How Can I File And Pay My Back Taxes

Its best to use reliable and easy-to-use software if you’re going to prepare your tax returns yourself. Plan on spending a few hours on each tax return you have to file. There are tax software programs that can help you for free.

Again, make sure youre using software and forms for the appropriate tax year. Regulations vary from year to year, and the software settings can be critical for compliance as well as your liabilities or refund.

You might get a better result by hiring an experienced tax professional because they can help you with more complicated tax compliance and know how to deal with the IRS, if necessary.

Look for someone with significant experience in preparing back taxes if you decide to use the services of a professional. This would be the way to go if you need advice on handling incomplete tax documentation, or an advocate who will negotiate with the IRS on your behalf.

Youll need to print out the back tax returns and mail them in to the IRS to officially file them. You cant do it online.

How To Plan Ahead To Pay Back Taxes

The best way to avoid paying back taxes is filing your annual tax return during tax season. Take time to review your overall tax situation to come up with strategies for reducing your tax bill and achieving your financial goals.

If you think you owe back taxes, consider working with a tax professional who can help you gather past tax returns and file any that you may have missed.

If you think you might owe the IRS when you file your tax return this year or next, consider making estimated tax payments in advance. These payments are generally required for sole proprietors who arent subject to withholding from their paychecks by an employer. Making quarterly estimated tax payments can help you to avoid penalties on your upcoming tax return.

Irs Transcripts Are Free

Your other option is to order a tax transcript from the IRS rather than an actual copy of your return. The IRS makes two types of transcripts available: a tax return transcript and a tax account transcript, and both are free. A transcript is more or less a summary of the information included in your return and your payment and refund histories.

Mail in Form 4506T-EZ if you want a tax return transcript, or Form 4506T if you want a tax account transcript. You can also request a transcript online from the Get Transcript Online page of the IRS website, or even call the agency, although the IRS isnt taking phone calls in spring 2020 due to the coronavirus pandemic.

It will take from five to 30 days to get the transcript, depending on whether you make the request online or via USPS mail, and theyre only available for four years the current year and the previous three.

Read Also: Roth Ira Reduce Taxable Income

Don’t Miss: Efstatus.taxact 2015

How Tax Software Works

Tax software programs generally use two types of interface to coach you through your tax return: an interview-style questionnaire or a form-based step-by-step guide.

Most tax preparation software programs also feature simple navigation tools that allow you to upload returns from prior years, W-2s and investment documents. This can save you a substantial amount of time as the software automatically imports your information into your return.

Once youre done entering all your information, tax software programs often run a diagnostic on to check for errors, verify that your information meets legal state provisions and check whether youre eligible for certain income adjustments or tax credits before you file.

After you file, you can easily track the status of your tax refund through the company’s online portal or the IRS website.

Tax Software Pros & Cons

Tax preparation software programs are a great resource for taxpayers who want to save time and file their returns from home. However, these services may not be for everyone.

Here are some advantages and disadvantages of tax preparation software.

