Tax Refund Check Delay Information

Kentucky taxes all income earned in the state. Residents use the states Form 740 or 740-EZ, while partial-year residents and non-residents use Form 740-NP. If your tax return was submitted correctly and didn’t give the state tax people any problems, you’ll get the money within the wait times set that year by Kentuckys Department of Revenue. The department is a phone call away if you need help finding a missing refund or to fix a filing.

How Do I Send My W2 To Kentucky

Through the website of the Kentucky Department of Revenue, W2/K2 forms can be submitted electronically in the EFW2 format used by the Social Security Administration. Electronic filing of 1099s and W2-Gs subject to state withholding is permitted only in the format specified by IRS Publication 1220 and only through CD.

When Can I E File My Kentucky State Taxes

Income taxes and forms for the state of Kentucky may be found here. The deadline for electronically filing Kentucky State Income Tax Return forms in combination with an IRS Income Tax Return for Tax Year 2018 has been extended to October 15, 2019. Electronic filing for the tax year 2019 will begin in January 2020.

Read Also: Ct Tsc Ind

Prepare And Mail Taxes

Gather all tax-related records and information, including any W-2 tax and wage statements, 1099 forms, receipts for deductibles and exemptions, and the completed copy of the 1040 federal income tax form.

Open the 740 Kentucky tax instruction booklet. Follow the accompanying instructions line-by-line, completing the 740 form in pencil.

Double check the math by going over each entry with the calculator.

Carefully copy the corresponding information from the pencil-filled form into the second 740 form in the packet with blue or black ink. Retain the pencil copy and file it away with important records.

Sign and date the 740 paper form that was completed using ink. Attach all relevant schedules and pertinent forms to the 740 form, fold the lot and insert it into an envelope.

If you are anticipating a refund, address the envelope containing your Kentucky state paper income tax forms to: Kentucky Department of Revenue, Frankfort, KY 40618-0006 or, if enclosing payment for additional Kentucky state taxes due, address the envelope to: Kentucky Department of Revenue, Frankfort, KY 40619-0008.

Attach proper postage to the envelopes and mail prior to the April 15 deadline.

Tips

References

Paying Taxes In Kentucky

Those individuals who must pay taxes and owe the state a balance are required to fill out Form 740-V and send that form, along with a paper check with their Social Security number and tax year written on it, to the state’s department of revenue. They can also pay their balance online on the state’s revenue department website. You will be taxed 2% a month per tax return that is late. The maximum penalty is 20% of the total tax due.

If a taxpayer expects to have an income of more than $5000 annually, and no income tax is being withheld, they may be required to make quarterly payments to prepay some of their income tax liability.

