Trump Denies Report That Fbi Sought Nuclear Documents During Mar

Former President Donald Trump on Friday denied a report from The Washington Post that said FBI agents were looking for classified documents related to nuclear weapons, among other items, when they searched his Mar-a-Lago home this week.

On his Truth Social platform, Trump said that “Nuclear weapons is a hoax, just like Russia, Russia, Russia was a hoax,” referring to then-special counsel Robert Mueller’s investigation into the Trump campaign’s ties to Russia.

Trump attacked the officials involved with the search of his home, calling them “sleazy.” He also suggested it was possible he was being framed, saying the agents who searched his home didn’t want other people present in areas they were searching. “Planting information anyone?” he wrote.

NBC News has not independently verified the Washington Post report, published Thursday evening.

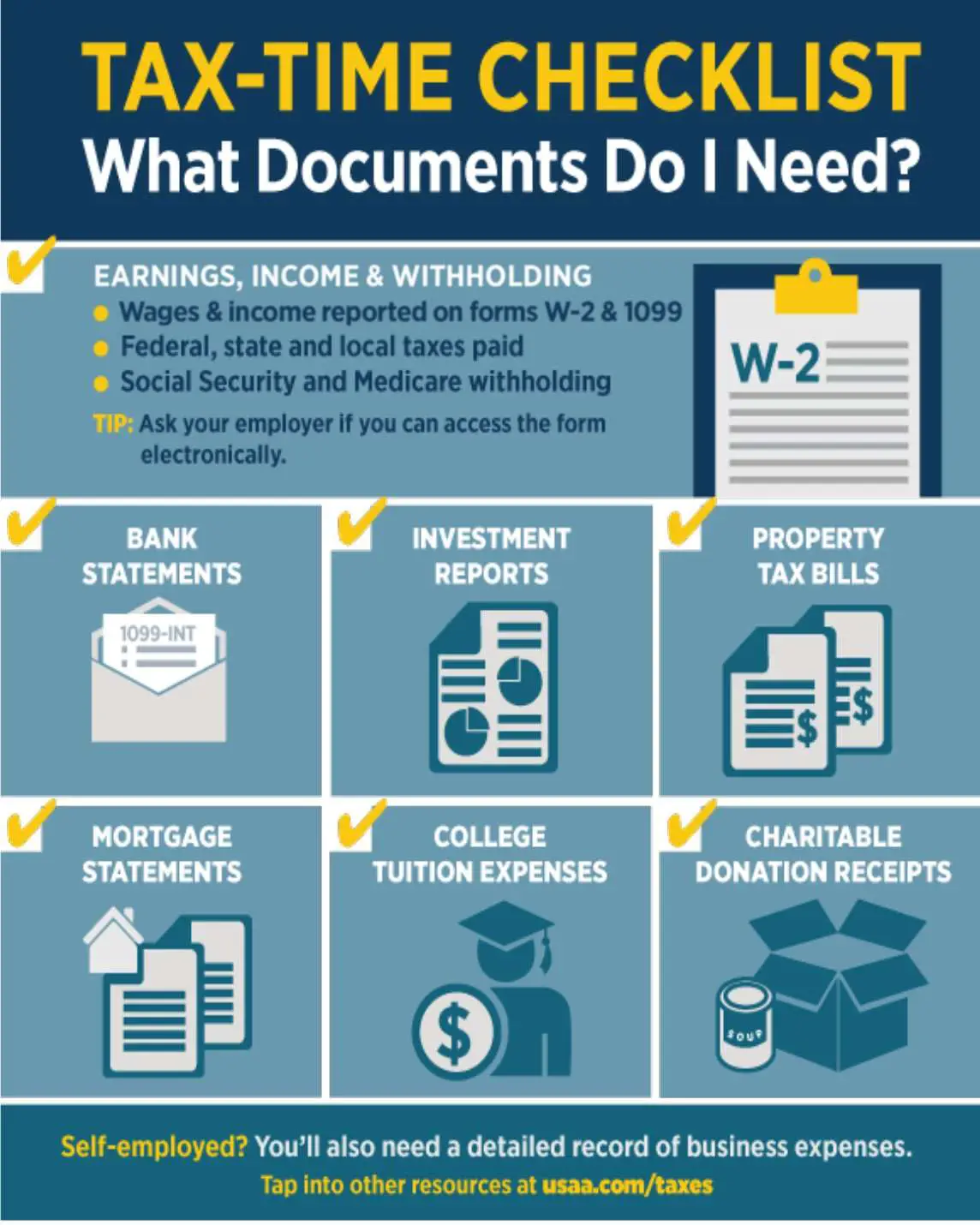

Documents That Support Tax Deductions

Identifying the documents youll need to claim certain tax deductions can be an arduous process. Ideally, youve been collecting them all year long as you paid certain expenses.

Its not necessary to provide your receipts to the IRS unless youre audited, but youll need them to ascertain how much you can claim for various deductions, and youll want to keep them on hand just in case. While you can take the easy way out and simply claim the standard deduction for your filing status, youll have to know how much you spent on qualifying expenses if you decide to itemize instead. Common itemized deductions include charitable giving, state and local property and income taxes, medical expenses, and health insurance.

A full list of available itemized deductions appears on Schedule A, which you must complete and submit with your tax return if you elect to itemize.

After You File Your Tax Return

Get your notice of assessment, find out the status of your refund, or make a change to your tax return

To provide feedback on your filing experience or any other CRA service, go to Submit service feedback – Canada.ca

To formally dispute your notice of assessment or reassessment, credit or benefit decision, you may want to file a notice of objection. To find out if this option is right for you, go to File an objection

Don’t Miss: How Much Tax Do You Have To Pay On Stocks

Donations Pension Contributions And Seis/eis Investments

With all of these, its best that you keep clear and organised records of every transaction. Collect all the important documents and keep them together . Keep all your receipts for tax record purposes.

