How Do I Know If A 1031 Exchange Is Right For Me

As we just discussed, there are both pros and cons to doing a 1031 exchange. So, how do you know if its right for you?

The answer to that question depends on your individual circumstances. If you are looking to defer your capital gains taxes, then a 1031 exchange may be a good option for you. However, if you are not comfortable with the idea of investing in passive real estate, then a 1031 exchange may not be the best option.

Only you can decide whether or not a 1031 exchange is right for you. Be sure to consult with a tax advisor and/or financial planner to get their professional opinion before making any decisions.

How Do I Calculate How Much Tax I Owe

Please contact a qualified tax advisor for advice on your situation.

What Is Liable To Tax

What individuals and businesses need to pay in taxes grows with each taxable event. These events are things that are subject to taxation. The most common instance of tax liability is when an individual or business earns income. We call this earned income tax and individuals and businesses owe earned income tax every year.

But there are other tax liable situations like when you buy or sell something or when a business issues payroll to their employees. You might see sales tax when you go to buy something and have to pay a little extra then the price tag amount. You might see payroll tax when you get a paycheck and see that a certain amount of your income went to pay things like Medicare and Social Security.

Another instance where you might run into tax liability is when you own property. If you own land, a home, or other forms of personal property, then you may have to pay property taxes on those items.

These are the main instances where you will accumulate tax liability. When you buy or sell something, earn money, or own certain kinds of property.

Also Check: What Tax Form Should I Use

Six Deduct Any Tax Reducers Due

Deduct from the amount of tax calculated at Step five any tax reductions to which the taxpayer is entitled for the tax year See sections 27 to 29 for further provision about the deduction of those tax reductions.

Step six is therefore the step where any tax reducers are deducted. Essentially they reduce the tax liability calculated above.

These reducers are listed in Section 26 with the most common being EIS, VCT & SEIS tax reliefs, top slicing relief, deficiency relief and community investment tax relief. Also, is deducted here. This arises when married couples and civil partners apply to transfer 10% of the unused income tax personal allowance from one to the other. To qualify, neither of the partners can be a higher rate taxpayer and they must not be claiming the married couples allowance. The word allowance is misleading as it delivers a tax reduction for the recipient rather than an additional allowance.

It is also here that additional relief at source relief is available for Scottish taxpayers. Scottish taxpayers subject to 21% intermediate, 41% higher or 46% additional rate are entitled to claim additional relief by completing a tax return. There is an example here.

Example of restricted tax reducer –

Pay Employment Tax Liability

In addition to income tax, your small business has to pay payroll tax on wages paid to employees and yourself. This is true regardless of industry or employee presence. These taxes typically include:

- Social Security Tax

- Federal Unemployment Tax

Some of these taxes are paid by the employee, but the company is responsible for withholding money from wages and sending it to the IRS. As a self-employed sole proprietor, you will have to pay self-employed tax. This is the sum of social security and Medicare tax liability. This is because there is no other employer to pay half the tax.

Don’t Miss: Can I File My Taxes For Free

What Is A Tax Liability

9 Min Read | Feb 17, 2022

Hey, were not going to geek out on accounting terminology, but to understand tax liability, its helpful to be familiar with two basic accounting terms: assets and liabilities. Assets are things you ownthink money, property, your collection of obsolete cell phones. Liabilities are money you owe to other people. In other words: Bills you need to pay.

So what is a tax liability?

A tax liability is a tax bill you owe to a state, local or federal government entity. But usually when people talk about tax liability, theyre referring to the big one: federal taxes.

Add Up Your Liabilities

Accounting software will automatically add up all your liabilities for you.

Otherwise, you will need to manually add your liabilities up in whatever software you chose, such as Excel.

- For example, a small pet store owes $500 in accounts payable for its utility bills, phone and internet bills, and more. Its mortgage is $2000 a month and it has of $5000. It took out a $10,000 business loan a couple of years ago to renovate its space and it still owes $2000 on the balance. Finally, the owner owes the government $1000 in sales and income tax.

- $500 + $2000 + $5000 + $2000 + $1000 = $10,500 total liabilities

Also Check: Do You Pay Taxes On Crypto

How To Figure Out The Tax Rate For C Corporations

Under the Tax Cuts and Jobs Act, its become much more straightforward for C corporations to make tax calculations. Instead of worrying about the corporate tax rate schedule and its eight different tax brackets, C corporations only have to pay a flat 21% tax rate.

It essentially means that a C corporation will have to pay an income tax rate of 21%, no matter the amount of taxable business income it earns.