Read Also: Doordash Stripe 1099

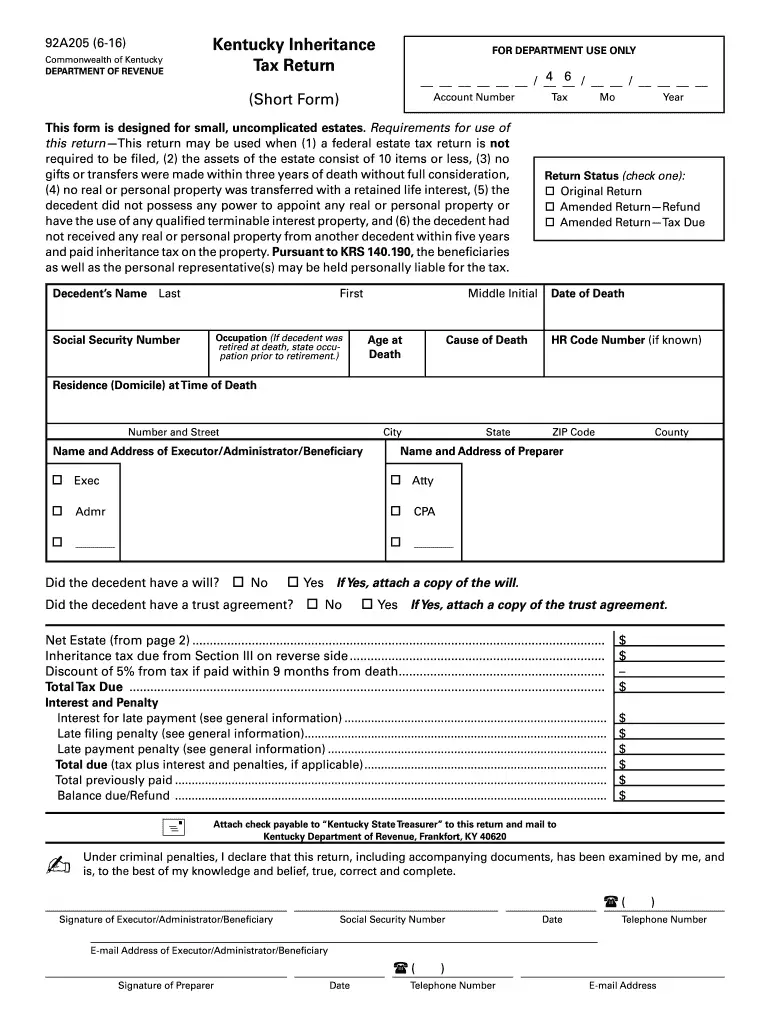

Filing Final Tax Returns For The Deceased

When a family member passes away, there are many decisions that need to be made and many emotions to handle. The last thing anyone thinks about is taxes.

Unfortunately, even the deceased cant escape taxation. If the departed family member earned taxable income during the year in which they died, then federal taxes may be owed. An executor or a survivor must, therefore, file a final federal income tax return .1

Similarly, if the deceased individual had a sizable estate or assets that might generate income in the future, the estate may owe taxes. Federal estate tax forms pertaining to the decedents estate may need to be filed .1

The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult a professional with tax expertise if you find yourself in this situation.

What If I Owe And Cant Pay

Taxpayers are expected to paytheir taxes by the filing deadline. Those who are unable to pay their taxes ontime should pay what they can and contact the Department of Revenue to discussoptions for a payment plan.

Those whose tax debt is being handled by the Division of Collection can also set up a payment plan by going online to CACS for Government. The maximum payment term is 24 months and the minimum monthly payment is $50.

If your desired paymentsexceed these limits or if you want to pay by credit card, youll need tocontact the Department of Revenue at 1-502-564-4921, extension 5357.

Also Check: Ein Free Lookup

Need More Tax Guidance

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H& R Block to help you get the support you need when it comes to filing taxes. You deserve more from your tax company than unqualified help and surprise fees. Heres how we make filing taxes more fair than the other guys:

- Expert guidance: In person or online, get help from a tax pro.

- Upfront pricing: Know the price, before you start.

- More ways to file: Do your taxes how & when you want.

Need to check the status of your federal refund? Visit our Wheres My Refund page to find out how soon youll receive your federal refund.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

Where Do I Send My Kentucky State Income Tax Forms

If you are expecting a refund, address the envelope containing your Kentucky state paper income tax forms to: Kentucky Department of Revenue, Frankfort, KY 40618-0006 if you are enclosing payment for additional Kentucky state taxes that are due, address the envelope to: Kentucky Department of Revenue, Frankfort, KY 40619-0008 and if you are enclosing both, address the envelope to: Kentucky Department of Revenue, Frankfort, KY 40619-0008.

You May Like: Is Freetaxusa Legit

What Address Should I Use For My Tax Return

If you are referring to the mailing address that you enter under the Personal Info tab, you should use the address of where you live right now, as that is the address to which the IRS will send any correspondence that is related to your tax return. If you are referring to something else, you should use the address of where you have lived in the past.

What Happens If You Mail Your Tax Return To The Wrong Address

Sending a return shipment to the incorrect address. If you send your income tax return to the incorrect Internal Revenue Service Center or address it incorrectly in any other way, it may cause a delay in the processing of both the return and any refund that may be due.

Read Also: Does Doordash Send You A 1099

What Are The Penalties For Late Filing And Underpayment Of Taxes

There are penalties for filing late or not paying taxes owed by the due date.

The Kentucky Department of Revenue charges two percent of the taxes due per month, or a fraction thereof, due for filing late. But the most you can be charged is 20 percent.