For any donations youve made, wed need:

- The amount

- The date

- The charity of donation in either document form or a spreadsheet

When it comes to pension contributions, we need any documents or information that mentions them. A spreadsheet works too!

Submitting information on your SEIS or EIS investments isnt as complicated as you may think. We do everything, as long as you provide us with:

- Your SEIS3 or EIS3 certificates

- Or your share certificates

Check out our guides on how to claim your SEIS tax relief or your EIS tax relief.

Although this may seem like a lot, were on hand to help throughout the entire process. Use our spreadsheets to track and stay on top of all your finances.

If you have any other questions, feel free to contact our support team on

See more on:

New Alternative Media Preference To Help Taxpayers

Beginning January 31, 2022, taxpayers can complete Form 9000, Alternative Media PreferencePDF, to choose to receive their IRS tax notices in Braille, large print, audio or electronic formats. This includes notices about additional taxes or penalties owed. Taxpayers can include the completed form with their tax return, mail it as a standalone form to the IRS or call to elect their preferred format.

Also Check: Has The Deadline For Taxes Been Extended

What Is A 9465 Form

If you cannot pay your taxes in full when you file, you can use Form 9465 to request a monthly payment plan. If you can pay within 120 days and you owe less than $50,000, you can request a payment plan online, too. Such payment plans will incur a user fee, accrued penalties and interest, but low-income taxpayers may have the user fee reduced, waived or reimbursed. User fees are usually lower when you set up a payment plan online. While a payment plan is in effect, late-payment penalty accruals are cut in half. If you can pay your taxes in full within 120 days, you can apply online for the IRSs payment plan or call the IRS at 800-829-1040 to avoid the fee associated with setting up an installment agreement.

Best for:People who need more than 120 days to pay their taxes in full and owe more than $50,000. If you want to set up a monthly payment plan, the IRS encourages you to request one online.

What Tax Documents Do I Need If I Bought A House

If you bought a house, keep documents like your closing costs paperwork, mortgage statements, home improvement invoices and receipts , property tax statements, and more. For example, if you were issued a qualified Mortgage Credit Certificate by a state or local government unit or agency, you may be able to a mortgage interest credit.