Hire The Best Corporate Tax Consultants In Dubai Uae

Corporate tax agents in Dubai such as Jitendra Chartered Accountants can advise business owners on critical tax matters such as the calculation of payable tax. JCA has a team of corporate tax advisors in Dubai who can help the businesses to comply with such complex provisions in the corporate tax regime.

Our services at JCA as Corporate Tax Consultants include CT Assessment & Advisory Services , CT Compliance Services & CT Agent Services to Represent to Federal Tax Authority of UAE in case of any notices served by FTA. Ensure corporate tax compliance and avoid relevant penalties by availing of JCAs corporate tax services in Dubai, UAE. JCA offers customised tax solutions to allow businesses to comply with the UAE corporate tax hassle-free.

You May Like: How To File Taxes Yourself Online

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Of Ct Payable Calculation

The Public Consultation Document issued in April 2022 by the MOF has outlined a method for calculating the CT payable for a financial year. Businesses can seek additional information and advice from a reputed Dubai based professional tax consultant, IMC Group to accurately evaluate the CT liability as specified in the consultation document.

The 9 % CT will be imposed on businesses only if the taxable value exceeds AED 375,000. CT in UAE is calculated at a flat 9% rate of the net profit shown in the companys financial statements after deducting all applicable deductions and excluding the exempted income. Any taxes paid in overseas jurisdictions will also be allowed for reduction from the profit shown in the financial statement. The net profit derived after all deductions will be considered as taxable income.

UAE CT will apply to UAE resident companies on their global income including overseas income which may be subject to a similar tax like UAE CT in another jurisdiction outside of UAE. The proposed UAE CT regime, for avoiding double taxation, will allow a credit for the tax paid in an overseas jurisdiction on the foreign sourced income against the UAE CT liability as a foreign tax credit.

The maximum Foreign Tax Credit that can be availed will be determined by the amount of tax that is paid in the foreign jurisdiction or the UAE CT payable on the foreign sourced income and whichever is lower.

Also Check: Are Taxes Extended This Year

One Identify The Components Of Income Then Add Together To Arrive At Total Income

Identify the amounts of income on which the taxpayer is charged to income tax for the tax year. The sum of those amounts is total income. Each of those amounts is a component of total income.

What is meant by a component? These are all possible components of a clients total income.

- Employment income

|

Onshore and offshore bond gains and slices |

Top slicing information is available here

Do You Know What Your Tax Liability Is

Part of being a responsible business owner is paying your bills on time, which includes taxes. Estimating, recording, and paying your taxes may not be fun, but it is necessary. Dont let yourself be surprised by a huge tax bill at year’s end. Know what your tax liabilities are and make sure theyre paid when they’re due.

You May Like: Which States Have The Lowest Property Taxes

What Is The Formula For Calculating Total Income

The formula for calculating net income is:

File Your Taxes With Confidence

While tax season may never be your favorite time of year, you dont have to do it all on your own. Reach out to a RamseyTrusted Endorsed Local Provider in your area to help you sort out your tax situationtax liabilities and all! Get ready to walk into the next season feeling like a tax boss. Get a tax pro today!

Feel like your taxes are simple enough to do yourself with tax software? Ramsey SmartTax makes it easy to take control of your taxes and file your tax return in a matter of minutes. You wont be surprised by hidden fees, and you wont have to make sense of confusing tax jargonwhat you see is what you get!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

Also Check: Is Memory Care Tax Deductible

What Are The Main Sources Of Federal Tax Revenue In The Us

Individual income taxes are the primary source of U.S. tax revenue when considering all local, state, and federal tax collections combined.

Social insurance taxes like payroll taxes make up the second-largest share of revenue, followed by consumption taxes, property taxes, and corporate income taxes.

How To Calculate Your Total Business Tax Liability

Business tax liability is the amount of taxes owed based on the current income of your business. If your business is structured as a sole proprietorship, partnership, S corporation, or LLC, youll use pass-through taxation, which means that any profits that the business earns are taxed on your personal tax return.

If your business is a C corporation, youll be taxed at the normal federal corporate tax rate, which is 21%, as well as your state tax rate, which varies.

Unless youre a C corporation, you should be calculating your business tax liability quarterly, based on your yearly taxable income. This allows you to make quarterly payments to the IRS based on those estimates, avoiding a big tax bill at the end of the fiscal year. If youre not sure how to calculate tax liabilities, start with the following steps.

