Should You Prepay Your Property Taxes Before January 1

President Trump signed sweeping tax legislation in 2017 that capped property taxes and other state and local taxes deductions at $10,000. This change went into effect in January 2018, which impacted 2018 taxes that were filed in April 2019, and continues to impact taxes today. The SALT deduction became a major worry for many homeowners in high-tax states. To lessen the impact, some homeowners can prepay property taxes for the next calendar year before the end of this year in order to deduct them from their current tax bill. Lets take a look at the tax advantages of paying your taxes before January 1.

Consider working with a financial advisor to help you manage your finances and create a tax plan that works for your situation.

What Property Is Non

Not every property tax payment is deductible. Heres a rundown of some of the things you wont be able to deduct:

- Taxes paid on a property you dont own

- Taxes you paid on commercial or rental property

- Taxes you havent yet paid

- Taxes paid on transferring the sale of a house

- The cost of home renovations

- Costs for local improvement construction

- Utilities or services like trash collection or water

More Help On Property Tax Breaks

Navigating property tax breaks can be tricky which is why you can ask for help. Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H& R Block to help you get back the most money possible.

Related Topics

Donating household goods to your favorite charity? Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H& R Block.

You May Like: How To Find Tax Lien Properties For Sale

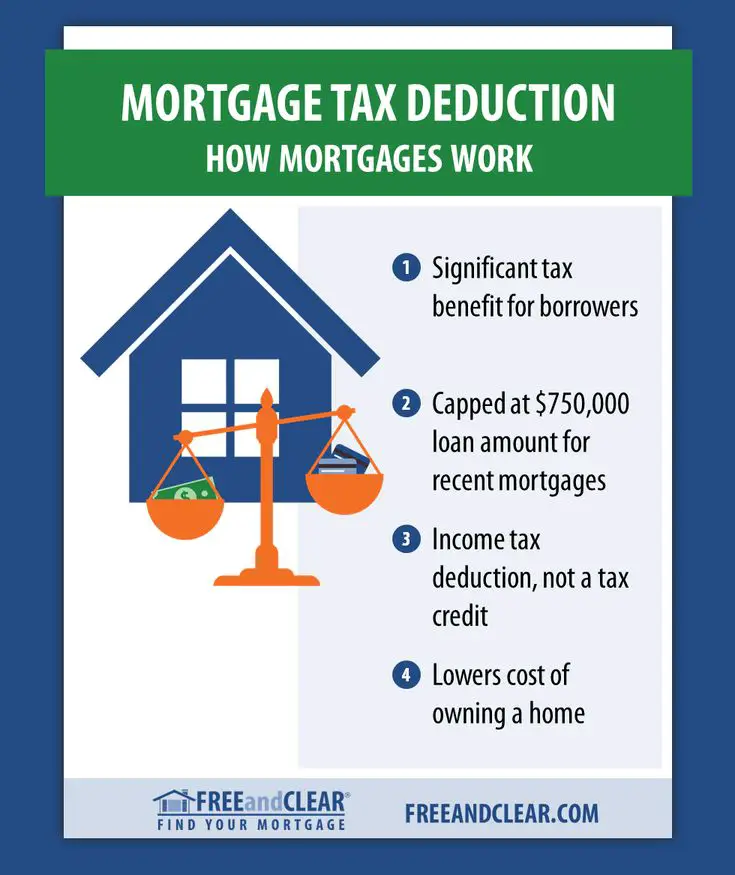

You Can Deduct Mortgage Points From Your Taxes Too

You can buy mortgage points, also called “discount points,” when buying a house to decrease the interest on the mortgage. Each 1% of the mortgage amount that home buyers pay on top of their down payment generally reduces their interest rate by 0.25%, though the exact amount will depend on the lender and the loan.

Discount points can save you big money on a 30-year mortgage by lowering the total interest you’ll have to pay across decades, but they can also save you money on your taxes when you buy them. The IRS considers mortgage points to be prepaid interest, so you can add the amount paid for points to your total mortgage interest that’s entered on Line 8 of 1040 Schedule A.

Deducting Your Maintenance And Repairs

While home improvements are deductible through depreciation, the tax code does allow you to deduct certain repair and maintenance costs separately. The big difference is that these efforts keep your property in rentable condition, but do not add significant value. According to the IRS, examples of improvements include additions , landscaping, heating and air conditioning, plumbing, insulation, interior upgrades .

If you hire someone else to do the work, you can deduct the labor costs. The same goes for property or on-site managers, should you choose to hire one. If you take the do-it-yourself approach, you can deduct any rental fees for tools and equipment. Homeowner association and condo fees would are also deductible following the same principle.

You May Like: When Is The Due Date For Taxes

Read Also: Why Do You Have To Pay Taxes

Tax Deduction Vs Tax Credit Vs Tax Exemption

Tax deductions are one of three main types of individual income tax incentives the other two are tax credits and tax exemptions.

Tax incentives are government policies that attempt to get taxpayers to spend money, save money or encourage a particular behavior that benefits the countrys economy by reducing their tax bill. Tax deductions, tax credits and tax exemptions do this in different ways. Understanding the differences between them and how each may apply to you can help you get the most out of your personal finances.