Don’t Miss: How Much Does The 1 Pay In Taxes

View Irs Account Information Online

Individuals can use their IRS Online Account to securely access information about their federal tax account, including payments, tax records and more.

To help with filing a return, individuals can view:

- The total amounts of Economic Impact Payments issued for tax year 2021

- The total amount of advance Child Tax Credit payments

- Their adjusted gross income from their last tax return

- The total of any estimated tax payments they made, and refunds applied as a credit

They can also now make and track payments and manage communication preferences, including the option to go paperless and request email notifications for certain notices available online. Taxpayers are encouraged to register for an online account, if they haven’t already, or sign in to access this information and explore these new features.

Adjustments To Your Income

The following can help reduce the amount of your income that is taxed, which can increase your tax refund or lower the amount you owe.

- Student loan interest

- Health Savings Account contributions

- Moving expenses

- Keogh, SEP, SIMPLE and other self-employed pension plans

- Alimony paid that is tax deductible

- Educator expenses

Don’t Miss: Is Memory Care Tax Deductible

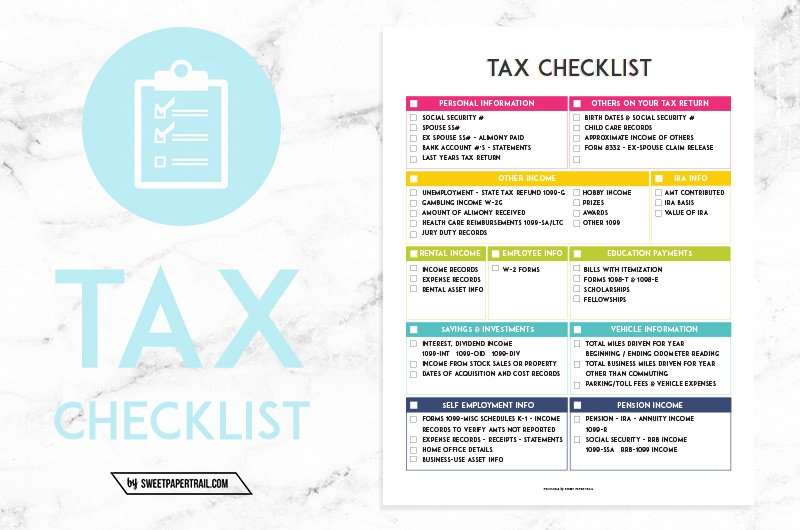

Documents You May Need To File Your Taxes

What I Need to File Taxes Online

When approaching a complex task like filing your taxes, it’s best to get organized by creating a comprehensive checklist in advance. There are many forms and documents required when filing your taxes and it’s best not to wait until the 11th hour to start locating them. While opting to e-file your taxes can take a lot of guesswork out of the tax filing process, we recommend creating a personal tax checklist regardless of your preferred method of filing. From required personal information to tax forms and documents, here’s what you’ll need before you start to file.

Personal Information Required to File Taxes Online

- Business expenses, child care expenses, gambling losses, medical expenses, moving expenses, Personal property tax, such as car registration paid, real estate tax bills.

How Do I Get A Copy Of My Tax Return In Canada

If you need a copy of your notice of assessment or tax slips from previous years, you can get those from the CRA website. You can sign into your My Account or use the CRA mobile app to view it.

For copies of a previous years tax return, how you get it will depend on how you filed it. If you used a tax preparation service, you should be able to access PDFs through that service. If you used a preparation service or an account, you can contact them to get a copy of your tax return.

Also Check: Do I Pay Taxes On Unemployment

What Are 1099 Forms

1099-G: States will send both you and the federal government a 1099-G form at the beginning of the year, which shows income you received from that state during the previous tax year. The income can include:

- Unemployment compensation.

- State or local income tax refunds, credits or offsets.

- Reemployment trade adjustment assistance payments.

- Taxable grants.