Also Check: How Are Qualified Dividends Taxed

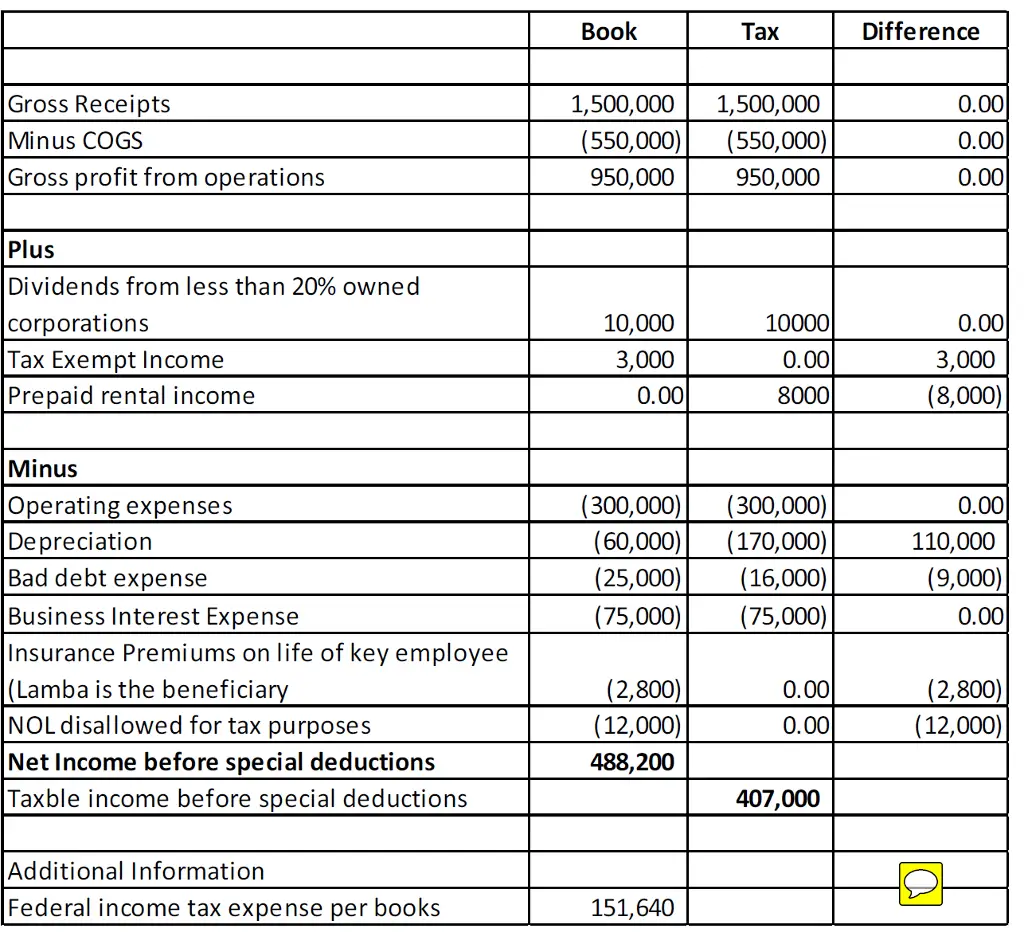

Income Tax Expense Vs Income Tax Payable

Income tax expense and income tax payable are two different concepts.

Income tax expense can be used for recording income tax costs since the rule states that expenses are to be shown in the period during which they were incurred, instead of in the period when they are paid. A company that pays its taxes monthly or quarterly must make adjustments during the periods that produced an income statement.

Basically, income tax expense is the companys calculation of how much it actually pays in taxes during a given accounting period. It usually appears on the next to last line of the income statement, right before the net income calculation.

Income tax payable, on the other hand, is what appears on the balance sheet as the amount in taxes that a company owes to the government but that has not yet been paid. Until it is paid, it remains as a liability.

