Death Benefit Paid On Or After 6 April 2016

Section 206 Finance Act 2004

Sections 636A and and 636AA Income Tax Act 2003

The Pension Benefits Regulations 2006 – SI 2006/136

If the lump sum is paid on or after 6 April 2016 its tax treatment depends on how old the member was when they died, and who receives the payment.

If the member was aged under 75 when they died the lump sum is not taxable.

The lump sum death benefit is taxable if the member was aged 75 or older when they died. Whether the taxable lump sum payment is:

- taxable as income of the recipient, or

- subject to the special lump sum death benefits charge

depends on whether or not the lump sum is paid to a non-qualifying person. Payments to a non-qualifying person are subject to the special lump sum death benefits charge.

Go to PTM073010 for more detailed information on the tax treatment of lump sum death benefits, including the definition of a non-qualifying person.

Be Specific In How You Want Your Money Allocated

Your designated beneficiaries may be reliable, but unless they know precisely how you want your assets distributed, they may make an error.

Most annuity beneficiary designation forms allow you to name multiple primary and contingent beneficiaries and to specify the percentage of assets youd like each person to receive after you pass away.

Taxes On Annuity Death Benefits

By | Submitted On March 29, 2012

The death benefits from an annuity are subject to income tax. The amount of taxes due will depend on the amount of money involved and how it is inherited.

The term death benefit can apply to either the funds in the plan or to a life insurance policy attached to it.

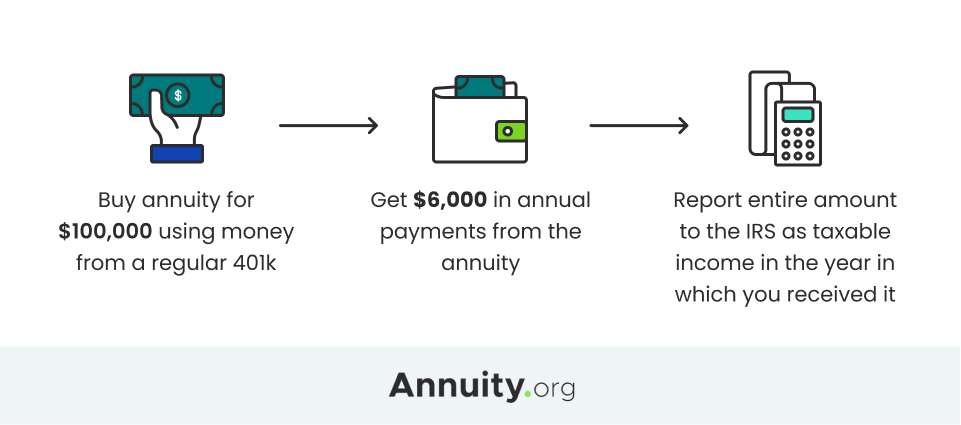

Annuities are a tax-deferred investment which means that taxes are due when funds are taken out of one. Therefore taxes will be due if a person inherits all of the money in one or takes all of the funds out. Many people get quite a shock because they are not expecting the funds or the increase in their tax bill.