- Agricultural payments.

You will receive a 1099-G in 2021 from any state that gave you money in 2020. This form is where the unemployment compensation you received is listed. Remember: If you made less than $150,000 in 2020, only unemployment benefits over $10,200 are taxable. If taxes were withheld from your unemployment insurance checks, this will be reflected in your 1099-G form.

Best for:People who received unemploymentcompensation.

1099-MISC and 1099-NEC: For tax year 2020 or a prior year, entities or people who have paid you money during the year will mail you a 1099-MISC form for miscellaneous income. If youre a freelancer or a contract worker, you can expect to receive a 1099 form in the mail for each of the people or companies you worked for. Starting with tax year 2020, freelancers will receive the new Form 1099-NEC. There are a number of other reasons you might receive a 1099-MISC form, including if you received monetary prizes or awards, or were paid royalties or rent. Youll use the form to file your own taxes.

Best for:Freelancers, contract workers or anyone who receives miscellaneous income.

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

You May Like: Do I Have To File Taxes

What Tax Documents Do I Need To Keep

It may be wise to keep your annual tax returns from at least the last three years. You’ll likely want to reference your prior year’s tax return when you file the current year’s return. You’ll also want to keep any receipts from charitable contributions, proof for tax deductions or tax credits you hope to claim, and any forms the IRS sends you year-round.

Where Do I Mail My Tax Return In Canada

If you want to mail your tax return, you will need to select the right tax centre. This depends on the province, territory, or area where you live.

For residents who live in Alberta, British Columbia, Manitoba, Saskatchewan, Northwest Territories, Yukon, or the following cities in Ontario: Hamilton, Kitchener, Waterloo, London, Thunder Bay, or Windsor, mail your return to:

Winnipeg Tax Centre

Station Main

Winnipeg MB R3C 3M3

Residents of New Brunswick, Newfoundland and Labrador, Nova Scotia, Nunavut, Prince Edward Island the following cities in Ontario: Barrie, Belleville, Kingston, Ottawa, Peterborough, St. Catharines, Sudbury, or Toronto and the following cities in Quebec: Montréal, Outaouais, or Sherbrooke, mail your return to:

Sudbury Tax Centre

1050 Notre Dame Avenue

Sudbury ON P3A 5C2

For Quebec residents of all areas other than Montréal, Outaouais, or Sherbrooke, mail your return to:

Jonquière Tax Centre

2251 René-Lévesque Boulevard

Jonquière QC G7S 5J2

If you are a non-resident and need to mail your income tax return, the tax centre mailing address depends on your country of residence.

Non-resident individuals who live in USA, United Kingdom, France, Netherlands, Denmark, Alberta, British Columbia, Manitoba, Saskatchewan, Northwest Territories, Nunavut, Yukon, or in the following cities in Ontario: Belleville, Hamilton, Kingston, Kitchener, Waterloo, London, Ottawa, Peterborough, St. Catharines, Thunder Bay, or Windsor, should mail their tax return to:

Don’t Miss: How Do I File My Pa State Taxes

What Documents Do I Need To Prepare My Tax Return

What documents do I need to prepare my tax return?

With the exception of leap years, there are 105 days from New Years Day to April 15th the deadline to pay federal income taxes. While some taxpayers file their returns during this period, many wait until the last minute. And lots of people file extensions to get their taxes done after the regular deadline. Whether you file promptly or procrastinate, here are some ideas on how to make things flow smoothly.

These Forms Help you Organize Income

Whether you prepare your own return or use the services of a professional, you can improve the efficiency of the process with a little organization.

Some of the forms to help you calculate your top-line income include:

- 1099s and W2s from all sources

- K-1s from any partnerships you own, either public or private

- Bank and brokerage statements

If you have any questions about any of these items, the IRS is a good resource for answers. If your return is complicated, you should seek the advice of licensed tax preparer or CPA.

Forms you Receive to Report Deductions

- If you pay interest on a home loan, youll receive a 1098 from the lender.