Differences Between Tax IncentivesJoin Thousands of Other Personal Finance Enthusiasts

Tips For Maintaining A Strong Financial Life

- Finding a qualified financial advisor doesnt have to be hard. SmartAssets free toolmatches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Being able to create a defined budget is a skill that not many people have anymore. However, a budget is the best way to ensure that you never fall on hard financial times. Budgets can be useful if youre looking to save up for a vacation or another expensive venture as well. SmartAssets budget calculator makes it extremely easy to get a plan ready to go.

Recommended Reading: How Do I Pay Taxes

Deducting Mortgage Interest On Second Homes

If you have two homes, you can still deduct the mortgage interest on your federal taxes on a second home. To qualify, the property must be listed as collateral on the loan. You can only deduct interest on one home besides your primary property.

However, the rules are different if the second home is a rental property. If that’s the case, you can only take the deduction if you live in the property for 14 days or for 10% of the time that it is rented. If you never live in it, then it is exclusively treated as a rental property so you can’t take the mortgage interest deduction.

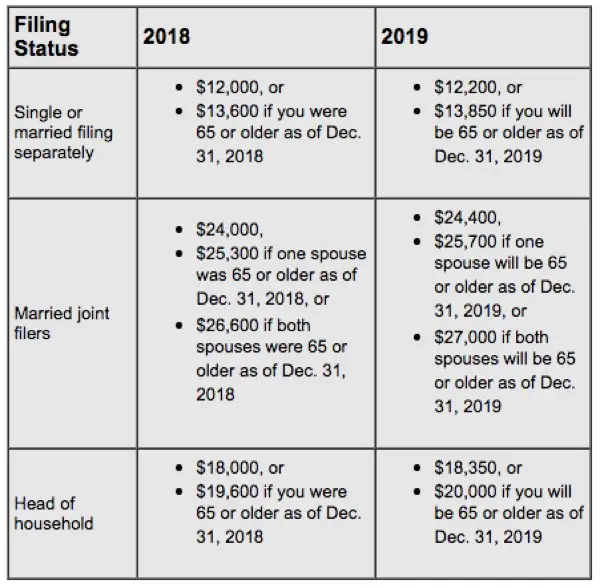

The Standard Deduction For 2022 Is Higher

It’s typical for the standard deduction to increase a little each year, along with the rate of inflation. For your 2022 tax return, the standard deduction for single tax filers has been increased to $12,950 , and has been bumped to $25,900 for those married filing jointly .

The standard deduction is what most taxpayers with simple tax returns claim to reduce their taxable income. If you receive a traditional paycheck through an employer and aren’t eligible for many special deductions or credits, the standard deduction likely makes sense for you. If you have expenses or individual deductions you’d rather claim, like self-employment tax breaks, you would not claim the standard deduction.

Also Check: Is There Property Tax In Florida

Double Check Your Escrow Account

If you make your property tax payments through an escrow account set up by your mortgage lender, it’s even easier to keep track of what you paid. Each year, your lender will send you a 1098 statement. This statement lists the amount of mortgage interest you pay during the tax year. But it also lists the property tax payments your lender has made on your behalf. You can find this number in Box 4 of your 1098 form.

Real Estate Investing Tax Deductions

As we mentioned previously, you cant claim a property tax deduction for investment properties. But thats just fine! A savvy investor can still take advantage of several tax benefits, including some that go even further than the property tax deduction. One of the biggest ways to save is to set up an LLC and take advantage of the pass-through deduction. You can deduct 20% of any income youve paid yourself through the LLC with the pass-through deduction. It might not save your business any money, but its a huge break on your personal taxes.

If your investment property is a rental, you can claim a number of expenses as deductions. You can deduct the cost of repairs, management, and other costs of day-to-day operations. You can claim a deduction for any depreciation in the propertys value, and even for appliances in the property that belong to you. Theres also a more complicated benefit called a 1031 exchange, which comes into play when you use the profits from one investment property to pay for another, similar property.

Heres an in-depth view of tax deductions for real estate investors:

You May Like: Where Can I File Taxes For Free

Tax Brackets Vs Flat Tax Structure: Pros And Cons

When it comes to taxation, there are two primary schools of thought as to how it should be done. The first, which is currently used in the United States, is a progressive tax schedule. The second is a flat tax schedule. The differences between the two are fairly significant, and choosing one over the other is the subject of endless debate among economists, politicians and taxpayers alike. But, how exactly are progressive and flat taxes different, and what are the pros and cons? Heres a quick overview.

Do You Have a Tax Question? Ask a Tax Pro

No Matter How You File Block Has Your Back

Read Also: Who Claims Child On Taxes With 50 50 Custody

Let A Tax Expert Do Your Taxes For You

Get every dollar you deserve and your max refund, guaranteed with Live Full Service Deluxe.

Search over 350 tax deductions and find every dollar you deserve with TurboTax Deluxe.

-

Estimate your tax refund and seewhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Homeowners Don’t Miss These Tax Breaks To Maximize Your Tax Refund

It’s almost time to get something back for all the money you spent on your home in 2022.