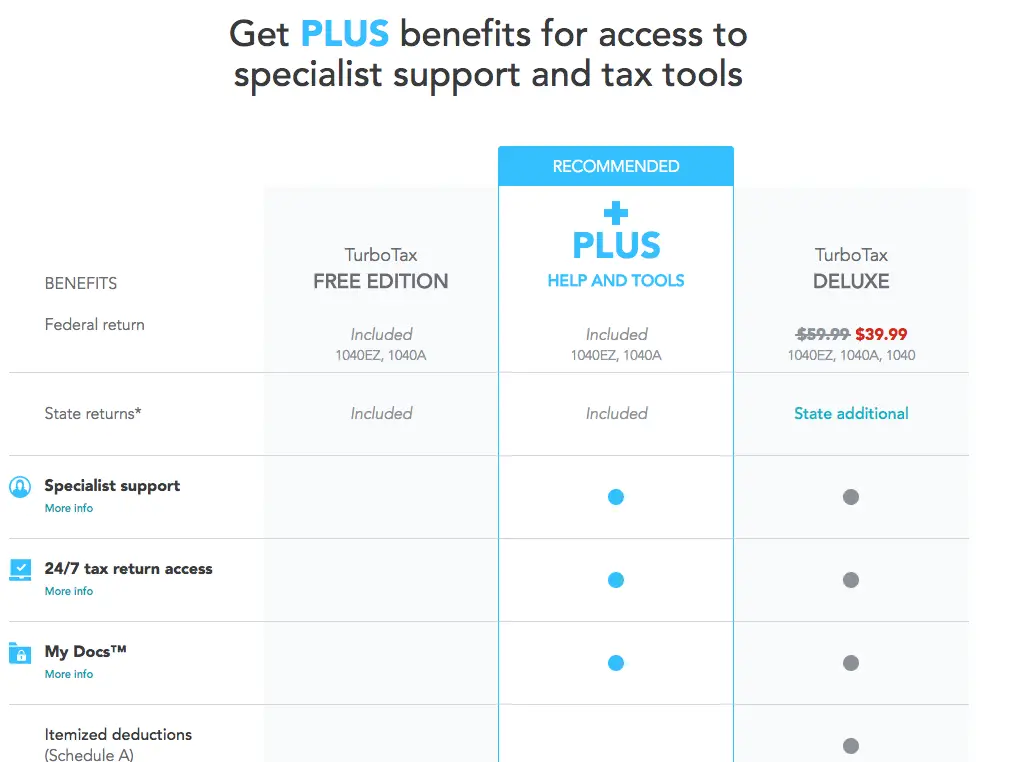

How Much Does Turbotax Cost

The price for TurboTax will depend on which product you use. As said earlier, TurboTax has a variety of products to best fit your personal tax situation and they are all priced differently. Heres a breakdown of the different TurboTax products and their pricing structures. Not quite sure which one to use? This year, TurboTax will guide users to the product best suited to their situation.

TurboTax is free for Canadians with simple tax situations, no matter your income level. Thats right, its completely free with no hidden fees. But dont worry, just because its free doesnt mean it is lacking. As long as you dont need any of the additional features offered from the paid versions, TurboTax Free is still set to get you the best refund possible and can handle student credits, RRSP contributions, COVID benefits and repayments, and more.

The next option is TurboTax Deluxe which includes everything in the free model plus some additional bells and whistles. With TurboTax Deluxe you will have more options to maximize more tax deductions and credits. This includes things like donations, employment expenses, and medical expenses. This version will automatically search over 400 credits for you to choose from and identify tax-saving opportunities for the best refund .

- Assist & Review Basic: $39.99/return

Recommended Reading: How Much Should I Save For Taxes Doordash

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the “Out of Country” circle on Page 1 of Form D-400. “Out of the Country” means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.

What Is Free File

Yet a simple way to cut down on costs which many people oddly dont tap into remains using the IRS Free File system, if you qualify. Why pay $40 or $50 or more for online software if you dont have to do so?

The Free File program at IRS.gov gives eligible taxpayers free access to brand name software programs offered by rival tax-prep companies. Those who qualify can use online software that prompts filers with key tax questions, does the math and allows you to file returns electronically for free. E-filing helps the IRS process returns and issue refunds more quickly than a return filed by paper.

TurboTax was but one partner in Free File. Those who selected TurboTax last year are able to opt for another online tax preparation service in the Free File program. Last year, there were nine tax software products available via Free File in English and two in Spanish.

Recommended Reading: Doing Taxes For Doordash

How To View Previous Turbo Tax Files

Related

Turbotax past returns are available only if you used the system to file your past returns. Otherwise, you retrieve past returns through the system you used to file for the given year. As an alternative, previous tax returns are accessible through a request system with the IRS. Saving tax returns each year is prudent as they are often needed for home loans and other lending matters. The ability to prove your income through tax returns is handy, and it saves time to make them accessible.

Determine Deductions To Reduce Taxable Income

Reduce your tax bill with deductions. Just because you are filing your return late doesn’t mean you forfeit the deductions you could have taken. If you plan on itemizing deductions, you need to obtain whatever documentation you have that supports each deduction.

If you don’t have this, you can always claim the standard deduction for each of those years. You can also reduce your tax by claiming deductions and credits for any dependents you were eligible to claim in the prior years. You need the names and Social Security numbers for each dependent you claim.

Also Check: Does Doordash Take Taxes Out For You

Collect All Necessary Documentation

You need W2s, 1099s, and all other relevant forms for the year in question. If you are itemizing deductions, you also need receipts and records to back up your claims. If you dont have these forms, contact your employer, former employer, or a financial institution. With wages, you can often get the numbers you need from your last pay stub of the year.

If you cant get a hold of these documents, contact the IRS directly at 1-800-829-1040 or request the IRS mail you a wage and income transcript . Usually, wage and income tax transcripts go back up to 10 years. Therefore, you can obtain 1099 and W2 information, even if you cannot locate these documents.

If you are self-employed and were 1099d, IRS wage and income transcripts will help you determine your income for a taxable year. Also, you can obtain bank statements that will also help you identify income and expenses.