- Youll get a 1098E if you have a student loan.

Documents to Keep if you Itemize Deductions

If any of the following apply to you, ask your tax preparer or CPA which of these documents youll need to complete your return.

Other Paperwork to Hold Onto

All investing involves risk, including the potential loss of principal.

20211220-1964622

Why Is It Important To Understand Tax Forms

Nowadays, most people file their taxes using websites or other products that do the work of figuring out which forms you need to file and filling them out. But its not always cheap. Many of those services and software like TuroTax or H& R Block charge users depending on which forms they need to use.

For 2020 tax filings , anyone who made less than $72,000 a year is able to file for free as part of the IRS Free File program. Companies including Intuit, which makes TurboTax, H& R Block and others spent millions lobbying to bar the IRS from making its own free filing option while promising to create their own free products. But then, as ProPublica reported, they systematically undermined the truly free options by hiding search results and even though for many, theyre anything but.

If you havent filed yet, we recommend checking out our guide to filing your state and federal taxes completely for free, looking to see if you qualify for the Earned Income Tax Credit or learning how to track your refund. Though the IRS offers the option of paper filing, with the current COVID-19 state of affairs and a massive backlog of paper returns and documents the agency is encouraging taxpayers to file electronically to ensure prompt payment of refunds and avoid filing errors. Most paid and free tax prep services will tell you which forms you need to file, but if youre still confused, see below for a list of the most commonly used tax forms.

Recommended Reading: How To Track Your Income Tax Check

Before You Start Tax Preparation

If you use a program such as Quicken® to keep track of your finances, print a report of your transactions for the tax year . This will make your tax preparation much easier, and helps you clearly see where your money goes each year.

- Having this information in a report is much easier than going through your checks and bank statements for the entire year.

- As you review the report, highlight information you will need to prepare your tax return or make notes to remind yourself of something later.

Required Documentation To File Your Tax Return

Personal information

- A copy of last year’s tax return in order to access your Adjusted Gross Income

- Valid Social Security numbers for yourself, your spouse, and any dependent, if applicable

Proving your AGI: income and receipts

- Social Security benefits documentation

- All receipts pertaining to your small business, if applicable

- Income receipts from rental, real estate, royalties, partnerships, S corporation, trusts

Other income

- W-2s, showing your annual wages from all of your employers

- Form 1099-INT, showing interest paid to you throughout the year

- Form 1099-G, showing any refund, credit or offset of state and local taxes

- Forms 1099-DIV and 1099-R, showing dividends and distributions from retirement and other plans paid to you during the year

Affordable Care Act filers

- Form 1095-A, Health Insurance Marketplace Statement. For more information see Affordable Care Act Tax Provisions.

- Form 8962,Premium Tax Credit

File electronically

- Verify your identity by using your 2019 AGI. If you created a 2019 personal identification number, that will work too. The personal identification number required that you create a five-digit PIN that could be any five numbers that you choose which serves as your electronic signature.

- Can’t find your AGI or PIN? If you do not have a copy of your 2019 tax return, you may use the IRS Get Transcript self-help tools to get a tax return transcript showing your AGI. You have two options:

Don’t Miss: Where Can I Pay My Property Taxes

Information About Your Income

- Income from jobs: forms W-2 for you and your spouse

- Investment incomevarious forms 1099 , K-1s, stock option information

- Income from state and local income tax refunds and/or unemployment: forms 1099-G

- Taxable alimony received

- Business or farming incomeprofit/loss statement, capital equipment information

- If you use your home for businesshome size, office size, home expenses, office expenses.

- IRA/pension distributionsforms 1099-R

- Rental property income/expenseprofit/loss statement, rental property suspended loss information

- Social Security benefitsforms SSA-1099

- Income from sales of propertyoriginal cost and cost of improvements, escrow closing statement, cancelled debt information

- Prior year installment sale informationforms 6252, principal and Interest collected during the year, SSN and address of payer

- Other miscellaneous incomejury duty, gambling winnings, Medical Savings Account , scholarships, etc.