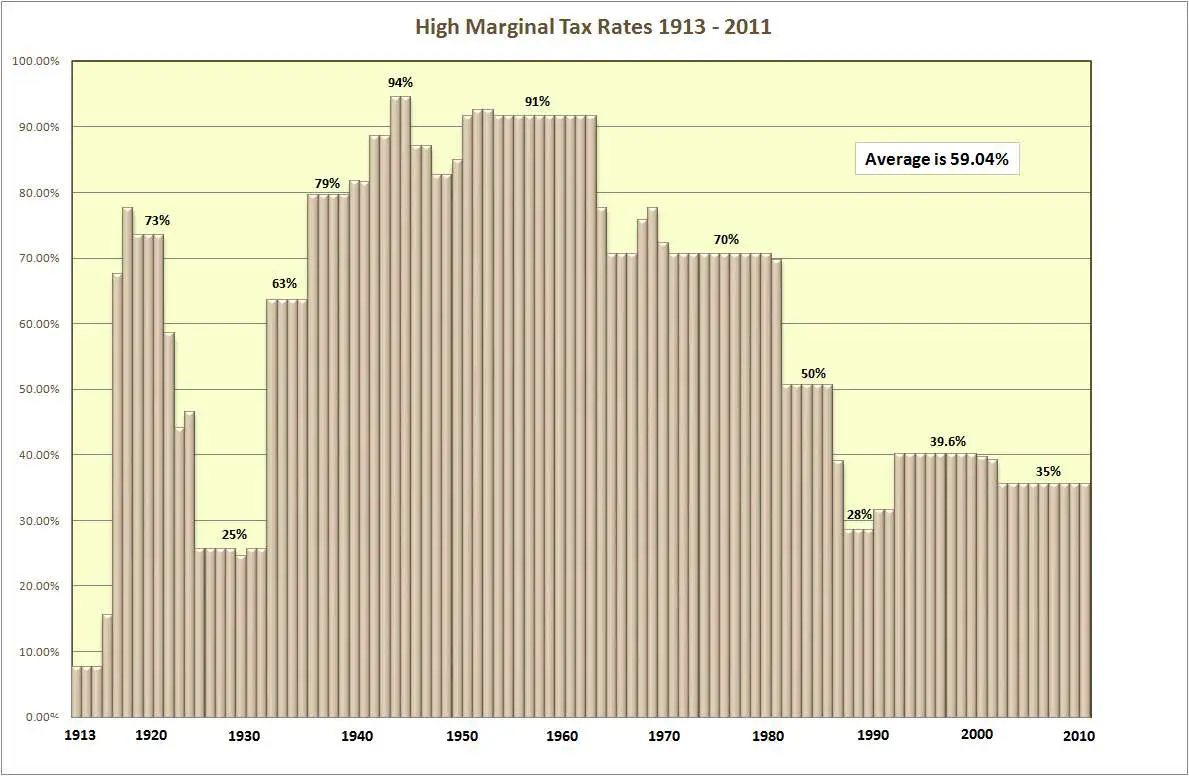

Any money that you receive from an annuity including funds you inherit from one is reportable income. That means it could increase your tax bracket and your tax rate. If there’s a large amount of money in a plan it will affect your tax rate. Any increase in the value of an indexed or variable annuity that you inherit will be regarded as an increase in income by the IRS.

Annuity Payments vs. Death Benefit

The only time you will be taxed on annuity funds you inherit is if they are distributed directly to you. If you simply take over the payments you will only have to report the payments on your taxes. The funds in the plan itself will still be tax deferred.

Inheriting an Annuity

Steven Hart is a freelance writer and a Financial Advisor from Cary, IL. He writes about Annuity topics like Annuity Calculator, and Annuities Good or Bad.

You May Like: Are New York State Tax Refunds Delayed

There Are Choices When It Comes To Taking Income From Life Insurance Proceeds

Life insurance settlement options have a number of different ways that a beneficiary can receive income.

Depending upon the amount of life insurance that the insured individual had in force, a very creative and solid stream of income can be devised to meet the needs of a family.

There are guarantees, flexibilities, and safeguards built into the framework of the settlement options.

These settlement options are essentially the same thing as annuities, the only difference being settlement options are derived from life insurance death proceeds and annuities come from any other form of cash.

Requirements For Payout Of Death Benefits

The process of receiving a death benefit from a life insurance policy, pension, or annuity is straightforward.

Beneficiaries first need to know which life insurance company holds the deceased’s policy or annuity. There is no national insurance database or other central location that houses policy information. Instead, it is the responsibility of each insured to share policy or annuity information with beneficiaries. Once the insurance company is identified, beneficiaries must complete a death claim form, providing the insured’s policy number, name, Social Security number, and date of death, and payment preferences for the death benefit proceeds.

Beneficiaries must submit death claim forms to each insurance company with which the insured or annuitant carried a policy, along with a copy of the death certificate. Most insurers require a certified death certificate, listing the cause of death. If multiple beneficiaries or survivors are listed on a policy or annuity, everyone is required to complete a death claim form to receive the applicable death benefit.

Also Check: How To Pay Sales Tax In California

Transfer Of A Beneficiarys Annuity From One Insurance Company To Another

Paragraph 17 to , 27AA to and 27FAto Schedule 28 Finance Act 2004

The Registered Pension Schemes Regulations 2006 – SI 2006/499

A beneficiarys annuity contract represents the contractual liability of an insurance company to pay a pension to a beneficiary in respect of a member of a registered pension scheme, either for life or until a given situation arises.

The annuity is not being paid directly under a registered pension scheme. An annuity contract can be transferred from one insurance company to another, but it wont be a recognised transfer because no registered pension scheme is directly involved.

The annuity contract will have been purchased using the sums and assets from a registered pension scheme. Section 161 Finance Act 2004 provides that the payments rules and tax charges apply to payments from an insurance or annuity contract acquired using registered pension scheme funds.

Where a beneficiarys annuity is transferred from one insurance company to another the amount transferred between insurance companies will be an unauthorised payment unless certain conditions are met.

PTM106000 provides guidance on the transfer of beneficiarys annuities between insurance companies.