While buying your own home might be the traditional American dream, it also comes with a lot of costs — not only your mortgage, interest and property taxes, but also maintenance and upkeep. Luckily for homeowners, the tax season provides an excellent chance to get some of that money back in the form of tax credits or deductions that can lead to a bigger tax refund.

For homeowners, learning about your tax benefits now can help you review and adjust your tax situation for when you file your income tax return later this year.

Most homeowners with mortgages know they can deduct payments toward their loan interest, but many tax deductions and tax credits involved in owning a house are less obvious. Learn about all the possible tax breaks for homeowners to get the biggest refund possible on your 2022 taxes.

For more on taxes, learn about the new income brackets and standard deduction for 2023.

Note: The 2022 tax forms haven’t been completed, so our links currently point to draft versions of 2022 forms from the official IRS site. You can’t file your income taxes with these forms — official tax forms for 2022 will be available in late .

Recommended Reading: Where Do I Pay Property Taxes

How Much Mortgage Interest Is Tax Deductible

The official line of the Canadian government is that you can deduct the interest you pay on any money you borrow to buy or improve a rental property. If you rent out your property for the entire year, then the total amount of interest on your mortgage is tax deductible. If you only rent it out for a portion of the year, then only that period of interest payments is tax deductible.

It ultimately depends on both the proportion of the space rented out, and the length of time said space is generating rental income. Heres a table to help break it down for you:

| Size of space, time rented | Amount of mortgage interest thats tax deductible |

| Whole property, whole year | |

| Whole property, part of the year | 100% of the interest payments for the time the property was rented out |

| Part of the property , whole year | % total square footage x 12 months. (e.g. a 500 sqft. Basement suite rented for one year in a 1500 sqft home = total property space, and therefore total yearly mortgage interest is tax deductible. |

| Part of the property , part of the year | % total square footage x time rented. E.g. 500 sqft basement in a 1500 sqft home, rented for 2 months, = total interest payment for only those 2 months of the year is tax deductible. |

In a situation where you are not using your residential property space to generate rental income, check out our post, What is The Smith Maneuver, to learn more about how much of your mortgage interest could be tax-deductible.

What Are Property Taxes

Property taxes and real estate taxes are the same, and the terms can be used interchangeably.

State and local taxes are used to pay for services where you live. In particular, property taxes often fund school districts, garbage pick-up and all the other services that municipalities offer. Property taxes are assessed locally on the value of your home.

If your mortgage servicer maintains an escrow account sometimes referred to as an impound account on your behalf, you may not think much about property taxes, but they’re being paid as part of your monthly mortgage payment. This account is also used to pay homeowners and mortgage insurance premiums, if applicable.

Read Also: How Do You Paper File Your Taxes

What Home Expenses Are Tax Deductible 2020

There are certain expenses taxpayers can deduct. They include mortgage interest, insurance, utilities, repairs, maintenance, depreciation and rent. Taxpayers must meet specific requirements to claim home expenses as a deduction. Even then, the deductible amount of these types of expenses may be limited.

The Home Office Deduction

Small business owners who work from home may qualify for the home office deduction. If youre eligible, you may be able to deduct a portion of your homeowners association fees, utility bills, homeowners insurance premiums and the money you used to repair your home office. The amount you can deduct depends on several factors, including the percentage of your home thats used exclusively for business.

Claiming the home office deduction wont automatically trigger an IRS audit, but youll need to be careful. Youll need to keep up with receipts, canceled checks and other documentation and be ready to prove that your home office isnt used for another purpose that isnt related to your business.

You May Like: How To Save Money On Taxes

Deduction The Year You Buy Your Property

For federal income tax purposes, the seller is treated as paying the property taxes up to, but not including, the date of sale. You are treated as paying the taxes beginning with the date of sale. This applies regardless of the lien dates under local law. Generally, this information is included on the settlement statement you get at closing. You and the seller each are considered to have paid your own share of the taxes, even if one or the other paid the entire amount. You each can deduct your own share, if you itemize deductions, for the year the property is sold.

What Is A Property Tax Deduction

Counties, cities, and states levy property taxes on various kinds of property. Property may include owned real estate, recreational vehicles, boats, land, vacation homes and more.

Homeowners can deduct the state and local taxes that have been paid on their property from their federal income taxes, says Shmuel Shayowitz

president and chief lending officer at Approved Funding, This includes annual property taxes as well as the taxes that may have been paid at closing during the sale or purchase of the property.

But homebuyers who pay off delinquent tax liens from earlier years at closing are not allowed to deduct them from federal taxes. Payments such as these should be treated as part of the cost of purchasing a property rather than a property tax deduction.

If you pay property taxes by depositing money into an escrow account each month as part of your mortgage payment, the entire payment shouldnt be treated as a property tax deduction. Only the amount that the bank reports to the Internal Revenue Service is eligible for the deduction. That is because the amount you pay to an escrow account is adjusted each year to be as close as possible to the exact amount due, but its never exactly the same amount.

You May Like: Can I File Taxes Without All My W2s