Obtain Proper Tax Forms

Obtain the correct forms and instructions for the specific tax year. Your past-due returns must be filed on the original tax forms. You can easily access prior year tax forms on the TurboTax website or by contacting the IRS. Don’t make the mistake of using current year tax forms or you may end up preparing the return again.

Read Also: Tax Lien Investing California

Locate The Necessary Tax Forms

When filing back taxes, you need to use the tax forms from that year. For example, if you are preparing an individual tax return for 2015, you have to use Form 1040 for 2015. This is because the rules and credits may change from year to year. You can find most old forms online. If you cannot find one you need, contact the IRS or your states Department of Revenue. However, remember, if you are using software or a tax preparer, then you will not need to find the forms.

Mail Form 4506 And Payment

Mail Form 4506 and your payment to the appropriate IRS office. The IRS charges a fee for each tax year you request a return for. As of 2021, the fee for each one is $50 and you can make payment by check or money order, payable to the U.S. Treasury.

Also include your Social Security number and the notation Form 4506 request on your check or money order. After signing the bottom of the form, check the instructions to determine the appropriate IRS address. Note that the IRS office you mail it to depends on your address at the time of filing the tax return, not your current address.

Remember, with TurboTax, well ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

You May Like: How To Pay Taxes For Doordash

How To Get Copies Of Past Years Tax Returns

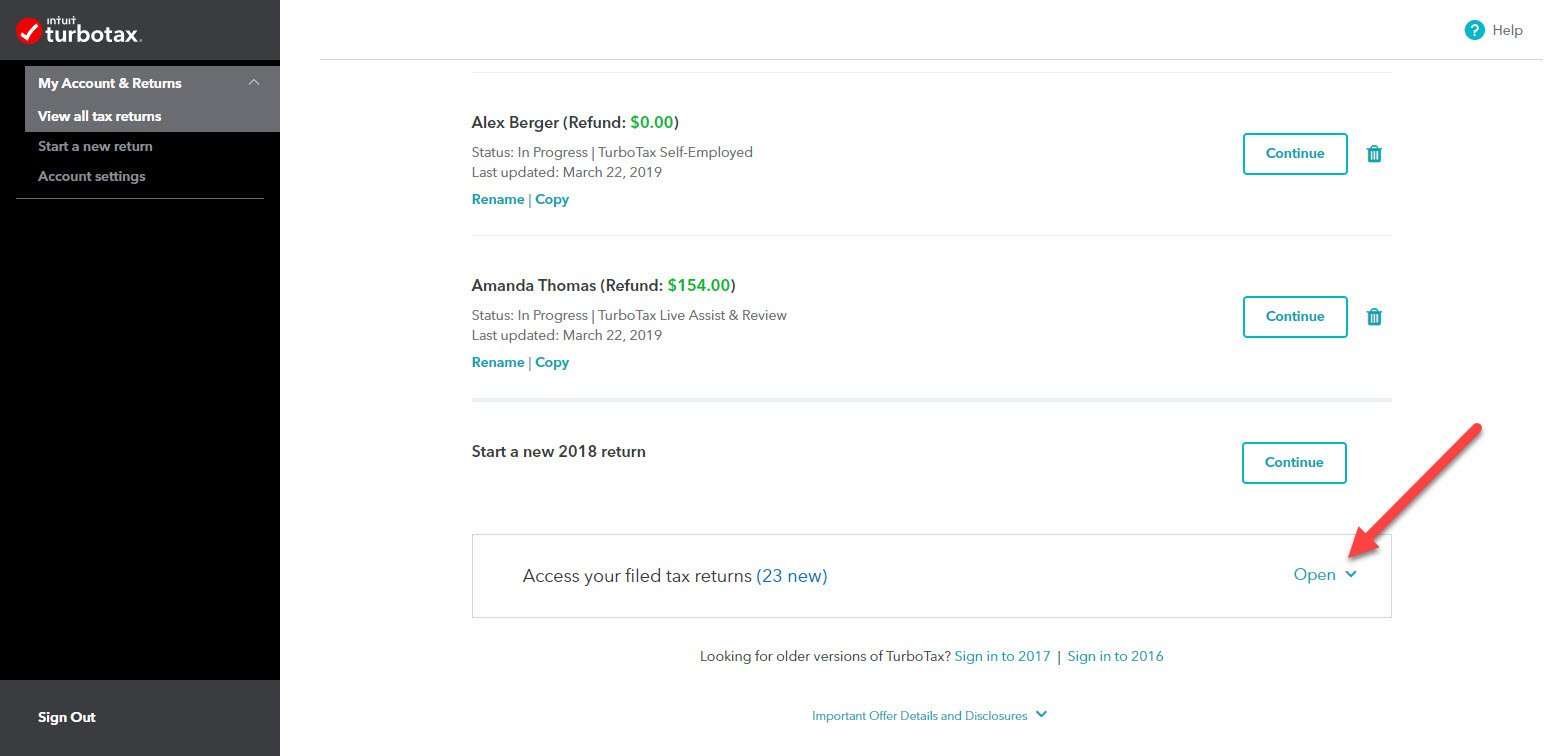

Heres how to obtain copies of a prior year return you filed in TurboTax Online:

If you dont see your tax year listed, you may have multiple accounts.

Hope this was helpful!

Read Also: Doordash Accounting Method

Why File For An Extension

Filing an extension automatically pushes back the tax filing deadline and protects you from possible penalties. Late-filing penalties can mount up at a rate of 5% of the amount due with your return for each month that you’re late.

- For example, if you owe $2,500 and are three months late, the late-filing penalty would be $375. x 3 = $375

- If you’re more than 60 days late, the minimum penalty is $100 or 100% of the tax due with the return, whichever is less.

- Filing for the extension wipes out the penalty.

TurboTax Easy Extension is a fast and easy way to file your extension, right from your computer.

You May Like: How To Pay Doordash Taxes

Who Qualifies For Free File

If your adjusted gross income was $73,000 or less in 2021, you can use free tax software to prepare and electronically file your tax return, according to IRS instructions online for the 2021 tax season. If you earned more, you can use Free File forms.

See IRS.gov/freefile to research options.

Roughly 70% of taxpayers, based on income, qualify for some software services offered. But only a small fraction of those who qualify actually use Free File.

More than 4.2 million taxpayers used one of the free online partner products that are part of Free File in 2020, according to data from the IRS. That is excluding the millions of nonfilers who used the system to claim Economic Impact Payments.