There is also a penalty for paying your taxes due late. Every 30 days, or a fraction thereof, that your payment is late, you are charged two percent. The maximum you can be charged is 20 percent.

Unlike just filing late, failure to file at all or not furnish information results in a higher penalty. It is five percent per month of the estimated tax due to a maximum of 50 percent. There is a $100 minimum penalty.

The Kentucky Department of Revenue charges a high penalty for fraud on a tax return. The rate is 50 percent of the assessed tax due. There isnt a minimum or maximum.

A taxpayer can apply for a penalty waiver for reasonable cause. A waiver may be considered for a portion or all penalties if reasonable cause can be demonstrated. The taxpayer must show they acted in a reasonable manner, but the tax liability was due to circumstances beyond their control.

But although the penalty may be waived, interest on due taxes must still be paid for statutory reasons.

Can You File Kentucky State Taxes Online

KY File is a new service that may be used to electronically file your state income tax return for the current year at no cost. You will have the ability to select the Kentucky income tax forms and schedules that are relevant to your situation. Complete your tax return by entering your information online.

Recommended Reading: Doordash Pay Calculator

Deadline To File Kentucky Filing Taxes:

What are the Kentucky 1099-MISC state filing requirements? Find your scenario below.

Scenario 1: No Kentucky state taxes withheld.

Recommended filing method: No filing required.

Scenario 2: There were Kentucky state taxes withheld.

Recommended filing method: Magnetic Media.

Deadline: January 31, 2022

Tax1099 fulfills: Yes

Cost: +$10per submission + $0.50 per form

When submitting your federal eFile through Tax1099, select to have us submit your forms to the state via magnetic media filing.

Most commonly, this takes the form of a CD-ROM/DVD. Well automatically alert you to this filing requirement based on the information you enter into your forms.

Kentucky requirements for 1099-NEC

Kentucky requires 1099-NEC filing, if Kentucky state tax is withheld.

Recommended filing method: CD-ROM

Where To Mail Kentucky Tax Return

Where should I send the paperwork for my Kentucky state taxes? I require the address, please. If you are requesting a refund as opposed to making a payment, the address will be different. Frankfort, Kentucky 40618-0006. Refunds and other types of returns should be sent to the Kentucky Department of Revenue.

The Department of Revenue strongly recommends that taxpayers file their tax returns using electronic means, but it should be noted that the mailing address for taxpayers who prefer to file their returns using the mail has been updated to the following: Kentucky Department of Revenue, P.O. Box 856910, Louisville, Kentucky 40285-6910.

You May Like: Employer Tax Identification Number Lookup

Kentucky State Tax Laws

Kentucky law excludes up to $31,110 in pension income from state tax . Dont forget to apply the Kentucky pension income exclusion against the amount taxable by the state.

Heres how:

The Kentucky return begins with the federal adjusted gross income, which is on line 5 of Form 740. But that figure can be lowered using the deduction of up to $31,110. On Schedule M, which is where deductions are itemized, line 9 allows up to $31,110 to be deducted. If the amount in box 2a of the 1099-R exceeds $31,110, a Schedule P, which reports pension income in detail, will need to be filed. Follow the instructions on the form to determine the amount that goes on Schedule M line 11.

General Tax Return Information

Due Date – Individual Returns – April 15, or same as IRS

Extensions – Kentucky allows an automatic extension of six months if no additional tax is due AND a federal extension has been filed. Any extension granted is for time to file and does NOT extend time to pay.

- If additional tax is due or a federal extension has not been filed, use Form 740EXT to request an extension.To access this form, in the Kentucky State main menu, Miscellaneous Forms > Kentucky Extension

- The Kentucky extension application can be e-filed.

Drivers License/Government Issued Photo Identification: Kentucky does not require this information in order to e-file, but does request that it be included in order to assist in efforts to protect the taxpayer and their identity.