Is An Annuity Death Benefit Taxable

The proceeds from an annuity death benefit are taxable when they are received by the beneficiary. In the case where the recipient is a surviving spouse, he or she can initiate certain measures to defer the payment or taxes on the amount received.

In other instances where the recipient is not the spouse, the recipient will have to pay taxes on the money he or she receives from the annuity. Depending on who the beneficiary is, these funds may be subject to estate taxes as well.

Before deep diving into this, it may be useful to have a clear understanding of what an annuity is. A simple way to think of an annuity is to refer to it as an insurance product that offers a certain income benefit, backed by contractual guarantees. It can be utilized as a component of a retirement benefit plan.

As an individual, you can purchase the annuity by paying a lump-sum premium payment or by making several premium payments over an extended span of time. The annuity premiums are allocated into the annuity contract, and the annuity owner receives benefits as the money grows over time.

You May Like: How Do Tax Debt Relief Companies Work

What Happens To My Pension When I Die

Thinking about death isnt easy, but its important to understand what will happen to your pension when you die, and what the tax implications will be of passing on your pension. How your workplace pension or one youve set up yourself might be paid to your beneficiaries when you die depends on what type of pension you have.

What Happens To My Annuity When I Die

Whether your loved ones get an annuity payout after you pass away will depend on how you set up your policy.

Most annuity policies dont pay out to loved ones when you die, meaning the policy stops on your death. That is unless you have a joint policy that keeps paying out until your partner dies.

But some annuities might have whats known as a death benefit where the owner of the policy is able to designate someone to receive the annuity income after death, either as income or a lump sum.

You May Like: How To Pay My Federal Taxes

Whether You Want To Leave Money To A Beneficiary Or Your Estate

You may decide that you want to leave money to your estate or a beneficiary when you die. If so, you could consider buying a term-certain annuity or a life annuity with either a joint and survivor option or a guaranteed payment period.

The annuity is not the only option. For example, you can also keep some money in another product, like a savings account, TFSA or RRIF.

How Does An Inherited Annuity Work

To receive an inherited annuity, your contract must include a death benefit provision and name a beneficiary.

Otherwise, payments will stop when you die, or the insurance company will keep any future payments.

If your contract includes a death benefit, remaining annuity payments are paid out to your beneficiary in either a lump sum or a series of payments.

You can choose one person to receive all the available funds or several people to receive a percentage of remaining funds.

You can also select a nonprofit organization as your beneficiary, or a trust established as part of your estate plan.

If you have inherited your spouses annuity, you can choose to transfer the annuity contract into your name.

Doing so allows you to keep the same options as the original owner, including the annuitys tax-deferred status.

You will also be able to receive remaining funds as a stream of payments instead of a lump sum.

Non-spouses can also inherit annuity payments. However, they cannot change the terms of the contract and will only have access to the designated funds outlined in the original annuity agreement.

There are three main ways beneficiaries can receive inherited annuity payments.

Inherited Annuity Payout OptionsStress-Free Annuity Buying

Also Check: How Do I Get My Past Tax Records

What Is An Annuity Death Benefit

When the holder of an annuity contract passes away, the money and the death benefit available from the annuity come into play. Many annuity products come with the provision for the annuity holder to include a death benefit for a beneficiary, which they choose while setting up the contract.

The policyholder may choose his or her child, spouse, or any other individual as the beneficiary. In some cases, depending on the type of payout option the policyholder chooses, the insurance company may be the beneficiary. It would receive the balance of the money in the contract when the policyholder passes away.

This payout option is called life-only, and depending on your financial picture it may or may not make sense for your personal situation. You can ask your insurance or financial professional for more details.

The amount of the death benefit receivable from an annuity may be the entire amount left in the contract at the time of the policyholders death. In the case where the annuitant has made any withdrawals, the same amount and any applicable fees and/or charges are deducted from the death proceeds.

There are some types of annuities that offer a guaranteed death benefit to the beneficiary no matter the amount left over in the contract. However, in order to enjoy this death benefit rider, the annuity owner will need to pay an annual fee.

How Death Benefits Work

The standard death benefit in a VA is set initially at whatever amount is invested. Depending on the VA, the death benefit then resetseither on the contract anniversary date if the contract value has increased or whenever the contract cash value reaches a new high. Additional investments in the annuity can also help increase the death benefit. Once set, the death benefit doesn’t decrease if the contract declines in value, but it does decrease if the contract owner takes a distribution. The adjustment may be a dollar-for-dollar or percentage decrease.