For fiscal year 2020, the IRS processed more than 150 million individual electronically filed returns.

Why has Free File participation been so historically low even after an uptick in 2020? Is it because taxpayers don’t know about the heavily hyped Free File? Or did taxpayers go online and end up being directed somewhere else for tax services?

We’re not talking about a new program. It has been about 20 years since the IRS first entered into a special agreement to encourage tax software companies to provide free tax return software to a certain percentage of U.S. taxpayers. But in exchange, the bargain included getting the IRS to agree that it would not compete with these companies by providing its own software to taxpayers.

Request Tax Documents From The Irs

Finding documents from previous years may be challenging for some. Thankfully, the IRS has a form you can fill out to request any tax information they have on file for you for a given year. Form 4506-T allows you to request a transcript of your tax return information, even if you haven’t filed a tax return. You can request information from the last 10 tax years.

The IRS will send the information it has on record, including information found on forms such as W-2s, 1099s, and 1098s. It won’t have information about deductions and credits you may qualify for, though, so you’ll still need to do some work on your own.

Also Check: How To File Taxes From Doordash

What Tax Documents Do I Need To File Back Taxes

When was the last year you filed? Do you have a copy of that tax return? Do you still have W-2s and other tax documents for the years you didn’t file?

You can request copies of your tax documents from the IRS if youre missing anything by filing Form 4506-T, or you can contact your employer or the institution that would have sent them to you.

Keep in mind that current or former employers or other establishments might not still have these documents on file, or at least they may not be easily accessible. There might also be a fee if you choose this option.

At a minimum, youll need Forms W-2 and 1099 for any income you brought in during the year in question, as well as specific tax returns and forms for that tax year. For example, you cant file a 2020 Form 1040 to report 2019 income. You should also gather supporting documentation of anything you spent that year that might be tax deductible or that will qualify you for tax credits, such as bank statements and credit card statements for that period of time.

How Do I File Old Tax Returns With Sprintax Can I Still File Taxes For 2019 2018 2017 And Other Years

If you want to file a previous years tax return, you should know that you can use Sprintax to file for the last 3 years. However, if you need to file prior years tax returns, we have another option for you.

When you choose Prior tax years, you will be transferred to Sprintaxs sister company Taxback.com who has more than 20 years of experience in tax return services. The process with them is very simple and straightforward. You just need to follow the steps.

Whats the difference?

With Sprintax, you can use a software service to prepare your old tax returns online, while with Taxback.com, an experienced tax agent will help you complete and file your prior-year tax returns at affordable pricing.

Also Check: Doordash 1099 Example