You May Like: 1040paytax.com Official Site

How To Paper File My Kentucky State Taxes

To file Kentucky state income taxes, single filers may be able to use the simpler 740-EZ form if the taxpayer: 1) has only wages, salaries and tips shown on the W-2 2) has taxable interest income totaling not more than $1,500 3) filed the federal 1040-EZ form and 4) is not eligible to claim credits for the elderly and blind. All full-year Kentucky residents regardless of marital status or income levels can use the more encompassing standard 740 form. Additionally, members of the Kentucky National Guard must use the standard 740 since, regardless of federal income tax status, they are ineligible to use the 740-EZ.

How Can I Track A Kentucky State Tax Refund

Taxpayers who e-file returns can expect to receive their refunds within two to three weeks if they also choose direct deposit. Those who submit paper returns will receive their refund within eight to 12 weeks. Its possible to check the status of a refund online on the Refund Status page of the Kentucky Department of Revenues website. Youll need to know your Social Security number and refund amount to check the status of your refund.

Don’t Miss: How Much Is Doordash Taxes

How Can I File A Kentucky State Tax Return

More than 90% of Kentucky residents e-file their income taxreturns, which the state of Kentucky recommends. Kentucky taxpayers have multiple options for e-filingtheir returns.

- KY File KY File was designed as a simple online version of a paper form. It allows users to complete their tax forms online, have basic calculations done by the system, electronically sign and e-file, and print their complete return. But KY File doesnt ask questions to help you complete the forms, explain tax situations, perform complex calculations or check for errors.

- Free File Online Depending on income level and other factors, Kentucky taxpayers may be able to file for free through the Free File Online program. Be sure to access Free File products through Kentuckys website or the IRS Free File website.

- Credit Karma Tax® never charges you to file your tax returns, and you can use it to file single-state and federal returns.

Kentucky residents can also obtain their tax forms online and can submit their return via mail to the following address if they owe taxes:

Kentucky Department of Revenue

If youre owed a refund :

Kentucky Department of RevenueLouisville, KY 40285-6970

Registration In Other States

If you will be doing business in states other than Kentucky, you may need to register your LLC in some or all of those states. Whether you’re required to register will depend on the specific states involved: each state has its own rules for what constitutes doing business and whether registration is necessary. Often activities such as having a physical presence in a state, hiring employees in a state, or soliciting business in a state will be considered doing business for registration purposes. Registration usually involves obtaining a certificate of authority or similar document.

For more information on the requirements for forming and operating an LLC in Kentucky, see Nolo’s article, 50-State Guide to Forming an LLC, and other articles on LLCs in the LLC section of the Nolo website.

Don’t Miss: Doordash Tax Percentage

Kentucky Income Tax Form Addresses

Kentucky has multiple mailing addresses for different tax forms and other forms of correspondence. Make sure you send your completed tax forms to the correct address – some forms may have a different mailing address specified in the form instructions.

Here are two of the most important Kentucky Department of Revenue mailing addresses for tax returns and general correspondence:

Income tax Returns Kentucky Department of RevenueIncome Tax Returns Kentucky Department of Revenue

Disclaimer: While we do our best to keep this list of Kentucky income tax forms up to date and complete, we cannot be held liable for errors or omissions. Is a form on this page missing or out-of-date? Please let us know so we can fix it!

Wheres My Refund Kentucky

To check the status of your Kentucky state refund online, go to .

In order to view status information, you will be prompted to enter the following information:

- Social Security number

- Refund amount from your return

Generally, e-filed returns deposited electronically take two to three weeks, but allow an extra week if a paper check was requested. Generally, paper returns take eight to 12 weeks, if completed correctly . (Non-resident Kentucky returns could take an additional two to three weeks.

Also Check: Do They Take Taxes Out Of Doordash

Joint Federal And State Filing

You can file your state and federal returns electronically at the same time in Kentucky. You have a problem if the IRS rejects your federal return since it will not forward your state return to Kentucky. Your Kentucky return will be in limbo until the federal return is corrected. At that point, you’ll have to file both returns again.

Where Can I Check My Kentucky Refund Status

If you e-file and set up a direct deposit, a refund will take two to three weeks. A paper submission will cause the refund to take eight to 12 weeks. Keep in mind that an error correction will delay the refund and may result in a paper check being sent to you.

To check on a refund, go to the Wheres My Refund page on the Kentucky Department of Revenues website.

You May Like: Efstatus.taxact.com Login