easy way to withhold more taxes is to ask your employer to do so. Simply write on the appropriate line of your W-4 a dollar amount that you want taken out of each paycheck. Want $10 taken out every time? Write that down. It might seem like youre going to be getting smaller paychecks, but youre simply paying the taxes you owe in advance, so you wont be surprised with a large tax bill later.

Adjusting your pre-tax contributions can also affect how much taxes are withheld. Pre-tax contributions change how much taxable income you have because they come out of your wages before income tax is removed. Pre-tax accounts include flexible spending accounts, health savings accounts, commuter benefits program and retirement accounts such as a 401 or 403.

Thinking of buying a home in Georgia? Now that youve learned all about the states income tax, head over to our Georgia mortgage guide. There you can learn more about rates and getting a mortgage in the Peach State.

Also Check: Will I Get Any Money Back From My Taxes

Sales Tax Collection Discounts In Georgia

Georgia allows merchants to keep a small percentage of the sales tax they collect as a collection discount, which serves as compensation for the work required to comply with the Georgia sales tax regulations

The collection discount is 3% of the first three thousand of tax due and 0.5% of any additional amount. This being said, discount limits are applicable to all locations.

Georgia Adopts Qualified Timberland Rules And The Property Appraisal Manual

The Georgia Dept. of Revenue has adopted amendments to the Film Tax Credit. Specifically, the Dept. of Economic Development must electronically certify to the DOR when requirements for the 10% additional tax credit for including a qualified Georgia promotion have been met. The additional 10% tax credit will not be issued final certification unless the state certificated production has been commercially distributed in multiple markets within five years of the date that the project was first certified by the DED. Changes were also made to the definition of post-production expenditures and the limits on the recapture of specified tax credits.

Recommended Reading: Can You File Missouri State Taxes Online

Georgia Median Household Income

| 2010 | $46,430 |

If you file in Georgia as a single person, you will get taxed 1% of your taxable income under $750. If you earn more than that, then youll be taxed 2% on income between $750 and $2,250. The marginal rate rises to 3% on income between $2,250 and $3,750; 4% on income between $3,750 and $5,250; 5% on income up to $7,000; and, finally, 5.75% on all income above $7,000.

For married couples who file jointly, the tax rates are the same, but the income brackets are higher, at 1% on your first $1,000 and at 5.75% if your combined income is over $10,000.

Georgia Filing Requirements: Everything You Need To Know

Georgia filing requirements are the income tax guidelines for individuals and businesses who earn income in the state. 3 min read

Georgia filing requirements are the income tax guidelines for individuals and businesses who earn income in the state. In most cases, you’ll need to file a tax return if you earned income or won the lottery in Georgia. The exception is for amounts lower than either $5,000 or 5 percent of your income, whichever is less.

Read Also: What Are The Different Tax Forms

Who Is Required To File Georgia Taxes

You will need to file a Georgia state tax return if:;

- You are a resident of Georgia OR;

- You are not a;resident,;but;you earn income in the state of Georgia, and;

- You are already required to file federal taxes, and;

- You earn more than the;state standard deduction;and personal deductions;

*Important*;If you had Georgia state income taxes withheld from your paycheck, you should file a state tax return. This is the only way to;get;your;refund if you are owed money back;from the state.;

Are you a military spouse?;;Your income may be exempt from tax in Georgia.;Read this article to find out more.;

In Ga At The Age Of 63 You No Longer Have To Pay State Taxes How Does That Show Up On My State Returns

Yes if under certain circumstances

Retirement Income Exclusion;

Taxpayers who are 62 or older, or permanently and totally disabled regardless of age, may be eligible for a retirement income adjustment on their Georgia tax return. Retirement income includes:

;;; Income from pensions and annuities;;; Interest income;;; Net income from rental property;;; Capital gains income;;; Income from royalties;;; Up to $4,000 of earned income

For married couples filing joint returns with both members receiving retirement income, the maximum adjustment for that year may be up to twice the individual exclusion amount. Retirement income exceeding the maximum adjustable amount will be taxed at the normal rate.

See Form IT-511 to obtain the worksheet for calculating the maximum allowable adjustment.

You May Like: How Much Does H&r Block Cost To File Taxes

Georgia Has Announced That The Tax Filing Deadline For Individual Returns Is May 17th

Georgia personal income tax returns are due by the 15th day of the 4th month following the end of the tax year. For calendar year taxpayers, this deadline is typically April 15th. If you cannot file by that date, you can request a 6-month state tax extension. A Georgia extension will move your filing deadline to October 15 .

There are two ways you can get a Georgia personal tax extension. The first option is to obtain a Federal personal tax extension using IRS Form 4868. The State of Georgia will recognize your valid Federal extension and grant you a corresponding state extension. Make sure to attach a copy of Form 4868 to your Georgia tax return when its filed.

The second option is to submit Georgia Form IT-303 . Use this form if you only need a Georgia state tax extension and have not filed a Federal tax extension or if your Federal extension was denied. Individuals who are requesting a Georgia extension using Form IT-303 are required to provide a reason for the extension.

Your Georgia extension request needs to be filed by the original due date of your return .

For more information, please visit the Georgia Department of Revenue website: dor.georgia.gov

Your Georgia Sales Tax Filing Requirements

To file sales tax in the state of Georgia, you must begin by reporting gross sales for the reporting period, and calculate the total amount of sales tax due from this period. In the state of Georgia, all taxpayers are given three options for filing taxes. One is filing online using the online service Autofile. You can also file online at the Georgia Department of Revenue. Payment can also be remitted through either of these online systems. You can also file manually through the mail using the form ST-3. Tax payers in the state of Georgia should be aware of late penalties the district applies. The penalty for late filing is either 5% of the tax due, or five dollars, whichever is the greater amount, for each month or fraction of a month that the filing is late, with a compounded penalty of 25% or twenty five dollars. The late payment penalty is 1% of any unpaid tax for each month of fraction of a month that the payment is late.The state of Georgia does not require that a seller who owns a sales tax permit files sales tax return by the required day, even if the tax return is “zeroed-out”, and there is nothing to report.

Recommended Reading: How Much Is Sales Tax In New Mexico