Many contracts also offer an enhanced death benefit rider that can be purchased for an additional fee of around 0.5% to 1.0% of the contract value. The additional fee is charged each year. Enhanced death benefits vary, but many contracts offer an annual guaranteed step up. The contract may, for example, guarantee that the death benefit will increase by the greater of 5% a year or reset to the highest contract value. Over time, it is not unusual for a VA to end up having a death benefit that is higher than the actual contract surrender value.

Annuity beneficiaries may pay income or capital gains tax on death benefits they receive, but these benefits don’t have to go through probate.

Recommended Reading: What Is Medicare Tax Used For

Exceptions To The New Rules

Some exceptions apply to this new 10-year rule, so check with your tax advisor and estate planning attorney to see if those might apply to you.

Its also prudent to consult with experienced professionals in these areas if you are generally wanting to know the tax consequences of different options. That can help with making an efficient wealth transfer to your loved ones.

That being said, these exceptions are listed as follows:

- Surviving spouses are still exempt. They can roll the deceased account holders IRA into their own and defer taking distributions until the date when the decedent would have reached the age requiring him or her to take required minimum distributions.

- Chronically ill and disabled beneficiaries are exempt.

- Minors are exempt until they reach the age of majority.

- Beneficiaries who are less than 10 years younger than the decedent are exempt.

- Beneficiaries who have already inherited an IRA and are currently taking taxable distributions from their IRA before January 1, 2020.

The exemption status is determined on the date of death of the account holder. The 10-year rule kicks in for minors once they reach the age of majority.

The five-year rule still applies to any IRA that has no designated beneficiary, or if the beneficiary is the decedents estate, a charity, or other non-individual. In these instances, the old rules still apply. Conferring with experienced professionals can help greatly in these situations, as they can become very complex.

Is A Survivor Annuity Death Benefit Taxable

You may have heard of annuities and how they are the only thing besides Social Security that can pay you guaranteed lifetime income. But what happens to an annuity when someone passes away? The tax rules surrounding survivor or inherited annuities are already complex, but the SECURE Act, a federal law passed in 2019, has made them even more complicated.

The proceeds in a survivor annuity are generally taxable when the heirs receive them. If the recipient isnt a spouse of the original annuity owner who passed, that recipient will pay taxes on the money they receive from the annuity.

If the surviving recipient is a spouse, then there are some steps that they can take to defer the taxes on the annuity proceeds. How much of the proceeds are taxable will depend on what type of account the annuity was housed in.

Most annuities are bought with pre-tax qualified money, meaning the premiums often come from a traditional IRA, a 401 plan, or another qualified plan. Since most annuities are bought with this pre-tax money, we will talk about how the SECURE Act can affect an heirs tax burden now.

Read Also: What Happens If The Irs Rejects Your Tax Return

What Is A Death Benefit

A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured or annuitant dies. For life insurance policies, death benefits are not subject to income tax and named beneficiaries ordinarily receive the death benefit as a lump-sum payment.

The policyholder can structure how the insurer pays the death benefits. For example, a policyholder may specify that the beneficiary receives half of the benefit immediately after death and the other half a year after the date of death. Also, some insurers provide beneficiaries with different payment options instead of receiving a lump sum. For example, some beneficiaries elect to use their death benefit proceeds to open a non-qualified retirement account or elect to have the benefit paid in installments.

Death benefits from retirement accounts are treated differently than life insurance policies, and they may be subject to taxation.

Other Taxable Events That Can Occur

If an improper transfer for value is made, a taxable situation can occur.

A transfer for value occurs when a life insurance policy is transferred to someone or to an entity of some sort and there is an exchange for another item of value, the death benefit can be includible in the gross income of the beneficiary.

There are rules to be followed and if they are violated, then the proceeds can be taxable as ordinary income.

An example of a violation of a transfer for value transaction could occur if a life insurance policy were to be exchanged for a piece of real estate, and the value of the real estate was worth more than the death benefit of the life insurance policy.

If an insured dies and is the owner of the life insurance policy, the proceeds of the policy would be included in the insureds gross estate for estate tax purposes.

The estate would have to be quite large under current law, which excludes the first $10 million in an estate where a husband and a wife are involved.

Recommended Reading: When Will Taxes Be Deposited 2021

Death Benefits Before And After Annuitization

Annuitization is typically an option with modern deferred annuities. Below are options for an annuity beneficiary of an inherited annuity before and after the annuity was annuitized.

If Annuitant Dies Before Annuization

If an annuitant dies before annuitizations begin, the beneficiaries will receive the annuitys value in a lump sum or a series of payments.

If Annuitant Dies After Annuization

If an annuitant dies after annuitizations begin, the beneficiaries will receive either the remaining series of annuity payments or nothing, depending on the annuitants choice of an annuity payout.

| Dies Before Annuitization |

|---|