How Is Tax Liability Calculated

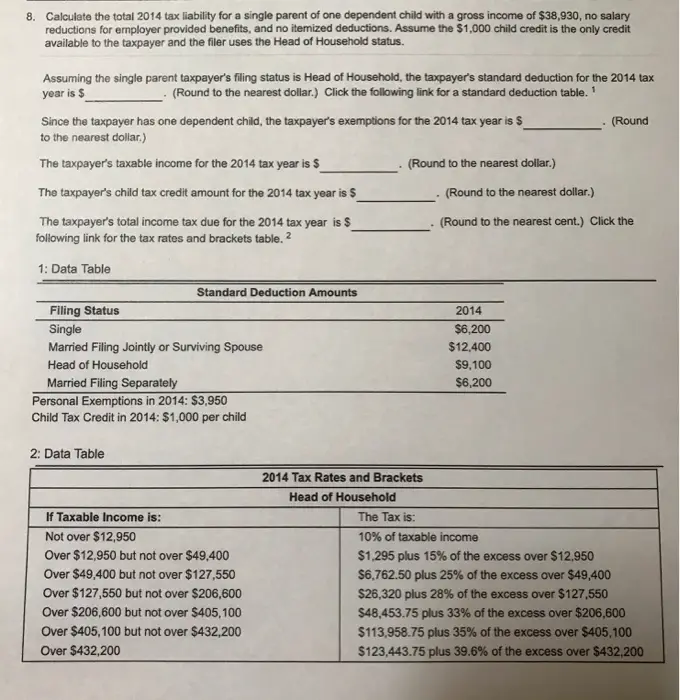

Now, lets put all the pieces together. Taking each of the concepts outlined abovemarginal tax rates and brackets, refundable and nonrefundable credits, and standard and itemized deductionshere is an example of how a taxpayers overall liability might be calculated.

Nate is an engineer and earns $75,000. Emily teaches 7th grade and earns $50,000. The couple has two children, ages 7 and 9. In Scenario 1 they rent a townhouse and have no itemized deductions. In Scenario 2, they own their own home and pay $16,000 annually in mortgage interest. They pay a combined $10,000 in property taxes and state income taxes and contribute $2,000 to their church and various charities.

Lets compare their tax liability in the two scenarios:

Read Also: How To Find Unpaid Property Taxes

Check The Basic Accounting Formula

In double-entry bookkeeping, there is an accounting formula used to check if your books are correct. The formula is:

Liabilities + Equity = Assets

Equity is the value of a companys assets minus any debts owing. An asset is an item of financial value, like cash or real estate.

In a nutshell, your total liabilities plus total equity must be the same number as total assets. If both sides of the equation are the same, then your book’s “balance” is correct.

A small business can use this formula to check whether they accurately calculated their liabilities.

That said, if the equation doesn’t work, you’ll need to double-check your equity and assets as well to figure out what account is wrong.

If you already know your total equity and assets, you can also use this information to calculate liabilities:

Assets – Equity = Liabilities

A balance sheet generated by accounting software makes it easy to see if everything balances.

In the below example, the assets equal $18,724.26. Assets plus liabilities also equal $18,724.26. Total liabilities must be correct because the equation balances.

If youre using Excel, plug in your assets and equity and make sure the equation works.

For more information on balance sheets and how to read and use them, read this article.

People also ask:

- Pension expenses

What Is State Income Tax Liability

State income tax liability is specifically how much you owe in taxes to the state government. Each year taxpayers earn income and depending on your state, you may owe a state income tax on what you earned.

Research your state’s income tax laws and income tax rate. These details will be different for every state. For example, Utah’s income tax rate is 4.95%, so taxpayers in Utah will owe 4.95% of their earned income to the state government in state income tax.

Read Also: How To Stop Unemployment From Taking Tax Return

How To Calculate Income Tax

Income tax calculation for the Salaried

Income from salary is the sum of Basic salary + HRA + Special Allowance + Transport Allowance + any other allowance. Some components of your salary are exempt from tax, such as telephone bills reimbursement, leave travel allowance. If you receive HRA and live on rent, you can claim exemption on HRA. Calculate exempt portion of HRA, by using this HRA Calculator.

On top of these exemptions, a standard deduction of Rs 40,000 was introduced in budget 2018. This has been increased to Rs 50,000 in budget 2019.

In case you opt for the new tax regime, these exemptions will not be available to you.

Lets understand income tax calculation under the current tax slabs and new tax slabs by way of an example. Neha receives a Basic Salary of Rs 1,00,000 per month. HRA of Rs 50,000. Special Allowance of Rs 21,000 per month. LTA of Rs 20,000 annually. Neha pays a rent of Rs 40,000 and lives in Delhi.

| Nature |

|---|

| Rs 12,500 + Rs 25,500+ Rs 37,500 + Rs 50,000 + Rs 62,500 + Rs 1,77,600 + Rs 14,604 | Rs 3,79,704 |

What are the exemptions/ deductions that are disallowed under the new tax regime?

Individual or HUF opting for taxation under the newly inserted section 115BAC of the Act shall not be entitled to the following exemptions/deductions:

Recommended Reading: How Much Are Annuities Taxed